Tax Documents

Cross-Border Taxation

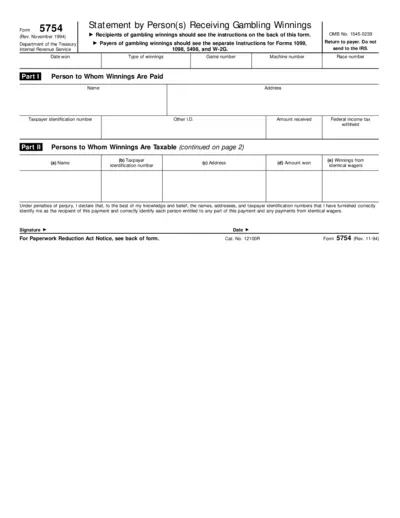

Form 5754 Instructions for Reporting Gambling Winnings

This file provides essential details and instructions for individuals receiving gambling winnings. It outlines the necessary fields to complete the form accurately. Use this form to ensure compliance with IRS regulations and correct reporting.

Cross-Border Taxation

FTB Form 565 Instructions for Partnership Return

This file contains detailed instructions for completing the California FTB Form 565 for partnership returns. It provides essential information regarding tax credits, filing requirements, and submission guidelines. Businesses and individuals should refer to this document for accurate tax preparation.

Cross-Border Taxation

Nebraska Estimated Income Tax Payment Instructions

This file provides essential information on estimated income tax payments for Nebraska residents and nonresidents. It includes instructions on payment deadlines and methods, as well as eligibility criteria for required payments. Utilize this guide to ensure compliance with Nebraska tax regulations.

Cross-Border Taxation

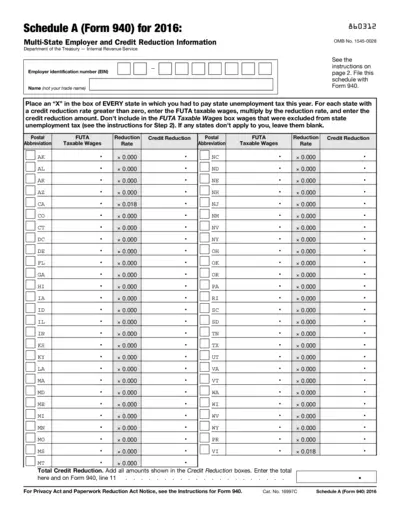

Schedule A Form 940 Multi-State Employer Instructions

This file contains Schedule A (Form 940) instructions for the year 2016, including multi-state employer information. It outlines steps for reporting state unemployment tax payments and credit reductions. This guide is essential for employers who need to navigate their unemployment tax obligations accurately.

Cross-Border Taxation

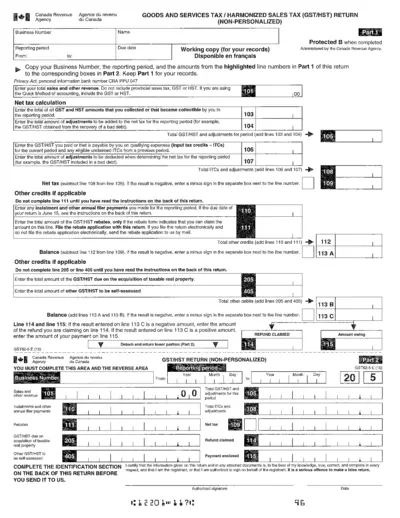

Canada GST/HST Return Filing Instructions

This file contains important instructions for completing your GST/HST return. It details the necessary steps, required fields, and guidelines for accurate reporting. Ensure compliance with Canada Revenue Agency regulations by following this guide.

Cross-Border Taxation

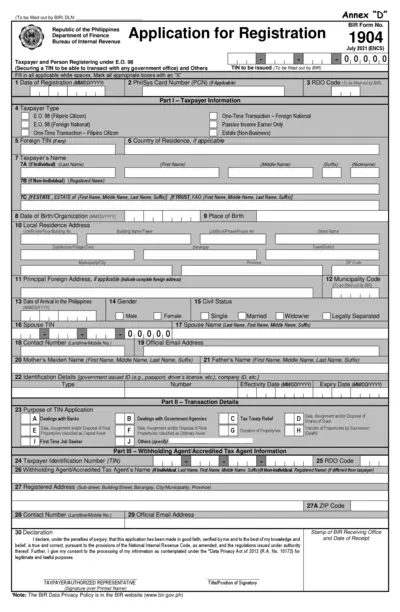

Application for Registration - BIR Form 1904

This file contains the application form for registration with the Bureau of Internal Revenue in the Philippines. It includes essential details for both individuals and non-individuals applying for a Tax Identification Number (TIN). Use this document to ensure compliance with tax regulations.

Cross-Border Taxation

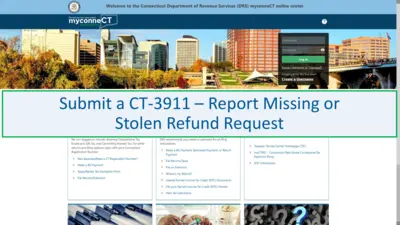

Connecticut DRS myconneCT Online Tax Filing

This file contains essential instructions for using the Connecticut Department of Revenue Services myconneCT online center. It guides users on filing and paying taxes efficiently online. Ideal for both individuals and businesses needing to manage their tax obligations.

Cross-Border Taxation

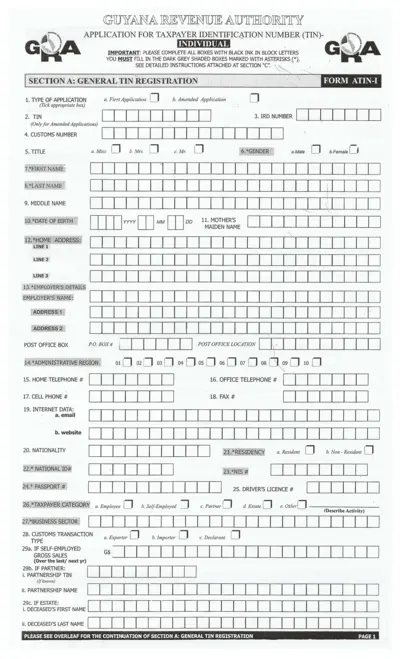

Guyana Taxpayer Identification Number Application

This file contains the application form for obtaining a Taxpayer Identification Number (TIN) in Guyana. It includes detailed instructions for individual applicants. Proper completion of the form is essential for successful registration.

Cross-Border Taxation

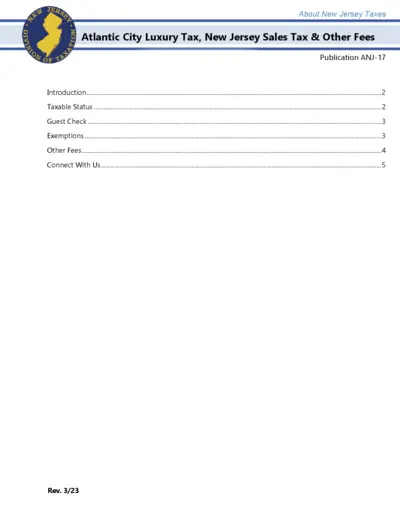

Atlantic City Luxury Tax Guidance and Instructions

This file provides comprehensive guidance on Atlantic City Luxury Tax and New Jersey Sales Tax. It outlines taxable status, exemptions, and guest check details to ensure compliance. Ideal for individuals and businesses involved in transactions in Atlantic City.

Cross-Border Taxation

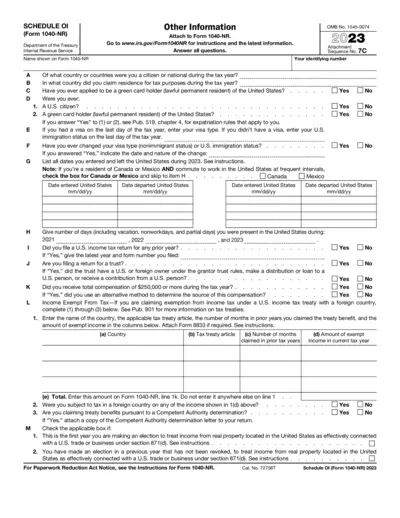

Schedule OI Form 1040-NR Instructions and Details

This file contains the Schedule OI for Form 1040-NR, detailing important information on residency, citizenship, and income tax treaty benefits. It serves as a guide for users needing help with their tax filing in the U.S. and outlines the necessary steps to complete the form accurately.

Cross-Border Taxation

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.

Taxation of Digital Services

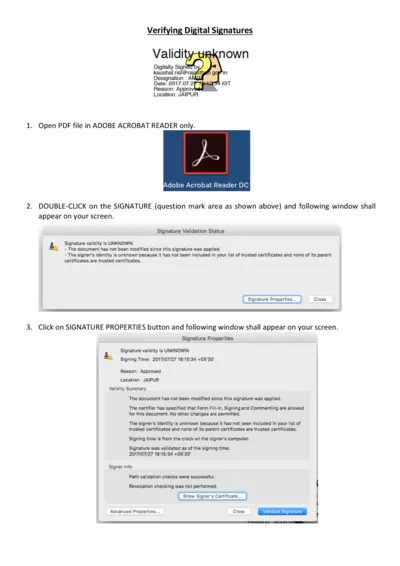

Guide for Verifying Digital Signatures and Certificates

This document provides detailed instructions for verifying digital signatures in PDF files. It outlines the necessary steps to ensure the authenticity of signatures and certificates. Users can follow the guidelines to enhance their understanding of digital signatures.