Tax Forms Documents

Tax Forms

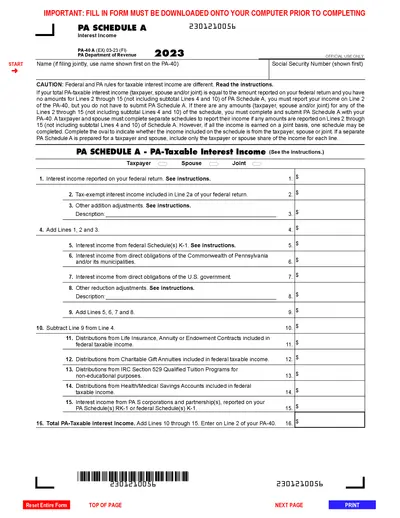

PA-40 A: 2023 Interest Income Schedule A Instructions

This file provides the instructions and details for completing the PA-40 Schedule A to report interest income for Pennsylvania tax purposes. It includes information on taxable interest, required schedules, and specific line items. Instructions for filling out, editing, and submitting the form are also provided.

Tax Forms

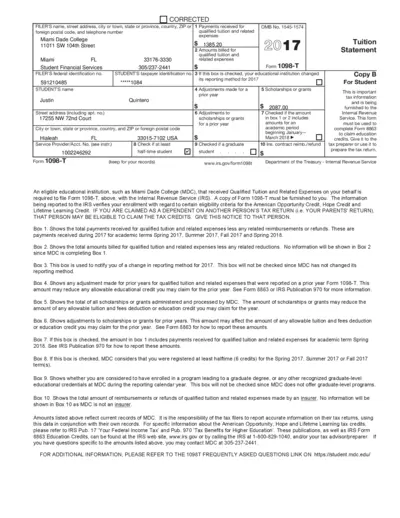

Form 1098-T: Tuition Statement for Tax Credits

Form 1098-T is provided by educational institutions to students for the purpose of reporting qualified tuition and related expenses for tax credits. It includes details about tuition payments, scholarships, and grants received. Use this form to claim education credits on your tax return.

Tax Forms

Instructions for Form 4972 - Tax on Lump-Sum Distributions

This document provides detailed instructions for filling out IRS Form 4972, which helps taxpayers figure the tax on qualifying lump-sum distributions from retirement plans. It includes eligibility requirements, specific conditions, and various methods to calculate the tax dues. By following this guide, individuals can ensure compliance with tax laws and accurately compute their liabilities.

Tax Forms

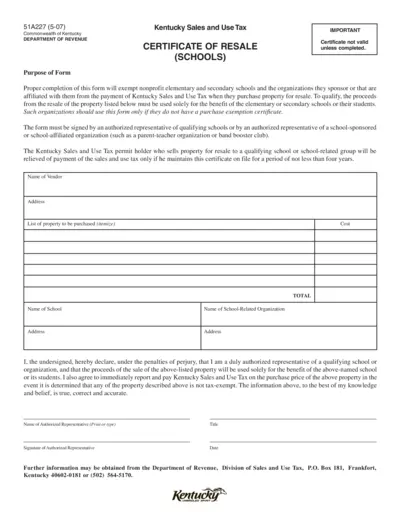

Kentucky Sales and Use Tax Certificate of Resale

This form is for nonprofit elementary and secondary schools in Kentucky to be exempt from sales and use tax when purchasing property for resale. An authorized representative must complete and sign this form. It should be kept on file for at least four years.

Tax Forms

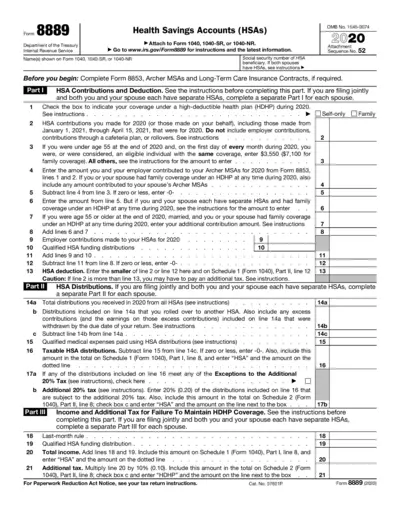

Form 8889: Health Savings Accounts (HSAs) Instructions

Form 8889 is used to report Health Savings Accounts (HSAs) contributions, deductions, and distributions. It's attached to Form 1040, 1040-SR, or 1040-NR. Complete the form as per the instructions and latest information provided by the IRS.

Tax Forms

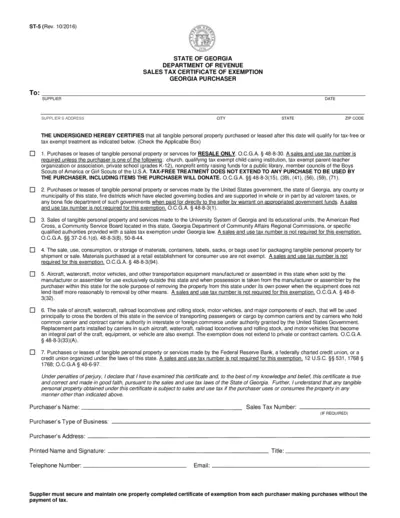

Georgia Sales Tax Certificate of Exemption

The Georgia Sales Tax Certificate of Exemption is used for claiming exemption from sales tax on certain purchases or leases in Georgia. It is applicable to various entities such as government bodies, educational institutions, and specific non-profits. This document certifies that the purchase qualifies for tax-free treatment.

Tax Forms

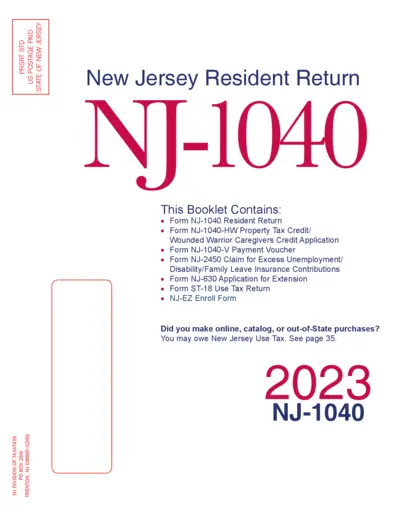

New Jersey 2023 NJ-1040 Tax Return & Instructions Guide

This file contains the 2023 NJ-1040 tax return form and instructions for New Jersey residents. It includes important tax credits, health insurance enrollment, and online filing information. Follow the included guidelines for a smooth filing process.

Tax Forms

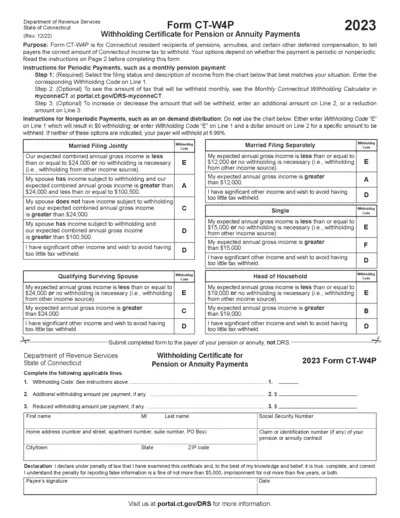

Connecticut Form CT-W4P: Withholding Certificate for Pension or Annuity Payments

This document is used by Connecticut residents receiving pensions, annuities, and other deferred compensation to inform payers about the correct withholding amount for state income tax. It helps prevent underpayment or overpayment of taxes by specifying the withholding code based on expected annual gross income. The form also provides instructions for periodic and nonperiodic payments.

Tax Forms

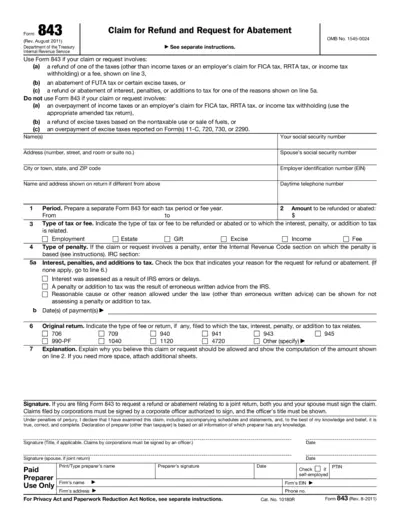

Claim for Refund and Request for Abatement Form

Form 843 is used to claim a refund or request an abatement of certain taxes. Users can file this form for various tax-related issues. It provides clear instructions for ensuring accurate submissions.

Tax Forms

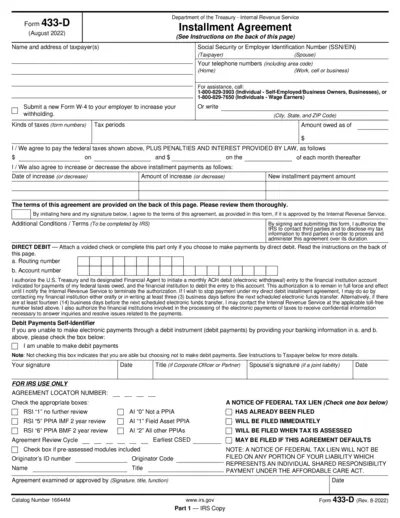

IRS Form 433-D Installment Agreement August 2022

Use Form 433-D to apply for an Installment Agreement with the IRS. This form assists taxpayers in paying their owed federal taxes over time. It includes agreements on payment terms and conditions.

Tax Forms

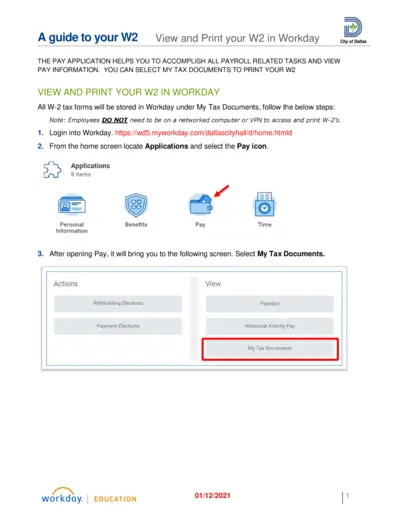

Guide to View and Print W2 in Workday

This guide helps employees view and print their W-2 forms through Workday. It contains step-by-step instructions for accessing tax documents. Perfect for City of Dallas employees looking to complete their payroll tasks efficiently.

Tax Forms

IRS Instructions for Form 8936 Qualified Vehicle Credit

This file contains instructions for completing Form 8936, which is used to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit. It provides detailed information on eligibility, how to fill out the form, and important updates regarding the credit for new clean vehicles. This essential guide is particularly useful for taxpayers looking to maximize their credits for electric and clean vehicles.