International Tax Documents

Cross-Border Taxation

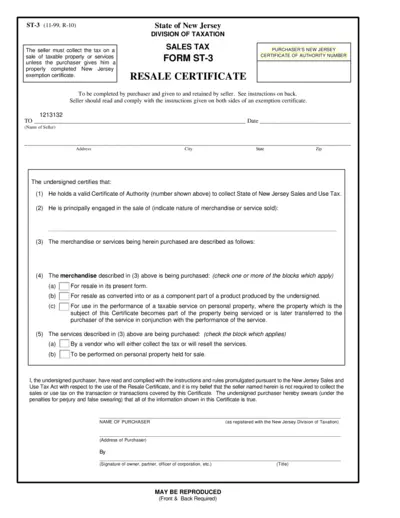

New Jersey Sales Tax Resale Certificate ST-3

The New Jersey Sales Tax Resale Certificate ST-3 is essential for sellers who need to collect sales tax. This form allows purchasers to claim tax exemptions for resale items. Proper completion ensures compliance with New Jersey tax regulations.

Tax Residency

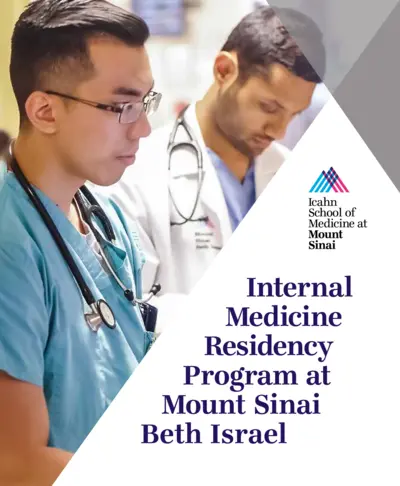

Internal Medicine Residency Program at Mount Sinai

This file provides comprehensive details about the Internal Medicine Residency Program at Mount Sinai Beth Israel. It offers valuable insights into the program structure, application process, and contact information for prospective residents. Ideal for applicants looking to join a prestigious residency program in New York.

Cross-Border Taxation

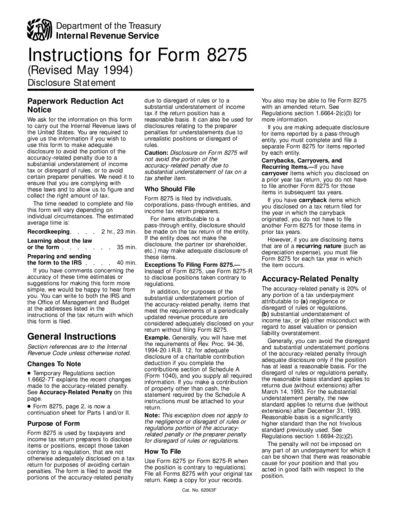

Instructions for Form 8275 Disclosure Statement

Form 8275 is used to disclose tax positions to avoid penalties. It allows taxpayers to comply with IRS rules effectively. Use this form to ensure proper disclosure and minimize risks of penalties.

Cross-Border Taxation

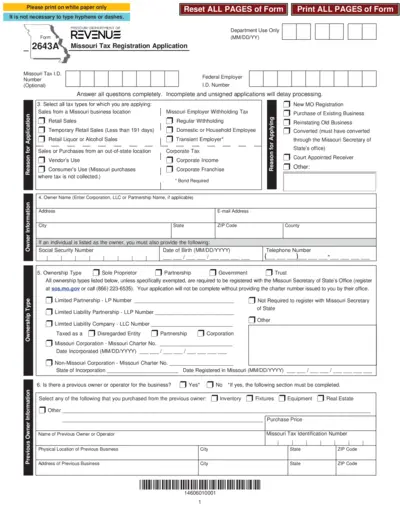

Missouri Tax Registration Application Form 2643A

The Missouri Tax Registration Application Form 2643A allows businesses to register for various tax types in Missouri. It outlines the required information and instructions for completing the form. Proper registration ensures compliance with Missouri tax laws and timely processing of applications.

Cross-Border Taxation

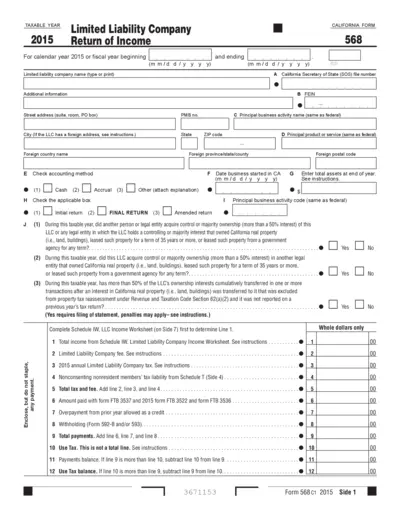

California Form 568 Limited Liability Company Tax Return

This form is essential for Limited Liability Companies in California to report their income and pay taxes. It includes various fields to capture business information and financial details. Ensure accurate completion to avoid penalties and ensure compliance.

Cross-Border Taxation

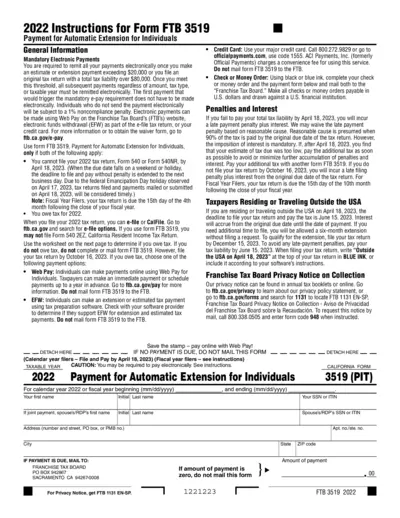

Form FTB 3519 Automatic Extension Payment Instructions

This document provides instructions for individuals filing Form FTB 3519 for automatic tax extension payments. It outlines who needs to use the form, how to fill it out, and payment options. Essential for those unable to file their 2022 tax returns by the deadline.

Cross-Border Taxation

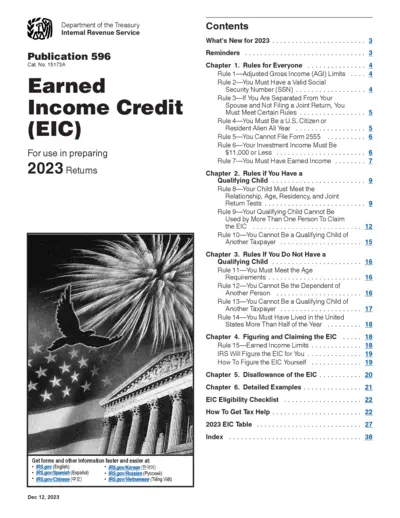

IRS 2023 Publication 596 Earned Income Credit Guidelines

This publication provides comprehensive guidance on the Earned Income Credit (EIC) for the tax year 2023. It outlines eligibility requirements, tax benefits, and instructions for claiming the EIC. Suitable for taxpayers seeking to maximize their tax benefits and ensure compliance with IRS rules.

Cross-Border Taxation

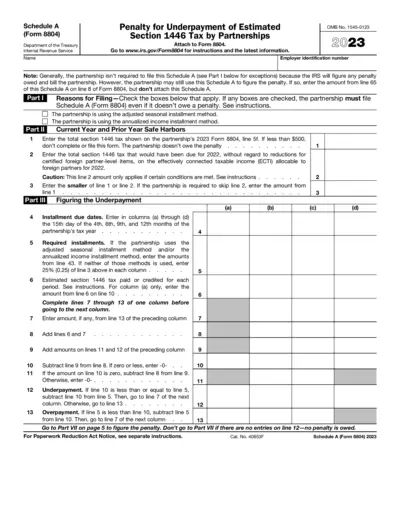

IRS Schedule A 2023 Guidance for Form 8804 Penalties

This file provides essential instructions for completing Schedule A (Form 8804). It covers penalty assessments for underpayment of estimated tax by partnerships. Perfect for partnerships needing clarity on tax obligations and calculations.

Cross-Border Taxation

Massachusetts Resident Income Tax Form 1 Instructions 2022

This document provides detailed instructions for filling out the Massachusetts Resident Income Tax Form 1 for the year 2022. It includes important dates, tax rates, and electronic filing options. Perfect resource for Massachusetts taxpayers seeking clear guidance.

Cross-Border Taxation

General Instructions for Forms W-2 and W-3 2024

This file provides essential guidelines for filling out and submitting IRS Forms W-2 and W-3 for 2024. It includes information on requirements, electronic filing, and special situations. Business owners and payroll administrators will find detailed instructions to comply with tax regulations.

Cross-Border Taxation

Authorization of Accountant in VAT Filing

This file is a formal authorization document required for a registered dealer in Karnataka who wishes to allow their accountant or tax practitioner to represent them before the Value Added Tax Authority. It is essential for ensuring compliance with the Karnataka Value Added Tax Act, 2003. Proper submission of this form can help streamline tax assessment processes.

Cross-Border Taxation

Louisiana Corporation Income and Franchise Tax Guide

This file contains detailed instructions for filing Louisiana Corporation Income and Franchise Tax returns. It provides information on who must file, important deadlines, and guidelines for completion. Business entities in Louisiana should reference this document for accurate compliance.