Tax Documents

Cross-Border Taxation

Instructions for Form 8960 Net Investment Income Tax

This document provides essential instructions for completing Form 8960, which calculates the Net Investment Income Tax. It is useful for individuals, estates, and trusts subject to this tax. Familiarize yourself with the guidelines to ensure accurate filing.

Agricultural Property Tax

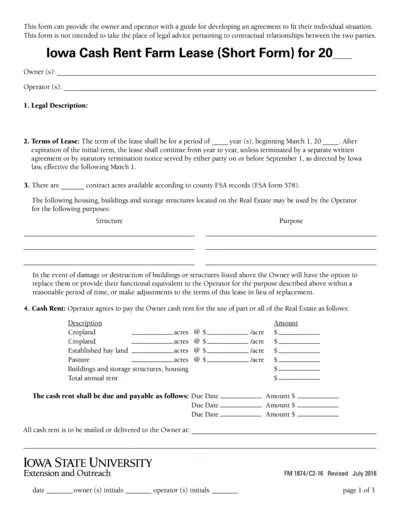

Iowa Cash Rent Farm Lease Short Form Instructions

This document provides a structured outline for creating a cash rent farm lease in Iowa. It helps both owners and operators establish terms and agreements tailored to their needs. Use this form as a guide to ensure comprehensive legal coverage.

Tax Returns

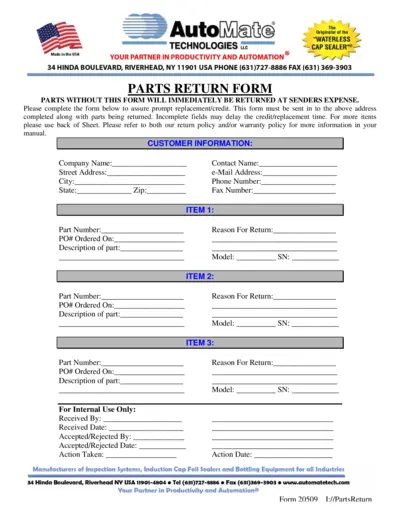

Parts Return Form - AutoMate Technologies

This Parts Return Form from AutoMate Technologies is essential for initiating the return process of parts. Users must complete the required fields to ensure prompt replacement or credit. Please refer to our guidelines for an efficient return experience.

Tax Returns

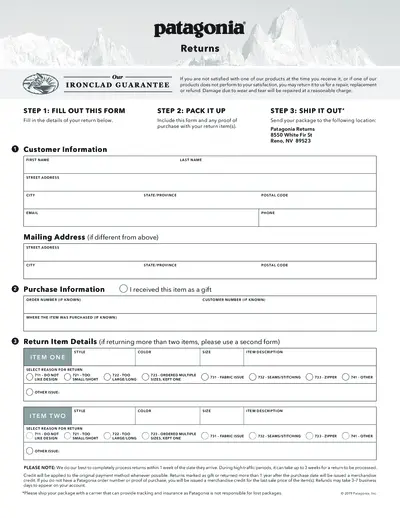

Patagonia Returns Instructions and Form Guide

This file contains detailed return instructions for Patagonia products. It includes a form for customer information and return item details. Users can follow the steps outlined to ensure a smooth return process.

Cross-Border Taxation

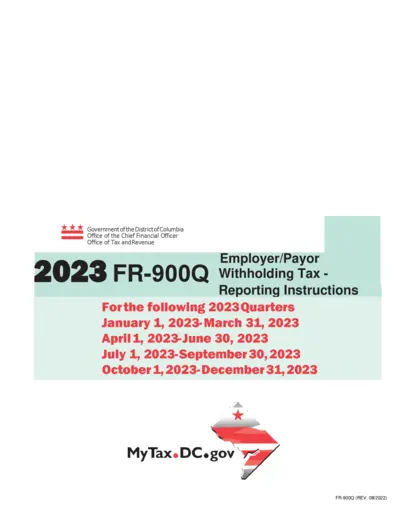

DC Withholding Tax Reporting Instructions for 2023

This file contains the employer/payor withholding tax reporting instructions for the year 2023. It includes essential details on filing the FR-900Q form each quarter. Employers should refer to this file for guidelines to ensure compliance with DC tax laws.

Payroll Tax

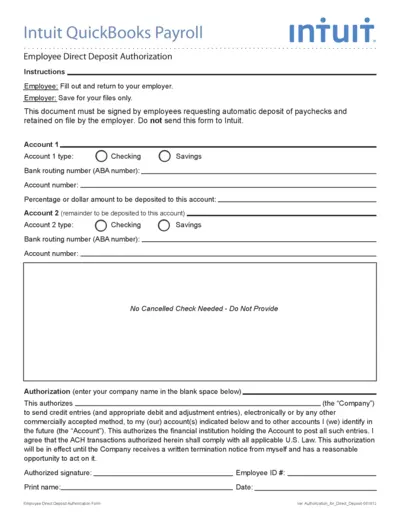

Intuit QuickBooks Payroll Direct Deposit Authorization

This file is the Employee Direct Deposit Authorization form provided by Intuit QuickBooks Payroll. It allows employees to authorize direct deposit of their paychecks into their bank accounts. This form must be filled out and returned to the employer for processing.

Cross-Border Taxation

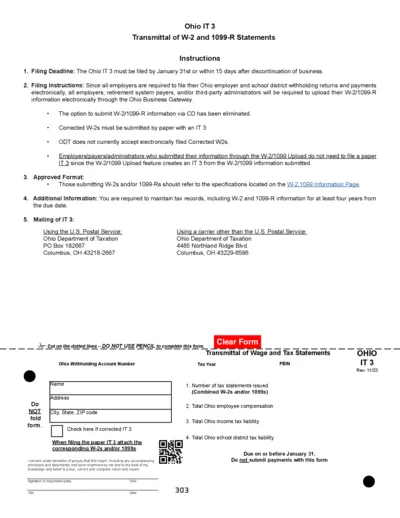

Ohio IT 3 W-2 and 1099-R Filing Instructions and Details

This document provides comprehensive instructions for filing the Ohio IT 3 form, including W-2 and 1099-R statements. It outlines filing deadlines, electronic submission processes, and additional information for employers. Ensure compliance with Ohio tax regulations using this essential guide.

Cross-Border Taxation

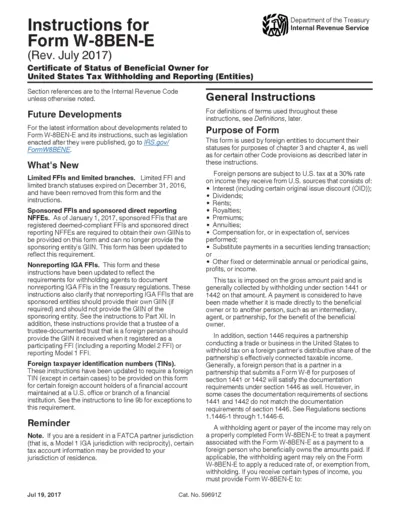

W-8BEN-E Form Instructions for Tax Compliance

This document provides comprehensive instructions for completing Form W-8BEN-E, which certifies the status of beneficial owners for tax reporting. It includes information on applicable rules and regulations for foreign entities. Ensure compliance with U.S. withholding tax requirements by following the guidelines provided.

Cross-Border Taxation

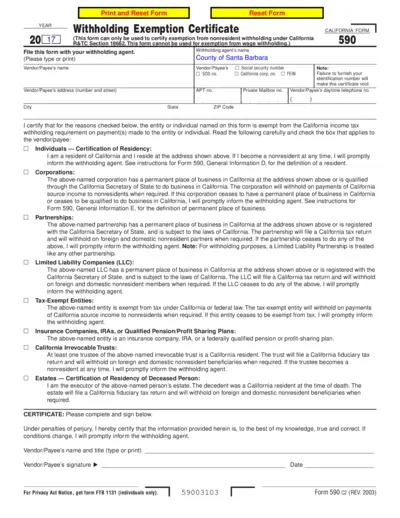

California Form 590 Withholding Exemption Certificate

California Form 590 is used to certify exemption from nonresidential withholding. Ensure that the appropriate sections are filled out accurately. This is essential for residents and entities wishing to avoid unnecessary tax withholdings.

Tax Returns

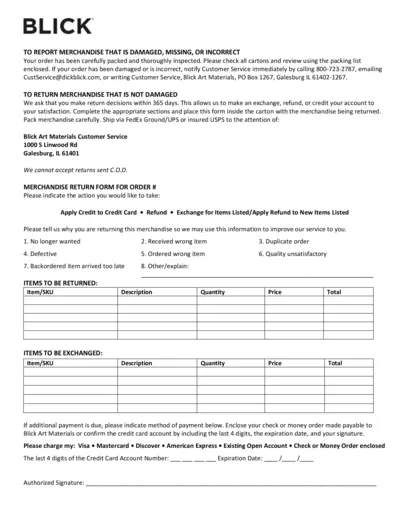

Blick Merchandise Return Instructions and Form

This document provides detailed instructions for returning damaged or incorrect merchandise purchased from Blick Art Materials. It includes a merchandise return form and guidelines for shipping. Customers are encouraged to submit the return form within 365 days for a smooth exchange, refund, or credit.

Cross-Border Taxation

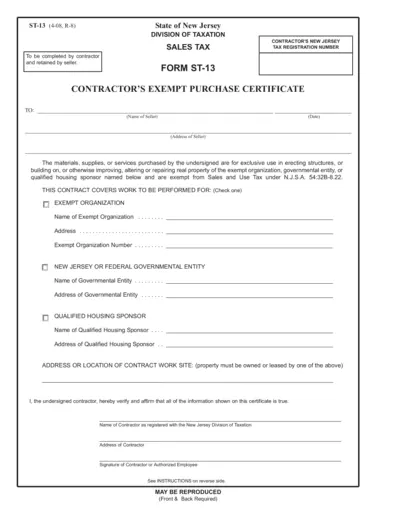

New Jersey Contractor's Exempt Purchase Certificate

The New Jersey Contractor's Exempt Purchase Certificate is a crucial document for contractors working with exempt organizations. This form allows contractors to purchase materials and services without paying sales tax for projects involving exempt entities. Understanding how to fill it out correctly is essential for compliance and tax exemption.

Cross-Border Taxation

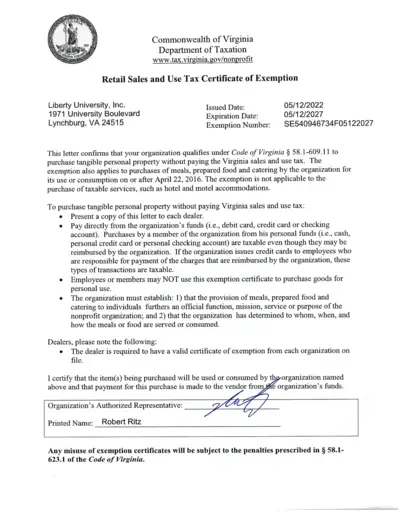

Virginia Retail Sales and Use Tax Exemption Certificate

This document serves as a retail sales and use tax exemption certificate for nonprofit organizations. It confirms the qualification for tax-exempt purchases. Ensure compliance with the specified instructions for valid use.