Form 8995-A Instructions for Business Income Deduction

Form 8995-A helps individuals and eligible entities figure their Qualified Business Income deduction. It includes necessary schedules and detailed guidelines to assist users in their calculations. This form is essential for those looking to optimize their tax deductions through qualified business income.

Edit, Download, and Sign the Form 8995-A Instructions for Business Income Deduction

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To successfully fill out Form 8995-A, gather all relevant financial information regarding your qualified business income. Make sure you understand the specific regulations that apply to your trade or business type. This form requires careful calculation to ensure accuracy in the deduction claimed.

How to fill out the Form 8995-A Instructions for Business Income Deduction?

1

Collect all necessary documents related to your qualified business income.

2

Determine whether you need to use any additional schedules.

3

Calculate your Qualified Business Income (QBI) and related components.

4

Complete Form 8995-A, following the instructions carefully.

5

Review your form for accuracy before submission.

Who needs the Form 8995-A Instructions for Business Income Deduction?

1

Self-employed individuals needing to calculate their QBI deduction.

2

Owners of pass-through entities like partnerships who want to maximize their tax benefits.

3

Estates and trusts managing qualified real estate investments that need clarity on deductions.

4

S corporations needing to report income and deductions through K-1 schedules.

5

Patrons of specified agricultural cooperatives looking for deductions under section 199A(g).

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Form 8995-A Instructions for Business Income Deduction along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Form 8995-A Instructions for Business Income Deduction online.

Edit the PDF directly on PrintFriendly by selecting the field you wish to modify. Our intuitive interface allows for quick adjustments and immediate previews of changes. Once completed, simply save your changes to download the updated document.

Add your legally-binding signature.

Sign the PDF on PrintFriendly by navigating to the signature section of the document. You can add your signature with our easy-to-use tools that allow for a digital signing experience. Finish by saving the signed document for your records.

Share your form instantly.

Sharing the PDF on PrintFriendly is easy; just click the share icon provided on the page. You can choose to share via email or social media platforms directly from the document. Enhance collaboration by enabling others to edit and view the PDF.

How do I edit the Form 8995-A Instructions for Business Income Deduction online?

Edit the PDF directly on PrintFriendly by selecting the field you wish to modify. Our intuitive interface allows for quick adjustments and immediate previews of changes. Once completed, simply save your changes to download the updated document.

1

Open the PDF file in PrintFriendly for editing.

2

Click on the sections you want to modify and apply your changes.

3

Utilize our preview feature to see the updates in real-time.

4

Once satisfied with your edits, click the download button.

5

Save the edited PDF to your device for future use.

What are the important dates for this form in 2024 and 2025?

For 2024, the federal tax filing deadline is April 15. Ensure all Form 8995-A submissions are made timely to avoid penalties. Important changes to tax laws may also affect filing requirements.

What is the purpose of this form?

Form 8995-A is designed to assist individuals and certain entities in calculating their Qualified Business Income (QBI) deduction for the tax year. This deduction can significantly reduce taxable income, thereby lowering overall tax liability. Understanding how to correctly fill out this form is essential for anyone looking to maximize their tax benefit from qualified business income.

Tell me about this form and its components and fields line-by-line.

- 1. Qualified Business Income (QBI): Total income derived from qualified trades or businesses.

- 2. W-2 Wages: Total wages paid to employees relevant to the QBI deduction.

- 3. UBIA: Unadjusted Basis Immediately After Acquisition of qualified property.

- 4. Specified Service Trades or Businesses: Income from businesses defined as specified service trades requiring limitation.

- 5. Deductions: Any deductions related to business income that affect QBI.

What happens if I fail to submit this form?

Failing to submit Form 8995-A may result in the inability to claim your eligible QBI deduction, leading to higher taxable income. Additionally, the IRS may impose penalties for failure to file or inaccuracies in reporting. It is essential to ensure timely submission to avoid negative financial consequences.

- Increased Tax Liability: Without the deduction, you may pay more taxes than necessary.

- Penalties: The IRS may impose penalties for late or incorrect submissions.

- Loss of Deduction Opportunities: Missing filing deadlines could result in losing potential deductions.

How do I know when to use this form?

- 1. Self-Employment Income: For self-employed individuals claiming their QBI.

- 2. Partnership Income: Partners who need to calculate their share of QBI.

- 3. Trust and Estate Income: Estates and trusts claiming deductions for QBI.

Frequently Asked Questions

How do I start editing my PDF?

Simply open the PDF in PrintFriendly and select the areas you want to edit.

Can I download the edited PDF once I am done?

Yes, after making your changes, you can easily download the updated PDF.

Is there a limit to the number of edits I can make?

No, you can make as many edits as needed before downloading.

Can I share my edited PDF directly?

Absolutely, you can share it via email or social media from our platform.

How do I sign my PDF?

Use the signature feature to easily add your digital signature to the document.

What types of files can I upload?

You can upload any standard PDF file for editing.

Will the formatting change when I edit?

PrintFriendly preserves the original formatting while allowing necessary edits.

Does PrintFriendly save my changes automatically?

Currently, you need to manually download your edited file.

Can I change text and images in my PDF?

Yes, you can modify text and images directly within the document.

Is there a tutorial available for using PrintFriendly?

Yes, we offer guides to help you navigate through editing and managing your PDFs.

Related Documents - Form 8995-A

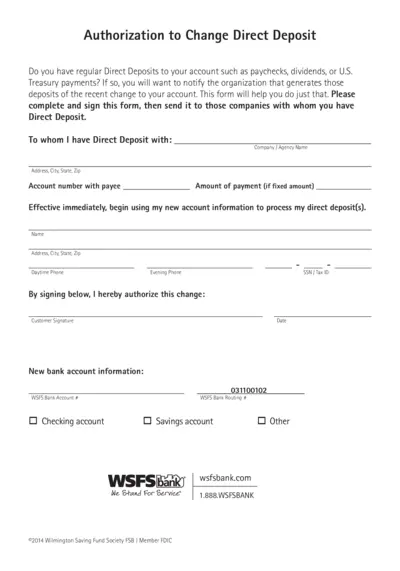

Authorization to Change Direct Deposit Form

This form is for notifying organizations of changes to your direct deposit account. Complete and sign this form and send it to the companies handling your direct deposits. The form includes sections for personal information and new account details.

Sprouts Farmers Market 2023 Annual Meeting Proxy Statement

This document contains details about the 2023 Annual Meeting of Stockholders for Sprouts Farmers Market, Inc. It includes information on the meeting date, items of business, and instructions for proxy voting. Access to proxy materials and voting instructions are also provided.

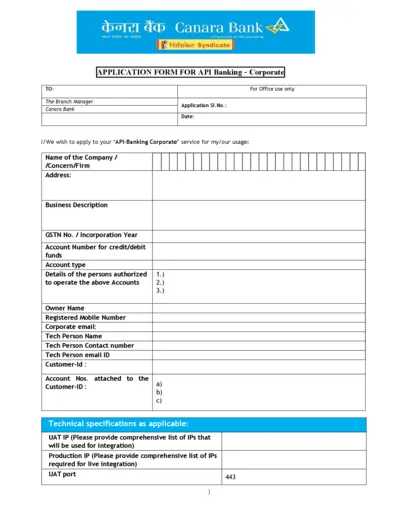

Canara Bank API Banking Application Form

This file is an application form for Canara Bank's API Banking services for corporate entities. The form includes sections to provide company details, technical specifications and authorized personnel. It requires the applicant to declare understanding and acceptance of terms and conditions related to the service.

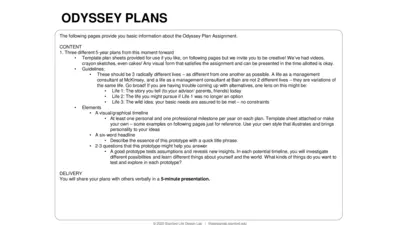

Odyssey Plan Assignment Guide: Create Your Future in 3 Steps

This file provides the guidelines and templates for creating three distinct 5-year Odyssey Plans. It encourages creative visual representations and exploration of multiple life possibilities. It is designed to help users test assumptions and gain new insights about potential life paths.

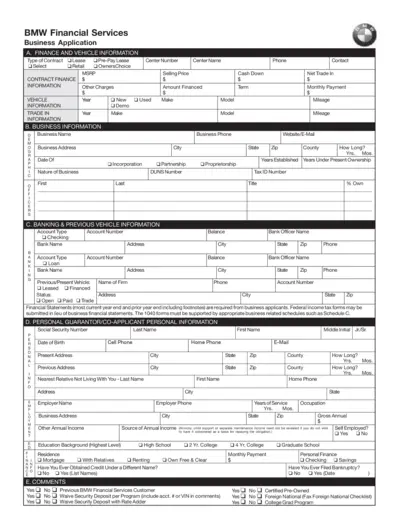

BMW Financial Services Business Application Form

This form is used to apply for various financing options through BMW Financial Services, including lease, retail, pre-pay lease, and OwnersChoice. It collects detailed information about finance, vehicle, business, banking, and personal guarantor information. Instructions and certifications required for business entities and personal guarantors are included.

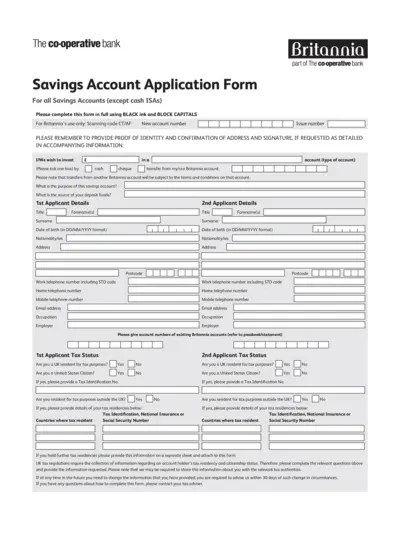

Savings Account Application Form - The Co-operative Bank

This application form is needed to apply for a savings account with The Co-operative Bank. It requires personal information, tax status, and account preferences. Follow the instructions carefully for successful submission.

Union Bank of India Simplifies Form 15G & H Submission via WhatsApp

Union Bank of India has simplified the annual submission of Form 15G & H by enabling online submission via its WhatsApp channel Union Virtual Connect in association with RBIH. This initiative aims to make the submission process easier for senior citizens and tech-savvy customers. It provides banking services in 7 different languages through WhatsApp.

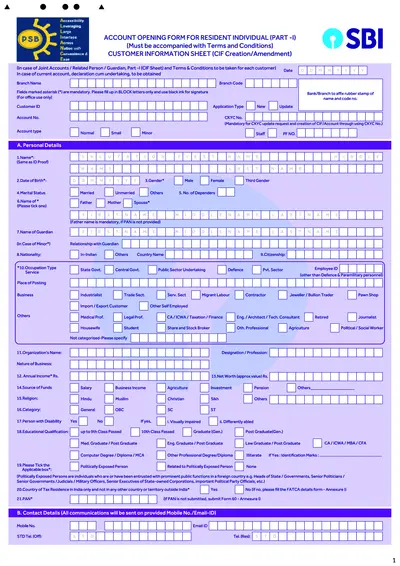

SBI Account Opening Form for Resident Individuals

This file is an account opening form for resident individuals of SBI. It includes detailed sections that need to be filled for creating a Customer Information File. The form must be accompanied by terms and conditions and is suitable for various types of accounts including saving bank, current account, and term deposits.

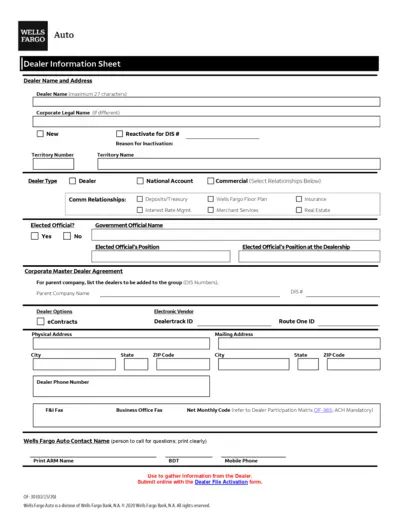

Wells Fargo Auto Dealer Profile Form

This document contains information and instructions for Wells Fargo Auto Dealers on completing the Dealer Information Sheet, ACH Profile Authorization Form, and Franchise Dealer Profile. Dealer's details, bank account information, and dealership legal details are required.

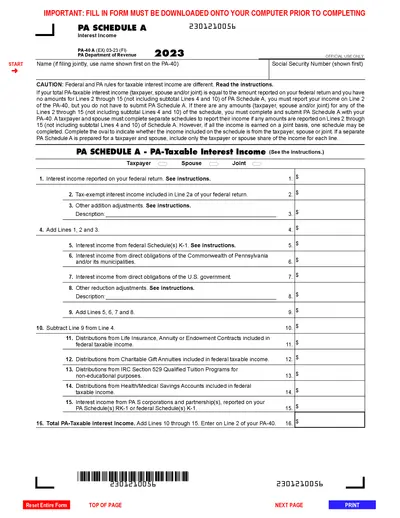

PA-40 A: 2023 Interest Income Schedule A Instructions

This file provides the instructions and details for completing the PA-40 Schedule A to report interest income for Pennsylvania tax purposes. It includes information on taxable interest, required schedules, and specific line items. Instructions for filling out, editing, and submitting the form are also provided.

Internet Banking Application | BANKWEST

This file contains the application form for BANKWEST's Internet Banking service. Users are required to provide their personal details and sign the document. The form is mandatory to open an Internet account with BANKWEST.

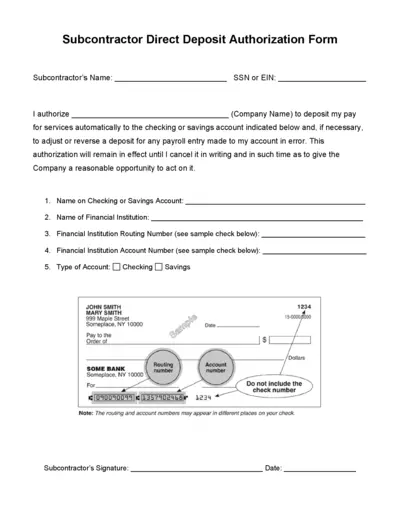

Subcontractor Direct Deposit Authorization Form

This form is used by subcontractors to authorize direct deposit of their pay into a chosen checking or savings account. It allows the company to make automatic payroll deposits. The form requires financial institution details and account information.