Tax Forms Documents

Tax Forms

IRS e-file Signature Authorization Form 8879-EO

This file contains the IRS e-file Signature Authorization for Exempt Organizations. It provides essential guidance and details for completing IRS Form 8879-EO. Important to retain for your records and not submit directly to the IRS.

Tax Forms

Form 4626 Alternative Minimum Tax Instructions

This document contains detailed instructions for completing Form 4626, which determines corporate alternative minimum tax. It outlines who must file this form and the necessary steps to ensure proper submission. Understanding these guidelines is essential for compliance with the tax regulations.

Tax Forms

NJ Gross Income Tax Resident Payment Voucher

This is the NJ-1040-V form used for making resident payments for New Jersey Gross Income Tax. Ensure you fill it out accurately to avoid any issues with your tax payments. Follow the instructions provided to complete the form effectively.

Tax Forms

IRS Reporting Agent Authorization Technical Guide

This publication provides essential instructions and specifications for the preparation and submission of Form 8655. It includes the necessary requirements for electronic filing and the Reporting Agent's List for clients/taxpayers. A must-have resource for professionals involved in tax submission and compliance.

Tax Forms

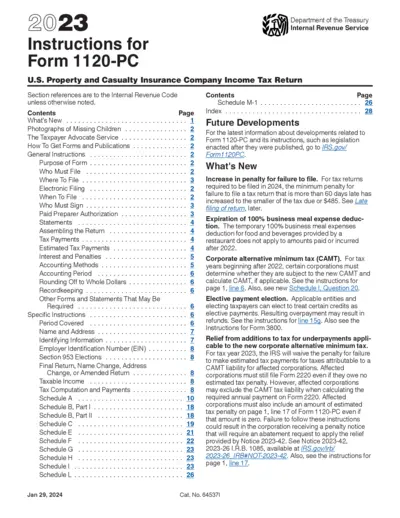

Form 1120-PC Instructions for 2023 Tax Year

This file contains detailed instructions for completing Form 1120-PC, the U.S. Property and Casualty Insurance Company Income Tax Return. It includes essential guidelines for tax year 2023, ensuring compliance with IRS regulations.

Tax Forms

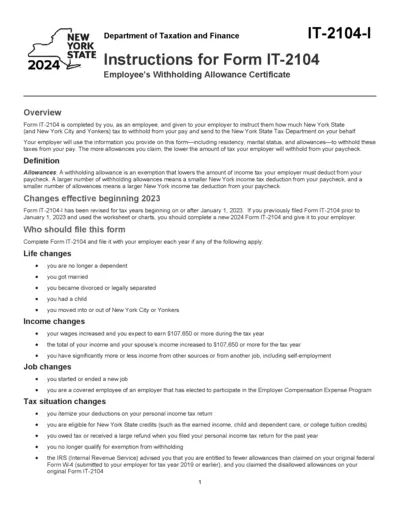

Instructions for Form IT-2104 Employee Withholding

This document provides comprehensive instructions on filling out Form IT-2104, the Employee's Withholding Allowance Certificate. It is essential for New York employees to determine the correct withholding for state taxes. Following these guidelines ensures compliance and minimizes tax liabilities.

Tax Forms

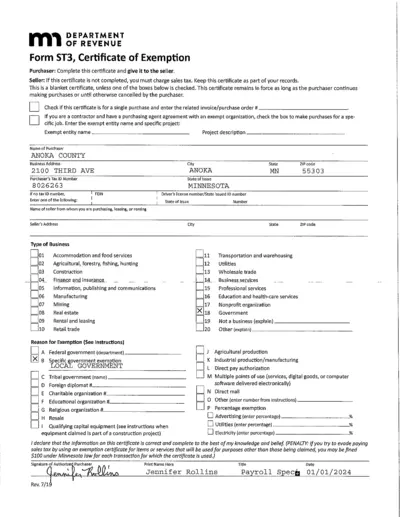

Form ST3 Certificate of Exemption Detailed Instructions

The Form ST3 Certificate of Exemption is essential for purchasers who are claiming exemption from sales tax. This certificate must be completed accurately to ensure compliance with Minnesota tax regulations. It serves as proof of the purchaser's exemption status during transactions.

Tax Forms

Instructions for Schedule B-2 Form 1065 IRS 2018

This document provides essential instructions for completing Schedule B-2 of Form 1065. It outlines eligibility criteria and filing procedures for partnerships. Understanding this guidance is crucial for tax compliance.

Tax Forms

Alabama Sales Use Tax Exemption Reporting Requirements

This file outlines the requirements for statutorily exempt organizations in Alabama. It details the process for filing the quadrennial informational report and maintaining a tax exemption certificate. Compliance with these requirements is essential to avoid revocation of tax exemptions.

Tax Forms

2022 Oregon Income Tax Form OR-40 Instructions

The 2022 Oregon Income Tax Form OR-40 Instructions provide essential guidance for full-year residents filing their income tax returns. This document details various tax credits, penalties, and information on electronic filing options. Ensure you meet the necessary deadlines and criteria by utilizing this comprehensive instruction guide.

Tax Forms

Georgia Amended Individual Income Tax Form 500X

The Georgia Form 500X is an Amended Individual Income Tax Return form designed for taxpayers needing to amend their 2019 tax return. This form ensures corrections are made based on changes to federal returns or updates to income details. It's essential for those who want accurate state tax reporting.

Tax Forms

Form 9465 Installment Agreement Request Instructions

This file provides detailed instructions for Form 9465, which is used to request an installment agreement from the IRS. It outlines eligibility criteria, payment options, and how to fill out the form accurately.