Tax Forms Documents

Tax Forms

Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 serves as the Heavy Highway Vehicle Use Tax Return for the tax period from July 1, 2017, to June 30, 2018. This form is essential for reporting heavy highway vehicle usage and calculating corresponding taxes. It is important for vehicle owners to file accurately and on time to avoid penalties.

Tax Forms

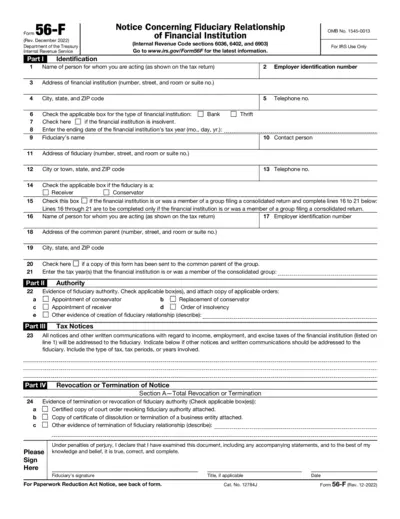

IRS Form 56-F Notify of Fiduciary Relationship

The IRS Form 56-F is used to notify the IRS of a fiduciary relationship with a financial institution. It is mandatory for fiduciaries to file this form within a specific time frame to ensure compliance with tax laws. This document includes detailed instructions for completing and submitting the form.

Tax Forms

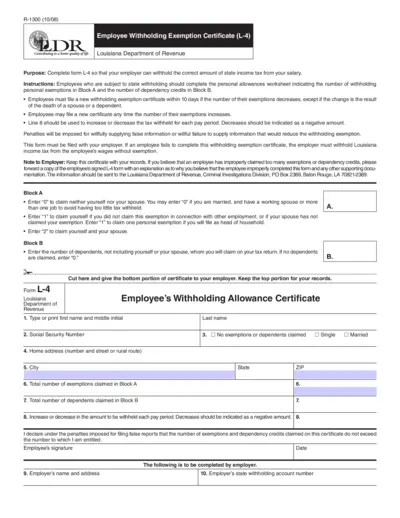

Employee Withholding Exemption Certificate L-4

The Employee Withholding Exemption Certificate (L-4) allows employees in Louisiana to declare the correct amount of state income tax withheld from their salaries. This form is essential for ensuring that employees do not overpay or underpay their taxes. It provides clear instructions for determining personal allowances and dependency credits.

Tax Forms

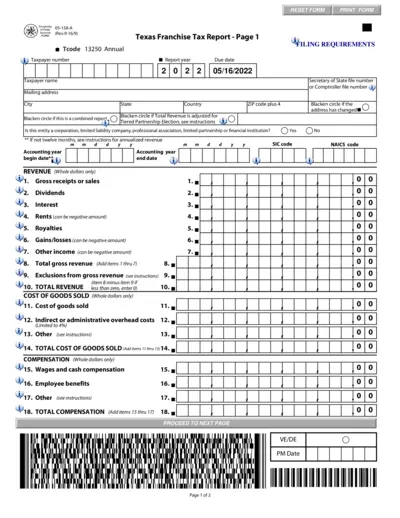

Texas Franchise Tax Report - Form 05-158

The Texas Franchise Tax Report Form 05-158 is essential for businesses to report their financial data to the Texas Comptroller. This document helps in calculating the franchise tax owed by the entity for the reported year. Accurate submission ensures compliance with state tax regulations.

Tax Forms

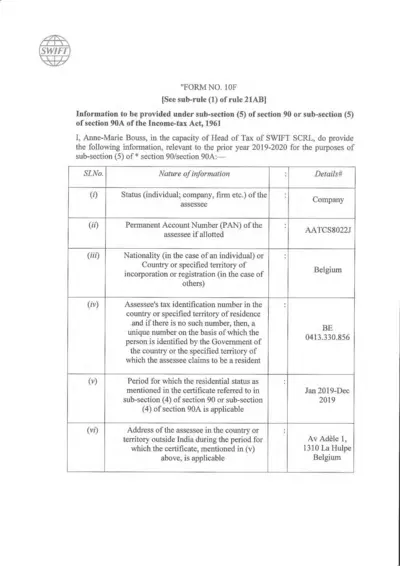

Form No. 10F Information Submission

This document provides essential information as required by the Income-tax Act, 1961. It is relevant for individuals and entities seeking tax residency status. Fill out this form accurately to ensure compliance with tax regulations.

Tax Forms

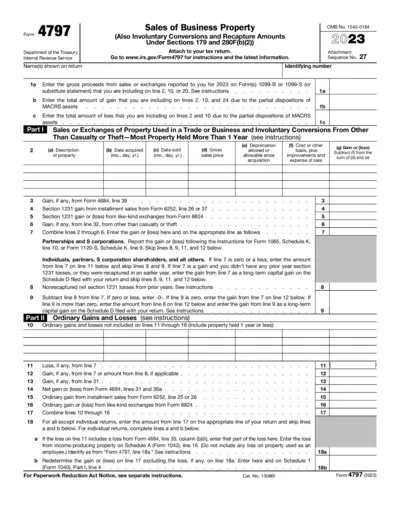

Form 4797: Sales of Business Property Instructions

Form 4797 provides guidelines for reporting sales of business property. This form is crucial for calculating gains and losses related to sales, exchanges, and involuntary conversions. Properly filling out this form ensures compliance with IRS regulations and accurate reporting on your tax return.

Tax Forms

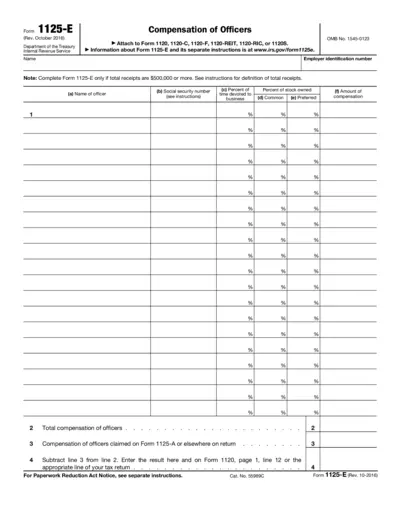

Form 1125-E Compensation of Officers Instructions

Form 1125-E is used for reporting officer compensation.

Tax Forms

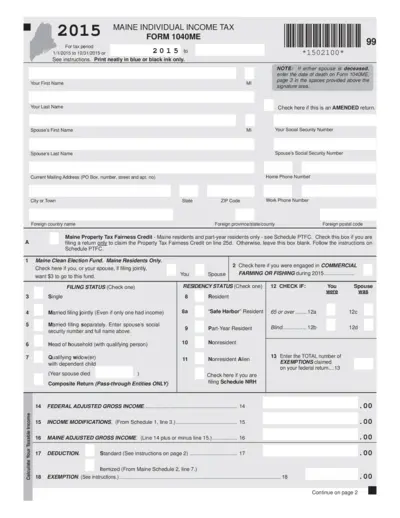

Maine Individual Income Tax Form 1040ME Instructions

This document provides a comprehensive guide for filling out the Maine Individual Income Tax Form 1040ME. It includes crucial deadlines, filing statuses, and step-by-step instructions. Use this form for your income tax filing needs in the state of Maine.

Tax Forms

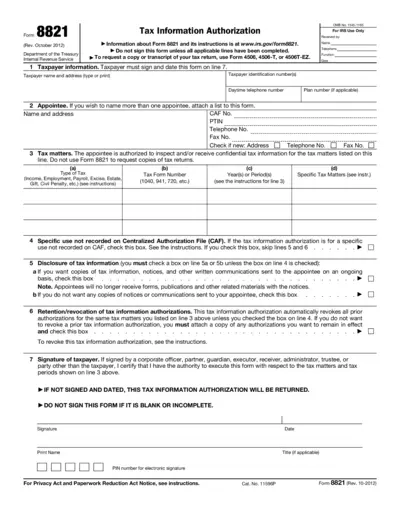

Form 8821 Tax Information Authorization

Form 8821 allows you to authorize an individual or entity to inspect and receive your confidential tax information. It is essential for managing your tax matters effectively. This form outlines the permissions granted and ensures proper handling of your tax data.

Tax Forms

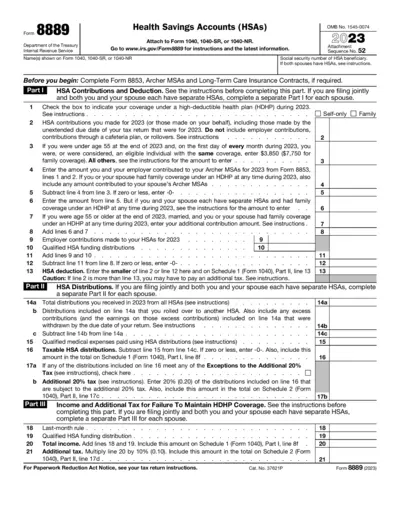

Form 8889 Health Savings Account IRS Instructions

Form 8889 is used to report Health Savings Account (HSA) contributions, deductions, and distributions. This form is crucial for individuals with HSAs to ensure compliance with IRS regulations. It provides necessary information for calculating tax benefits related to HSAs.

Tax Forms

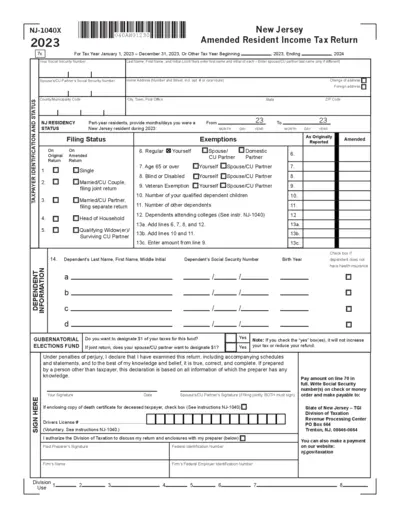

NJ 1040X Amended Resident Income Tax Return 2023

The NJ-1040X is used for filing an amended resident income tax return for New Jersey. This form is crucial for correcting any errors made on your original return and ensuring proper tax compliance. For tax year 2023, it is important to provide accurate information to avoid penalties and ensure timely processing.

Tax Forms

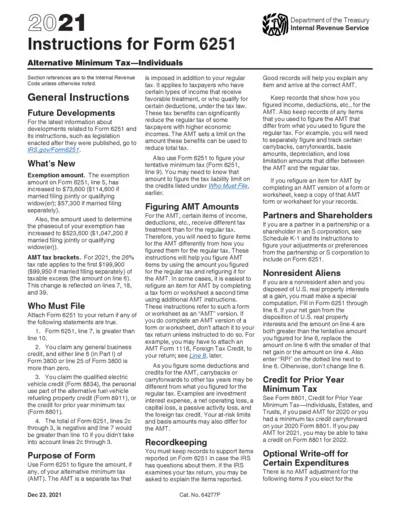

Instructions for Form 6251 - Alternative Minimum Tax

This file contains comprehensive instructions for Form 6251, which is used to calculate your Alternative Minimum Tax (AMT) obligations. It details exemptions, tax brackets, and required filings. This guide is essential for taxpayers subject to AMT regulations.