International Tax Documents

Cross-Border Taxation

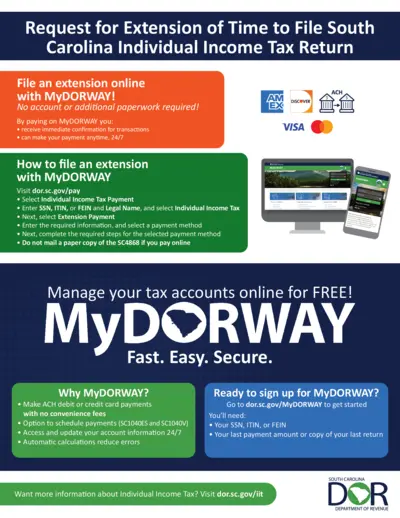

Request for Extension of Time for SC Income Tax Return

This form allows South Carolina taxpayers to request an extension for filing their Individual Income Tax Returns. Using MyDORWAY, users can easily submit their extension request online without additional paperwork. Ensure timely payments to avoid penalties and maintain compliance.

Cross-Border Taxation

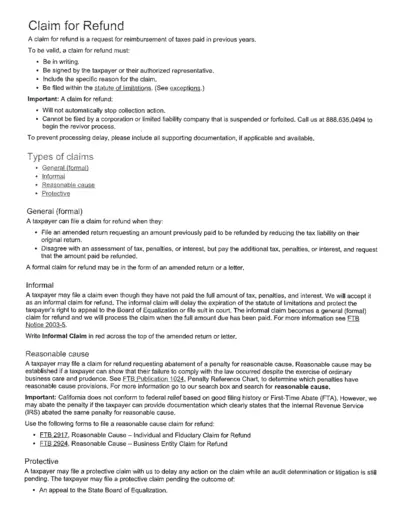

Claim for Refund Instructions and Guidelines

This file contains important information about filing a claim for refund on previously paid taxes. It outlines the requirements, types of claims, and instructions to successfully submit your request. Users can utilize this resource to understand the process and necessary steps for tax reimbursement.

Cross-Border Taxation

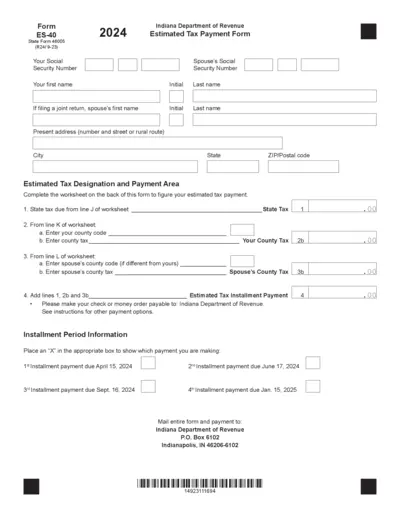

Indiana Estimated Tax Payment Form ES-40 2024

The Indiana Estimated Tax Payment Form ES-40 is designed for individuals who need to pay their estimated state income taxes. This form allows taxpayers to submit their tax installment payments to the Indiana Department of Revenue. Ensure you follow the provided instructions for accurate completion and timely submission.

Cross-Border Taxation

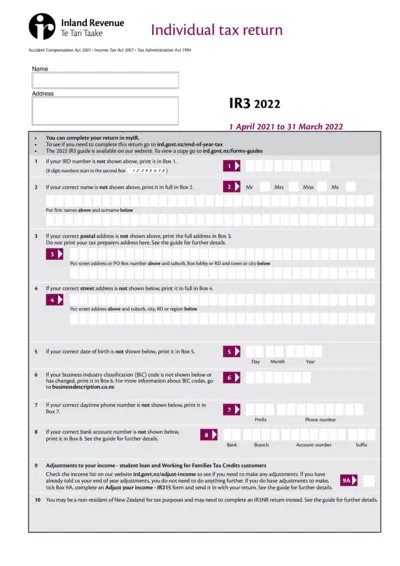

Individual Tax Return Instructions - IR3 2022

This file provides comprehensive details regarding the IR3 individual tax return in New Zealand. It includes instructions for completing the return and important information regarding tax obligations. This document is essential for residents needing to report income and calculate their taxes for the 2022 tax year.

Cross-Border Taxation

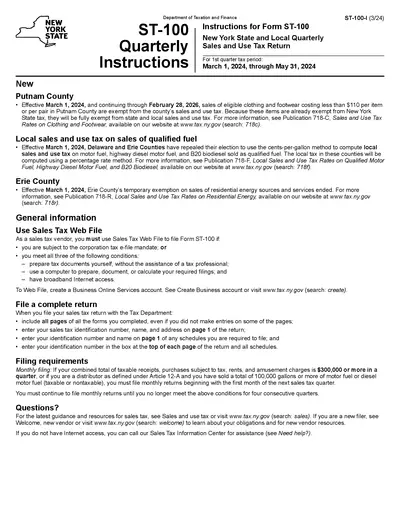

New York State ST-100 Quarterly Sales Tax Instructions

The ST-100 file provides instructions for New York State and local quarterly sales tax returns. This guide includes important information about filing requirements, deadlines, and exemptions for eligible clothing and footgear. Ensure compliance by following the outlined procedures to avoid penalties and fines.

Cross-Border Taxation

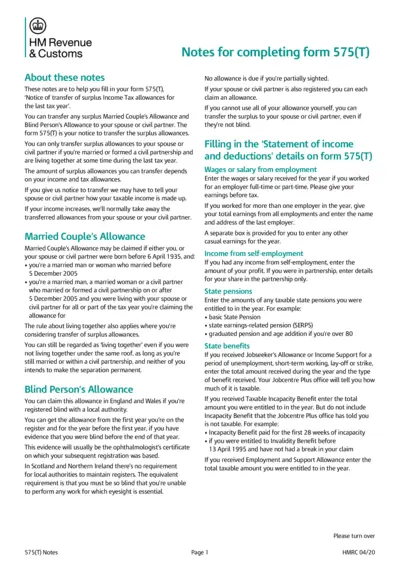

Form 575T Guidance for Income Tax Allowances

Form 575(T) provides the necessary guidance for transferring surplus Income Tax allowances. It outlines the eligibility criteria and instructions for completion. This form is essential for married couples and civil partners looking to manage their tax allowances effectively.

Cross-Border Taxation

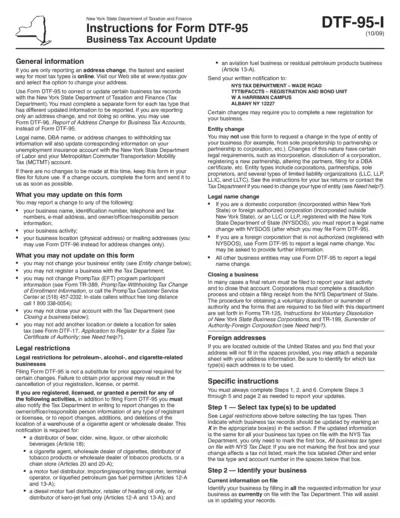

New York State Tax Business Account Update Instructions

This document provides essential instructions for updating your business tax account with the New York State Department of Taxation and Finance. It guides users on how to correctly fill out Form DTF-95 for various updates. Follow the steps outlined to ensure accurate submission and compliance.

Cross-Border Taxation

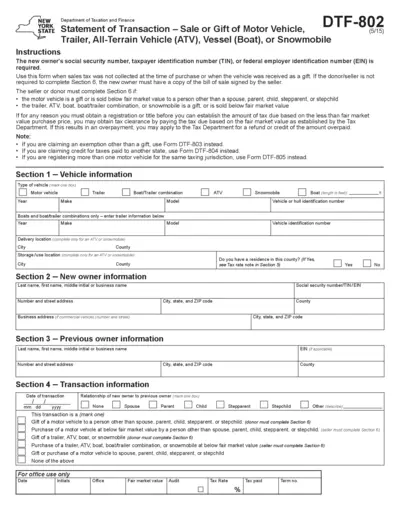

NY State Motor Vehicle Sale or Gift Transaction Form

This form is required for the sale or gift of motor vehicles in New York State. It captures essential information like the new owner's details, the previous owner, and transaction information. Ensure to complete all necessary sections to avoid delays.

Cross-Border Taxation

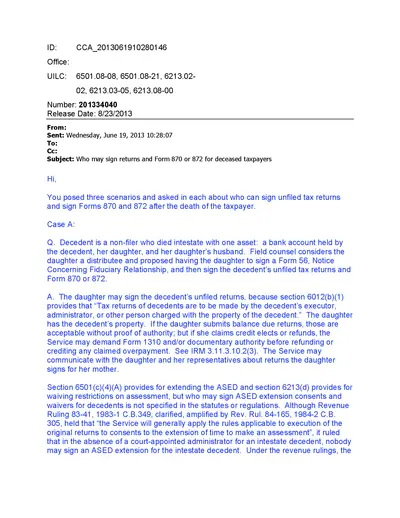

Who Can Sign Returns for Deceased Taxpayers?

This document clarifies who has the authority to sign unfiled tax returns and forms for deceased taxpayers. It includes various scenarios and guidance for executors and personal representatives. Understanding these regulations can help ensure compliance during the tax filing process for estates.

Cross-Border Taxation

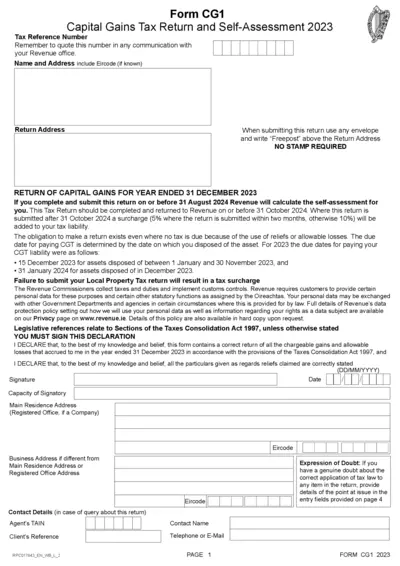

Form CG1 Capital Gains Tax Return Self-Assessment

This form is for the Capital Gains Tax Return for the year ended 31 December 2023. It includes sections for personal details, asset disposals, and claim to reliefs. Submit by 31 October 2024 to avoid penalties.

Cross-Border Taxation

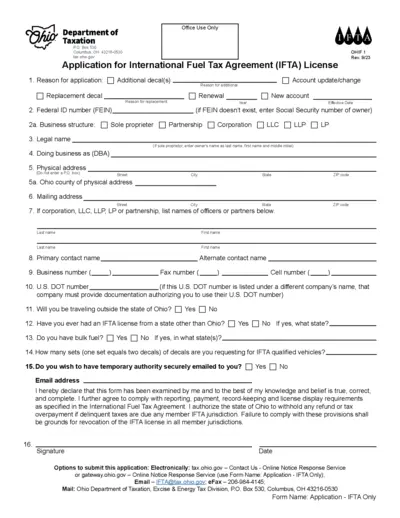

Application for IFTA License - Ohio Department of Taxation

This file contains the application form for obtaining an IFTA license in Ohio. It provides detailed instructions for completing the form accurately. Users must ensure compliance with reporting and payment requirements as outlined.

Cross-Border Taxation

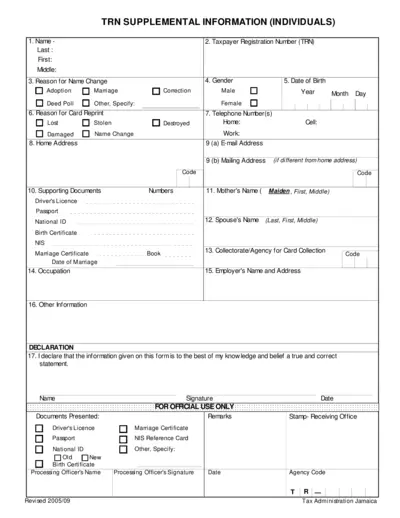

TRN Supplemental Information Form for Individuals

This file contains essential information for individuals applying for Taxpayer Registration Number (TRN). It includes instructions on filling out the form correctly and submitting it. This guide serves as a resource for users needing clarity on the application process.