International Tax Documents

Cross-Border Taxation

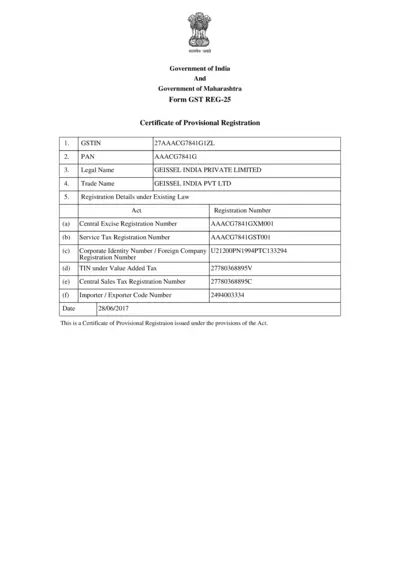

Certificate of Provisional Registration GST REG-25

This file is a certificate for provisional registration under GST. It includes essential details such as GSTIN and PAN. Businesses applying for GST registration must use this file.

Cross-Border Taxation

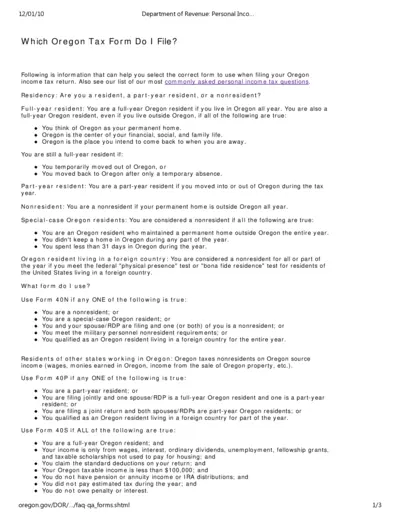

Oregon Department of Revenue Personal Income Tax Forms

This document provides essential information for filing personal income tax forms in Oregon. It includes guidelines for residents and nonresidents, along with important form selection criteria. Understanding your residency status and the appropriate forms is crucial for accurate tax filing.

Cross-Border Taxation

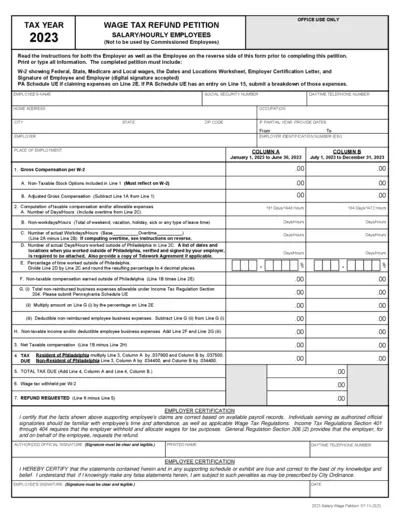

2023 Wage Tax Refund Petition Instructions

This document provides essential instructions for filling out the 2023 Wage Tax Refund Petition. It is designed for salary and hourly employees who are seeking a refund of over-withheld wage taxes. Follow the detailed guidelines to ensure your petition is completed correctly.

Cross-Border Taxation

Instructions for Form 8960 Net Investment Income Tax

This document provides essential instructions for completing Form 8960, which calculates the Net Investment Income Tax. It is useful for individuals, estates, and trusts subject to this tax. Familiarize yourself with the guidelines to ensure accurate filing.

Cross-Border Taxation

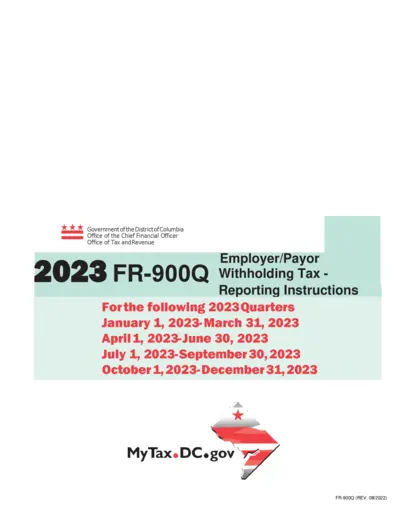

DC Withholding Tax Reporting Instructions for 2023

This file contains the employer/payor withholding tax reporting instructions for the year 2023. It includes essential details on filing the FR-900Q form each quarter. Employers should refer to this file for guidelines to ensure compliance with DC tax laws.

Cross-Border Taxation

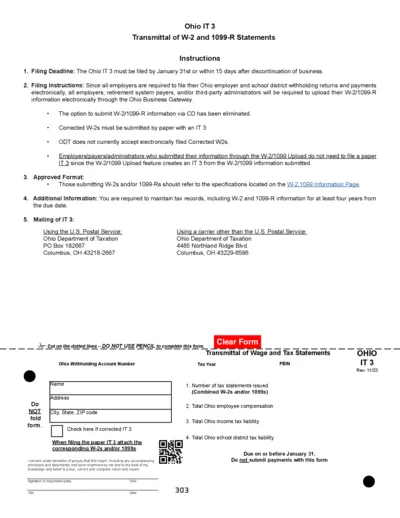

Ohio IT 3 W-2 and 1099-R Filing Instructions and Details

This document provides comprehensive instructions for filing the Ohio IT 3 form, including W-2 and 1099-R statements. It outlines filing deadlines, electronic submission processes, and additional information for employers. Ensure compliance with Ohio tax regulations using this essential guide.

Cross-Border Taxation

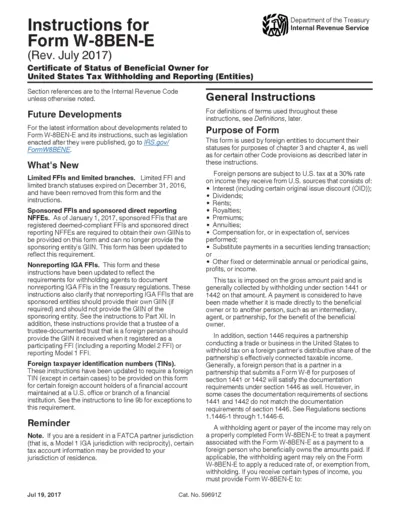

W-8BEN-E Form Instructions for Tax Compliance

This document provides comprehensive instructions for completing Form W-8BEN-E, which certifies the status of beneficial owners for tax reporting. It includes information on applicable rules and regulations for foreign entities. Ensure compliance with U.S. withholding tax requirements by following the guidelines provided.

Cross-Border Taxation

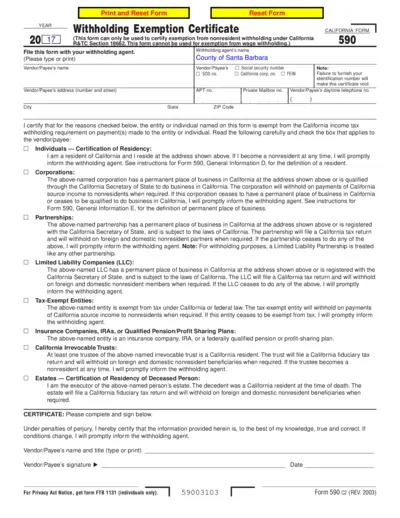

California Form 590 Withholding Exemption Certificate

California Form 590 is used to certify exemption from nonresidential withholding. Ensure that the appropriate sections are filled out accurately. This is essential for residents and entities wishing to avoid unnecessary tax withholdings.

Cross-Border Taxation

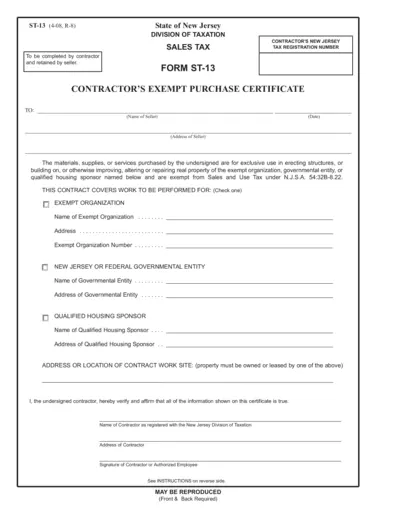

New Jersey Contractor's Exempt Purchase Certificate

The New Jersey Contractor's Exempt Purchase Certificate is a crucial document for contractors working with exempt organizations. This form allows contractors to purchase materials and services without paying sales tax for projects involving exempt entities. Understanding how to fill it out correctly is essential for compliance and tax exemption.

Cross-Border Taxation

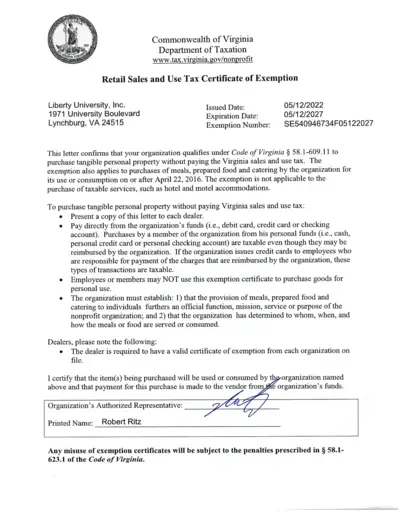

Virginia Retail Sales and Use Tax Exemption Certificate

This document serves as a retail sales and use tax exemption certificate for nonprofit organizations. It confirms the qualification for tax-exempt purchases. Ensure compliance with the specified instructions for valid use.