Tax Forms Documents

Tax Forms

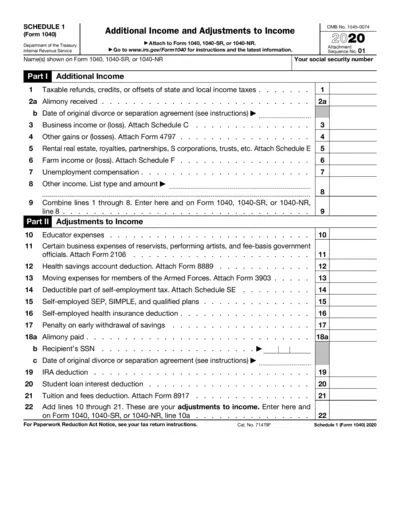

Schedule 1 Form 1040 Additional Income Instructions

This file provides essential instructions and information for filling out Schedule 1 of Form 1040. It is crucial for taxpayers to report additional income and adjustments. Completing this form accurately helps ensure proper tax compliance.

Tax Forms

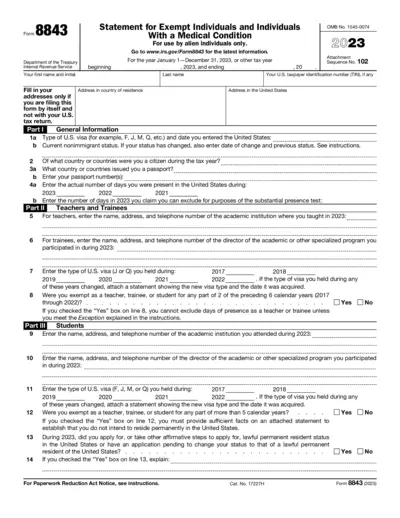

Form 8843 Instructions for Exempt Individuals 2023

Form 8843 is a statement for exempt individuals and individuals with a medical condition for the tax year 2023. It facilitates the declaration of presence in the U.S. and specific circumstances for exemptions. Ensure to follow the guidelines to complete your filing accurately.

Tax Forms

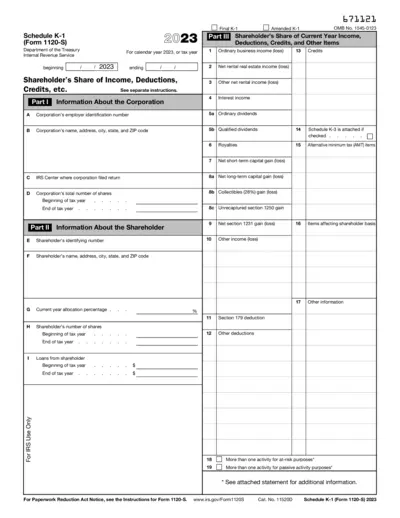

Schedule K-1 Form 1120-S 2023 Detailed Guide

Schedule K-1 (Form 1120-S) is used to report each shareholder's share of income, deductions, and credits for tax year 2023. This form is essential for S corporations to ensure accurate tax reporting. Understanding how to properly fill out this form is crucial for compliance with IRS regulations.

Tax Forms

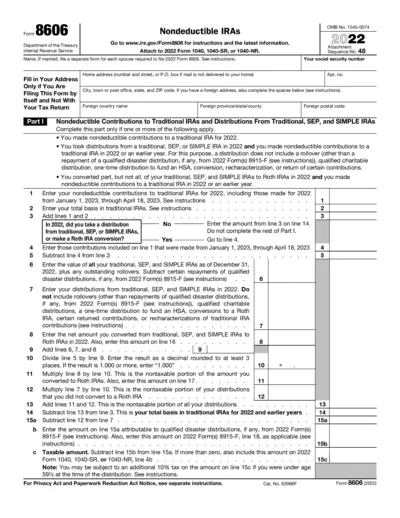

Form 8606: Nondeductible IRAs Instructions for 2022

Form 8606 is used to report nondeductible contributions to traditional IRAs and distributions from traditional, SEP, and SIMPLE IRAs. This form is essential for taxpayers who have made nondeductible contributions in 2022. Accurate completion ensures compliance with IRS regulations.

Tax Forms

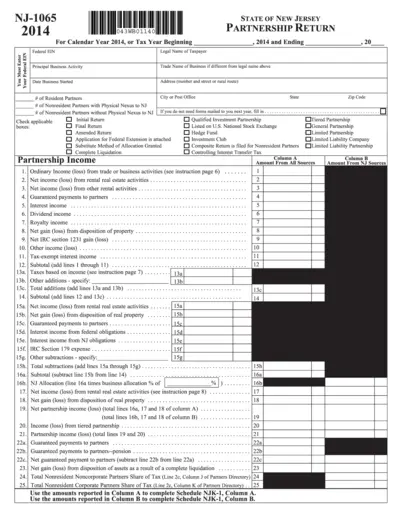

New Jersey Partnership Return NJ-1065 Form

The NJ-1065 form is essential for partnerships operating in New Jersey. This document facilitates the reporting of income, deductions, and credits for partnerships. It is crucial for ensuring compliance with state tax regulations.

Tax Forms

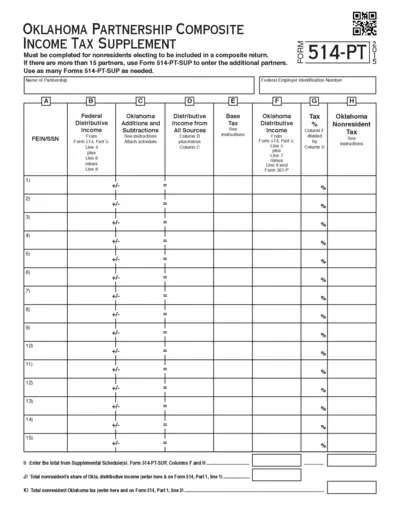

Oklahoma Partnership Composite Income Tax Supplement

This form is essential for nonresidents electing to be part of a composite return for Oklahoma income tax purposes. It helps report distributive income accurately and ensures compliance with state regulations. Use this form if there are over 15 partners to streamline the filing process.

Tax Forms

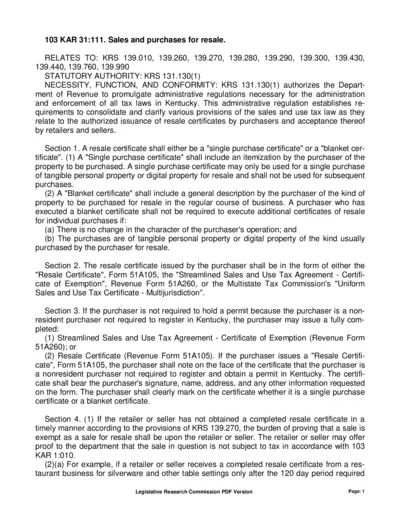

Sales and Purchases for Resale Instructions

This file provides detailed instructions on the use of resale certificates in Kentucky. It helps businesses understand the requirements for purchasing goods for resale. Essential for retailers and sellers in compliance with tax laws.

Tax Forms

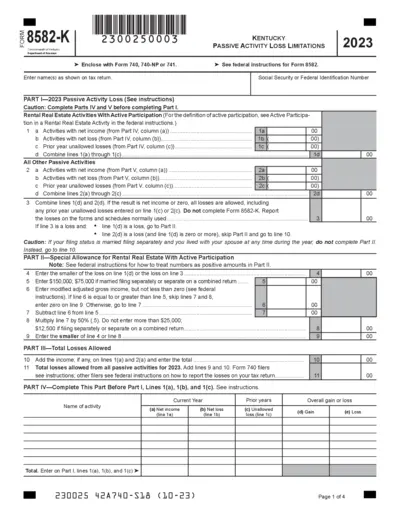

Passive Activity Loss Limitations Form 8582-K Kentucky

The Form 8582-K is essential for reporting passive activity losses in Kentucky. This document assists individuals in accurately calculating allowable losses. Utilize this form to fulfill state requirements for tax submissions related to passive activities.

Tax Forms

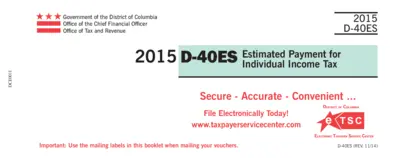

Estimated Payment for Individual Income Tax D-40ES

This file provides detailed instructions for filing the D-40ES form. It's essential for those expecting to owe more than $100 in District of Columbia taxes. Use this guide to navigate your estimated payment process easily.

Tax Forms

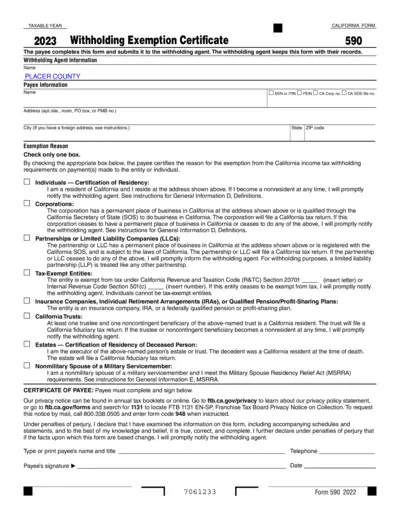

California Withholding Exemption Certificate Form 590

The California Withholding Exemption Certificate (Form 590) allows payees to certify their exemption from withholding on California source income. It is essential for individuals and entities wanting to avoid unnecessary tax withholding for California sourced income. Ensure all fields are completed accurately to avoid issues with the Franchise Tax Board.

Tax Forms

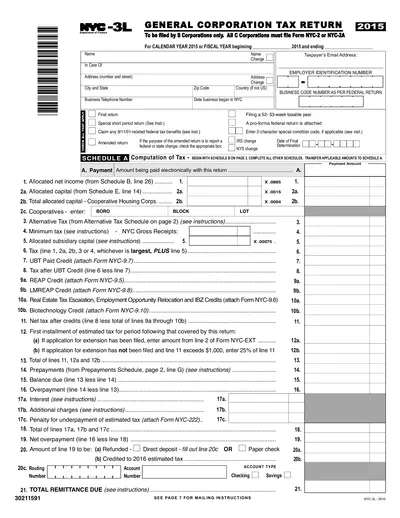

NYC Department of Finance Form NYC-3L 2015 Instructions

This file provides essential instructions for filling out the NYC-3L tax return form for S Corporations in New York City. It includes details on deductions, credits, and necessary fields. Perfect for business owners seeking to comply with NYC taxation requirements.

Tax Forms

Form 540-V Payment Voucher for 540 Returns

Form 540-V is a payment voucher for individuals filing California Resident Income Tax Returns. This form should be used to remit payments if you have a balance due. Follow the included instructions to ensure proper filing and timely payment.