Edit, Download, and Sign the 1771 Formulir SPT Tahunan Pajak Penghasilan Badan

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, start by carefully reading the instructions. Use capital letters when entering information into the fields. Make sure to provide accurate financial data as required.

How to fill out the 1771 Formulir SPT Tahunan Pajak Penghasilan Badan?

1

Read the instructions thoroughly before beginning.

2

Fill in personal and business identification details.

3

Enter financial data in the appropriate sections.

4

Review all entries for accuracy.

5

Submit the completed form by the deadline.

Who needs the 1771 Formulir SPT Tahunan Pajak Penghasilan Badan?

1

Corporate accountants need this form to report income and taxes.

2

Business owners require this document for legal compliance.

3

Tax consultants must use the form to prepare filings for clients.

4

Financial institutions need it for assessing loan eligibility.

5

Auditors require this document to verify tax compliance.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the 1771 Formulir SPT Tahunan Pajak Penghasilan Badan along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your 1771 Formulir SPT Tahunan Pajak Penghasilan Badan online.

Editing this PDF on PrintFriendly is easy and convenient. Utilize our user-friendly tools to modify any field as necessary. You can quickly make changes and download the updated document.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is a seamless process. Just upload your signature and place it where required on the document. Once signed, you can download and save the finalized form.

Share your form instantly.

Sharing the PDF on PrintFriendly is simple and fast. Use the sharing options provided to send documents to others directly. You can easily control how and with whom you share your files.

How do I edit the 1771 Formulir SPT Tahunan Pajak Penghasilan Badan online?

Editing this PDF on PrintFriendly is easy and convenient. Utilize our user-friendly tools to modify any field as necessary. You can quickly make changes and download the updated document.

1

Open the PDF in the PrintFriendly editor.

2

Select the field you wish to edit and make the changes.

3

Review your edits to ensure correctness.

4

Once satisfied, download the edited document.

5

Save or share the document as needed.

What are the instructions for submitting this form?

Submit the completed 1771 Form to the local tax office, or send it electronically via the official tax portal. Ensure that all required attachments and documentation accompany your submission. Follow up to confirm receipt and ensure compliance with submission guidelines.

What are the important dates for this form in 2024 and 2025?

For 2024, the form must be submitted by March 31. In 2025, anticipate similar deadlines. Stay updated with local tax authority announcements.

What is the purpose of this form?

The purpose of this form is to provide a structured format for corporate entities to report their income for tax assessment. It facilitates compliance with tax regulations by ensuring all necessary data is captured. This helps in maintaining transparency and accountability in financial practices.

Tell me about this form and its components and fields line-by-line.

- 1. NPWP: Nomor Pokok Wajib Pajak - Tax Identification Number required for submissions.

- 2. Nama Wajib Pajak: The name of the taxpayer or company.

- 3. Jenis Usaha: Type of business carried out by the entity.

- 4. Penghasilan Netto Fiskal: The net taxable income to be reported.

- 5. PPh Terutang: The payable income tax amount calculated.

What happens if I fail to submit this form?

Failure to submit the form can result in penalties and legal consequences. Corporations may face fines or audits by the tax authority if deadlines are missed. It is essential to ensure timely filing to avoid these complications.

- Penalties for Late Submission: Late filings may incur financial penalties imposed by tax authorities.

- Audits and Reviews: Failure to submit may trigger audit processes to ensure compliance.

- Loss of Tax Benefits: Late submission can result in loss of potential tax deductions or credits.

How do I know when to use this form?

- 1. Annual Tax Reporting: Required for reporting corporate income annually to tax authorities.

- 2. Compliance with Regulation: Necessary for adhering to local tax compliance laws.

- 3. Financial Audits: Used during audits to verify reported income and taxes.

Frequently Asked Questions

What is the purpose of the 1771 Form?

The 1771 Form is used for reporting corporate income taxes in Indonesia.

How can I fill out the 1771 Form using PrintFriendly?

You can fill out the form directly in our PDF editor and make edits as needed.

Can I save my changes to the form?

Yes, you can download the edited file after making your changes.

Is it necessary to attach additional documents?

Yes, additional documents may be required for completion.

What information is needed on the form?

You will need to provide company identification and financial data.

Can I share the form after editing?

Yes, sharing the edited document is easy through our platform.

What should I do if I make a mistake?

Simply edit the incorrect field before downloading the final document.

How is the form submitted?

The completed form must be submitted electronically or physically to the tax authority.

Where can I find help with the form?

Assistance can be found in the instructions included with the document.

What are the filing deadlines?

Filing deadlines are typically announced by the tax authority each year.

Related Documents - 1771 SPT Form

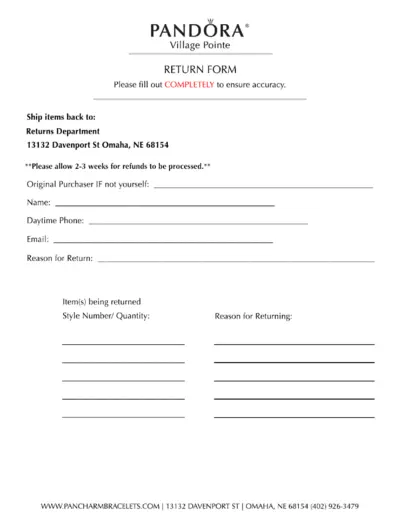

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

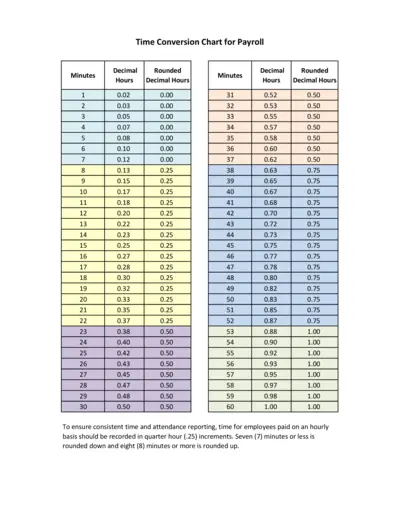

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

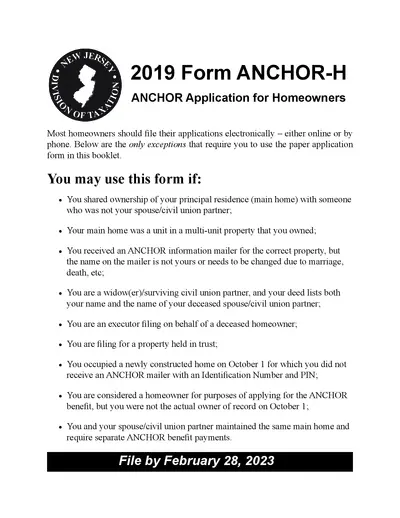

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

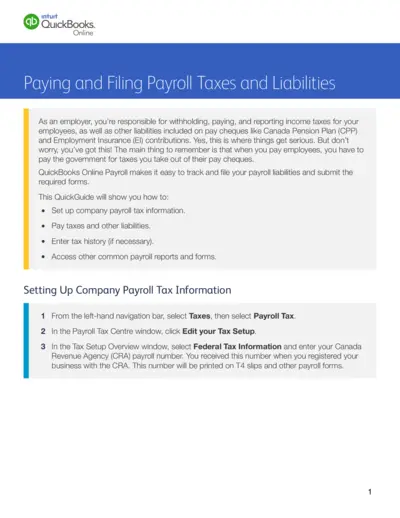

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

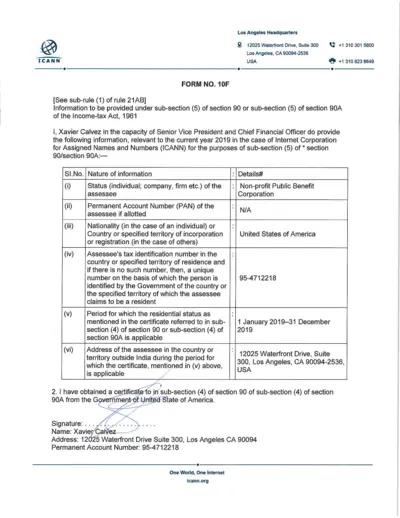

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

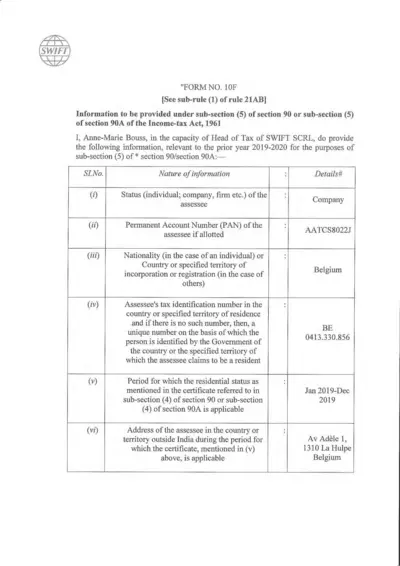

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

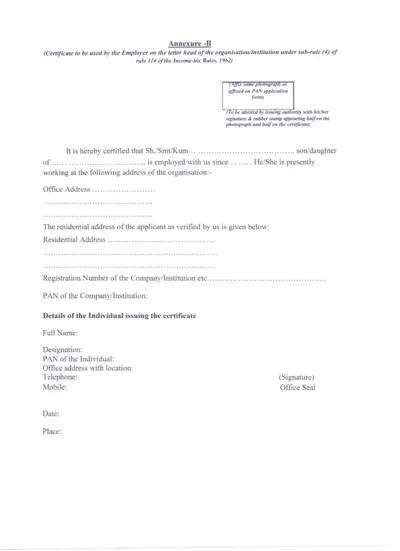

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

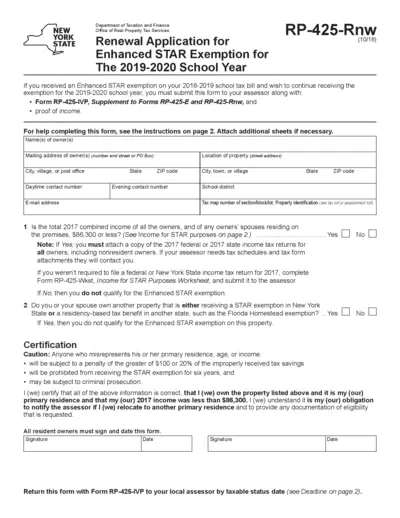

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

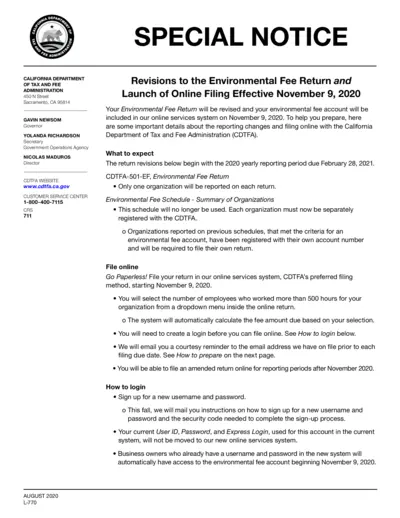

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

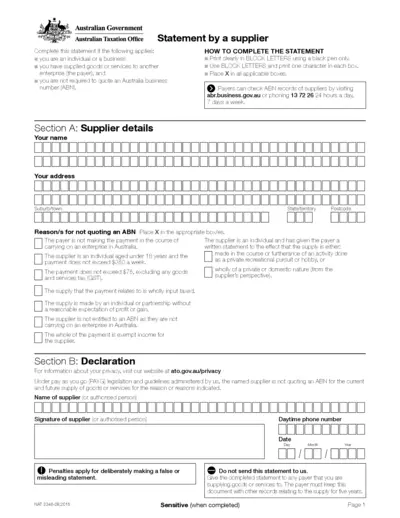

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

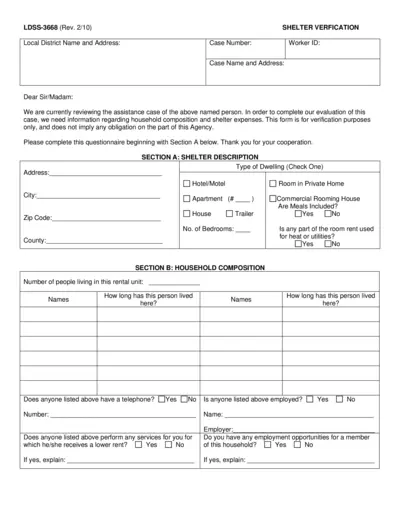

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

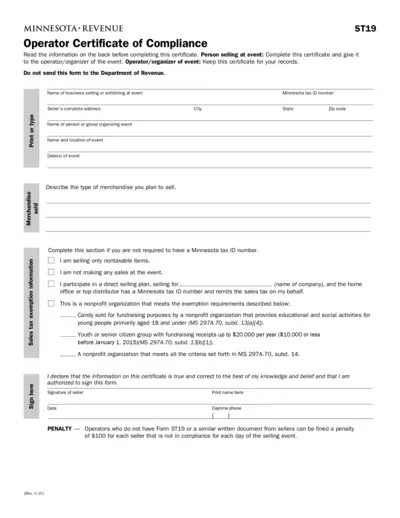

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.