Tax Documents

Income Tax

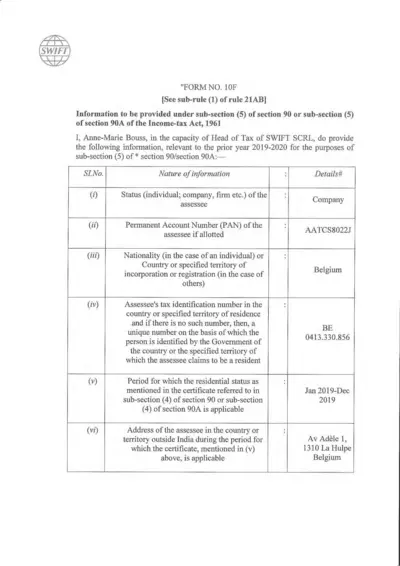

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

Tax Returns

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Payroll Tax

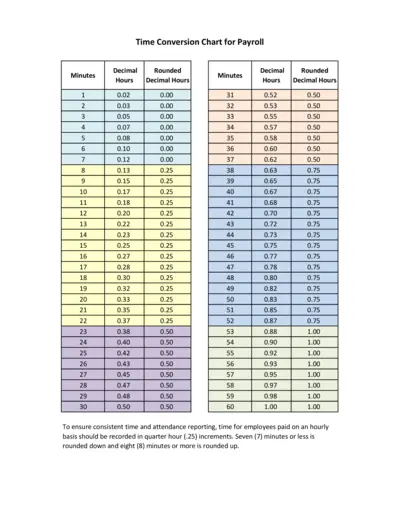

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Cross-Border Taxation

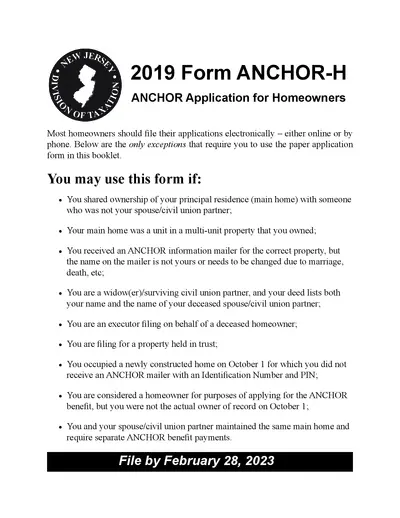

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Payroll Tax

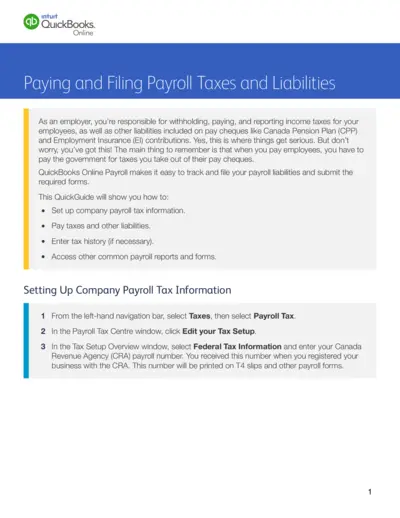

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

Cross-Border Taxation

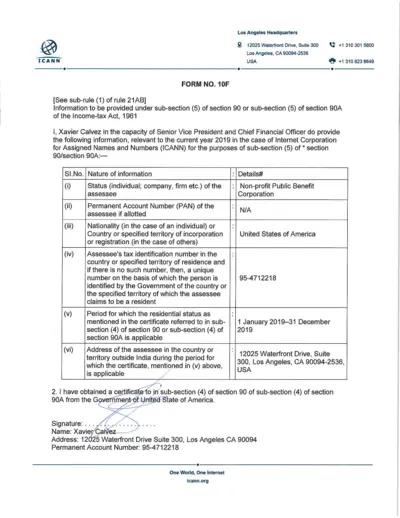

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

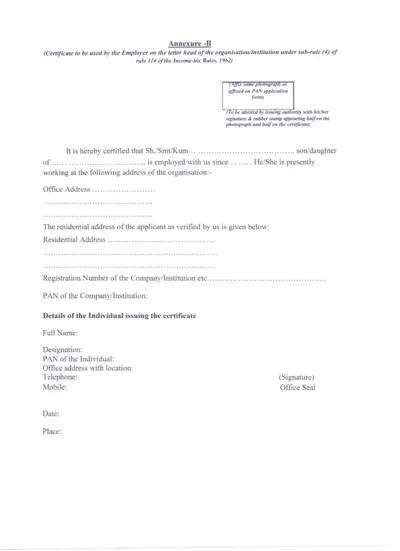

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

Cross-Border Taxation

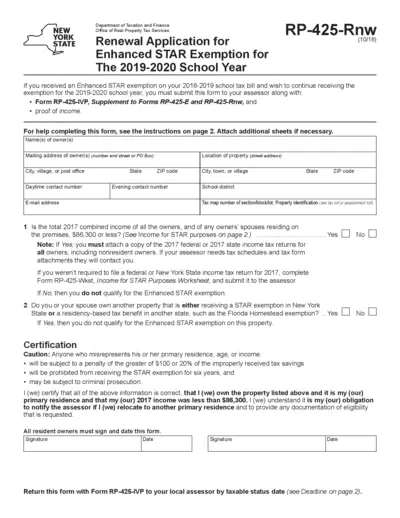

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

Cross-Border Taxation

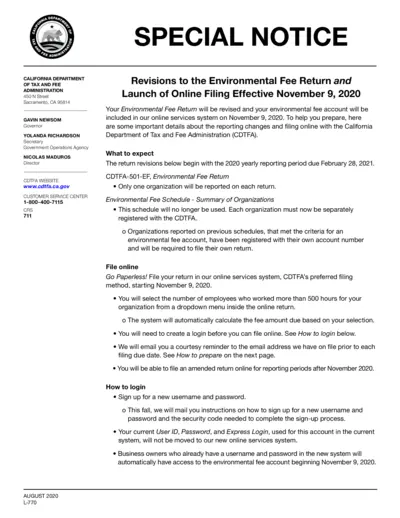

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

Cross-Border Taxation

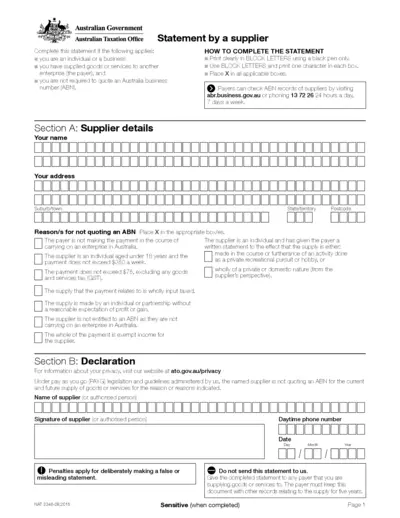

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

Income Verification

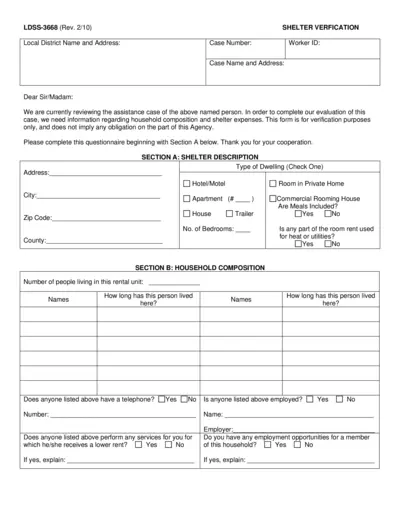

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

Cross-Border Taxation

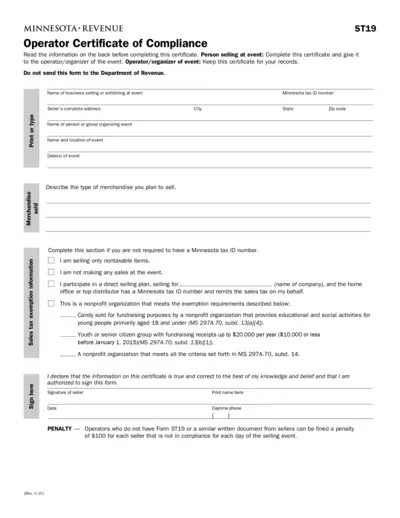

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.