International Tax Documents

Cross-Border Taxation

Connecticut DRS myconneCT Online Tax Filing

This file contains essential instructions for using the Connecticut Department of Revenue Services myconneCT online center. It guides users on filing and paying taxes efficiently online. Ideal for both individuals and businesses needing to manage their tax obligations.

Cross-Border Taxation

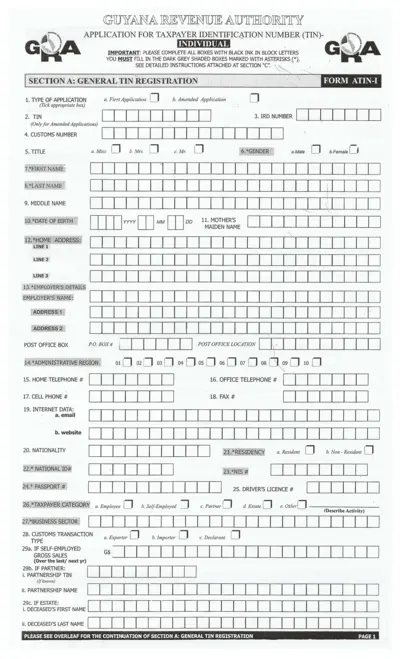

Guyana Taxpayer Identification Number Application

This file contains the application form for obtaining a Taxpayer Identification Number (TIN) in Guyana. It includes detailed instructions for individual applicants. Proper completion of the form is essential for successful registration.

Cross-Border Taxation

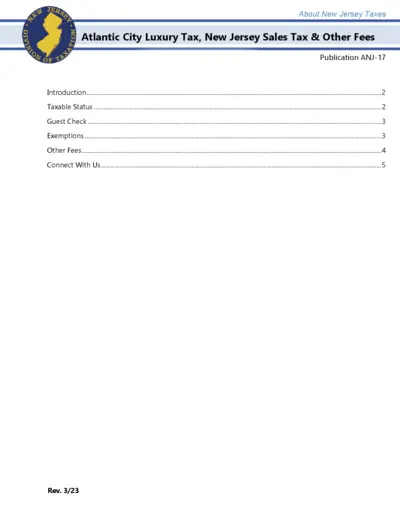

Atlantic City Luxury Tax Guidance and Instructions

This file provides comprehensive guidance on Atlantic City Luxury Tax and New Jersey Sales Tax. It outlines taxable status, exemptions, and guest check details to ensure compliance. Ideal for individuals and businesses involved in transactions in Atlantic City.

Cross-Border Taxation

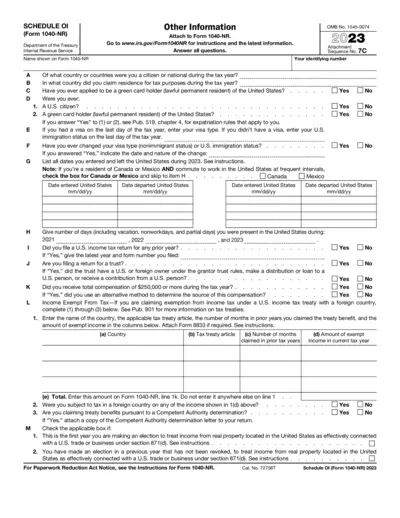

Schedule OI Form 1040-NR Instructions and Details

This file contains the Schedule OI for Form 1040-NR, detailing important information on residency, citizenship, and income tax treaty benefits. It serves as a guide for users needing help with their tax filing in the U.S. and outlines the necessary steps to complete the form accurately.

Cross-Border Taxation

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.

Taxation of Digital Services

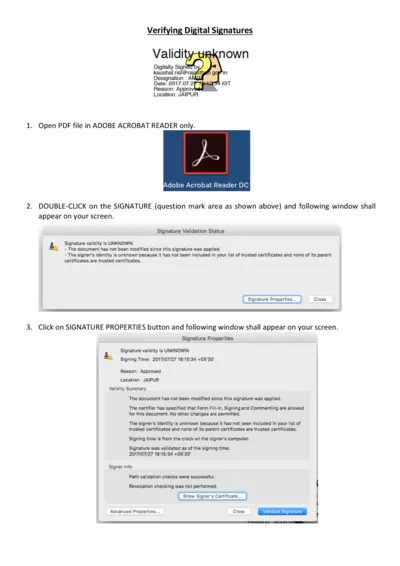

Guide for Verifying Digital Signatures and Certificates

This document provides detailed instructions for verifying digital signatures in PDF files. It outlines the necessary steps to ensure the authenticity of signatures and certificates. Users can follow the guidelines to enhance their understanding of digital signatures.

Cross-Border Taxation

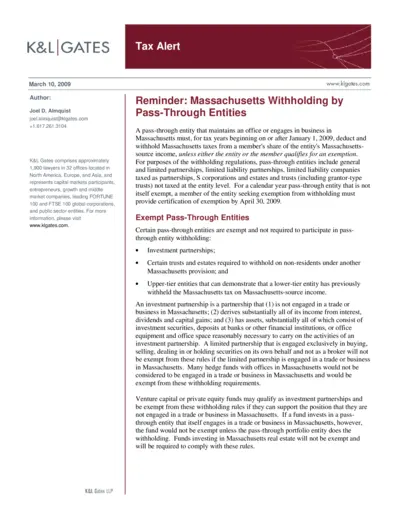

Massachusetts Withholding by Pass-Through Entities Guide

This file provides essential information regarding Massachusetts withholding tax obligations for pass-through entities. It outlines exemptions, necessary forms, and compliance requirements. Businesses and individuals involved with pass-through entities will benefit from understanding these regulations.

Cross-Border Taxation

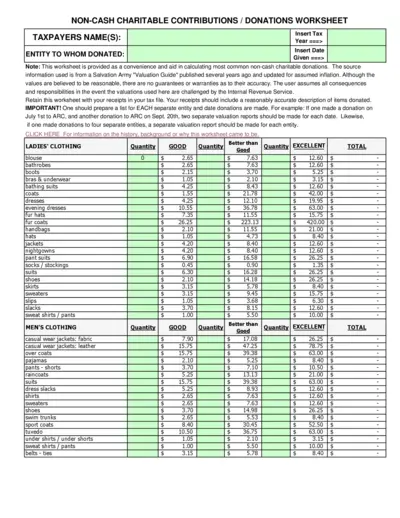

Non-Cash Charitable Contribution Worksheet

This worksheet assists taxpayers in documenting non-cash donations for tax purposes. It provides a convenient format to calculate the value of donated items based on guidelines from a recognized valuation source. Users are reminded to retain this worksheet with their receipts for accurate record-keeping.

Cross-Border Taxation

IRD Number Application for Resident Individuals

This document provides the application form for a resident individual to apply for an IRD number in New Zealand. It includes the necessary instructions, required documents, and applicant checklist. Ensure thorough completion for successful application processing.

Cross-Border Taxation

Acceptance of Electronic Signatures for IRS 2023

This file contains recommendations from the AICPA regarding the acceptance of electronic signatures and electronic filing by the IRS. It outlines the current policies, proposed changes, and the impact on taxpayers and tax practitioners. The document emphasizes the need for modernized tax administration to improve efficiency and reduce obstacles.

Cross-Border Taxation

Out-of-State Non-Resident Sales Tax Documentation

This file contains essential information about collecting sales tax for out-of-state vehicles. It outlines the required forms and procedures for dealers selling to out-of-state residents. Understanding this document is crucial for compliance and accurate tax collection.

Cross-Border Taxation

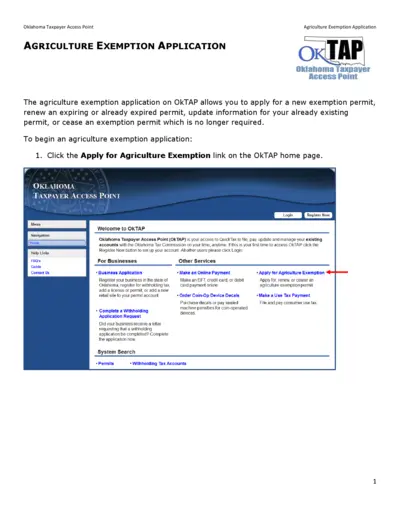

Oklahoma Agriculture Exemption Application Access

This file is an application for the Oklahoma agriculture exemption. It allows individuals and businesses to apply, renew, or update their exemption permits. Ensure you follow the instructions carefully to complete the application process.