International Tax Documents

Cross-Border Taxation

2024 Colorado Employee Withholding Certificate

This file is the 2024 Colorado Employee Withholding Certificate needed for state tax withholding purposes. Employees can use this form to adjust their Colorado withholding based on their individual tax situation. It provides detailed instructions to ensure accurate tax calculations.

Cross-Border Taxation

California Franchise Tax Board Withholding Guidelines

This document provides comprehensive guidelines on withholding requirements for California Franchise Tax Board. It assists users in understanding their obligations when making payments to nonresident contractors, partners, or beneficiaries. Perfect for businesses and individuals needing to comply with California tax regulations.

Cross-Border Taxation

Instructions for Form W-7 Application for ITIN

This document provides comprehensive instructions on how to complete Form W-7, the application for an IRS Individual Taxpayer Identification Number (ITIN). It outlines eligibility requirements, necessary documentation, and application procedures. Whether you're a nonresident alien or a dependent of a U.S. citizen, this guide is essential for tax purposes.

Cross-Border Taxation

Nebraska Individual Income Tax Booklet 2023

This file contains the 2023 Nebraska Individual Income Tax Booklet which provides essential information for taxpayers. It guides users in e-filing their tax returns, eligibility requirements, and available deductions. Ideal for individuals seeking to understand their tax obligations and options.

Cross-Border Taxation

Schedule 3 Form 1040 Additional Credits and Payments

Schedule 3 is a critical IRS form used to report additional credits and payments when filing your tax return. This form is essential for taxpayers seeking nonrefundable credits, refundable credits, payments, and other tax benefits. Properly filling out this form can help reduce your tax bill or increase your refund.

Cross-Border Taxation

Philadelphia Tax Change Form Update Instructions

This document provides instructions for updating your tax account information in Philadelphia. It details how to fill out the change form and the necessary steps involved. Use this guide to ensure your tax information is current and compliant.

Cross-Border Taxation

Understanding Foreign Entertainers Tax Application

This document provides important information regarding the Foreign Entertainers Tax application process. It outlines the steps needed to file and provides key tips for compliance. A must-read for entertainment professionals operating in the UK.

Cross-Border Taxation

New York State Resident Credit IT-112-R Instructions

This document provides the necessary instructions to claim a resident credit for taxes paid to another jurisdiction. Users will find forms to report their income and adjustments for New York State tax purposes. Follow the outlined steps to ensure accurate submission of your tax returns.

Cross-Border Taxation

IRS 1042 and 1042-S Instructions for Foreign Tax Return

This document provides essential instructions for filing Forms 1042 and 1042-S for foreign persons and income subject to withholding. It outlines who must file these forms, estimated time requirements, and key submission details. Ensure compliance with U.S. tax laws and accurately report income to avoid penalties.

Cross-Border Taxation

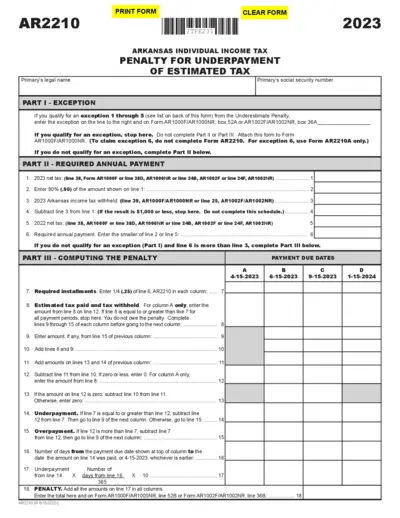

Arkansas Individual Income Tax Form AR2210 Instructions

The form AR2210 provides essential instructions for Arkansas taxpayers regarding underpayment penalties and exceptions. It includes detailed guidelines on annual payments and penalty computation. Users can easily understand their obligations and how to avoid penalties through this form.

Cross-Border Taxation

1771 Formulir SPT Tahunan Pajak Penghasilan Badan

This file is the official 1771 Formulir for annual tax reporting of corporate income. It provides guidance on filling out tax obligations accurately. The form includes necessary fields and instructions for submission to the tax authority.

Cross-Border Taxation

Virginia Pass-Through Entity Income Tax Instructions

This file contains detailed instructions for filling out the 2022 Form 502, specifically for Virginia Pass-Through Entities. It includes important updates on tax regulations and guidance for nonresident withholding. Use this document to ensure compliance with Virginia tax requirements.