Tax Forms Documents

Tax Forms

CD-405 Instructions for C-Corporation Tax Return

The CD-405 instructions guide the preparation of North Carolina's C-Corporation tax return. This document outlines filing requirements, deadlines, and necessary forms. Essential for businesses operating in North Carolina to ensure compliance with tax regulations.

Tax Forms

State Tax Form G-4 Instructions for Employees

This document provides detailed instructions for filling out the G-4 State Employee's Withholding Allowance Certificate. It is essential for US citizens, resident aliens, and non-resident aliens to understand the requirements for proper submission. Ensure you follow the guidelines accurately to avoid processing delays.

Tax Forms

Colorado Tax Information Authorization and POA

Form DR 0145 is necessary for taxpayers in Colorado who wish to appoint a representative for tax matters. This form enables both Tax Information Authorization (TIA) and Power of Attorney (POA). Properly filling out this form ensures efficient communication with the Colorado Department of Revenue.

Tax Forms

IRS 1040EZ Tax Form Instructions and Details

This file provides detailed instructions for filling out the IRS 1040EZ tax form. It includes filing requirements, eligibility criteria, and significant tax credits. Use this resource to ensure timely and accurate tax submissions.

Tax Forms

Instructions for Filling IRS Form 8937 Simplified

This document provides detailed instructions for Form 8937, which pertains to organizational actions affecting securities' basis. It is essential for issuers of specified securities to understand their filing requirements. The instructions are crucial to ensure compliance with IRS regulations.

Tax Forms

Instructions for Form 843 Claim for Refund Abatement

This file contains the official instructions for Form 843, used to claim a refund for overpaid taxes and request tax abatement. It outlines the necessary steps for filing claims related to specific taxes, penalties, and interest. Essential for individuals and businesses needing guidance on tax refund processes.

Tax Forms

Free File Fillable Forms User's Guide

This file provides comprehensive instructions for using the Free File Fillable Forms offered by the IRS. It guides users through account creation, form selection, and entry of information. Essential for anyone filing taxes using these fillable forms.

Tax Forms

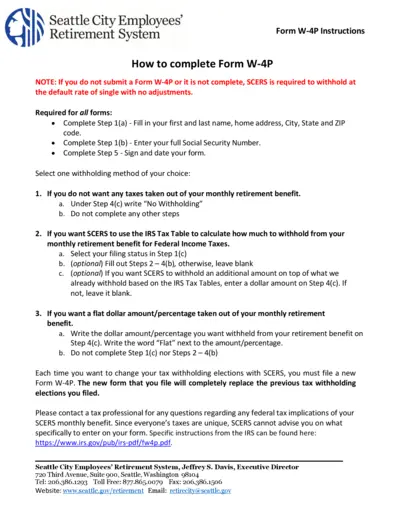

Form W-4P Instructions for Retirement Tax Withholding

This document provides essential instructions for filling out Form W-4P, which is necessary for tax withholding from periodic pension or annuity payments. It guides users on the steps required to properly complete the form and outlines important contact information for assistance. Ensure compliance with federal tax laws by accurately submitting this form.

Tax Forms

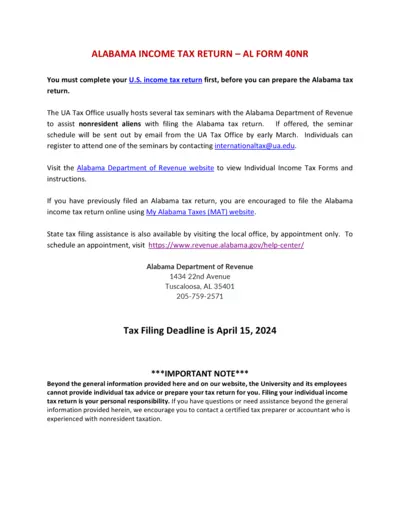

Alabama Income Tax Return Form 40NR Instructions

This file provides essential information and instructions for nonresident aliens filing the Alabama income tax return. It includes details about seminars, online filing options, and state assistance. Essential for ensuring compliance with Alabama tax regulations.

Tax Forms

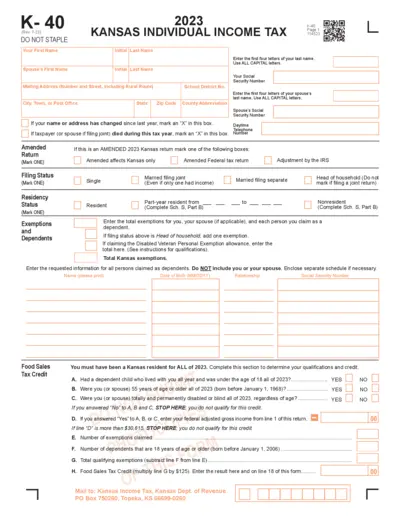

Kansas Individual Income Tax Form K-40 Instructions

The Kansas Individual Income Tax Form K-40 is essential for residents preparing their state tax returns. This form provides necessary fields for personal identification, income calculations, and deductions. Follow the guidelines to accurately complete and submit your tax return.

Tax Forms

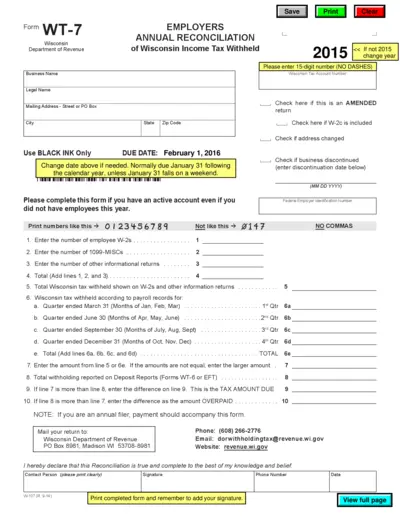

Wisconsin Employers Annual Reconciliation Form WT-7

The Wisconsin Employers Annual Reconciliation Form WT-7 is essential for businesses to report their state income tax withheld. This form must be filed even if there were no employees for the year. Ensure compliance by completing and submitting this form on time.

Tax Forms

California Real Estate Withholding Statement 2023

This form is used in California for the withholding of taxes on real estate transactions. It provides information necessary for remitters to comply with withholding requirements. Fill out the details accurately to ensure proper processing.