Tax Documents

Cross-Border Taxation

Massachusetts Resident Income Tax Form 1 Instructions 2022

This document provides detailed instructions for filling out the Massachusetts Resident Income Tax Form 1 for the year 2022. It includes important dates, tax rates, and electronic filing options. Perfect resource for Massachusetts taxpayers seeking clear guidance.

Cross-Border Taxation

General Instructions for Forms W-2 and W-3 2024

This file provides essential guidelines for filling out and submitting IRS Forms W-2 and W-3 for 2024. It includes information on requirements, electronic filing, and special situations. Business owners and payroll administrators will find detailed instructions to comply with tax regulations.

Cross-Border Taxation

Authorization of Accountant in VAT Filing

This file is a formal authorization document required for a registered dealer in Karnataka who wishes to allow their accountant or tax practitioner to represent them before the Value Added Tax Authority. It is essential for ensuring compliance with the Karnataka Value Added Tax Act, 2003. Proper submission of this form can help streamline tax assessment processes.

Cross-Border Taxation

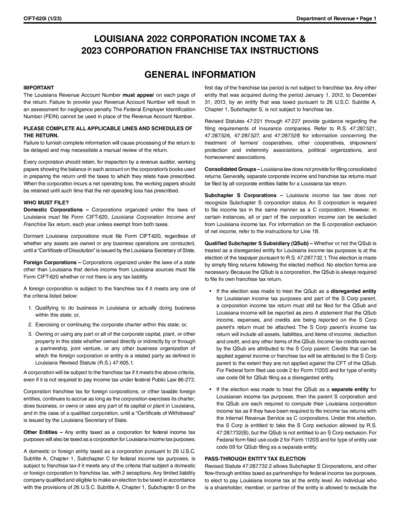

Louisiana Corporation Income and Franchise Tax Guide

This file contains detailed instructions for filing Louisiana Corporation Income and Franchise Tax returns. It provides information on who must file, important deadlines, and guidelines for completion. Business entities in Louisiana should reference this document for accurate compliance.

Cross-Border Taxation

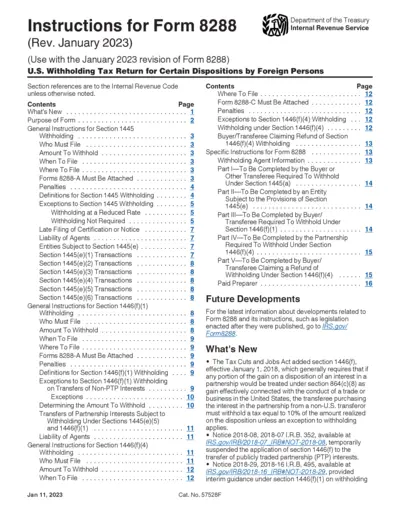

Instructions for Form 8288 U.S. Withholding Tax Return

This file provides essential guidance on Form 8288 for foreign persons involved in certain disposals. It outlines instructions on filling out the form, filing requirements, and withholding obligations. Ideal for taxpayers and accountants seeking compliance with U.S. tax withholding regulations.

Cross-Border Taxation

NY State IT-201-I Full-Year Resident Income Tax

This document provides detailed instructions for the New York State IT-201 Full-Year Resident Income Tax Form. It is essential for taxpayers to understand their filing requirements and available credits. Follow the guidelines provided to ensure accurate and timely submission.

Cross-Border Taxation

St. Louis Earnings Tax Return Instructions

This document provides essential guidance on filing the St. Louis Earnings Tax Return Form E-234. It includes instructions for various business types and details on penalties for late submissions. Ensure compliance with local tax regulations by following the guidelines outlined in this form.

Cross-Border Taxation

Instructions for Form 1116 Foreign Tax Credit

This file provides detailed instructions for filling out Form 1116, which is used to claim a foreign tax credit. It explains eligibility, deductions, and how to correctly report foreign taxes paid. Users will find guidance on specific line items and necessary qualifications to ensure compliance.

Cross-Border Taxation

New York State 2024 Estimated Tax Payment Guide

This file provides essential tips for estimated tax payment for estates or trusts in New York State for the year 2024. It includes instructions on filling out the necessary forms and details on submission. For assistance, users can refer to the provided links and contact numbers.

Cross-Border Taxation

Instructions for Form MTA-305: Tax Return

This document provides detailed instructions for filing Form MTA-305, the Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return. It outlines the tax obligations for employers in the Metropolitan Commuter Transportation District and describes how to accurately report payroll expenses. Perfect for New York employers who need guidance on metropolitan commuter tax compliance.

Cross-Border Taxation

Schedule B-1 Form 1120-S Information and Instructions

The Schedule B-1 (Form 1120-S) is an IRS form used by S corporations to report information on certain shareholders. This early release draft provides essential instructions and details to assist filers in completing the form accurately. It is crucial to use the finalized version after the draft is approved.

Payroll Tax

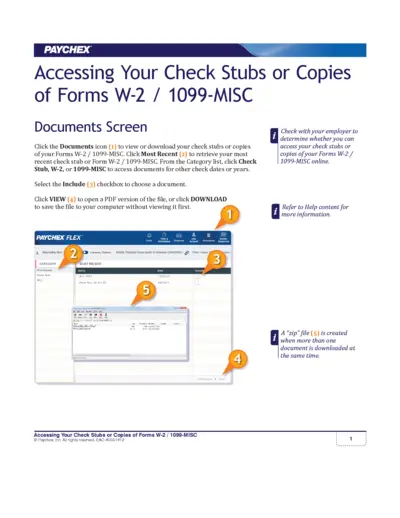

Access Your Paychex Check Stubs and W-2 Forms

This file provides step-by-step instructions for accessing your Paychex check stubs and W-2 forms. Users can learn how to view, download, and manage their payroll documents efficiently. Ensure you have your credentials ready to follow the instructions detailed within.