Connecticut DRS myconneCT Online Tax Filing

This file contains essential instructions for using the Connecticut Department of Revenue Services myconneCT online center. It guides users on filing and paying taxes efficiently online. Ideal for both individuals and businesses needing to manage their tax obligations.

Edit, Download, and Sign the Connecticut DRS myconneCT Online Tax Filing

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, begin by gathering all necessary documents related to your tax obligations. Next, log in to the myconneCT online center using your username and password. Follow the on-screen prompts to complete your tax filing or payment process.

How to fill out the Connecticut DRS myconneCT Online Tax Filing?

1

Gather all necessary tax-related documents.

2

Log in to the myconneCT online center.

3

Select the relevant tax filing or payment option.

4

Fill out the required fields with accurate information.

5

Submit the form and confirm your submission.

Who needs the Connecticut DRS myconneCT Online Tax Filing?

1

Individuals filing personal income taxes.

2

Businesses needing to pay corporate taxes.

3

Attorneys handling clients' tax issues.

4

Residents applying for tax exemptions.

5

Anyone tracking tax refunds or payments.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Connecticut DRS myconneCT Online Tax Filing along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Connecticut DRS myconneCT Online Tax Filing online.

Editing PDFs on PrintFriendly is incredibly easy. Simply upload your PDF, make the necessary changes using our editing tools, and save the modified document. Our platform ensures that the edits are made seamlessly for optimal user experience.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is made simple. You can add your signature digitally using our user-friendly interface. Once signed, you can download the document for your records.

Share your form instantly.

Sharing your PDF on PrintFriendly is effortless. Once your document is ready, use the share link to distribute it directly. This feature allows you to quickly share important documents with colleagues or clients.

How do I edit the Connecticut DRS myconneCT Online Tax Filing online?

Editing PDFs on PrintFriendly is incredibly easy. Simply upload your PDF, make the necessary changes using our editing tools, and save the modified document. Our platform ensures that the edits are made seamlessly for optimal user experience.

1

Upload the PDF file you want to edit.

2

Utilize the available editing tools to make changes.

3

Review your edits to ensure everything is correct.

4

Download the edited PDF to your device.

5

Share or save your edited document as needed.

What are the instructions for submitting this form?

To submit this form, simply log in to the myconneCT online center and complete all necessary fields. Once filled, submit your form electronically. For any inquiries, contact the DRS at 860-297-5962 or fax your documents to 860-297-5698. Mail submissions should be sent to Connecticut Department of Revenue Services, PO Box 2974, Hartford, CT 06104-2974.

What are the important dates for this form in 2024 and 2025?

For the 2024 tax year, important dates include filing deadlines on April 15, 2024, for individual tax returns. Estimated tax payments will be due quarterly on April 15, June 15, September 15, and January 15. In 2025, similar deadlines will apply, so be sure to check for any changes.

What is the purpose of this form?

The purpose of this form is to facilitate the online filing and payment of taxes through the Connecticut DRS myconneCT system. It aims to streamline the tax process for individuals and businesses, making it more accessible and user-friendly. By using this form, taxpayers can fulfill their obligations efficiently and with minimal hassle.

Tell me about this form and its components and fields line-by-line.

- 1. Username: Your unique identifier for accessing the myconneCT online center.

- 2. Password: Your secure password to log into the myconneCT system.

- 3. Tax Type: Specifies the type of tax you are filing (e.g., personal income, business).

What happens if I fail to submit this form?

Failure to submit this form may lead to penalties and delayed processing of your tax return. Additionally, you may miss out on potential refunds or deductions.

- Penalties: Late submissions may incur financial penalties.

- Refund Delays: Not submitting on time can delay your tax refund.

- Compliance Issues: Filing failure may raise compliance concerns with the IRS.

How do I know when to use this form?

- 1. Annual Tax Filing: Use this form for your yearly tax returns.

- 2. Estimated Payments: Required for making estimated tax payments throughout the year.

- 3. Tax Exemption Applications: Necessary for applying for any tax exemption.

Frequently Asked Questions

How do I access the myconneCT online center?

You can access the myconneCT online center by visiting the Connecticut Department of Revenue Services website.

What types of taxes can I file online?

You can file personal income taxes, business taxes, and various other tax-related documents online.

Can I save my progress while filling out the form?

While you are unable to save your progress, you can complete and download the form in one session.

Is there a fee for using the PDF editor on PrintFriendly?

Using the PDF editor on PrintFriendly is free of charge.

How do I know if my submission was successful?

You will receive a confirmation notice upon successful submission of your form.

What if I forgot my login information?

You can recover your login information by clicking the 'Forgot Username or Password?' link on the login page.

Can I amend a previously submitted return?

Yes, you can view or amend your previously filed returns through the myconneCT center.

What documents do I need to file my taxes?

Gather your W-2s, 1099 forms, and any other relevant tax documents before starting.

When is the deadline for filing taxes?

The specific filing deadline may vary, so check the Connecticut DRS website for the latest information.

Is technical support available for the online system?

Yes, technical support is available through the Connecticut DRS for any issues you encounter.

Related Documents - CT DRS myconneCT

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

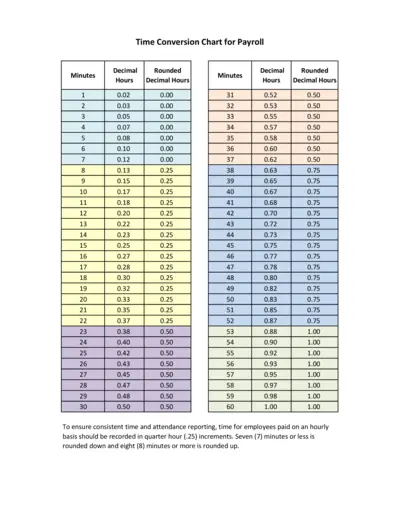

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

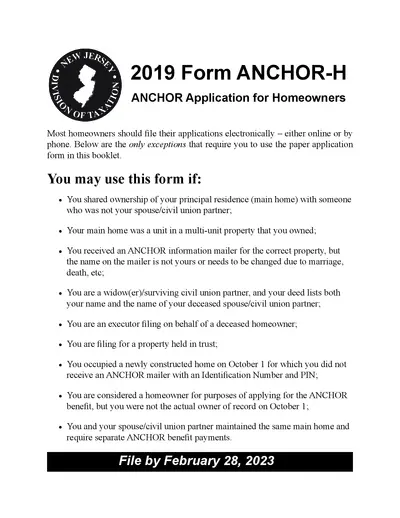

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

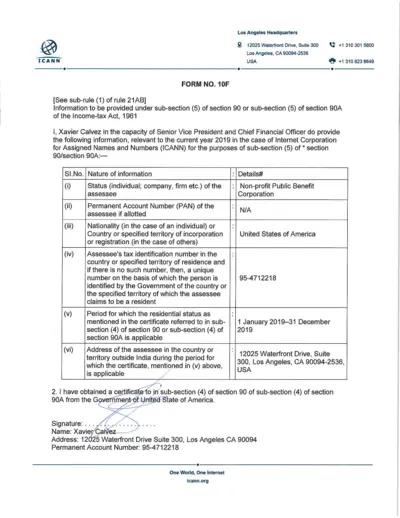

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

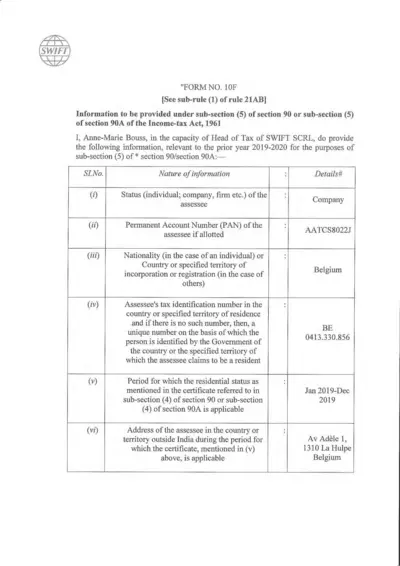

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

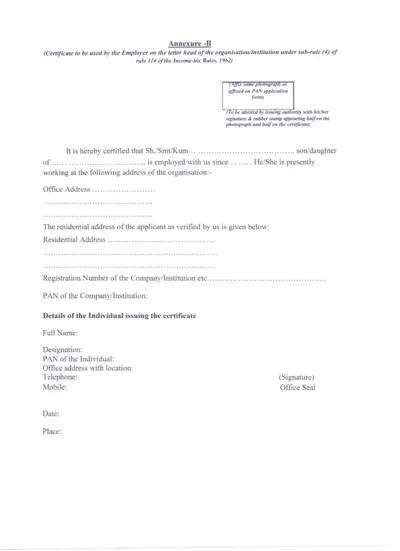

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

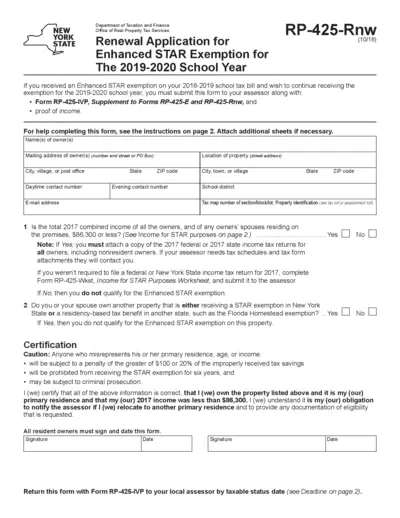

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

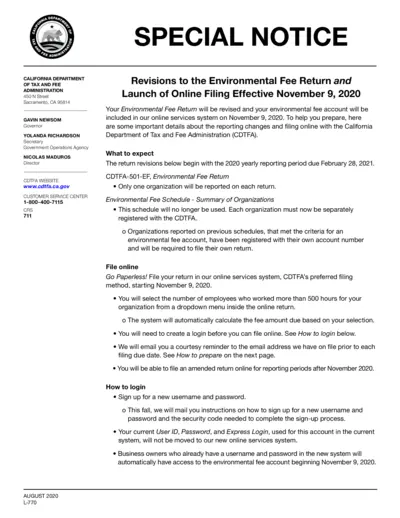

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

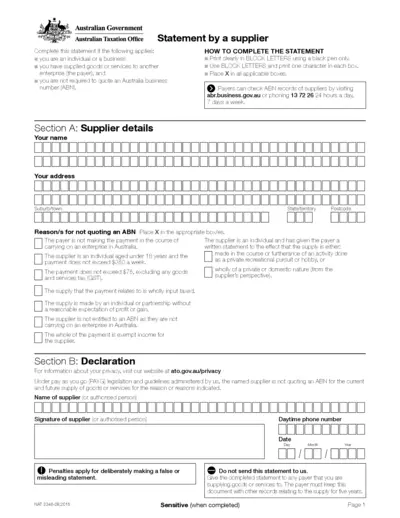

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

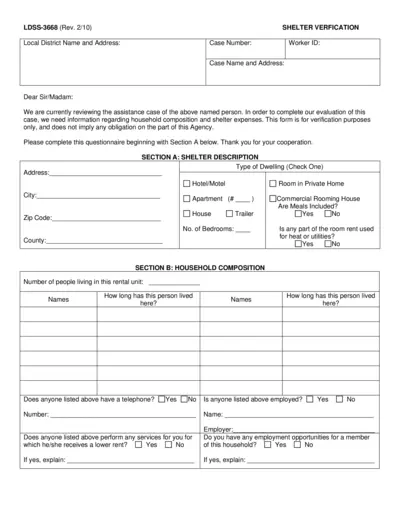

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

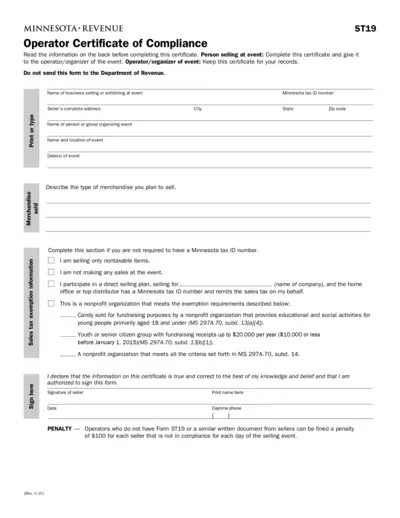

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.