International Tax Documents

Cross-Border Taxation

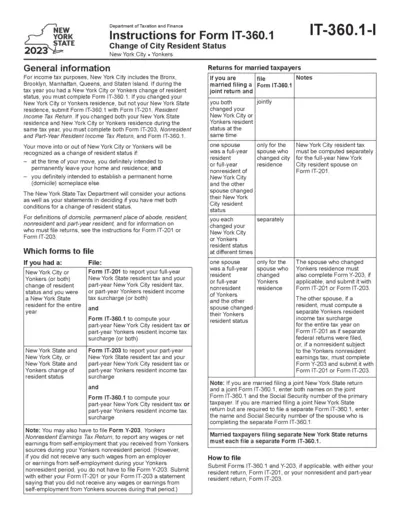

NYC and Yonkers Change of Resident Status Instructions

This file provides step-by-step instructions for completing Form IT-360.1 for New York City and Yonkers change of resident status for tax purposes. It includes essential guidance on necessary forms, eligibility, and filing procedures. Ideal for taxpayers navigating residency status changes in NYC or Yonkers.

Cross-Border Taxation

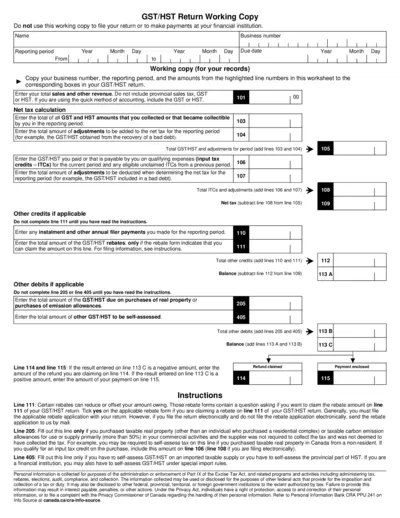

GST/HST Return Working Copy Instructions

This document serves as a working copy for filling out the GST/HST return. It provides essential details and instructions for accurately reporting your sales tax. Ensure you review the highlighted sections for correct entries.

Cross-Border Taxation

Instructions for Form 1042-S - IRS Guidelines

The Instructions for Form 1042-S provide essential information for reporting U.S. source income for foreign persons. This file outlines the necessary steps and requirements for filing the form accurately. It is a crucial resource for withholding agents and tax practitioners dealing with international income.

Cross-Border Taxation

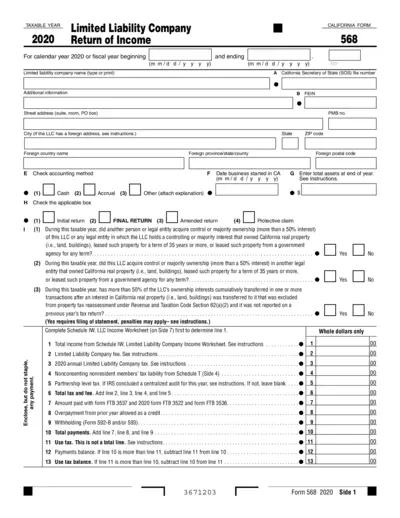

California Form 568 LLC Return of Income 2020

The California Form 568 is utilized by limited liability companies to report their income and taxes. It is essential for compliance with state tax regulations and ensuring accurate income reporting. This form is required for both calendar and fiscal year filings.

Cross-Border Taxation

Minnesota Property Tax Refund Instructions

This document provides essential information regarding the Minnesota Property Tax Refund programs available for homeowners and renters. It outlines eligibility requirements and application processes. Users can find crucial details to ensure they claim their refunds accurately.

Cross-Border Taxation

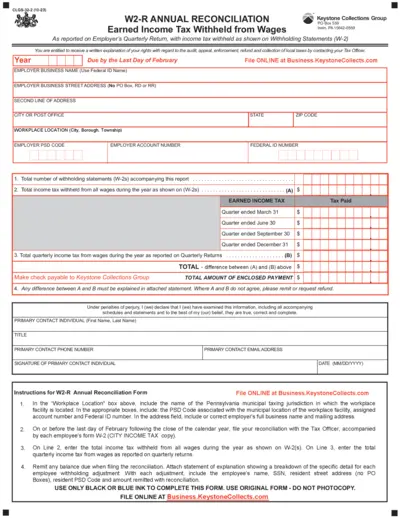

W2-R Annual Reconciliation Form Instructions

The W2-R Annual Reconciliation form is essential for employers to report earned income tax withheld from wages. It is used to reconcile annual income taxes and ensure compliance with local tax regulations. Employers must submit this form by the last day of February following the close of the calendar year.

Cross-Border Taxation

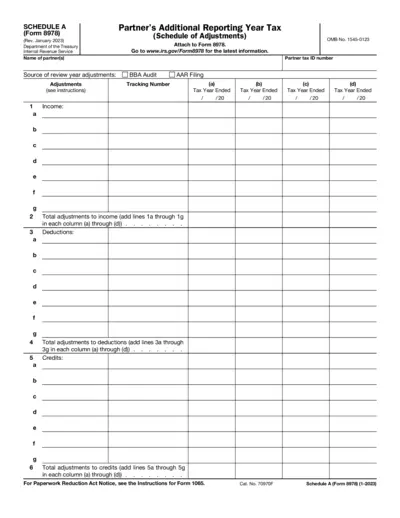

Schedule A Form 8978 Instructions and Overview

This file contains the instructions for Schedule A of Form 8978. It's essential for partners reporting additional tax information. Use this guidance to ensure accurate tax filing and compliance.

Cross-Border Taxation

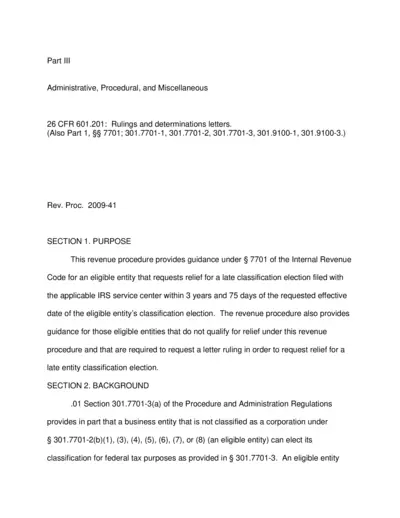

IRS Relief for Late Entity Classification Elections

This document provides guidance for eligible entities seeking relief for late entity classification elections with the IRS. It outlines the procedures, requirements, and relevant sections required for filing. Users will find valuable information for tax-related classifications.

Cross-Border Taxation

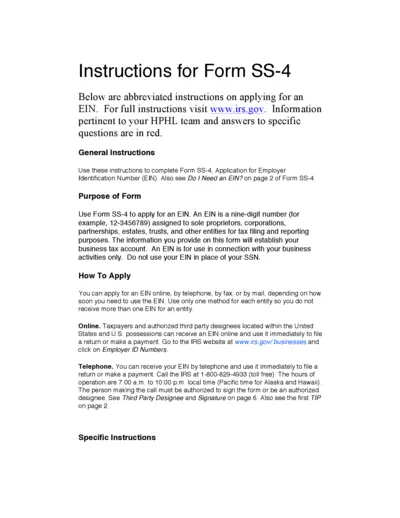

Instructions for Form SS-4: EIN Application Guide

This file provides detailed instructions on applying for an Employer Identification Number (EIN). It is essential for businesses, trusts, estates, and various entities for tax purposes. Follow the guidelines accurately to establish your business tax account.

Cross-Border Taxation

FBR Taxpayer Registration Form TRF-01 V-2 Pakistan

This file is the Taxpayer Registration Form (TRF-01 V-2) issued by the Federal Board of Revenue in Pakistan. It is a crucial document for taxpayers to register for Income Tax, Sales Tax, and Federal Excise. Follow the provided instructions carefully to complete the form accurately.

Cross-Border Taxation

Oregon Department of Revenue Form OR-65 Instructions

This document contains detailed instructions for filing the Oregon Form OR-65 for partnerships. It provides crucial information on tax obligations, filing deadlines, and penalties for non-compliance. Perfect for partnership entities conducting business in Oregon.

Cross-Border Taxation

Massachusetts DR-1 Office of Appeals Form Details

This file contains the Massachusetts Form DR-1 for Office of Appeals. It provides essential information for taxpayers filing disputes regarding taxes and penalties. Use this form to seek a pre-assessment, post-assessment, or other type of request regarding your tax situation.