Tax Forms Documents

Tax Forms

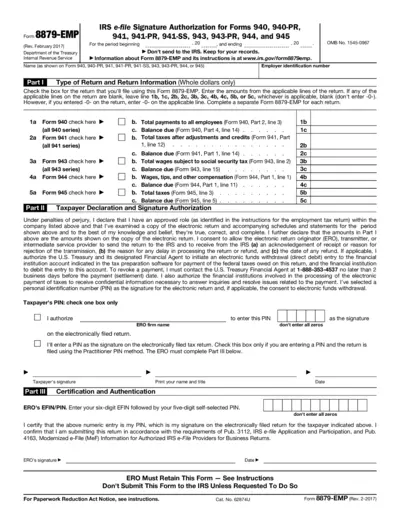

Form 8879-EMP IRS e-file Signature Authorization

Form 8879-EMP is used for the IRS e-file signature authorization of employment tax returns. This form allows taxpayers to electronically sign their returns with a PIN. It serves as an important document for employers to ensure compliance with federal tax regulations.

Tax Forms

California Installment Agreement Request Form

This document is the California Franchise Tax Board Installment Agreement Request form, used for requesting a payment plan for tax liabilities. It outlines the conditions for installment agreements and necessary taxpayer agreements. Use this form if you are unable to pay your tax liability in full immediately.

Tax Forms

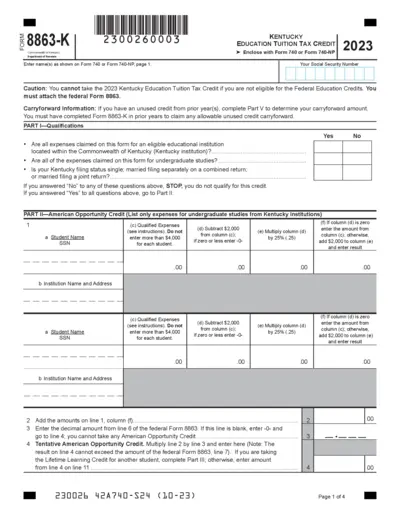

Kentucky Education Tuition Tax Credit Form 8863-K

Form 8863-K is essential for claiming the Kentucky Education Tuition Tax Credit. It details guidelines and qualifications for eligible taxpayers. Complete this form to potentially reduce your tax liability in Kentucky.

Tax Forms

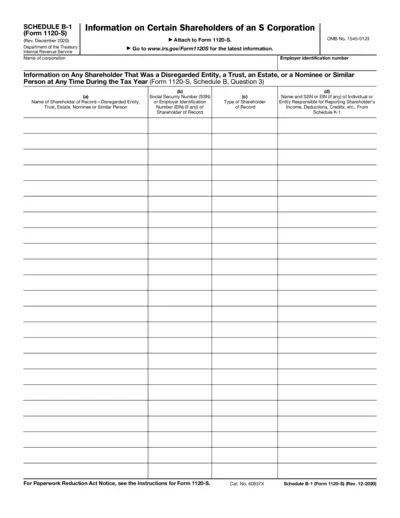

Form 1120-S Schedule B-1 Details and Instructions

Form 1120-S Schedule B-1 provides essential instructions for S corporations regarding certain shareholders. It details the necessary information required for filing and the specific conditions applicable to various types of shareholders. This document is crucial for ensuring compliance with IRS regulations.

Tax Forms

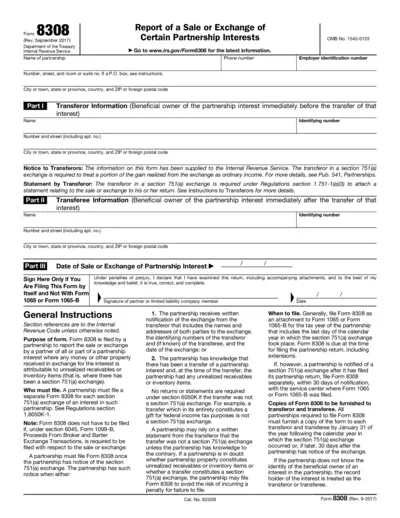

Form 8308 Report of Sale or Exchange of Partnership Interests

Form 8308 is utilized by partnerships to report the sale or exchange of partnership interests that may involve unrealized receivables or inventory items. It is essential for proper tax reporting and compliance with IRS regulations. This form requires detailed information about transferors, transferees, and the specifics of the transaction.

Tax Forms

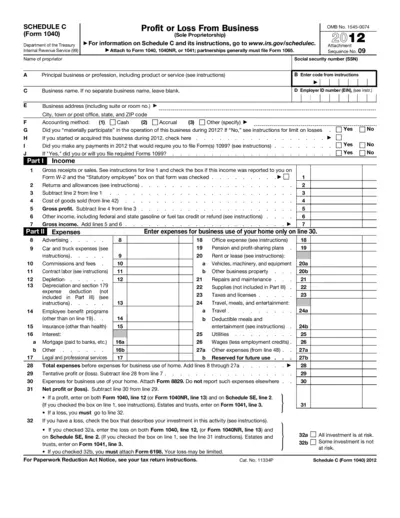

Schedule C Form 1040 Profit or Loss Business

This file is essential for sole proprietors to report income and expenses from their business. Sectioned into parts, it includes detailed calculations on profits and losses. Easily download and fill out this IRS form to ensure accurate tax filings.

Tax Forms

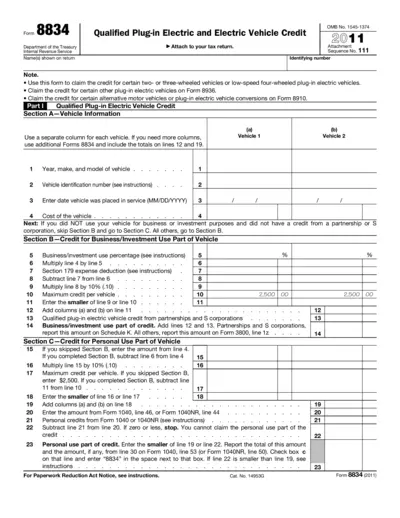

Qualified Plug-in Electric Vehicle Credit Form 8834

Form 8834 allows taxpayers to claim credits for qualified plug-in electric vehicles. It provides guidance on eligible vehicles and credit calculations. Use this form to successfully file your tax return and maximize your credits.

Tax Forms

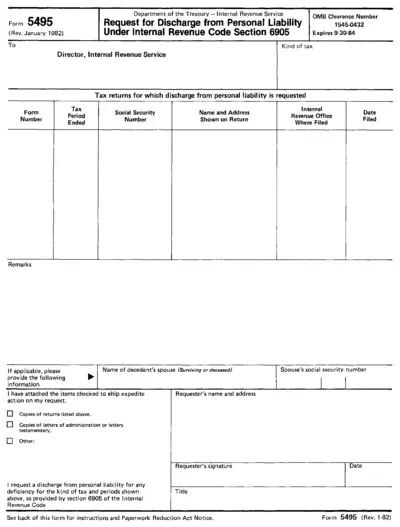

IRS Form 5495 Discharge from Personal Liability

Form 5495 is a request for discharge from personal liability under IRS Section 6905. It is used by individuals seeking to relieve themselves of tax liability. The form must be accompanied by necessary documentation.

Tax Forms

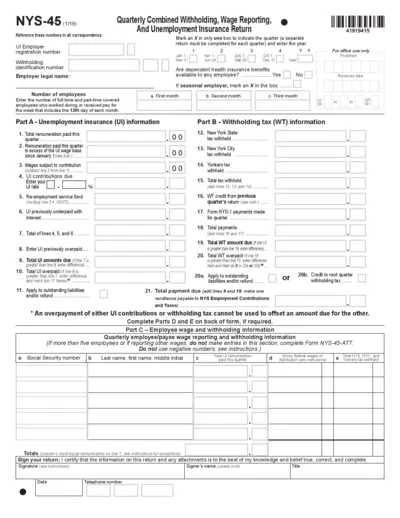

NYS-45 Quarterly Combined Withholding and Wage Return

The NYS-45 form is essential for New York employers to report combined withholding, wage information, and unemployment insurance return for employees. It provides detailed instructions on reporting remuneration, taxes due, and employee wages for a specific quarter. Completing this form accurately ensures compliance with state regulations and helps avoid potential penalties.

Tax Forms

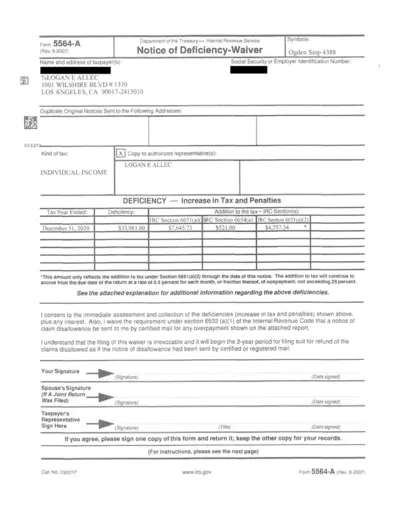

Form 5564-A Notice of Deficiency Waiver IRS

Form 5564-A is utilized to waive the notice of deficiency from the IRS. This form allows taxpayers to consent to the immediate assessment of deficiencies. Proper completion ensures a streamlined communication regarding tax discrepancies.

Tax Forms

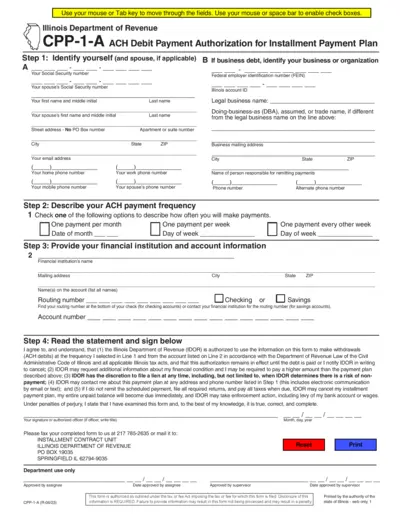

CPP-1-A ACH Debit Payment Authorization Form

This form is used to authorize ACH debit payments for installment payment plans to the Illinois Department of Revenue. It captures personal and financial information to facilitate automatic payments. Ensure to provide accurate details for a smoother processing experience.

Tax Forms

Instructions for Form 8889 Health Savings Accounts

This file contains detailed instructions for filling out Form 8889 related to Health Savings Accounts (HSAs). It explains eligibility, contributions, distributions, and deductions. Follow the guidelines to ensure compliance with tax regulations.