Tax Forms Documents

Tax Forms

Form 941c Instructions for Adjusting Tax Returns

Form 941c is used to correct information on previous tax returns for employers. This form is essential for filing adjustments related to income, social security, and Medicare taxes. Ensure accurate tax reporting and compliance by submitting this form with the relevant tax returns.

Tax Forms

Texas Franchise Tax Report Form 05-158-A

This file contains the Texas Franchise Tax Report Form 05-158-A for the reporting year 2014. It outlines the filing requirements and includes details on how to calculate the taxable margin. This document is essential for businesses filing taxes in Texas.

Tax Forms

South Carolina Individual Income Tax Payment Voucher

This file serves as the South Carolina Individual Income Tax Payment Voucher SC1040-V. It provides essential instructions for taxpayers filing their income tax payments. Users can learn how to complete and submit the voucher to the Department of Revenue.

Tax Forms

Form 100S California S Corporation Tax Return

Form 100S is essential for California S corporations to report income, deductions, and credits. This form is necessary for compliance with state tax laws. It ensures that corporations meet their franchise tax obligations.

Tax Forms

IRS Form 8879-PE Electronic Signature Authorization

Form 8879-PE is used for authorization by general partners or limited liability company member managers to sign partnership returns electronically using a PIN. This form ensures compliance with IRS regulations while streamlining the e-filing process. Retain this form for your records and share it with your electronic return originator (ERO) to facilitate submission.

Tax Forms

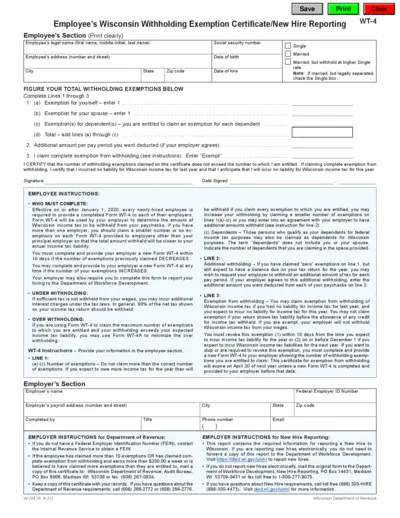

Wisconsin Withholding Exemption Certificate - WT-4

The WT-4 form is used by Wisconsin employees to claim withholding exemptions. Completing this form correctly ensures proper income tax withholding from your paychecks. This document is essential for newly hired employees in Wisconsin.

Tax Forms

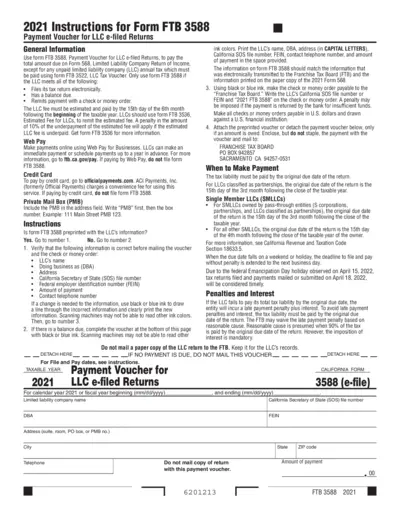

Instructions for Form FTB 3588 Payment Voucher LLC

The FTB 3588 form is used by LLCs to pay their tax liabilities electronically. It is crucial for LLCs with a balance due on Form 568. This guide will help you understand the payment process and requirements.

Tax Forms

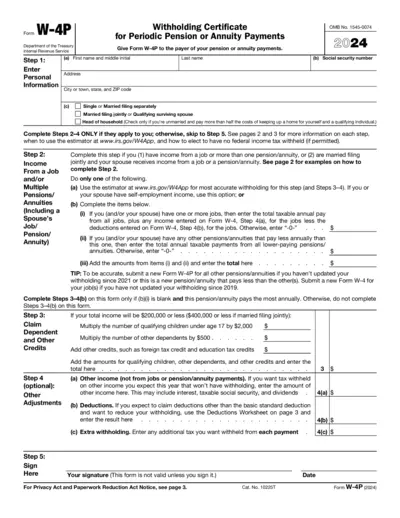

Withholding Certificate for Pension and Annuity Payments

The Form W-4P is crucial for individuals receiving periodic pension or annuity payments. It allows recipients to ensure correct federal income tax withholding from their payments. Completing this form correctly helps avoid underpayment or overpayment of taxes.

Tax Forms

Contractor Certification Form ST-220-TD

The ST-220-TD form certifies that contractors are registered to collect New York sales tax. This document is essential for contractors involved in contracts that exceed $100,000. Ensure you provide accurate and complete information for compliance.

Tax Forms

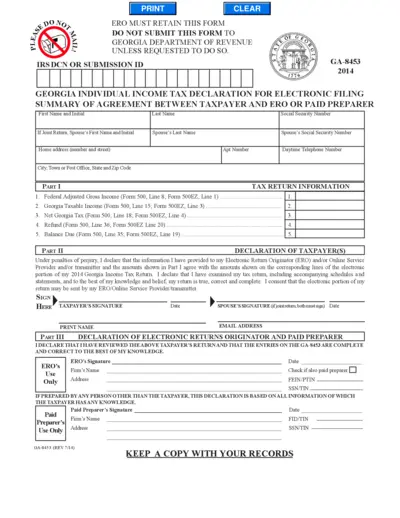

Georgia Individual Income Tax Declaration Form

The GA-8453 form is essential for electronic filing of Georgia individual income tax returns. It ensures the authenticity of the electronic return data provided by the taxpayer. This summary form must be retained by the taxpayer and not submitted unless requested by the Georgia Department of Revenue.

Tax Forms

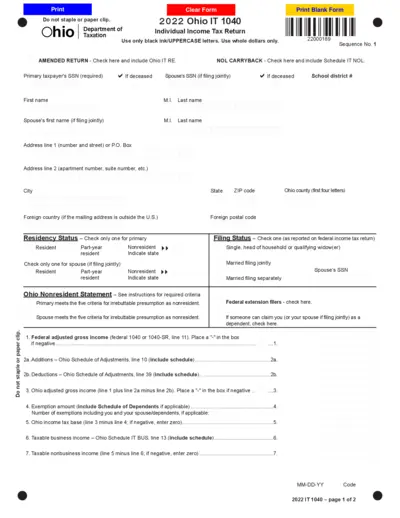

2022 Ohio IT 1040 Individual Income Tax Return

The 2022 Ohio IT 1040 Individual Income Tax Return is essential for residents and nonresidents filing their state income taxes in Ohio. It provides crucial information regarding income, deductions, and credits. Properly filling out this form ensures compliance with state tax regulations.

Tax Forms

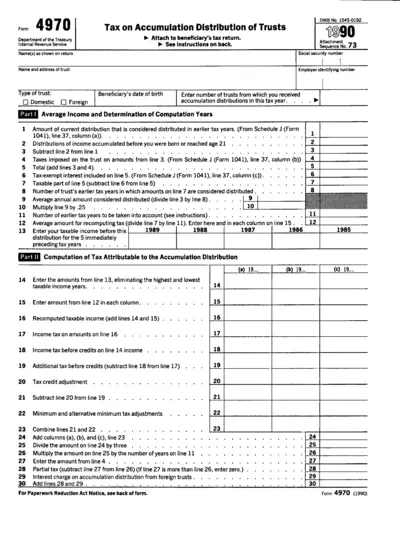

Form 4970 Instructions for Trust Tax Distribution

Form 4970 is used to report the tax on accumulation distributions from trusts. Beneficiaries must complete this form to compute any additional tax liabilities. Properly filling out this form ensures compliance with IRS tax laws.