Tax Forms Documents

Tax Forms

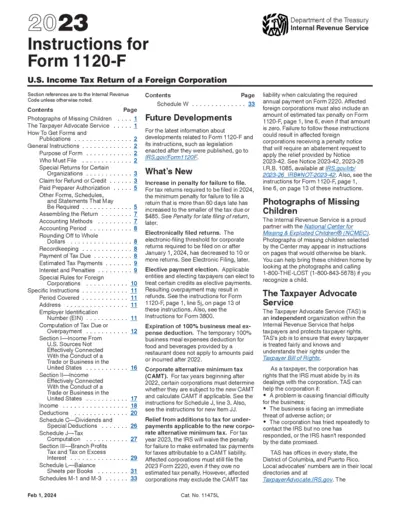

Form 1120-F U.S. Income Tax Return Foreign Corporation

This form is used by foreign corporations to report their income, deductions, and U.S. income tax liability. It allows them to claim refunds and fulfill their tax obligations. Understanding this form is crucial for compliance with U.S. tax regulations.

Tax Forms

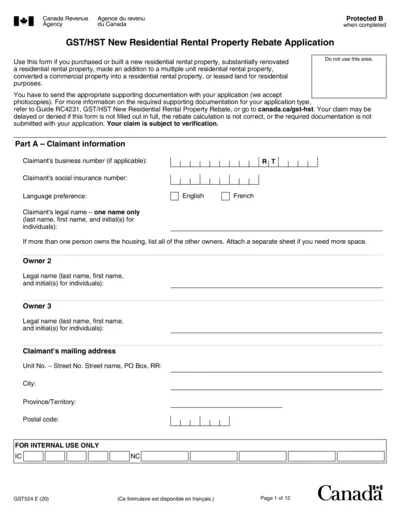

GST/HST New Residential Rental Property Rebate

This form is used to apply for the GST/HST New Residential Rental Property Rebate. It is intended for individuals and businesses that have purchased, built, or substantially renovated a new residential rental property. Ensure to include all necessary documentation to avoid delays or denials.

Tax Forms

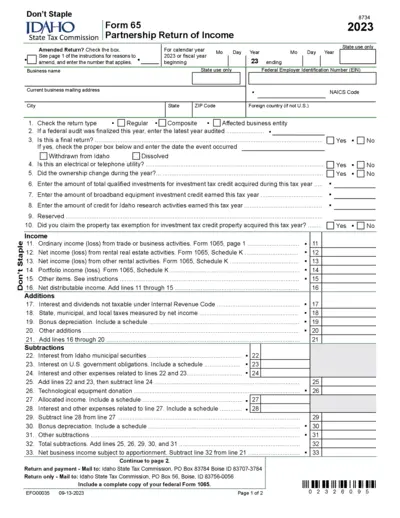

IDAHO State Tax Commission Form 65 Partnership Return

This file contains the Idaho Form 65, used for Partnership Returns for the fiscal year 2023. It provides guidelines for amending the return and necessary instructions for business tax filing.

Tax Forms

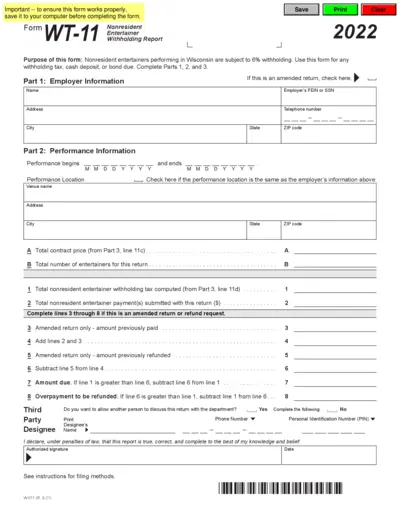

WT-11 Nonresident Entertainer Withholding Report

The WT-11 form is designed for nonresident entertainers performing in Wisconsin. It enables users to report withholding tax accurately. This essential document ensures compliance with state tax laws.

Tax Forms

IRS 1040 Tax Form Instructions for 2021

This file contains the IRS instructions for tax form 1040 and 1040-SR for the tax year 2021. It includes updates from the American Rescue Plan and provides essential filing requirements. Users will find detailed sections on filling out the form, necessary schedules, and important information for tax preparation.

Tax Forms

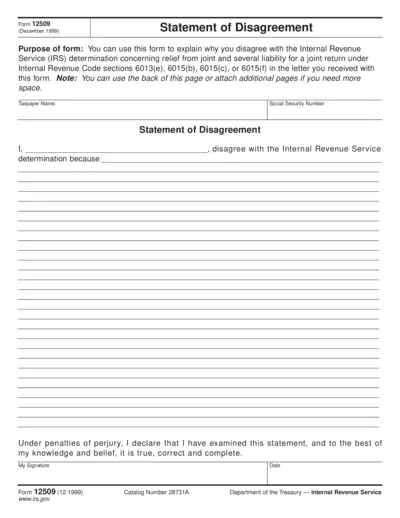

Form 12509 Statement of Disagreement for IRS

Form 12509 allows taxpayers to contest IRS determinations regarding joint return liability. Use this form to present your explanation clearly. It's essential for those seeking relief under IRS regulations.

Tax Forms

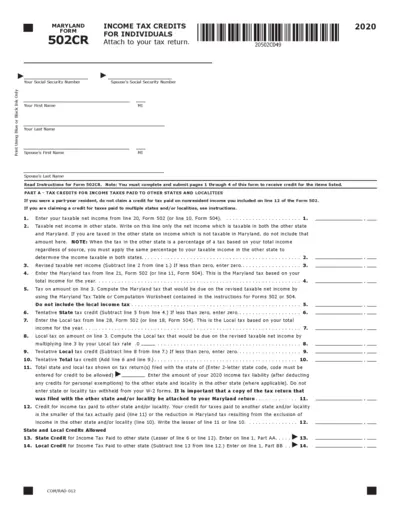

Maryland Form 502CR Income Tax Credits 2020

Maryland Form 502CR provides individuals with essential income tax credits applicable for the year 2020. This form assists in determining credits for taxes paid to other states and localities, child and dependent care expenses, and more. Ensure to attach this form to your tax return for proper credit assessment.

Tax Forms

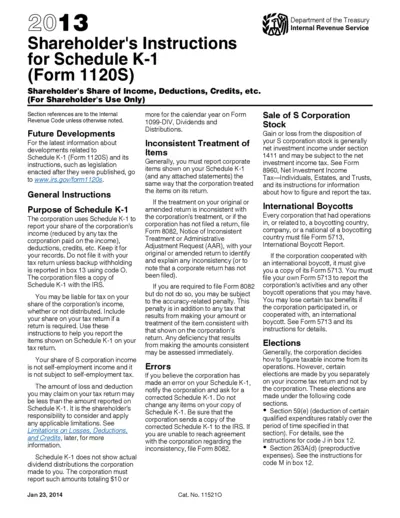

Shareholder's Instructions for Schedule K-1 (Form 1120S)

This file provides detailed instructions for shareholders on how to fill out Schedule K-1 (Form 1120S). It includes vital information regarding reporting your share of a corporation's income, deductions, and credits. Designed for S corporations, this guide ensures accurate tax reporting for shareholders.

Tax Forms

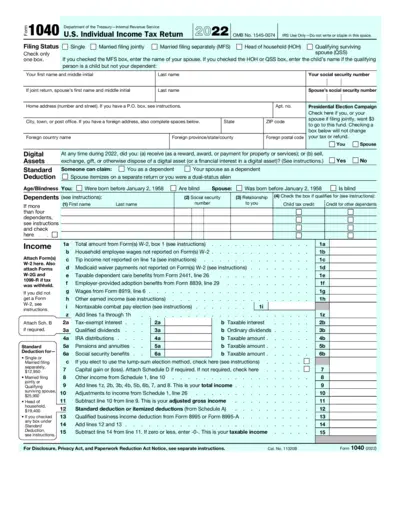

U.S. Individual Income Tax Return Form 1040 2022

The U.S. Individual Income Tax Return Form 1040 for the year 2022 is essential for individuals reporting their annual income to the IRS. This form determines filing status, calculates tax obligations, and claims deductions. Proper completion is vital to ensure accurate tax processing and compliance.

Tax Forms

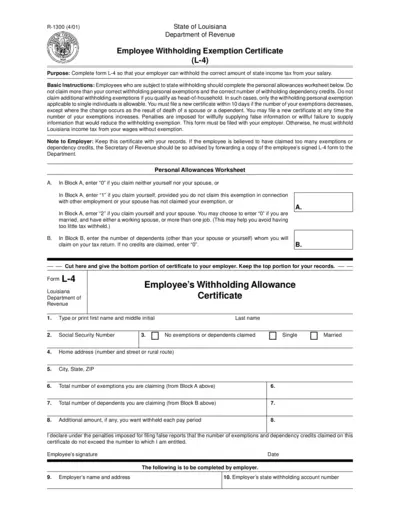

Employee Withholding Exemption Certificate L-4

The Employee Withholding Exemption Certificate (L-4) is essential for Louisiana workers. Fill this form to ensure correct state income tax withholding. It's crucial for employees to claim appropriate exemptions and dependency credits.

Tax Forms

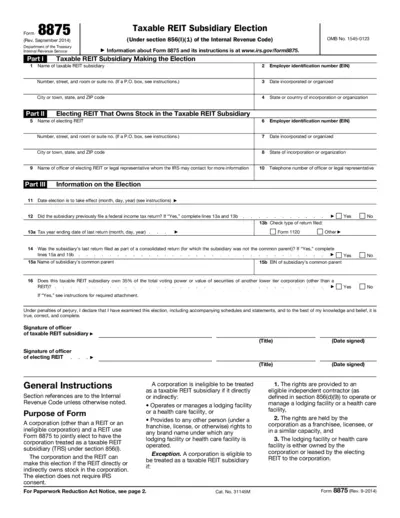

Taxable REIT Subsidiary Election Form 8875 Instructions

This document provides essential information and instructions for completing Form 8875, the Taxable REIT Subsidiary Election. It outlines the required details and filing process for eligible corporations and REITs. Ensure compliance with internal revenue code requirements with this comprehensive guide.

Tax Forms

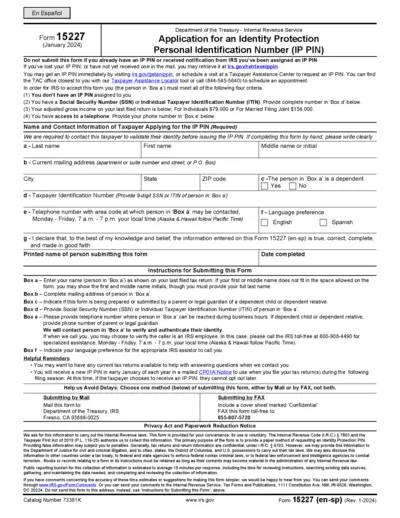

Application for Identity Protection PIN Form 15227

The IP PIN application form is essential for taxpayers seeking to secure their identity. This form is designed for individuals who need an Identity Protection Personal Identification Number. Follow the guidelines to ensure prompt processing of your application.