New York State 2024 Estimated Tax Payment Guide

This file provides essential tips for estimated tax payment for estates or trusts in New York State for the year 2024. It includes instructions on filling out the necessary forms and details on submission. For assistance, users can refer to the provided links and contact numbers.

Edit, Download, and Sign the New York State 2024 Estimated Tax Payment Guide

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, ensure that you have all required information at hand, including the identification number of the estate or trust. Pay careful attention to the details provided in each section, matching names and numbers accurately. Lastly, follow the submission instructions exactly to avoid any processing delays.

How to fill out the New York State 2024 Estimated Tax Payment Guide?

1

Gather all the necessary information related to the estate or trust.

2

Accurately fill in the identification number and other relevant details.

3

Check the amounts for New York State, New York City, and Yonkers.

4

Ensure the name is exactly as it appears on the federal Form SS-4.

5

Detach and mail the voucher with the payment as instructed.

Who needs the New York State 2024 Estimated Tax Payment Guide?

1

Estate Executors who need to report the estate's taxes.

2

Trustees managing a trust, requiring tax payment submissions.

3

Financial Advisors assisting clients with fiduciary responsibilities.

4

Tax Professionals working on behalf of their clients’ estates.

5

Individuals filing taxes on behalf of a deceased relative.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the New York State 2024 Estimated Tax Payment Guide along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your New York State 2024 Estimated Tax Payment Guide online.

Edit your PDF easily on PrintFriendly by selecting the 'Edit' option. You can make adjustments to text, add notes, or enhance the document as needed. Our user-friendly interface ensures that your edits are straightforward and effective.

Add your legally-binding signature.

Signing PDFs on PrintFriendly is a breeze with our new feature. Simply choose the 'Sign' option to add your signature to the document. You’ll be guided through the process to ensure your signature is applied correctly.

Share your form instantly.

Sharing your PDF is simple and efficient on PrintFriendly. Use the 'Share' function to send your document via email or social media. Your PDF can easily be shared with anyone in just a few clicks.

How do I edit the New York State 2024 Estimated Tax Payment Guide online?

Edit your PDF easily on PrintFriendly by selecting the 'Edit' option. You can make adjustments to text, add notes, or enhance the document as needed. Our user-friendly interface ensures that your edits are straightforward and effective.

1

Open the PDF file in PrintFriendly.

2

Select the 'Edit' option to begin modifying the document.

3

Make necessary changes directly on the PDF.

4

Review your edits to ensure accuracy.

5

Save and download the edited PDF file.

What are the instructions for submitting this form?

Submit this form by mailing it along with your payment to NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY 13902-4122. Ensure that you include the proper identification number and payment amounts. It's advisable to verify compliance with New York State tax guidelines to avoid rejection or processing delays.

What are the important dates for this form in 2024 and 2025?

For calendar-year filers, the due dates for submitting the estimated tax payment vouchers for the year 2024 are April 15, 2024; June 17, 2024; September 16, 2024; and January 15, 2025. Make sure to adhere to these deadlines to avoid penalties. Prepare ahead to ensure all necessary information is accurately completed.

What is the purpose of this form?

The purpose of this form is to facilitate the estimated tax payment for estates and trusts in New York State for the year 2024. It ensures compliance with state tax requirements while providing clear instructions for fiduciaries. Proper use of this form is critical for avoiding penalties and ensuring timely tax submissions.

Tell me about this form and its components and fields line-by-line.

- 1. Identification Number: The unique tax identification number for the estate or trust.

- 2. Fiscal Year Dates: Start and end dates for fiscal year, if applicable.

- 3. Name of Estate or Trust: The official name as it appears on the federal Form SS-4.

- 4. Estimated Tax Amounts: Amounts to be filled out for New York State, New York City, and Yonkers.

- 5. Total Payment: The total estimated tax payment amount due.

What happens if I fail to submit this form?

Failing to submit this form can result in penalties and interest on unpaid estimated taxes. It is crucial to ensure that this form is submitted by the due dates established by New York State. Neglecting this responsibility can complicate tax filing for the estate or trust.

- Penalties: Late submissions can incur financial penalties.

- Interest Charges: Interest may accrue on unpaid amounts.

- Complications with Tax Filing: Failure to submit can lead to issues with final tax returns.

How do I know when to use this form?

- 1. Estimated Tax Payments: Use for submitting estimated tax payments for estates and trusts.

- 2. Compliance with NY State Tax Laws: Ensure adherence to state tax regulations.

- 3. Fiduciary Responsibilities: Fiduciaries must use this form to manage tax obligations.

Frequently Asked Questions

How do I edit the PDF of this form?

You can edit the PDF by selecting the 'Edit' option on PrintFriendly and making adjustments as needed.

Can I download the edited PDF?

Yes, once you have finished editing, you can download the modified PDF for your records.

Is there a way to share the PDF directly from PrintFriendly?

Absolutely! Use the 'Share' feature to send the PDF through email or share it on social media.

How can I sign the PDF?

Select the 'Sign' option on PrintFriendly to add your signature to the document easily.

What if I make a mistake while editing?

You can easily undo changes or re-edit the PDF until you are satisfied.

Are there limits to what I can edit?

You can edit most text and add notes, ensuring your document meets your needs.

Can I edit this PDF on my mobile device?

Yes, PrintFriendly is accessible on mobile, allowing you to edit PDFs on the go.

What formats can I download my edited PDF in?

You can download your edited PDF in standard PDF format, ready for submission.

Is there a cost to edit or download PDFs?

Editing and downloading PDFs on PrintFriendly is completely free.

How do I ensure my edits are saved?

After finalizing your edits, simply download the PDF to save your changes.

Related Documents - NY Tax Payment Instructions 2024

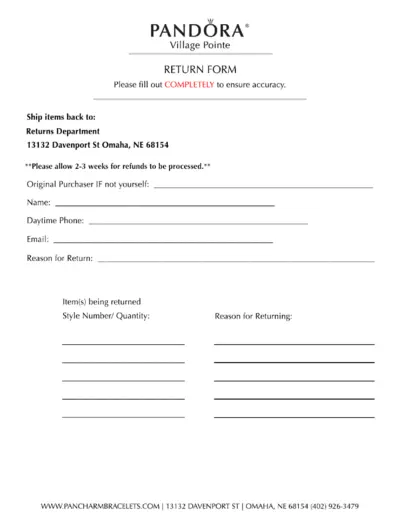

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

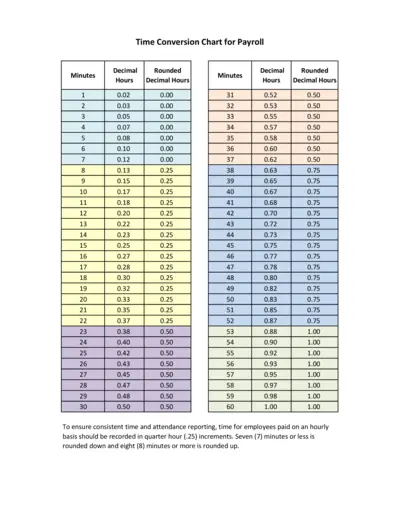

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

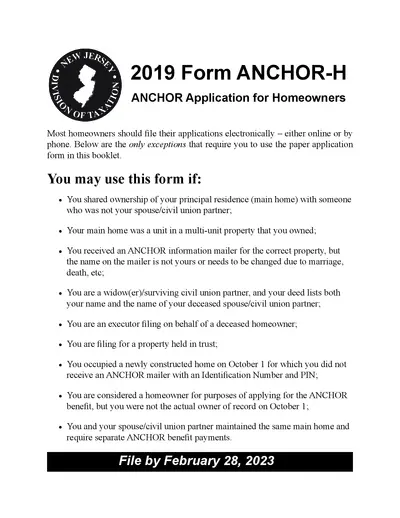

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

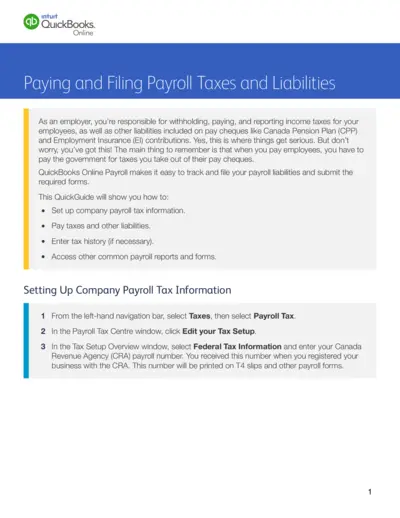

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

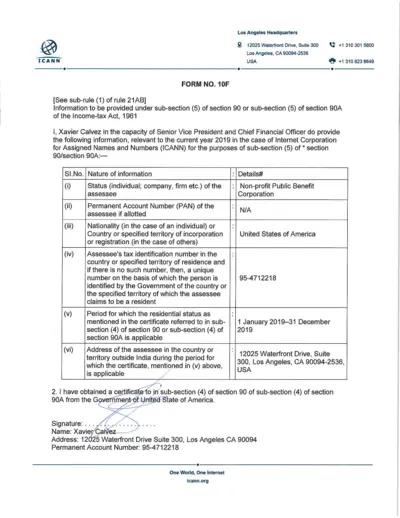

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

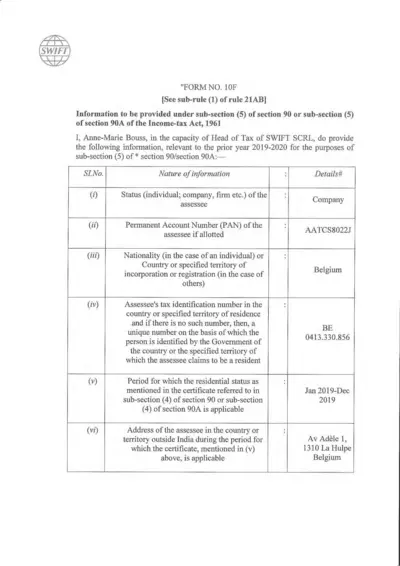

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

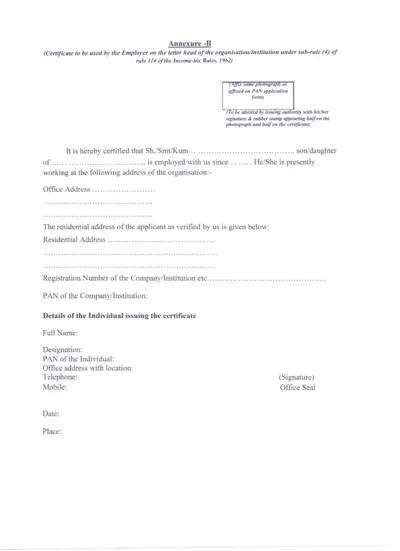

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

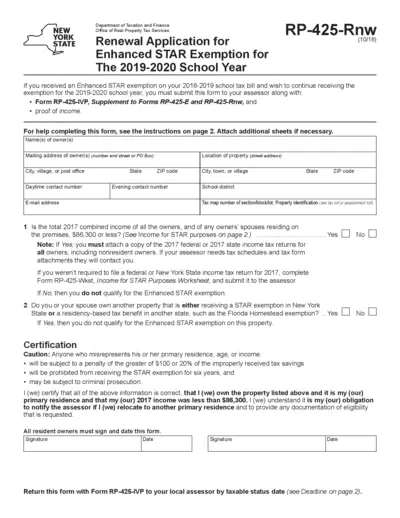

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

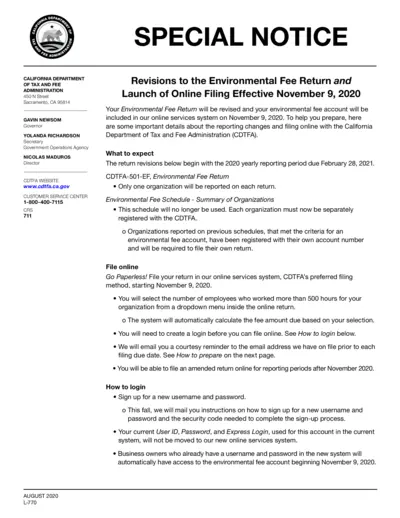

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

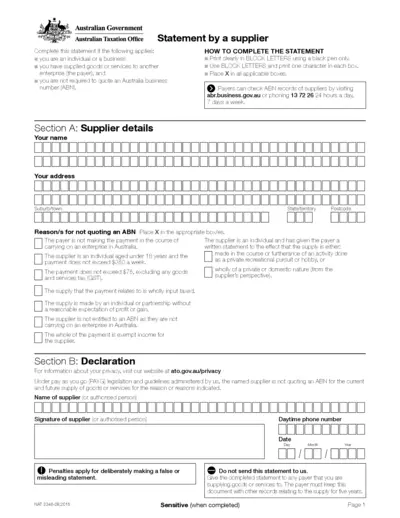

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

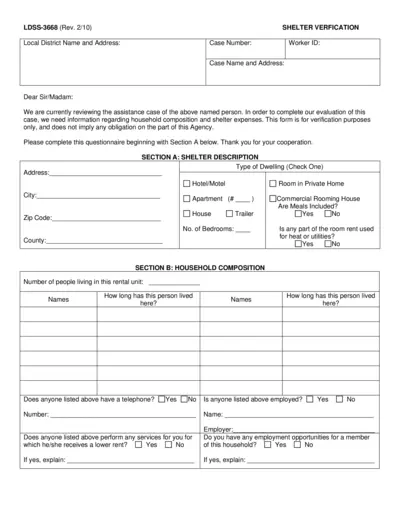

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

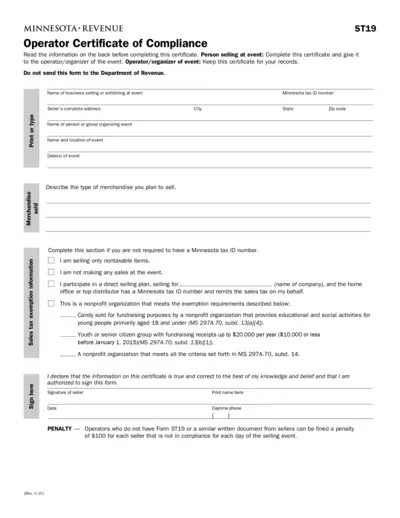

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.