International Tax Documents

Cross-Border Taxation

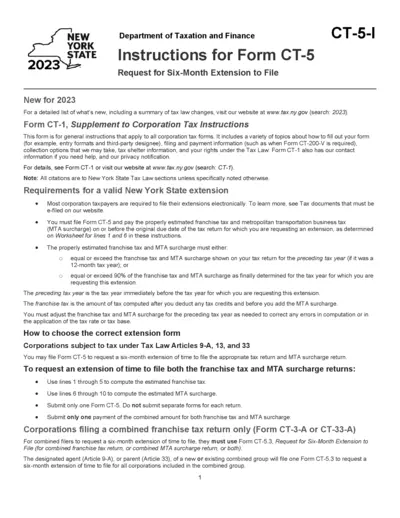

Instructions for Form CT-5 Request for Extension

This file provides detailed instructions for completing Form CT-5 to request a six-month extension for filing taxes in New York. It is essential for corporations seeking to extend their filing deadlines while ensuring compliance with tax laws. The guidelines include eligibility criteria, required forms, and submission instructions.

Cross-Border Taxation

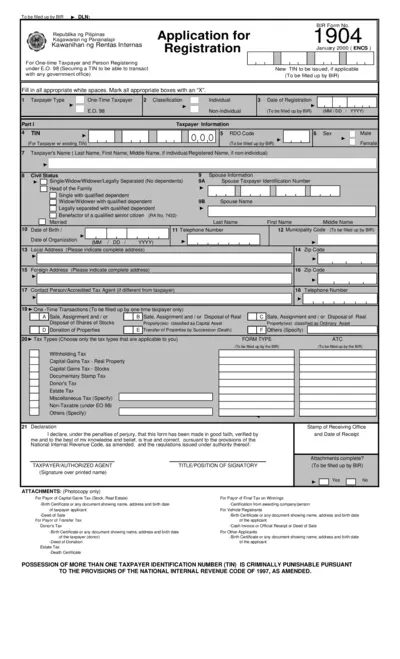

BIR Application for Registration Form No. 1904

This document is the BIR Form No. 1904, intended for one-time taxpayers and individuals seeking to secure a Taxpayer Identification Number (TIN). It outlines essential taxpayer information and includes sections to declare types of transactions and tax types. Proper completion and submission are mandated for compliance with the National Internal Revenue Code.

Cross-Border Taxation

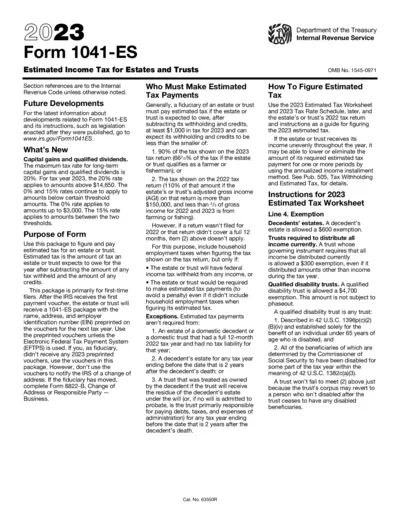

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is essential for estate and trust fiduciaries to calculate and prepay estimated taxes. Ensure compliance by submitting this form for tax year 2023. Understanding its structure aids in proper financial planning.

Cross-Border Taxation

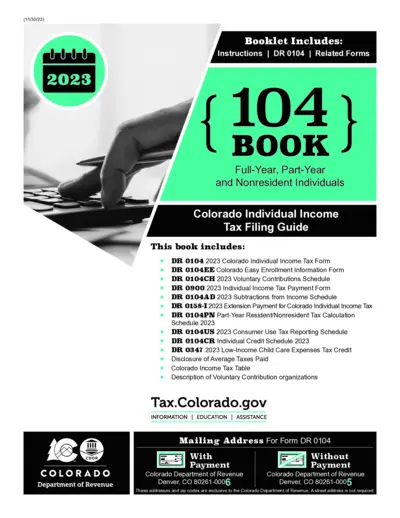

2023 Colorado Individual Income Tax Filing Guide

The Colorado Individual Income Tax Filing Guide provides detailed instructions for residents and nonresidents on completing their income tax returns. It includes various forms, schedules, and important tax information. Ideal for individuals looking to understand their obligations and options for filing taxes in Colorado.

Cross-Border Taxation

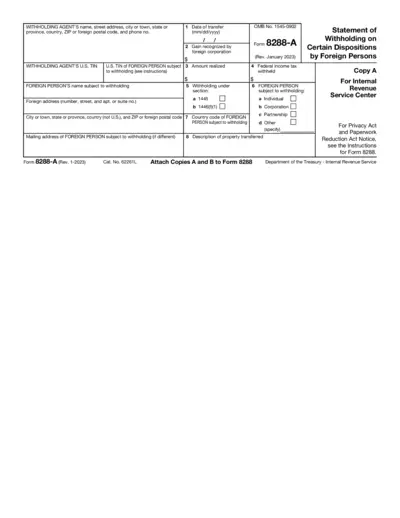

Form 8288-A Instructions for Foreign Withholding

The Form 8288-A is utilized for federal income tax withholding on foreign persons disposing of U.S. real property. This document provides essential instructions and the necessary fields to ensure accurate and compliant tax documentation. Users should follow the guidelines carefully to avoid penalties and ensure proper reporting.

Cross-Border Taxation

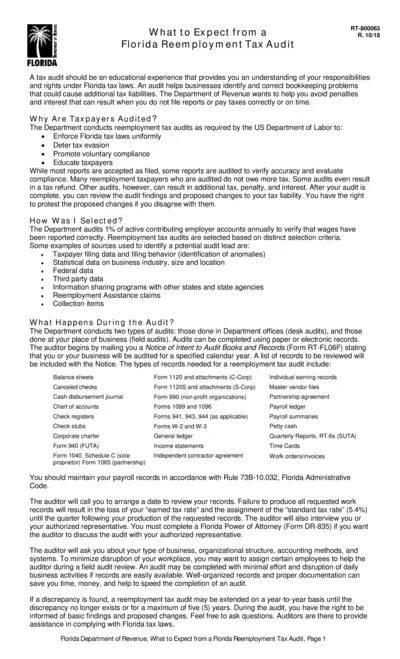

Florida Reemployment Tax Audit Guide

This document provides essential information regarding Florida reemployment tax audits. It outlines your rights and responsibilities during the audit process. Understanding this guide can help you navigate audits effectively.

Cross-Border Taxation

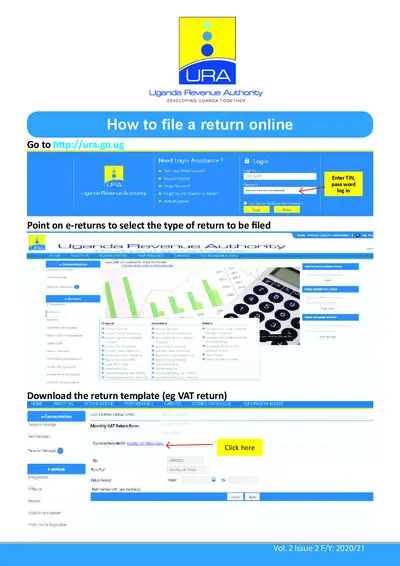

Uganda Revenue Authority Online Return Filing Instructions

This file provides detailed instructions on how to file online returns with the Uganda Revenue Authority. It also includes guidelines for filling out the forms correctly. Users can benefit from clear steps and necessary templates for submission.

Cross-Border Taxation

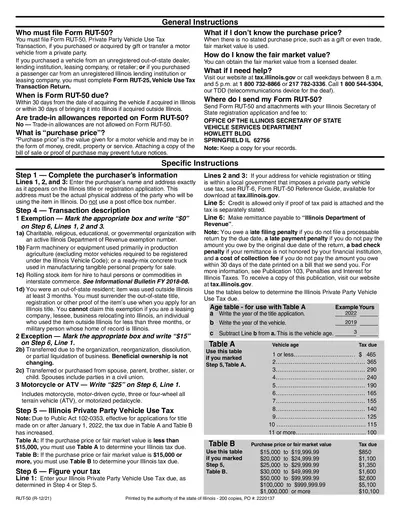

Form RUT-50 Instructions for Vehicle Tax Filing

Form RUT-50 is essential for reporting vehicle purchase taxes in Illinois. This file contains detailed instructions and guidelines for individuals and businesses. It serves as a comprehensive guide for filing and understanding vehicle use tax obligations.

Cross-Border Taxation

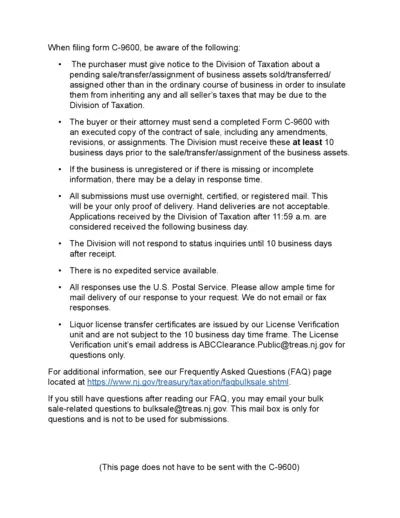

Filing Instructions for Form C-9600 in New Jersey

This file provides essential instructions for completing Form C-9600 required for reporting bulk sales in New Jersey. It details the submission process and necessary information to avoid tax liabilities. Users must follow these guidelines to ensure compliance with New Jersey tax regulations.

Cross-Border Taxation

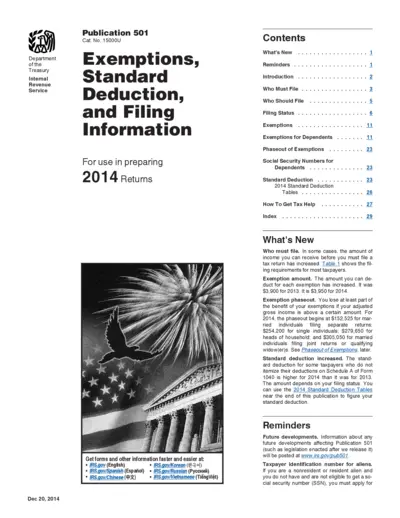

IRS Publication 501 Exemptions Standard Deduction

IRS Publication 501 provides essential details on exemptions, standard deductions, and filing information for the 2014 tax year. This guide is important for taxpayers to understand their filing requirements and benefits. Access crucial IRS resources and information to simplify your tax preparation process.

Cross-Border Taxation

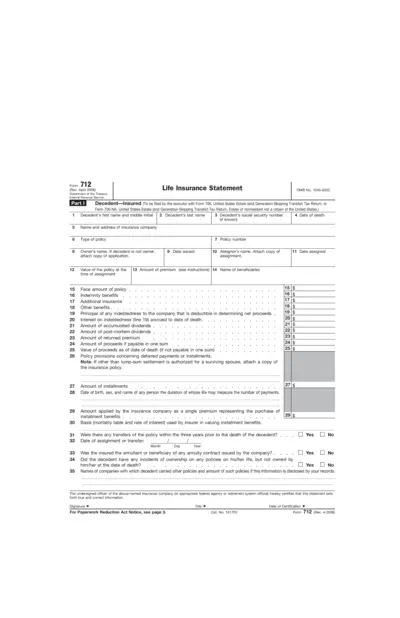

Life Insurance Statement Form 712 - IRS Guidelines

Form 712 is essential for reporting life insurance policies for estate tax purposes. Executors of estates must file this form with Form 706 or 706-NA. This form collects vital information about the insured's policies and is crucial for accurate tax assessments.

Cross-Border Taxation

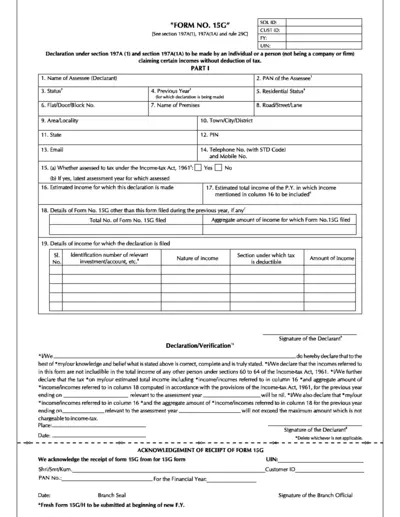

Form No 15G Declaration for Income-Tax Exemption

This file is a Form No. 15G declaration for individuals claiming certain incomes without tax deduction. It provides essential sections for filling out personal information, estimated income, and declarations related to tax. Use this form to submit income declarations to avoid tax deductions on certain incomes.