International Tax Documents

Cross-Border Taxation

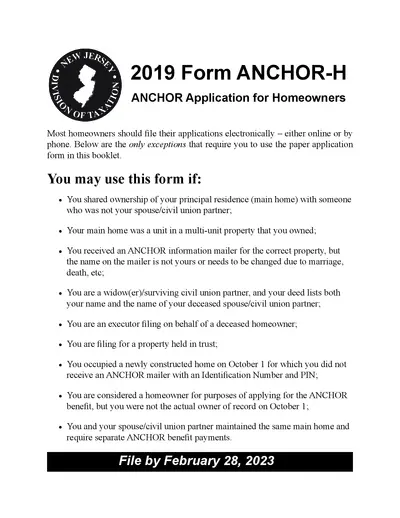

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

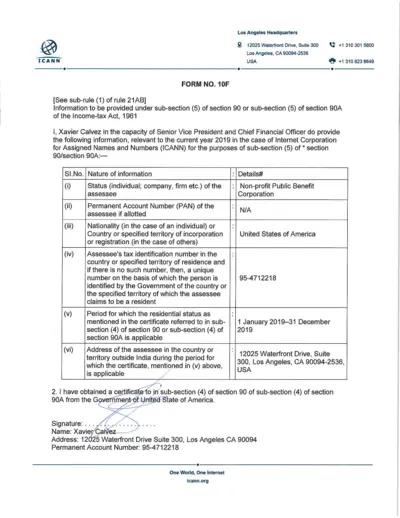

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

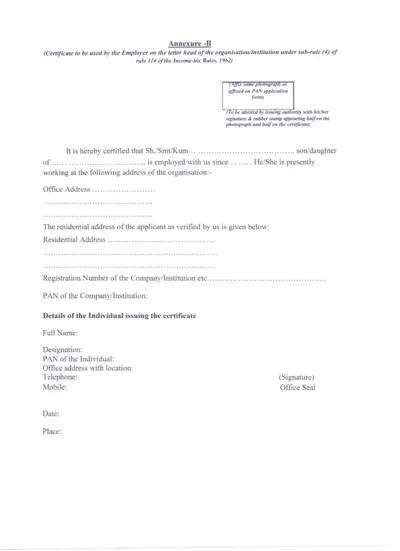

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

Cross-Border Taxation

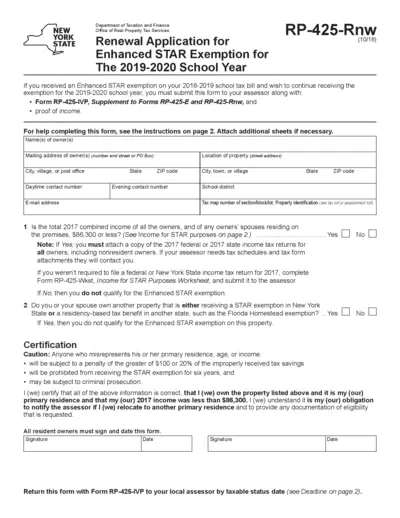

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

Cross-Border Taxation

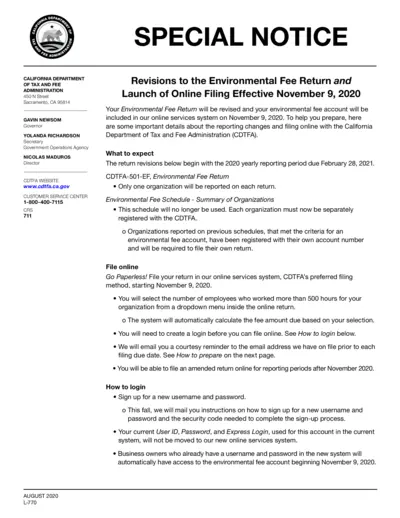

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

Cross-Border Taxation

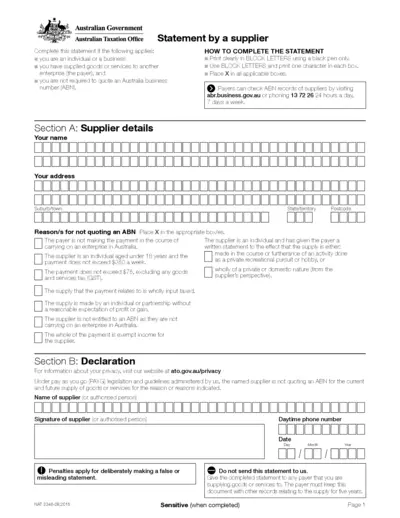

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

Cross-Border Taxation

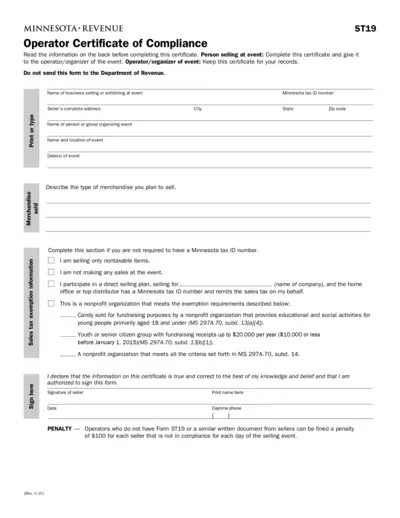

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.

Cross-Border Taxation

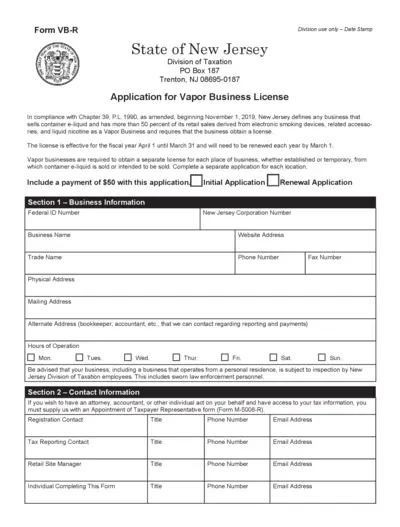

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

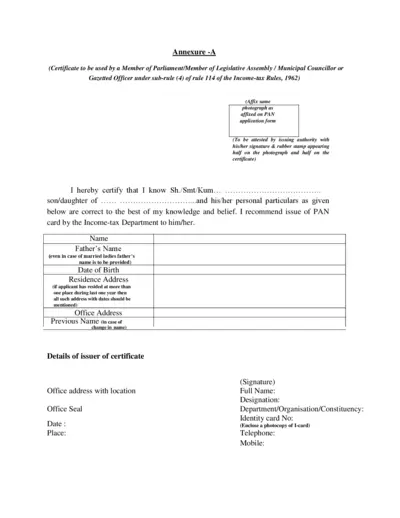

Certificate for PAN Card Application by Gazetted Officer or MP MLA

This file is Annexure-A, a certificate used by a Member of Parliament, Member of Legislative Assembly, Municipal Councillor or Gazetted Officer to attest an individual's PAN card application. It includes details such as the applicant's name, father's name, date of birth, residence and office address, and details of the issuing authority. This certificate is necessary under rule 114 of the Income-tax Rules, 1962.

Taxation of Digital Services

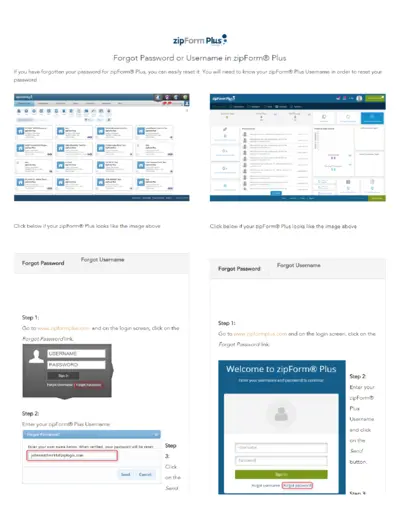

zipForm Plus® Password or Username Recovery Guide

This guide helps users recover their zipForm Plus® password or username. It provides step-by-step instructions on resetting your password. Ensure you know your username for a successful reset.

Cross-Border Taxation

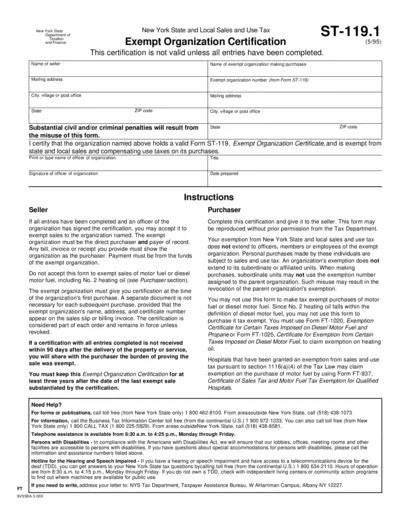

New York State Exempt Organization Certification

This document is the New York State Exempt Organization Certification form. It certifies that an organization is exempt from state and local sales and compensating use taxes. This certification must be filled out completely to be valid.

Cross-Border Taxation

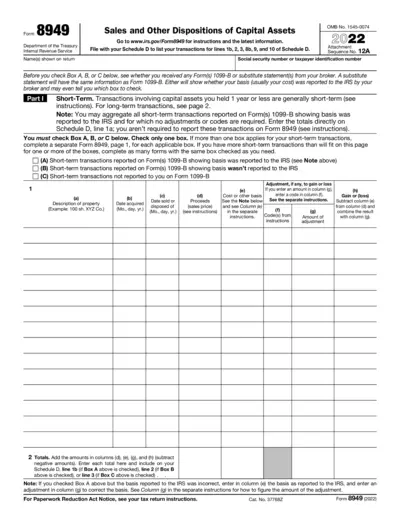

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and other dispositions of capital assets. It is essential for accurately reporting gains and losses during tax filing. This form assists both individuals and businesses in detailing their capital asset transactions for IRS compliance.