Tax Forms Documents

Tax Forms

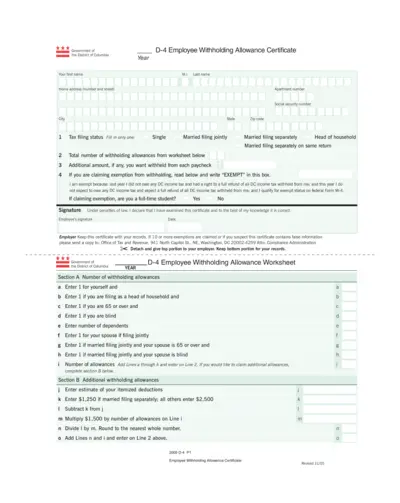

D-4 Employee Withholding Allowance Certificate Form

This form is essential for new employees in DC to establish their withholding allowances. Ensure accurate completion to avoid tax liabilities. Employers require this form to properly withhold DC income tax.

Tax Forms

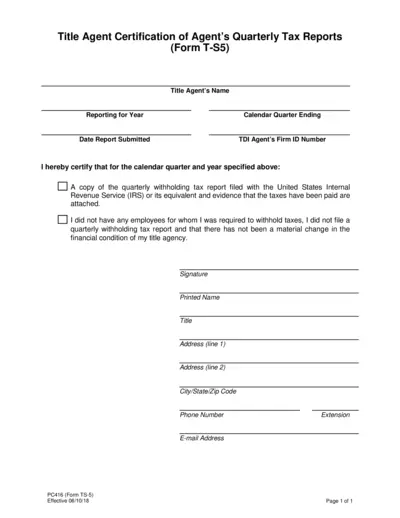

Agent Certification of Quarterly Tax Reports Form T-S5

This form is used by title agents to certify their quarterly tax filings. It includes necessary details about the tax reports and compliance. Ensure this form is filled out correctly to avoid any tax-related issues.

Tax Forms

IRS Form 3921 Instructions and Information

This file contains essential instructions for filling out IRS Form 3921, which is used for reporting incentive stock options. It provides clarity on submission procedures and penalties. Users will find detailed steps for accurate completion and submission.

Tax Forms

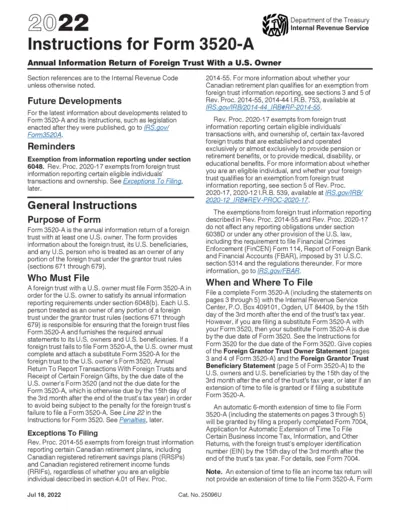

IRS Instructions for Form 3520-A Foreign Trust Filing

This document provides comprehensive instructions for completing Form 3520-A, essential for U.S. owners of foreign trusts. It outlines filing requirements, penalties, and important exemptions. Understanding these guidelines ensures proper compliance with IRS regulations.

Tax Forms

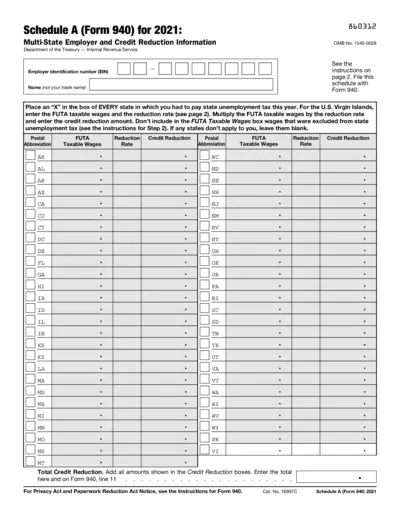

Schedule A Form 940 Multi-State Employer 2021

This file contains Schedule A (Form 940) information for employers who operate in multiple states. It provides detailed instructions for completing the form, including credit reduction guidelines. Essential for employers who must report state unemployment tax information.

Tax Forms

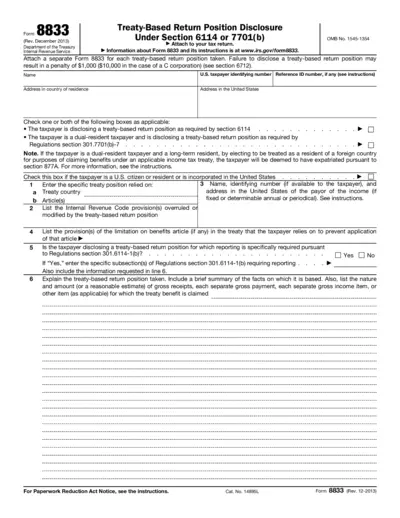

Treaty-Based Return Position Disclosure Instructions

This document provides detailed instructions for filing Form 8833, which is required for treaty-based tax return position disclosures. It is essential for both U.S. taxpayers and dual-resident taxpayers to avoid penalties and ensure compliance. Follow the guidelines to correctly fill out the form and understand your obligations.

Tax Forms

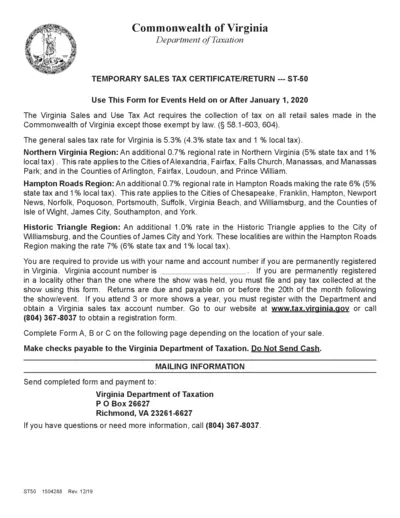

Virginia Temporary Sales Tax Certificate and Return

This file provides the necessary information and forms for the Virginia Temporary Sales Tax Certificate/Return. It is essential for vendors participating in sales events in Virginia. Ensure compliance with the Virginia Sales and Use Tax Act with this convenient guide.

Tax Forms

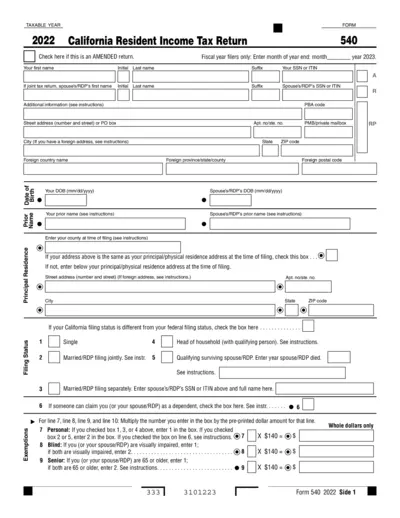

California Resident Income Tax Return 2022

This file contains the 2022 California Resident Income Tax Return for individuals. It provides detailed information on how to properly fill out your tax return. Ensure your compliance with state tax laws using this essential document.

Tax Forms

Free Tax USA Form 3800 General Business Credit

This file contains IRS Form 3800 for General Business Credit. It's essential for tax reporting and provides guidance for filling out the form. Users can e-file and print their federal tax return using FreeTaxUSA.

Tax Forms

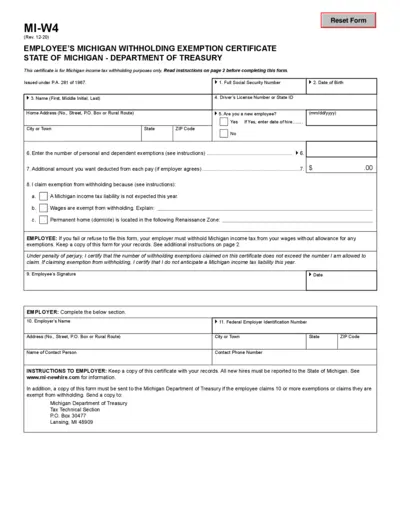

Michigan Withholding Exemption Certificate MI-W4 Form

The Michigan Withholding Exemption Certificate (Form MI-W4) is essential for employees to claim personal and dependent exemptions for state income tax withholding. It outlines the necessary details required for tax purposes and helps determine the correct withholding amount from wages. Understanding how to fill out this form correctly can save you money and ensure compliance with state tax regulations.

Tax Forms

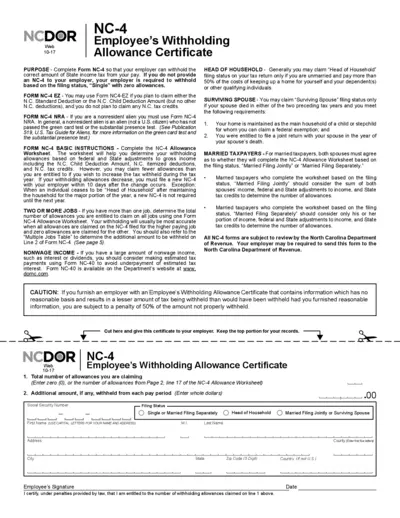

NC-4 Employee Withholding Allowance Certificate

The NC-4 form allows employees to determine the correct amount of State income tax withheld from their pay. Users can complete this form to make informed decisions regarding withholding allowances. It is essential for both individuals and employers to understand this form for accurate tax withholding.

Tax Forms

Instructions for IRS Form W-7 Application ITIN

This document provides detailed instructions for completing the IRS Form W-7, which is necessary for applying for an Individual Taxpayer Identification Number (ITIN). It outlines eligibility, application procedures, and documentation requirements. Understanding these guidelines is crucial for individuals needing an ITIN for tax purposes.