Tax Forms Documents

Tax Forms

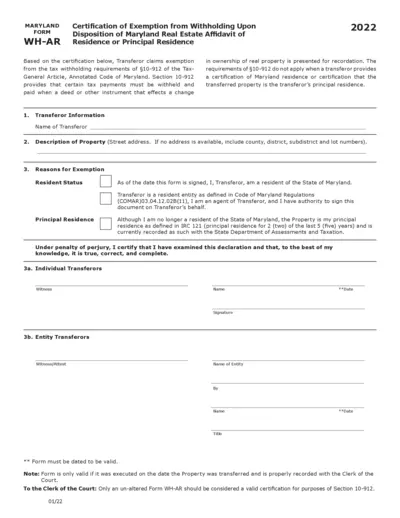

Maryland WH-AR 2022 Real Estate Withholding Exemption

The Maryland WH-AR form certifies exemption from withholding on the transfer of real estate. It is essential for Maryland residents and property owners. Ensure accurate completion to meet tax obligations.

Tax Forms

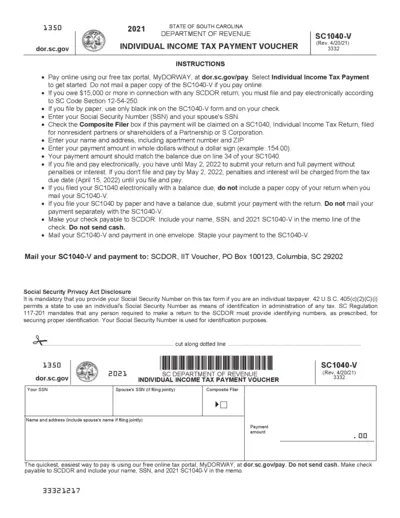

South Carolina Individual Income Tax Payment Voucher

This file provides the SC1040-V voucher for individual income tax payments. Users must fill out the form accurately to ensure proper processing. It includes essential instructions and deadlines for submission.

Tax Forms

FTB 5870A Instructions: Tax on Trust Distributions

The FTB 5870A instructions provide guidance on calculating tax on accumulation distributions from trusts. This document is essential for taxpayers dealing with foreign or domestic trusts. It ensures compliance with California tax laws and aligns with federal regulations.

Tax Forms

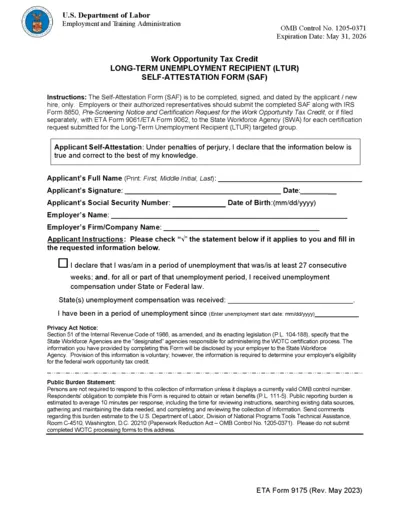

Work Opportunity Tax Credit Self-Attestation Form

The Self-Attestation Form (SAF) is required for applicants applying for the Work Opportunity Tax Credit. It collects essential information from long-term unemployment recipients to determine eligibility for the credit. Employers must submit this form along with IRS Form 8850.

Tax Forms

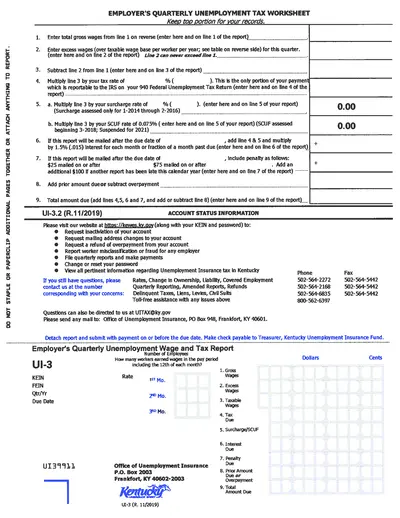

Employer Quarterly Unemployment Tax Worksheet

This form is essential for employers to report wages and calculate taxes for unemployment insurance. It provides clear instructions for completing each section accurately. Use this worksheet to ensure compliance with unemployment tax regulations in Kentucky.

Tax Forms

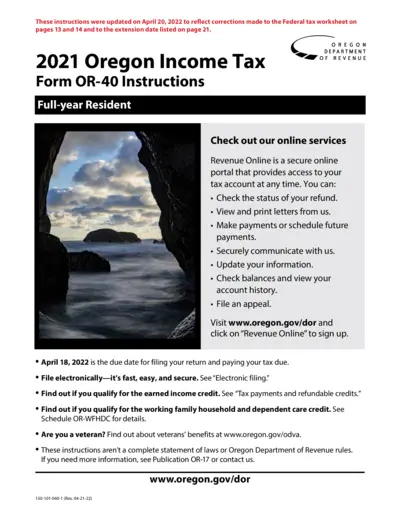

2021 Oregon Income Tax Form OR-40 Instructions

This document provides detailed instructions for filling out the 2021 Oregon Income Tax Form OR-40. It includes important deadlines, e-filing information, and resources for obtaining assistance. Essential for full-year residents of Oregon filing their income taxes.

Tax Forms

IRS Instructions for Form 2106 Employee Business Expenses

This file provides essential instructions for completing IRS Form 2106, which is related to employee business expenses. It is intended for individuals needing guidance on allowable deductions for business-related costs. Follow the instructions carefully to ensure proper filing.

Tax Forms

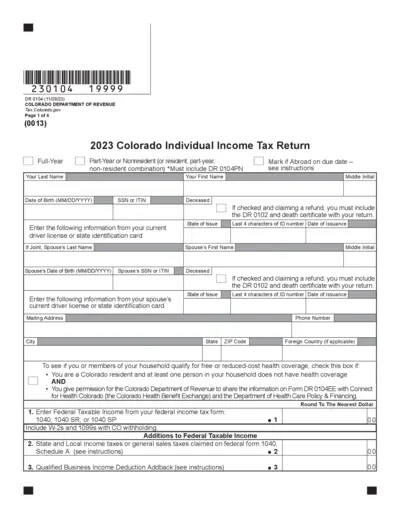

2023 Colorado Individual Income Tax Return Instructions

This document provides comprehensive instructions for filling out the 2023 Colorado Individual Income Tax Return. It includes essential information for both residents and non-residents. Users can navigate through various sections to ensure accurate and compliant submissions.

Tax Forms

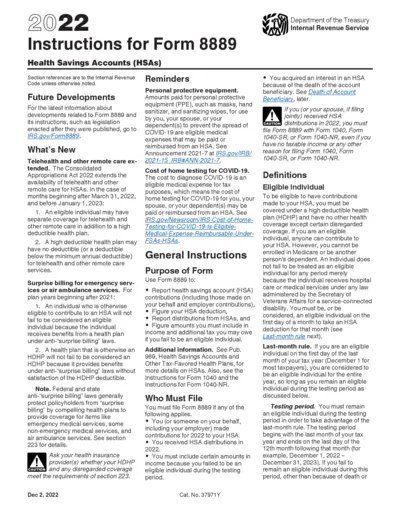

Instructions for Form 8889 Health Savings Accounts

This file provides detailed instructions for Form 8889 related to Health Savings Accounts. It outlines contributions, distributions, and eligibility criteria. Essential for anyone managing HSAs for tax purposes.

Tax Forms

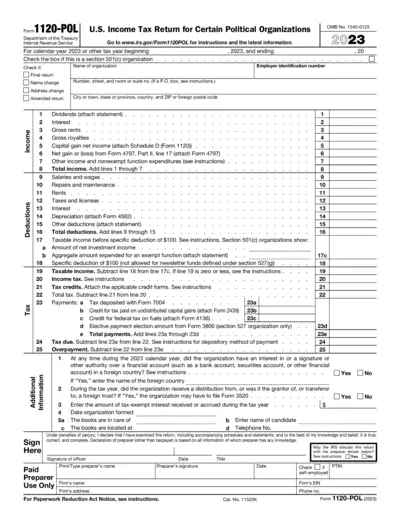

Form 1120-POL - U.S. Income Tax Return for Political Organizations

This file is the 1120-POL U.S. Income Tax Return for Certain Political Organizations. It provides guidance on completing the return accurately. Users can refer to the IRS website for detailed instructions and support.

Tax Forms

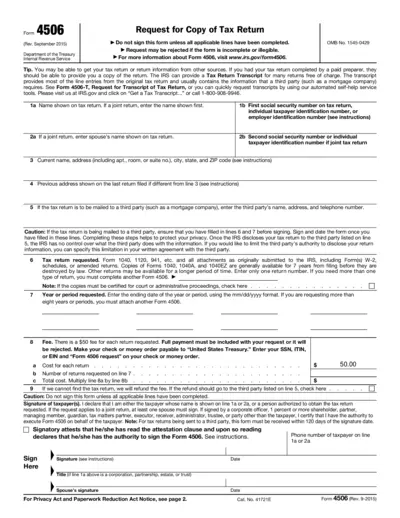

Request for Copy of Tax Return - Form 4506

Form 4506 allows you to request a copy of your tax return from the IRS. This form can be filled out by individuals or representatives for businesses to obtain tax documents. Learn how to complete this form and what information is needed to ensure your request is processed smoothly.

Tax Forms

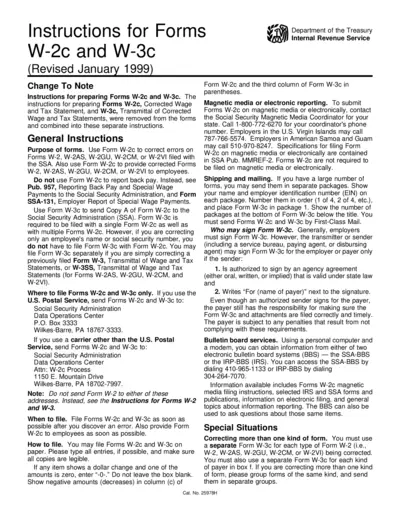

IRS Instructions for Forms W-2c and W-3c

This document provides comprehensive guidelines for correcting wage and tax statements using Forms W-2c and W-3c. It serves as an essential resource for employers aiming to rectify errors in submitted tax information accurately. Understanding these instructions ensures compliance with IRS regulations.