Tax Forms Documents

Tax Forms

Instructions for Form 8082: AAR and Inconsistent Treatment

This file provides essential instructions for Form 8082, including guidelines for filing an Administrative Adjustment Request (AAR) or reporting inconsistent treatment. It serves as a crucial resource for partners in TEFRA or BBA partnerships, S corporation shareholders, and other pass-through entity stakeholders to ensure compliance with IRS regulations. Understanding how to accurately fill out this form will help avoid potential penalties and ensure correct reporting.

Tax Forms

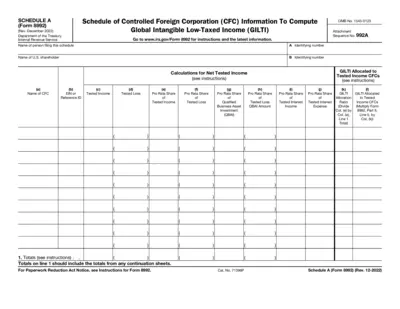

Schedule A Form 8992 GILTI Instructions

Schedule A (Form 8992) provides instructions for U.S. shareholders on how to report Global Intangible Low-Taxed Income (GILTI) and calculate net tested income from Controlled Foreign Corporations (CFCs). This form is essential for compliance with U.S. tax laws regarding foreign income. Access the latest information and guidelines on filling out this schedule at the IRS website.

Tax Forms

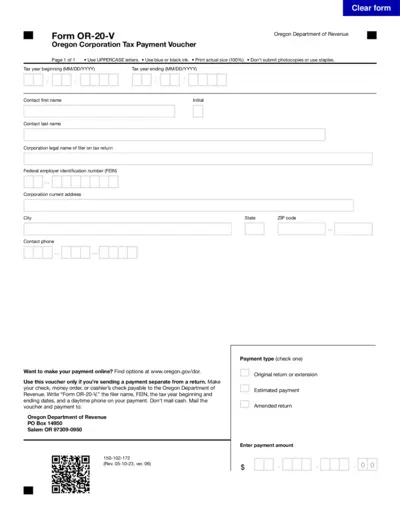

Oregon Corporation Tax Payment Voucher Instructions

This document provides essential instructions for completing the Oregon Corporation Tax Payment Voucher. It is necessary for businesses filing their taxes in Oregon. Use this guide to ensure accurate submission and payment.

Tax Forms

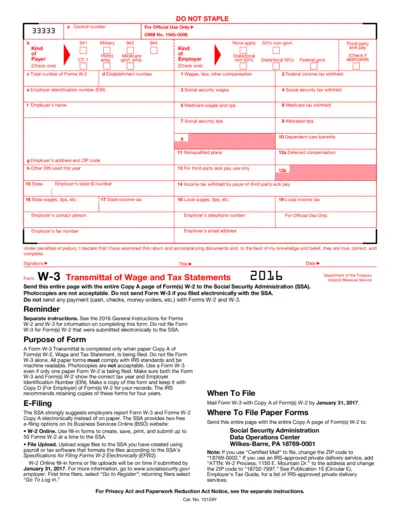

Form W-3: Transmittal of Wage and Tax Statements

Form W-3 is a transmittal form that accompanies Paper Form(s) W-2. It is used to report wage and tax statements to the Social Security Administration. Employers must submit this form to ensure proper recording of employee wages and taxes.

Tax Forms

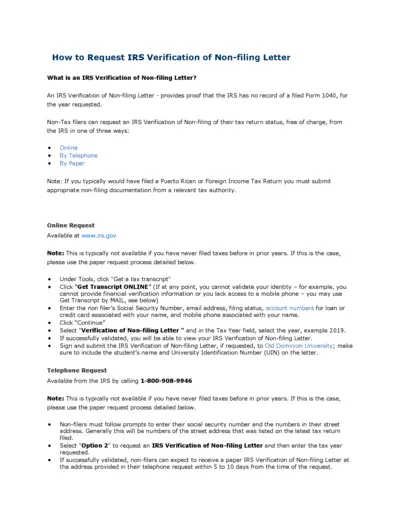

Request IRS Verification of Non-filing Letter

This file provides detailed instructions for requesting an IRS Verification of Non-filing Letter. It is essential for non-tax filers to prove their non-filing status to educational institutions or other organizations. Follow the guide for online, telephone, or paper request methods.

Tax Forms

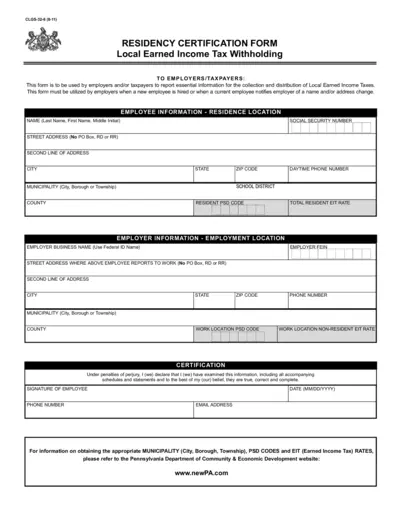

Residency Certification Form for Local Earned Income Tax

The Residency Certification Form is essential for employers and taxpayers reporting local earned income tax information. This form is required for new hires or for updates in employee information such as name or address. It ensures accurate tax reporting and compliance.

Tax Forms

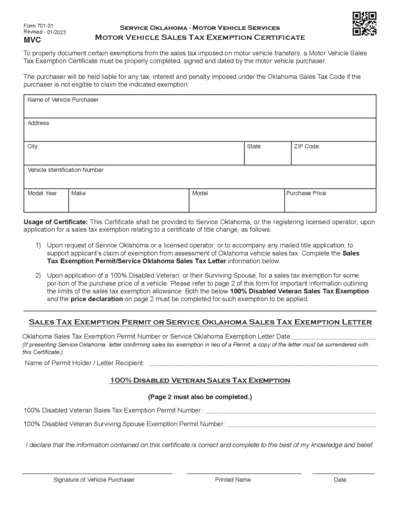

Motor Vehicle Sales Tax Exemption Certificate

The Motor Vehicle Sales Tax Exemption Certificate is essential for documenting exemptions from sales tax on vehicle transfers. This form must be completed, signed, and presented by eligible purchasers, such as disabled veterans. Ensure to understand the specific requirements to benefit from available exemptions.

Tax Forms

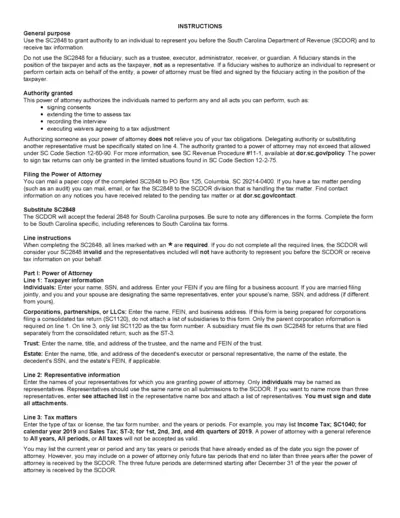

South Carolina SC2848 Power of Attorney Instructions

The SC2848 form authorizes an individual to represent you before the South Carolina Department of Revenue. It is essential for taxpayers needing assistance in handling their tax matters. Ensure all required sections are completed to avoid invalidation of the form.

Tax Forms

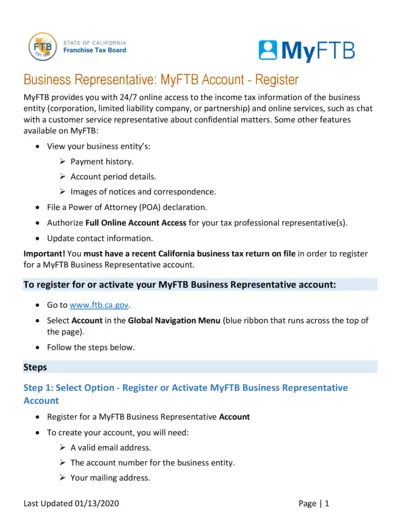

MyFTB Business Representative Account Instructions

This document provides detailed instructions on how to register and use the MyFTB Business Representative account. It includes steps for account creation, activation, and important features available to users. Ideal for business entities needing access to their tax information online.

Tax Forms

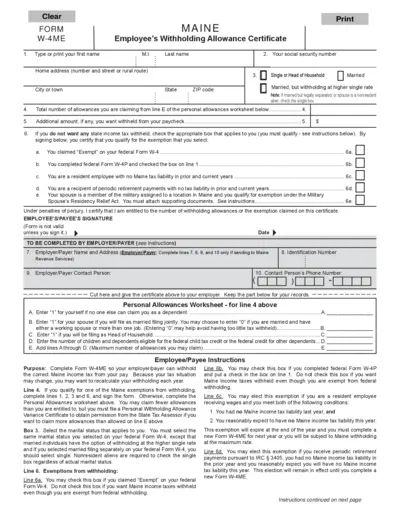

Maine Employee Withholding Allowance Certificate W-4ME

The Maine Employee's Withholding Allowance Certificate (Form W-4ME) is essential for employees to declare their withholding preferences. Properly filling out this form ensures accurate state income tax withholding. This guide offers step-by-step instructions to help you complete the W-4ME correctly.

Tax Forms

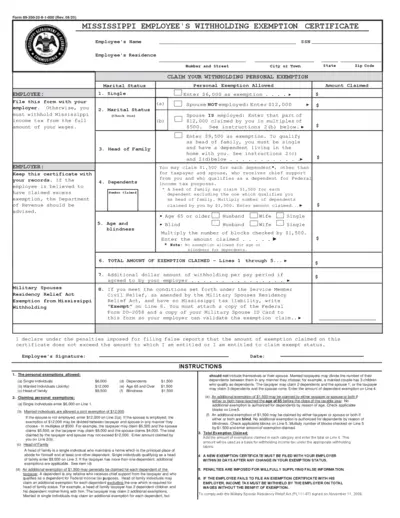

Mississippi Employee Withholding Exemption Certificate

The Mississippi Employee's Withholding Exemption Certificate is a crucial form for employees in Mississippi. It helps in determining personal exemptions for state income tax withholding. This certificate needs to be submitted to your employer to avoid unnecessary withholding.

Tax Forms

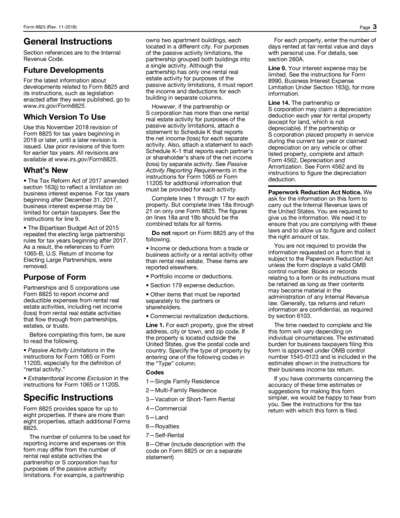

Form 8825 General Instructions for Tax Filing

Form 8825 is used by partnerships and S corporations to report income and deductible expenses from rental real estate activities. This guide provides detailed instructions to help you accurately fill out and file this essential tax form. Stay updated on the latest tax regulations and ensure compliance with your submissions.