Tax Forms Documents

Tax Forms

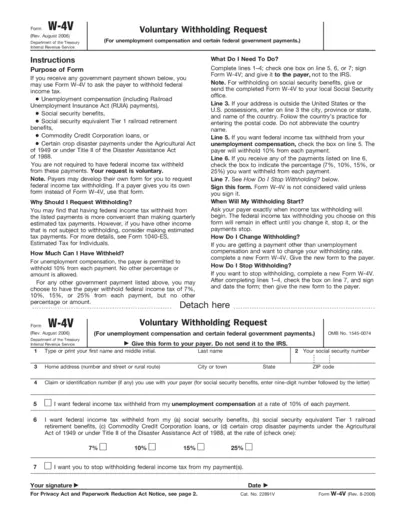

W-4V Voluntary Withholding Request Form

The W-4V Form allows individuals to request federal income tax withholding from unemployment compensation and certain government payments. It simplifies tax management by enabling recipients to opt for withholding instead of making estimated tax payments. Understanding this form can help ensure you meet your tax obligations effectively.

Tax Forms

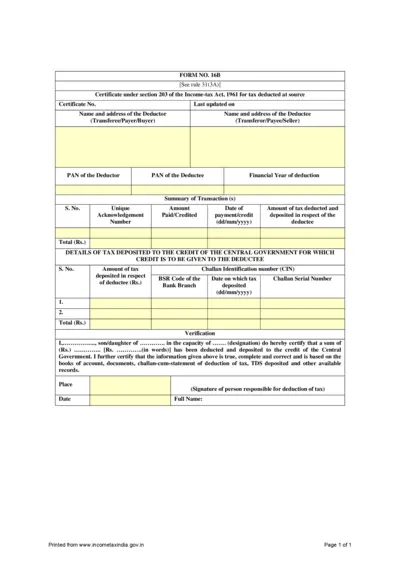

FORM NO. 16B - Income Tax TDS Certificate

This form is a Certificate under section 203 of the Income-tax Act for tax deducted at source. It provides details about the deductor, deductee, and transaction summary. This certificate is essential for taxpayers to claim TDS credit.

Tax Forms

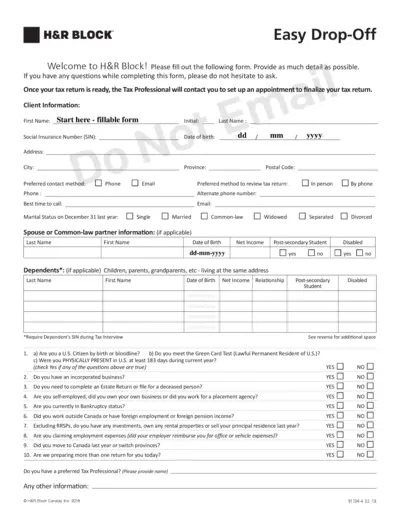

H&R Block Easy Drop-Off Tax Form Instructions

This file contains detailed instructions for the H&R Block Easy Drop-Off tax form. It guides clients through providing necessary information for tax returns efficiently. Perfect for first-time and returning users seeking assistance with tax documentation.

Tax Forms

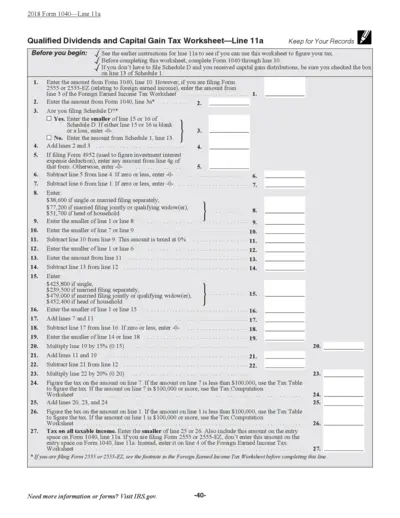

2018 Form 1040 Qualified Dividends Tax Worksheet

This document provides instructions for calculating qualified dividends and capital gains tax. It is essential for accurate tax filing. Use this worksheet to ensure compliance with IRS regulations.

Tax Forms

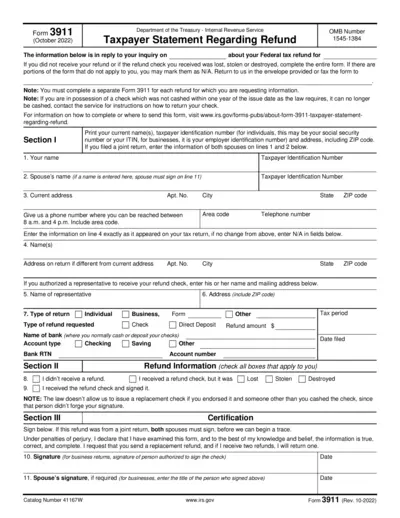

Taxpayer Statement Regarding Refund Form 3911

Form 3911 allows taxpayers to address issues regarding their federal tax refunds. It is essential for individuals who did not receive their expected refund. This document helps in requesting a replacement refund or tracing the original one.

Tax Forms

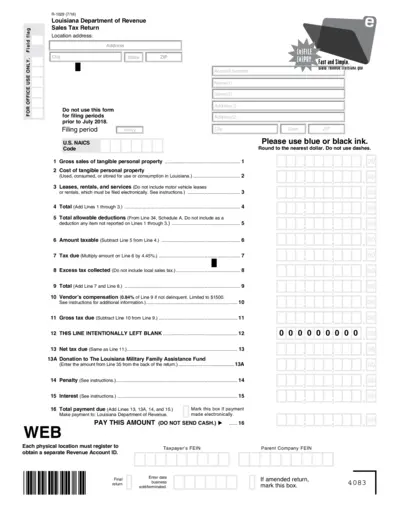

Louisiana Sales Tax Return R-1029 Instructions

This file contains the comprehensive instructions for filling out the Louisiana Sales Tax Return, R-1029. It provides detailed guidelines on allowable deductions, tax due calculations, and necessary account information. Perfect for businesses understanding their tax obligations in Louisiana.

Tax Forms

California Resident Income Tax Return Form 540

The California Resident Income Tax Return Form 540 is essential for filing your state taxes. This form helps determine your taxable income and calculates the taxes owed or refunds. Ensure you have all the necessary information to complete it correctly.

Tax Forms

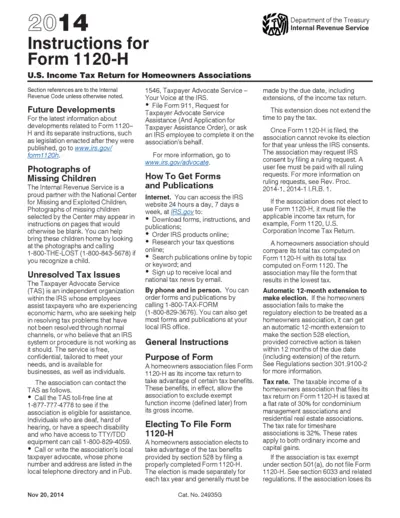

Instructions for Form 1120-H U.S. Income Tax Return

This document provides detailed instructions for completing Form 1120-H, specifically designed for homeowners associations. It outlines eligibility requirements, filing procedures, and essential tax information for associations. Proper understanding and completion of this form can lead to significant tax benefits.

Tax Forms

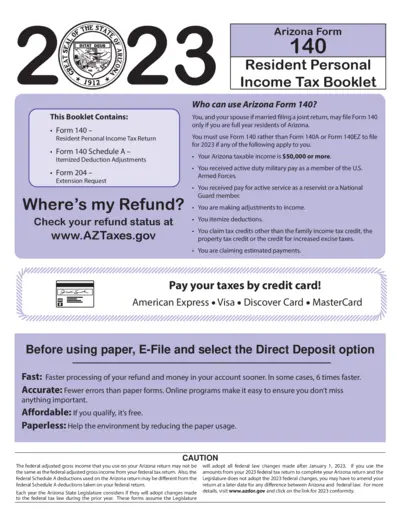

Arizona Form 140 Resident Personal Income Tax Instructions

This document provides the essential guidelines for completing Arizona Form 140, the Resident Personal Income Tax Return. It includes information on important dates, filing requirements, and deductions. Follow these instructions to ensure accurate and timely submission of your tax return.

Tax Forms

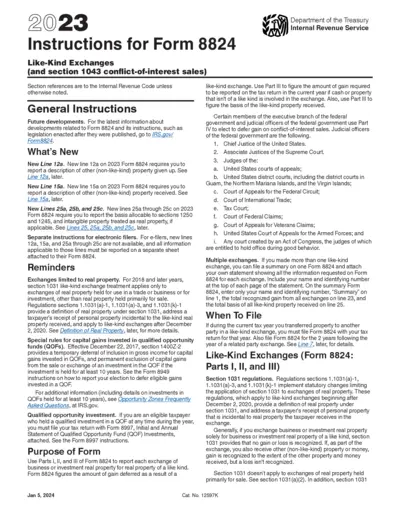

2023 Instructions for Form 8824 Like-Kind Exchanges

This document provides detailed instructions for filing Form 8824, which pertains to like-kind exchanges. It covers essential updates and regulations to facilitate accurate and compliant tax reporting. Users can find guidance on completing the form and understanding related requirements.

Tax Forms

Louisiana Corporation Income Tax and Franchise Tax 2023

This file provides essential instructions for filing the Louisiana Corporation Income Tax and Corporation Franchise Tax. It includes guidelines for completing the CIFT-620 form, eligibility criteria, and important filing deadlines. It serves as a comprehensive resource for corporations operating in Louisiana.

Tax Forms

Noncash Charitable Contributions Form 8283

This document outlines the instructions and details for Form 8283, which is used for reporting noncash charitable contributions. It is essential for taxpayers claiming deductions over $500 for donated property. Ensure to follow the guidelines to complete the form accurately.