Tax Forms Documents

Tax Forms

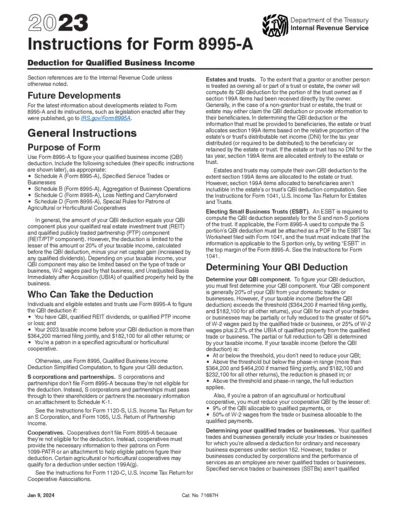

Form 8995-A Instructions for Business Income Deduction

Form 8995-A helps individuals and eligible entities figure their Qualified Business Income deduction. It includes necessary schedules and detailed guidelines to assist users in their calculations. This form is essential for those looking to optimize their tax deductions through qualified business income.

Tax Forms

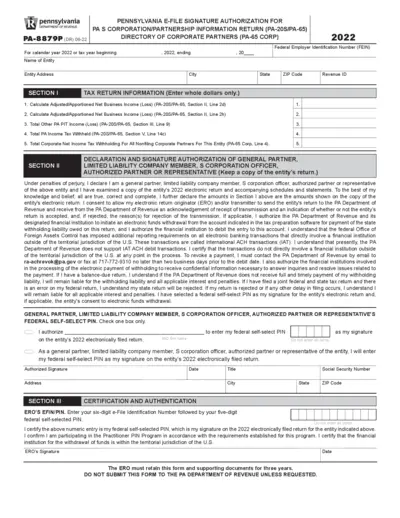

Pennsylvania E-File Signature Authorization Form

The PA-8879P allows general partners, LLC members, and S corporation officers to electronically sign tax returns. Proper completion is essential for a smooth filing process. Utilize this form to ensure compliance with Pennsylvania tax regulations.

Tax Forms

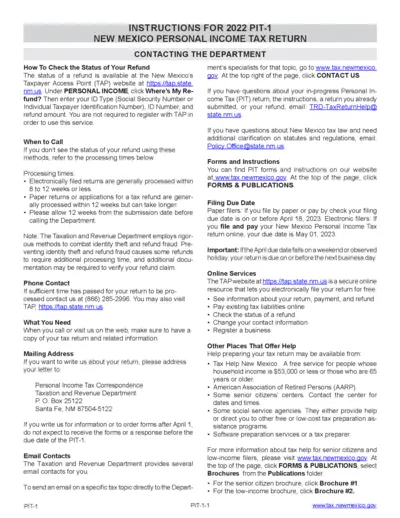

New Mexico Personal Income Tax Return Instructions

This file provides essential instructions for completing the 2022 PIT-1 form for New Mexico personal income tax. It includes contact information, filing deadlines, and guidance for residents and non-residents. Taxpayers can also find resources for assistance and details on military service members' tax obligations.

Tax Forms

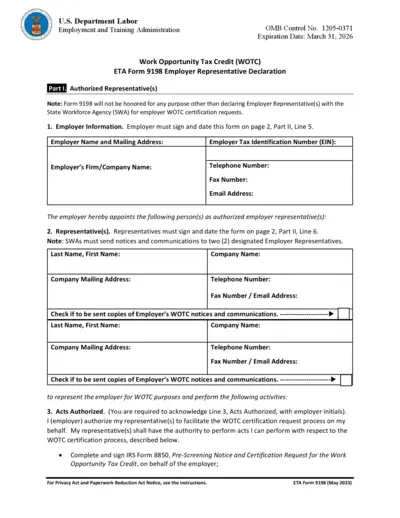

Employer Representative Declaration - WOTC Form 9198

The Employer Representative Declaration Form 9198 allows employers to authorize representatives for Work Opportunity Tax Credit (WOTC) certification requests. This form is essential for employers seeking to navigate the WOTC certification process effectively. By filling out this form, employers can ensure crucial communications regarding WOTC are handled by designated representatives.

Tax Forms

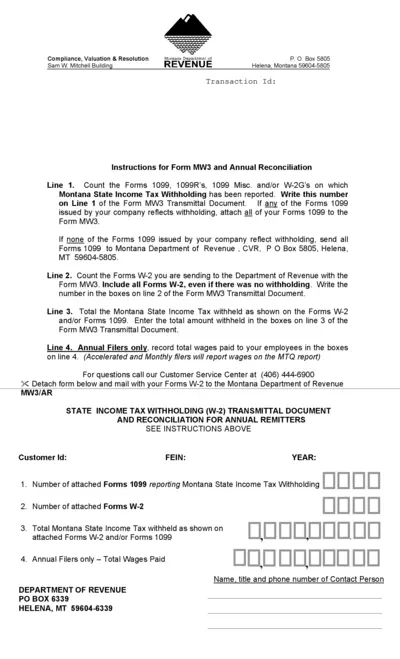

Montana MW3 Withholding Tax Form Instructions

This file provides detailed instructions for completing the Montana MW3 withholding tax form, essential for annual reconciliation. Users will find guidance on reporting taxes withheld from W-2s and 1099 forms. Ensure compliance with state tax requirements by following these steps.

Tax Forms

IRS Form 8288-A Instructions for Users

This file provides essential instructions for IRS Form 8288-A, used for withholding on certain dispositions by foreign persons. It includes details about the form's components and filing requirements. Ideal for tax professionals and individuals involved in U.S. property transactions.

Tax Forms

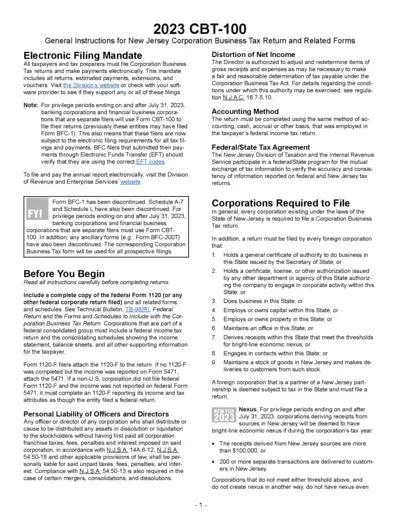

New Jersey Corporation Business Tax Return Guidelines

This document provides comprehensive instructions for filing the New Jersey Corporation Business Tax Return (CBT-100). It outlines electronic filing mandates, eligibility criteria, and details on submissions. Tax preparers and corporations will benefit from following these guidelines.

Tax Forms

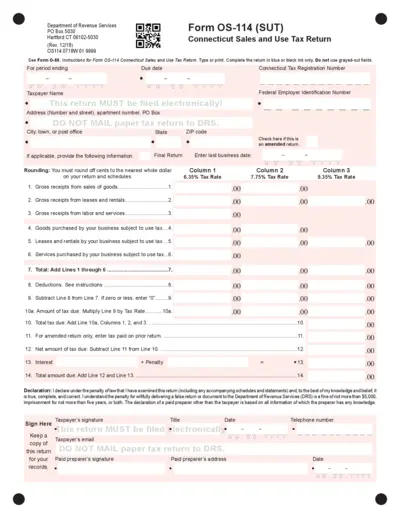

Connecticut Sales and Use Tax Return Form OS-114

Form OS-114 is necessary for reporting sales and use tax in Connecticut. This form must be filed electronically and includes various fields for tax calculations. Proper completion of this return is crucial for compliance with state regulations.

Tax Forms

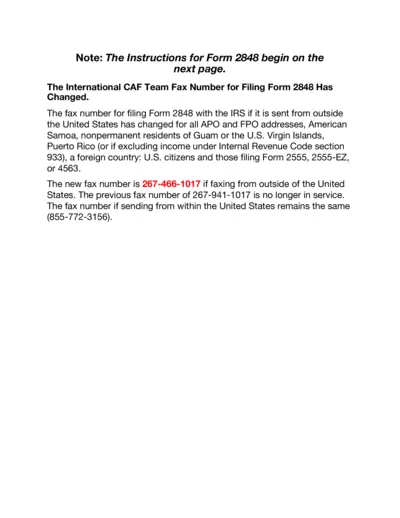

Instructions for IRS Form 2848 Power of Attorney

This document provides essential information on how to fill out IRS Form 2848 for Power of Attorney. It outlines the necessary steps and requirements for authorizing a representative for tax matters. Ideal for individuals needing to grant authority for tax-related issues.

Tax Forms

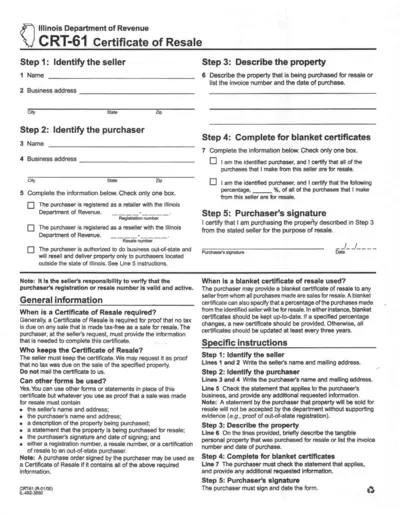

Illinois CRT-61 Certificate of Resale Guide

The CRT-61 Certificate of Resale is essential for businesses to make tax-exempt purchases intended for resale. This guide provides comprehensive information for both sellers and purchasers on completing the certificate. Ensure compliance with the Illinois Department of Revenue regulations by following the outlined steps.

Tax Forms

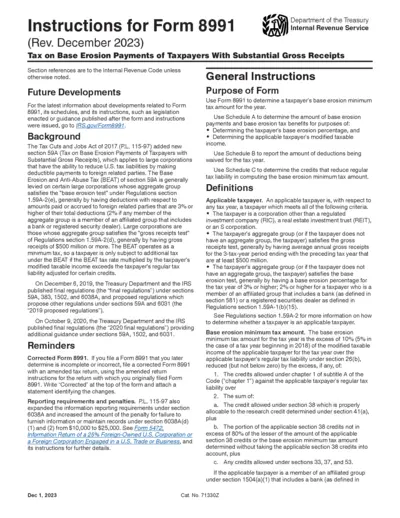

Form 8991 Instructions: Base Erosion Tax 2023

This document provides instructions for Form 8991, which is used to determine base erosion minimum tax amounts for taxpayers with substantial gross receipts. It outlines reporting requirements and penalties for large corporations involved in base erosion payments. Designed to assist taxpayers in complying with the Base Erosion and Anti-Abuse Tax (BEAT) provisions under section 59A.

Tax Forms

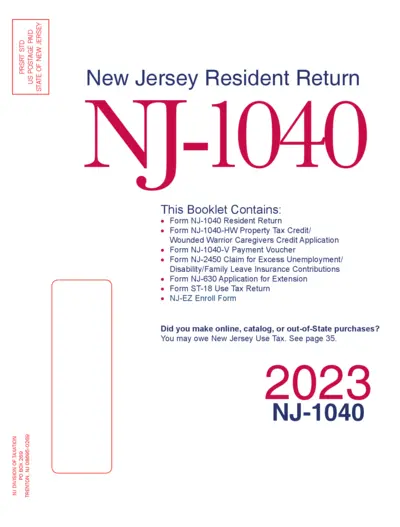

2023 NJ-1040 Resident Tax Return & Instructions

The 2023 NJ-1040 form is essential for New Jersey residents filing their state income taxes. This booklet includes instructions for filling out the form and important changes for the tax year. Utilize the NJ Online Filing service for fast and secure submission.