Tax Forms Documents

Tax Forms

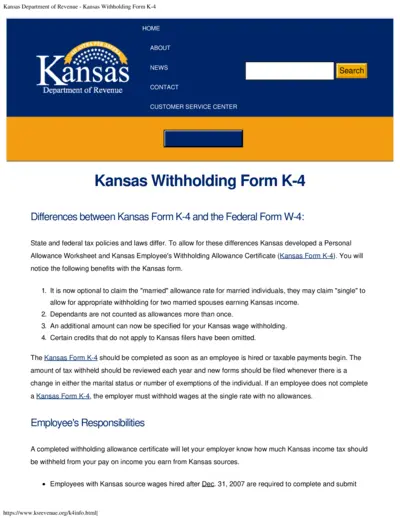

Kansas Withholding Form K-4 Instructions and Details

This document provides essential information about the Kansas Withholding Form K-4, including how to fill it out and who needs it. It's crucial for employees in Kansas to understand the differences between this state form and the federal Form W-4. Ensure you complete your K-4 accurately to maintain proper tax withholding.

Tax Forms

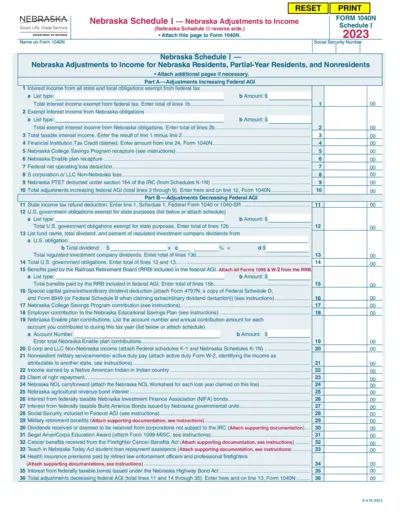

Nebraska Adjustments to Income Tax Form 1040N

This document provides the Nebraska Schedule I for adjustments to income for residents and nonresidents. It outlines how to calculate Nebraska adjustments effectively. Use this form to ensure accurate income reporting in compliance with Nebraska tax laws.

Tax Forms

Alabama Individual Income Tax Payment Voucher

This file contains the Alabama Individual Income Tax Payment Voucher. It provides essential information on how to submit your individual income tax payment. Use this voucher to ensure timely payment and avoid penalties.

Tax Forms

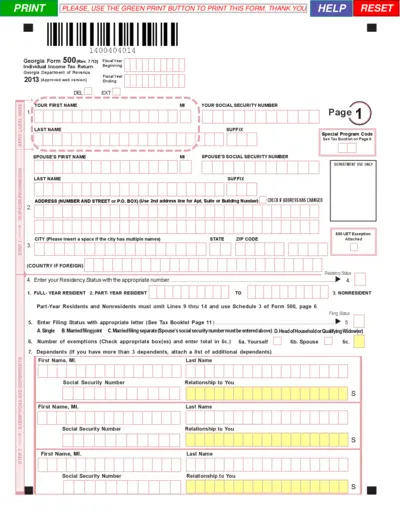

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is an Individual Income Tax Return form used by residents of Georgia to report their income and calculate taxes owed. This form must be completed annually and provides specific instructions for proper filing. Ensure you have all necessary information on hand before beginning to fill out this important tax document.

Tax Forms

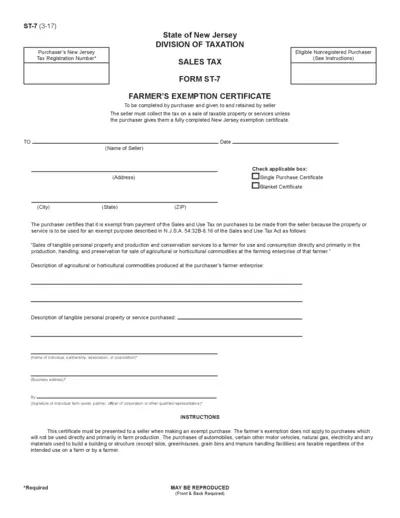

Farmers Exemption Certificate Form ST-7 Instructions

The Farmers Exemption Certificate Form ST-7 allows qualified purchasers in New Jersey to make tax-exempt purchases related to farming. This document must be presented to the seller to avoid sales tax on eligible items. It provides guidelines on filling out the form and the necessary exemptions applicable to farmers.

Tax Forms

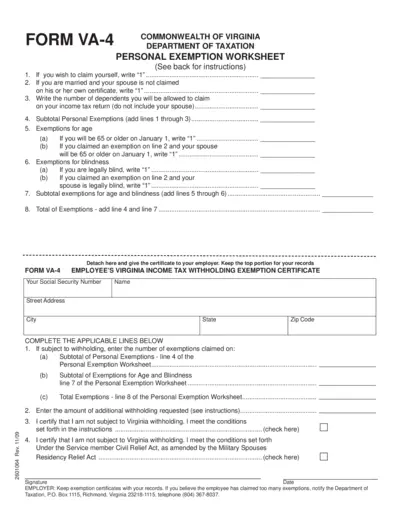

Virginia Tax Exemption Worksheet and Instructions

FORM VA-4 is a worksheet for Virginia residents to determine their personal tax exemptions. It includes detailed instructions for claiming yourself, your spouse, and dependents. Complete this form to notify your employer of your income tax withholding exemptions.

Tax Forms

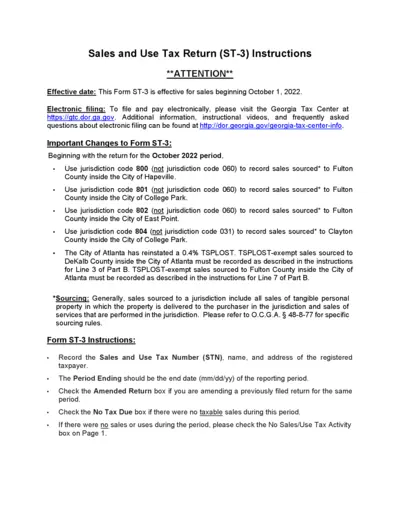

Sales and Use Tax Return ST-3 Instructions

Get detailed guidance on how to complete the Sales and Use Tax Return ST-3 form. This document provides essential instructions and jurisdiction codes necessary for accurate filing. Perfect for taxpayers in Georgia needing clarity on sales tax submissions.

Tax Forms

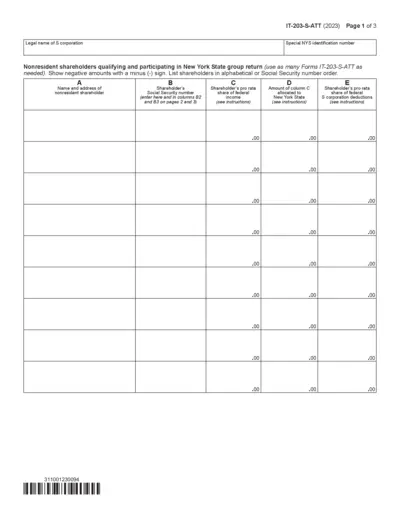

IT-203-S-ATT S Corporation Group Return Form

The IT-203-S-ATT form is used for S corporations with nonresident shareholders filing a group return in New York State. It helps in reporting shareholders' allocations of federal income, deductions, and New York tax liabilities. This form is essential for compliance with tax regulations and ensuring accurate reporting.

Tax Forms

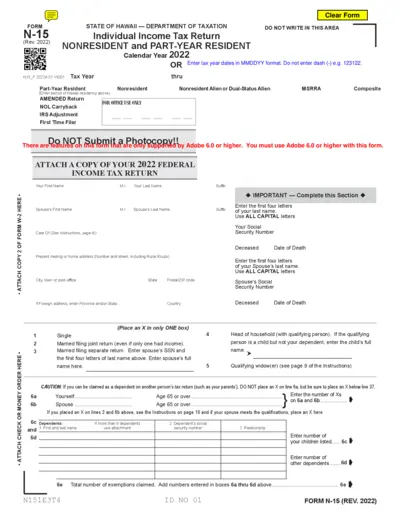

Hawaii Individual Income Tax Return Form N-15 2022

The Form N-15 is used by nonresidents and part-year residents in Hawaii to file their individual income tax returns. This form must be completed accurately to ensure compliance with state tax laws. Follow the provided instructions carefully to ensure smooth submission.

Tax Forms

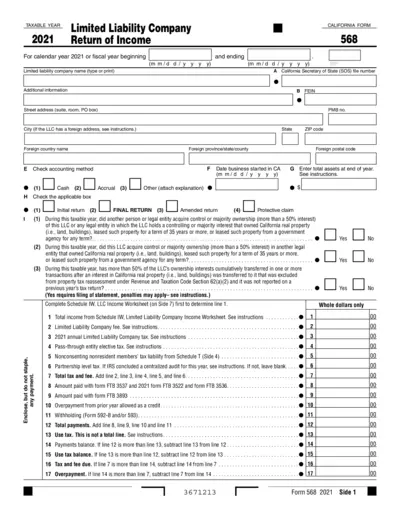

California Form 568 2021 Limited Liability Company Income

California Form 568 is a crucial document for Limited Liability Companies (LLCs) in the state for the tax year 2021. This return facilitates accurate income reporting and the payment of applicable fees. Ensure compliance with California tax regulations by completing this form correctly.

Tax Forms

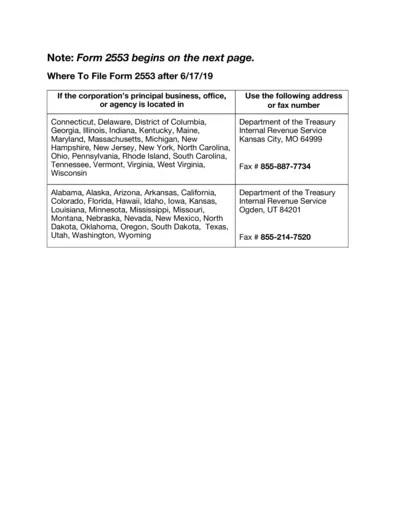

Form 2553 Instructions for S Corporation Election

Form 2553 is used by small business corporations to elect S corporation status. Proper completion and filing of this form is essential for tax purposes. This guide provides necessary instructions for using this form effectively.

Tax Forms

Instructions for Form 1065-X Amended Return

This file contains important instructions for Form 1065-X, an amended return or administrative adjustment request for partnerships. It includes what to attach, who must file, and defines key terms related to the form. Ensure compliance with filing requirements and understand recent changes.