Tax Forms Documents

Tax Forms

California Nonresident or Part-Year Resident Tax Return

This file contains the California 540NR income tax return form for 2022. It is essential for nonresidents or part-year residents filing their taxes. Use this form to report your income and calculate your California tax obligations.

Tax Forms

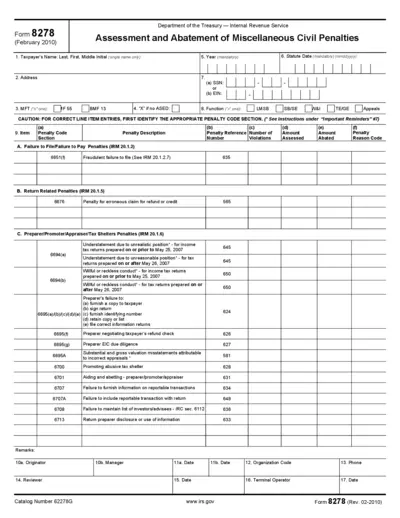

Form 8278 Assessment Abatement Civil Penalties

Form 8278 is used to assess and abate miscellaneous civil penalties by the IRS. It is essential for taxpayers seeking to resolve issues related to penalties. Understanding this form can help facilitate compliance with tax regulations.

Tax Forms

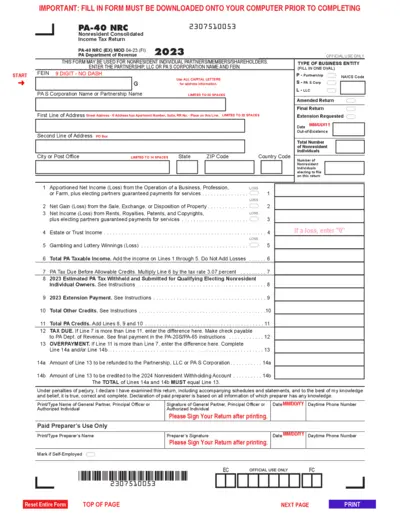

PA-40 NRC Nonresident Consolidated Income Tax Form

The PA-40 NRC form is for nonresident individuals to report their income. This form allows partnerships and LLCs to consolidate tax reporting. Ensure correct completion to avoid penalties.

Tax Forms

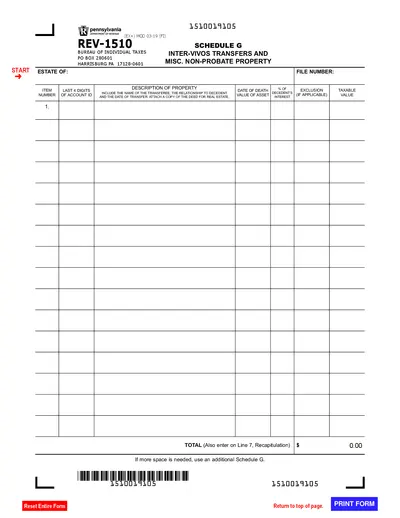

Pennsylvania REV-1510 Schedule G Tax Form Details

The Pennsylvania REV-1510 Schedule G form reports inter vivos transfers and miscellaneous non-probate property. The form provides essential information on property transfers made by a decedent before their passing. It also outlines instructions for reporting taxable values and exclusions pertinent to inheritance tax.

Tax Forms

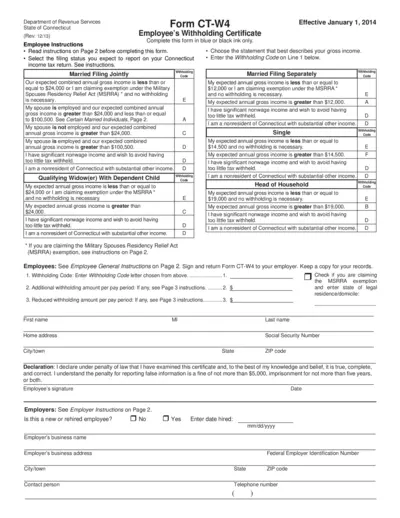

CT-W4 Employee Withholding Certificate Instructions

The CT-W4 form is essential for Connecticut employees to ensure correct state income tax withholding. This form helps determine your filing status and expected gross income for tax purposes. Complete the form accurately to facilitate proper withholding and avoid underpayment issues.

Tax Forms

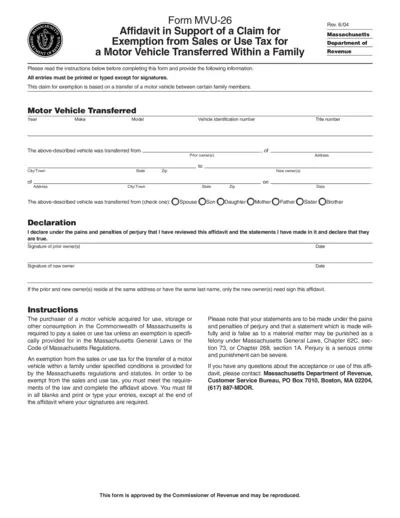

Massachusetts MVU-26 Tax Exemption Affidavit

This file contains the MVU-26 Affidavit for claiming exemption from sales or use tax for a motor vehicle transferred between family members in Massachusetts. It provides the necessary forms and instructions to support your tax exemption claim. Be sure to fill it out correctly to avoid any issues with the Massachusetts Department of Revenue.

Tax Forms

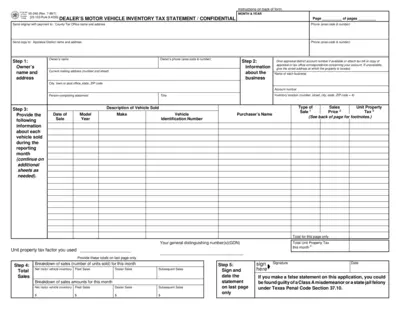

Dealer's Motor Vehicle Inventory Tax Statement

This file serves as the official declaration for dealers to report their motor vehicle sales. It provides necessary instructions for completion and submission of the inventory tax statement. Ensure accuracy to avoid potential penalties.

Tax Forms

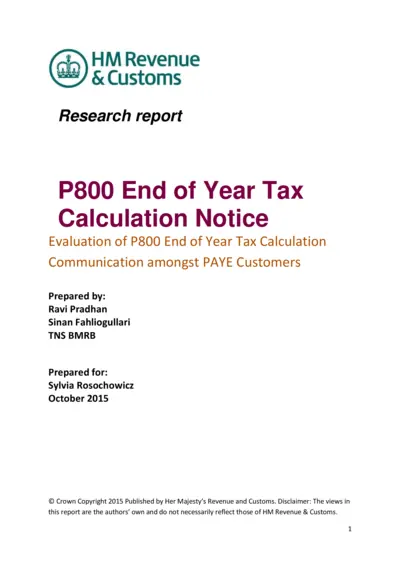

P800 End of Year Tax Calculation Notice Guide

This document provides essential information regarding the P800 End of Year Tax Calculation Notice issued by HM Revenue & Customs. It explains the purpose, how to fill it out, and who requires this notice. Users can learn the main findings and get insights into the communication processes involved.

Tax Forms

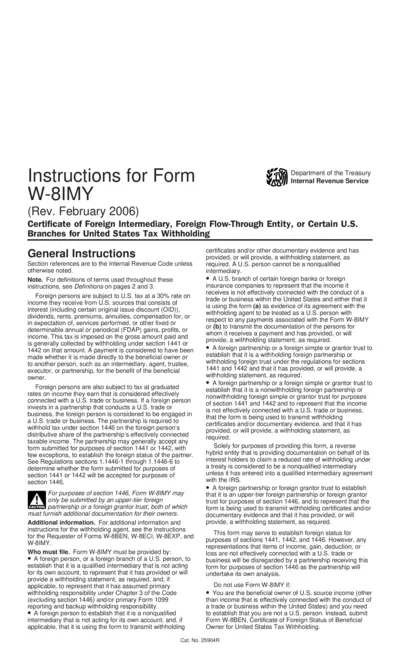

W-8IMY Instructions: Certificate of Foreign Intermediary

This file contains essential instructions for completing Form W-8IMY, which is used by foreign intermediaries for U.S. tax withholding purposes. It outlines who must file the form and provides guidance on filling it out correctly. This document is vital for ensuring compliance with U.S. tax regulations for foreign entities.

Tax Forms

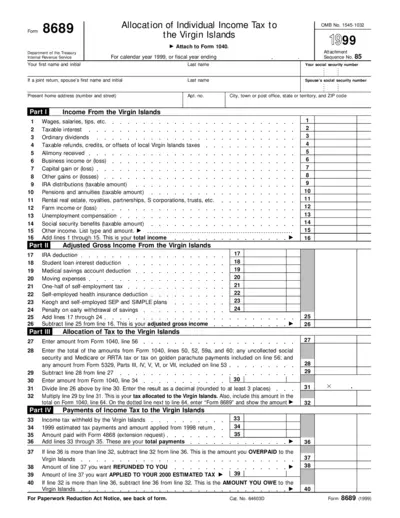

Form 8689 Instructions for Virgin Islands Tax Allocation

This file contains Form 8689, which is used to allocate individual income tax to the Virgin Islands. It provides detailed instructions and necessary information for taxpayers with income from the Virgin Islands. Completing this form ensures accurate tax filings and compliance with tax laws.

Tax Forms

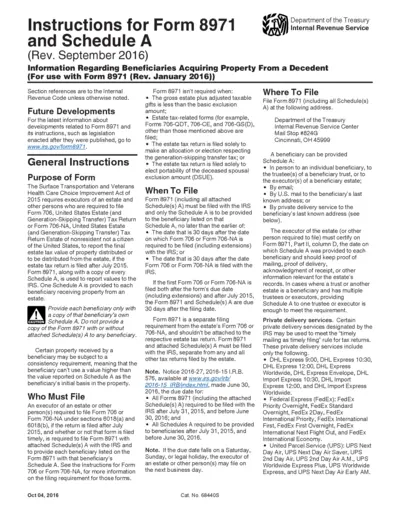

Instructions for Form 8971 and Schedule A

This document provides instructions for the IRS Form 8971, detailing the necessary steps for reporting estate property values. It is essential for executors and estate representatives to ensure compliance with tax laws. Understanding this form helps beneficiaries and executors accurately handle estate distributions.

Tax Forms

IRS Schedule SE Self-Employment Tax Form 2024

This document is an early release draft of the IRS Schedule SE form for self-employment tax for the year 2024. It contains detailed instructions for completing the form and eligibility criteria for different methods of reporting income. Users should be aware that this is a draft and not for filing.