Tax Forms Documents

Tax Forms

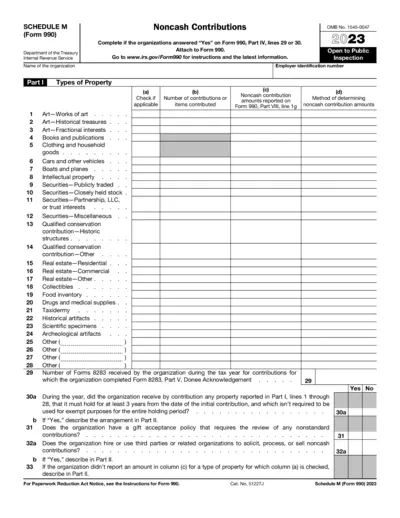

Schedule M Form 990 Noncash Contributions 2023

Schedule M (Form 990) is required for organizations reporting noncash contributions. It details the types of noncash contributions received during the tax year. Filling out this schedule accurately is crucial for compliance with IRS regulations.

Tax Forms

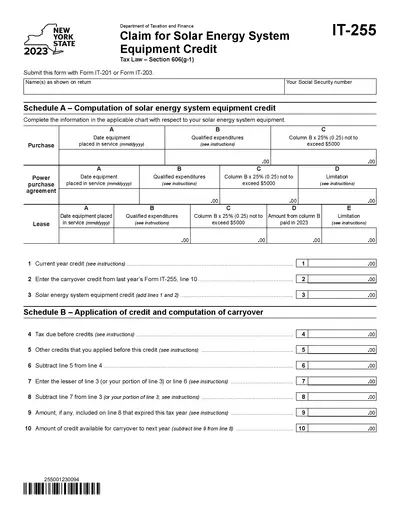

NY State 2023 Solar Energy System Equipment Credit

This document is the Claim for Solar Energy System Equipment Credit Form IT-255 for 2023. It provides essential information and instructions for taxpayers applying for the solar credit. Ensure you follow the guidelines to maximize your benefits.

Tax Forms

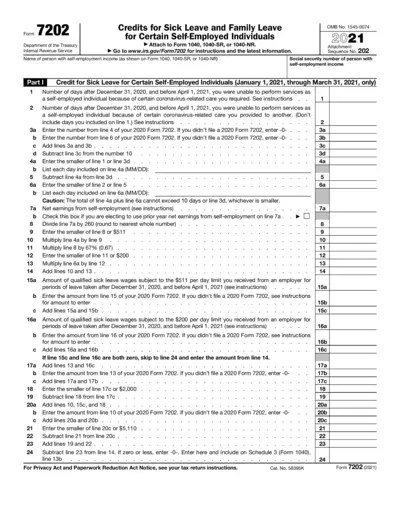

Credits for Sick Leave and Family Leave for Self-Employed

Form 7202 assists self-employed individuals in claiming credits for sick leave and family leave related to COVID-19. This form applies to specific dates in 2021 for those unable to work due to caring for themselves or others. It helps determine eligible days and corresponding tax credits.

Tax Forms

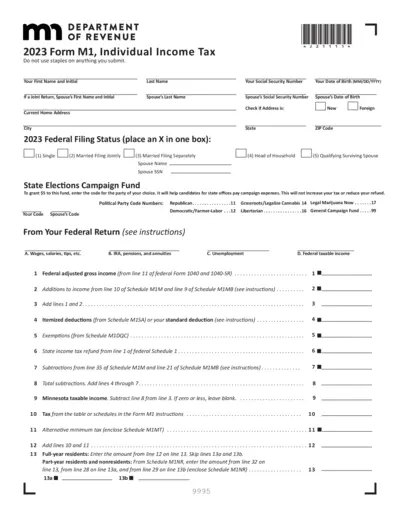

2023 Individual Income Tax Form M1

The 2023 Form M1 is the Individual Income Tax return for Minnesota residents. This form is essential for filing your state income tax accurately. Complete it with your personal and financial details to ensure proper tax assessment.

Tax Forms

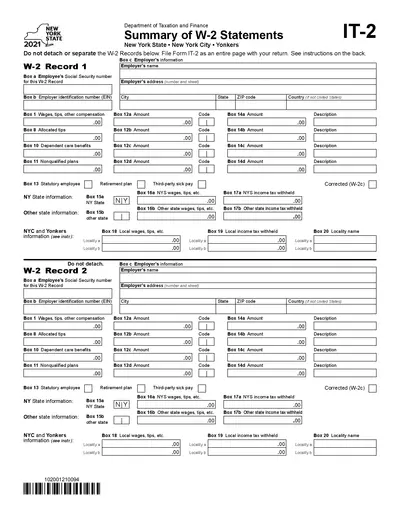

Summary of W-2 Statements for New York State

This file is a summary of W-2 statements required for New York State tax returns. It includes detailed instructions for filing taxes and specific information about your W-2 records. It is essential for anyone filing a New York State income tax return.

Tax Forms

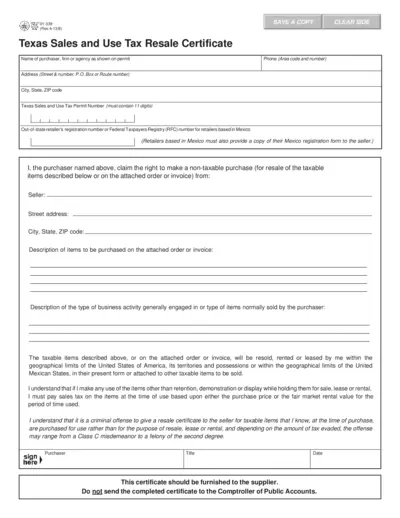

Texas Sales and Use Tax Resale Certificate and Exemption

This file provides essential information on completing the Texas Sales and Use Tax Resale Certificate and Exemption Certification. It is designed for both individual and business purchasers to ensure compliance with state tax laws. Fill out this form correctly to benefit from tax exemptions on eligible purchases.

Tax Forms

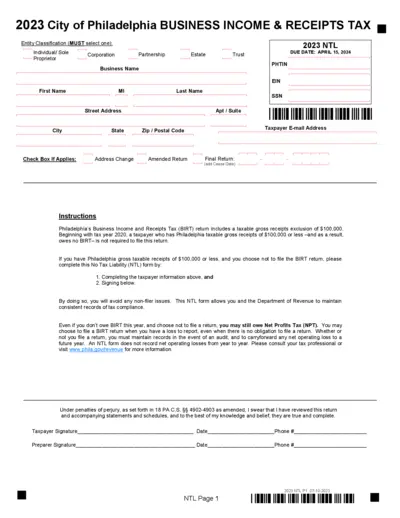

Philadelphia Business Income & Receipts Tax Form 2023

This form is essential for businesses to report their income and receipts for tax purposes in Philadelphia. It includes instructions for filing and details about tax liabilities. Proper completion ensures compliance with local tax regulations.

Tax Forms

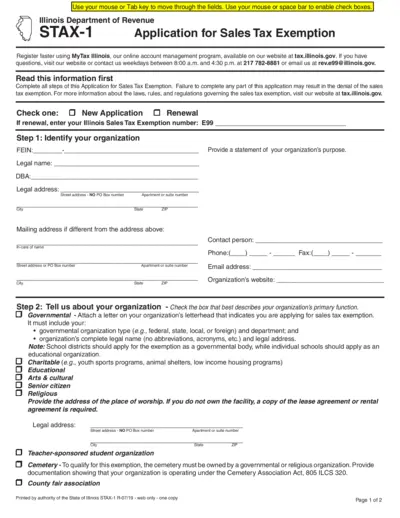

Illinois Sales Tax Exemption Application Form

This file provides the application format for sales tax exemption in Illinois. It includes detailed instructions for organizations seeking tax-exempt status. Access all the necessary information and required documentation here.

Tax Forms

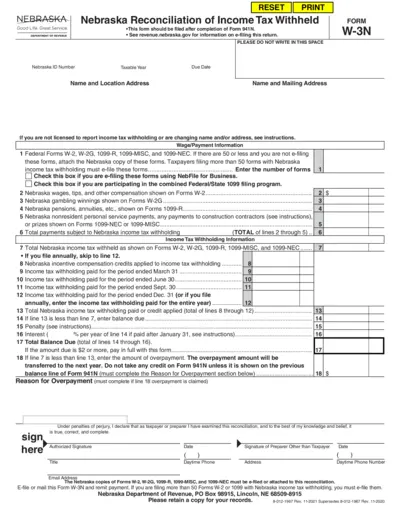

Nebraska Income Tax Withheld Reconciliation Form W-3N

The Nebraska Reconciliation of Income Tax Withheld, Form W-3N, is essential for employers to report income tax withholding details. This form must be filed by every employer or payor withholding Nebraska income taxes and includes necessary instructions for accurate completion. Ensure compliance by filing accurately and on time to avoid penalties.

Tax Forms

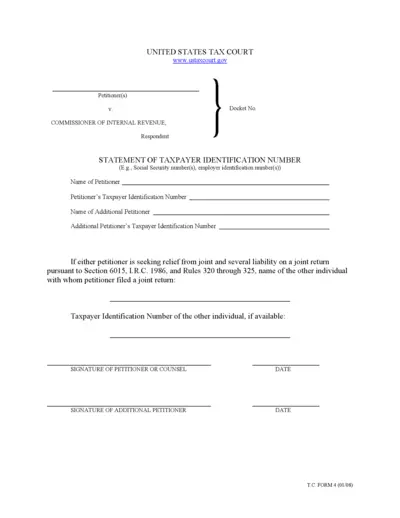

United States Tax Court Taxpayer Identification Form

This form is essential for taxpayers in the U.S. It requires taxpayer identification numbers for individuals and businesses. Use it for accurate tax filing and compliance.

Tax Forms

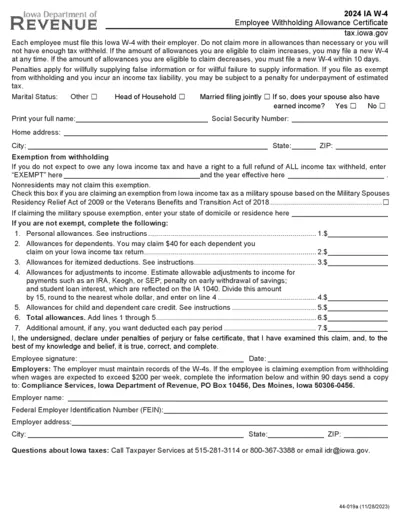

Iowa W-4 Employee Withholding Allowance Certificate

This Iowa W-4 form is essential for employees to declare their withholding allowances. It helps ensure the correct amount of state income tax is withheld from paychecks. Employers use this document to determine tax obligations for their employees.