Tax Forms Documents

Tax Forms

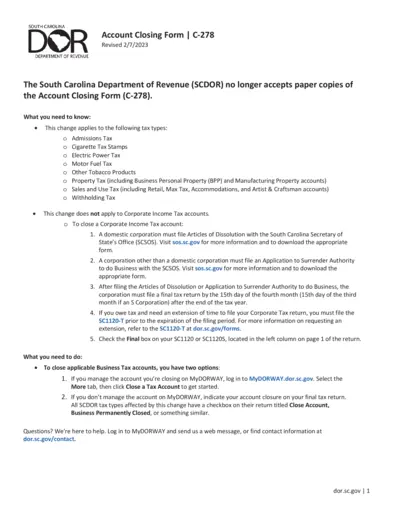

South Carolina Account Closing Form C-278 Instructions

The South Carolina Account Closing Form (C-278) is essential for businesses looking to close their tax accounts. This form ensures compliance with state regulations set by the Department of Revenue. Learn about the steps and requirements for submitting this important form.

Tax Forms

IRS Schedule C Form 1040 Instructions

The IRS Schedule C (Form 1040) provides profit or loss information for business proprietors. Learn how to accurately complete this tax form for the 2024 tax year. Essential guidelines for filing correctly and meeting regulatory requirements.

Tax Forms

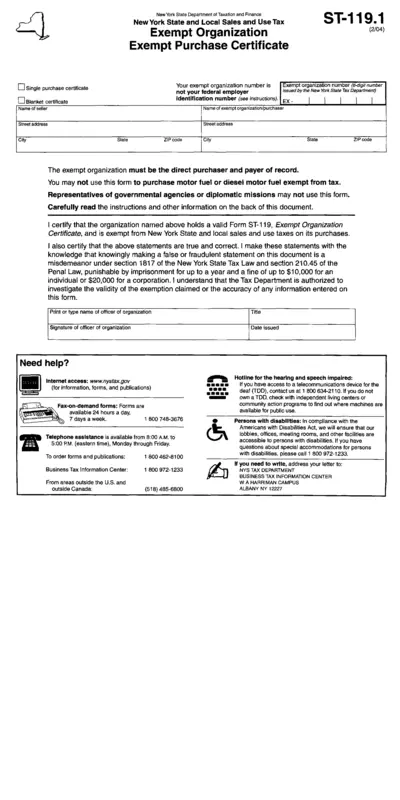

New York Sales Tax Exempt Purchase Certificate ST-119.1

This file is the New York Sales Tax Exempt Purchase Certificate ST-119.1. It is designed for exempt organizations to make tax-exempt purchases in New York State. Complete this form to certify your exemption status and ensure compliance with state tax laws.

Tax Forms

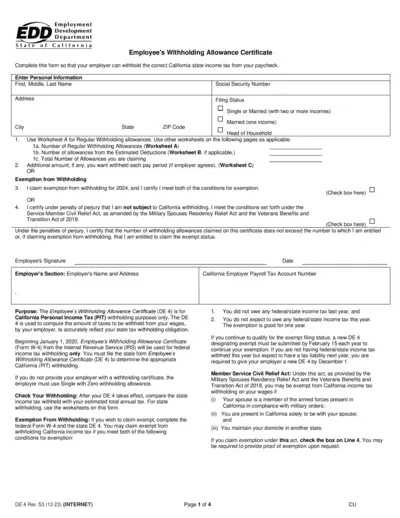

California Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate (DE 4) helps employees determine the appropriate California state income tax withholding. It's crucial for accurate payroll tax deductions based on your personal tax situation. Complete this form to ensure your employer withholds the correct amount from your paycheck.

Tax Forms

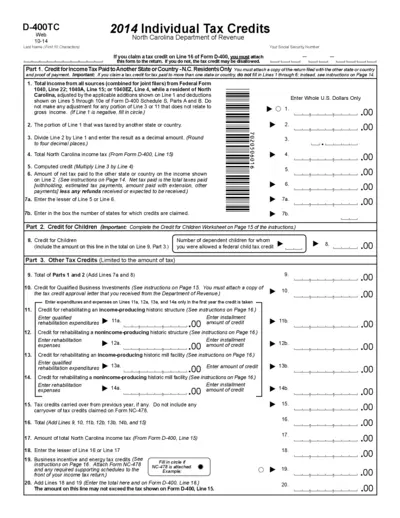

North Carolina D-400TC Tax Credit Form Instructions

The D-400TC tax credit form is essential for individuals claiming tax credits in North Carolina. This form outlines the necessary information for tax credits including those for children, business investments, and tax paid to other states. Follow the instructions carefully to ensure your credits are applied correctly.

Tax Forms

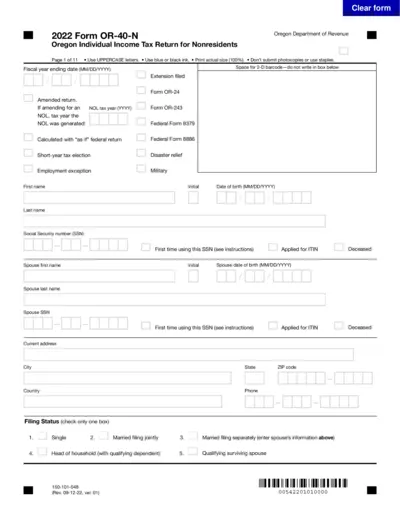

Oregon Individual Income Tax Return for Nonresidents

The 2022 Form OR-40-N is an essential document for nonresidents filing their Oregon Individual Income Tax Return. This form guides users through reporting their income, exemptions, and credits accurately. Ensure compliance with state tax laws by completing this form correctly.

Tax Forms

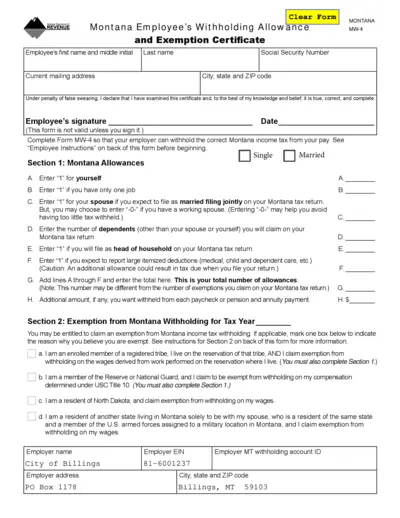

Montana Employee's Withholding Allowance Certificate

The Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) is designed for employees in Montana to accurately declare withholding allowances. This form ensures that the correct amount of state income tax is withheld from your paycheck. Completing the MW-4 helps prevent tax liabilities when filing your annual tax return.

Tax Forms

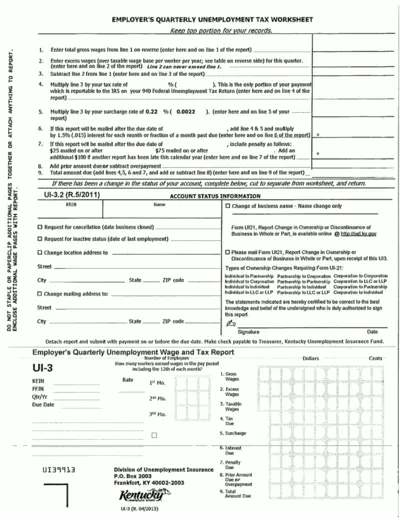

Employer Quarterly Unemployment Tax Worksheet

This worksheet is designed for employers to report quarterly unemployment taxes in Kentucky. It guides users through calculating gross wages, excess wages, and total tax due. Essential for compliance with IRS regulations.

Tax Forms

Arizona Form 5000 Transaction Privilege Tax Exemption

Arizona Form 5000 is utilized to claim sales tax exemptions for vendors. This certificate must be provided to vendors by departments to ensure correct tax handling. For frequent tax-exempt purchases, departments should consult Tax Compliance for guidance.

Tax Forms

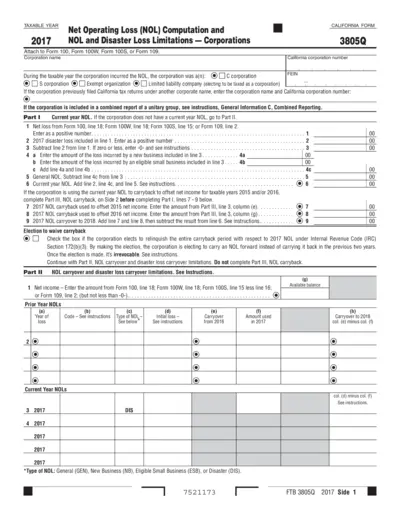

California 2017 NOL Computation and Limitations Form

This file contains the 2017 Net Operating Loss (NOL) Computation details for California corporations. It provides essential guidelines for completing Form 100, Form 100W, Form 100S, or Form 109. Utilize this form to compute NOL and understand disaster loss limitations effectively.

Tax Forms

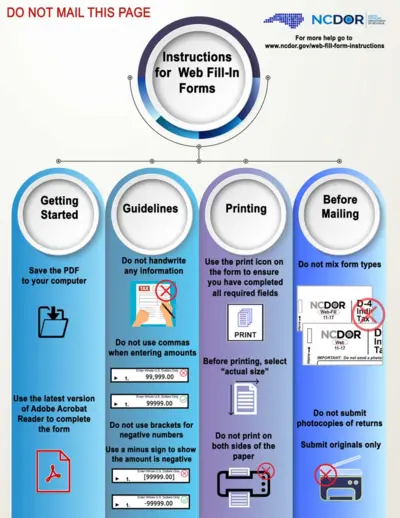

North Carolina D-400 Form Instructions 2024

This PDF provides detailed instructions on how to fill out the North Carolina D-400 form. It also includes guidelines for part-year residents and nonresidents for state tax purposes. Essential for ensuring proper tax filing in North Carolina.

Tax Forms

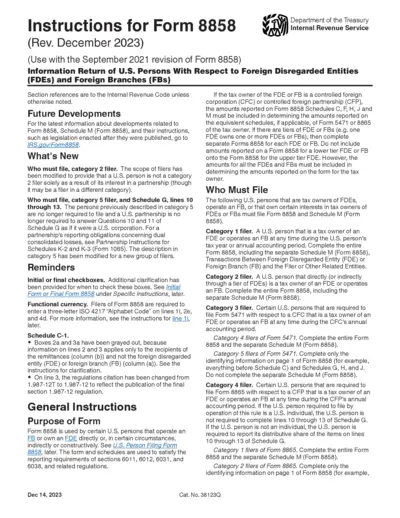

Instructions for Form 8858 - U.S. Persons.

This file provides essential instructions for U.S. persons regarding the filing of Form 8858, related to Foreign Disregarded Entities and Foreign Branches. It outlines the filing requirements, who must file, and necessary steps for compliance.