Tax Documents

Cross-Border Taxation

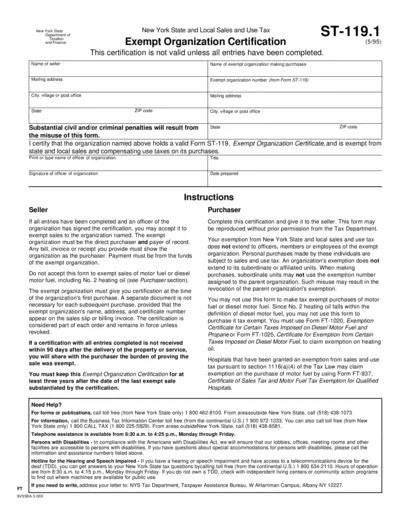

New York State Exempt Organization Certification

This document is the New York State Exempt Organization Certification form. It certifies that an organization is exempt from state and local sales and compensating use taxes. This certification must be filled out completely to be valid.

Cross-Border Taxation

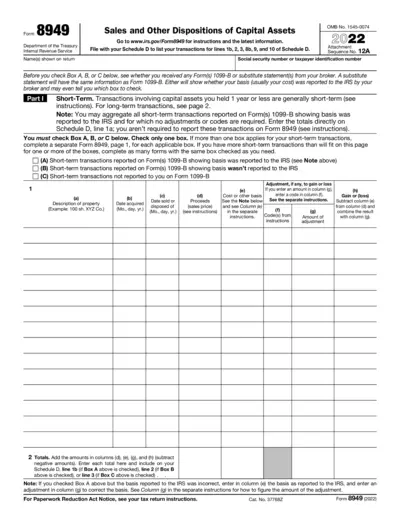

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and other dispositions of capital assets. It is essential for accurately reporting gains and losses during tax filing. This form assists both individuals and businesses in detailing their capital asset transactions for IRS compliance.

Tax Returns

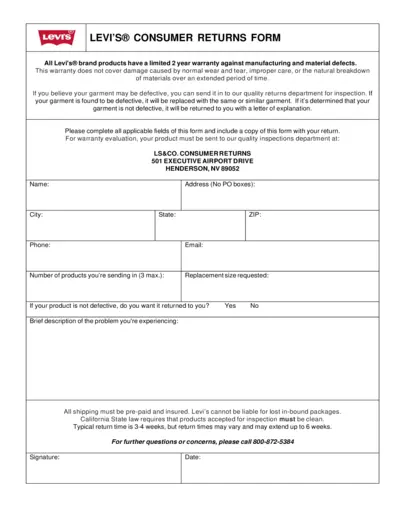

Levi's Consumer Returns Form Instructions

This file contains important information about Levi's consumer returns process. It details the warranty policy and provides a returns form for products. Users can find instructions on how to complete and submit the form.

Cross-Border Taxation

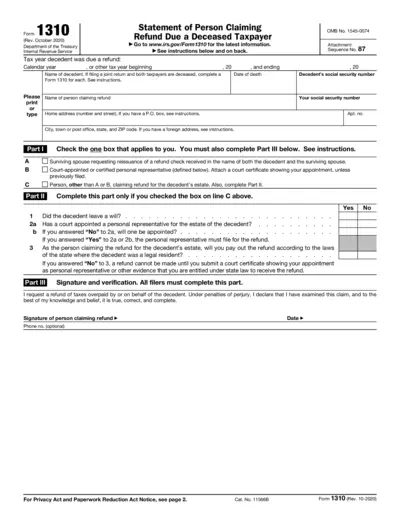

Claim Refund After Deceased Taxpayer Form Instructions

This document provides detailed instructions for claiming a tax refund due to a deceased taxpayer. It guides users through the process of completing Form 1310 effectively. Ensure compliance with IRS requirements by following this comprehensive guide.

Tax Returns

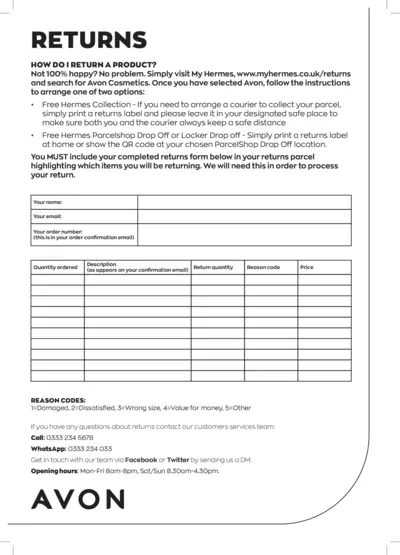

Return Instructions for Avon Cosmetics Products

This file provides comprehensive instructions on how to return Avon Cosmetics products. It includes details about filling out the returns form and the various return options available. Utilize this guide to ensure a smooth return process.

Cross-Border Taxation

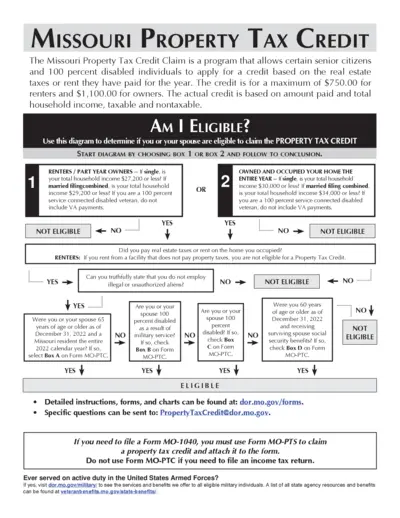

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

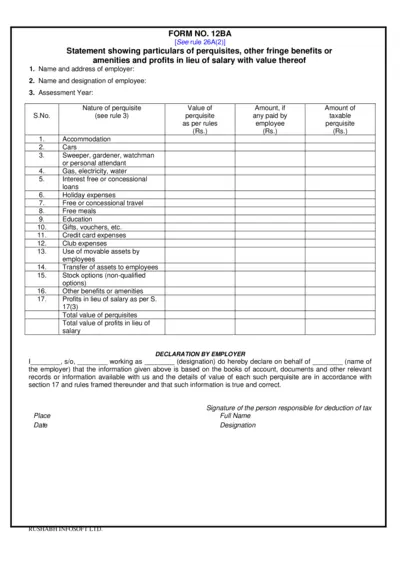

FORM NO. 12BA Statement of Perquisites and Benefits

FORM NO. 12BA provides an overview of the particulars of perquisites, fringe benefits, and amenities related to salary for taxation purposes. It assists employers in documenting employee perks and calculating their monetary value. This file is essential for tax assessment and compliance.

Sales Tax

Discover the Secrets to Creating a Sales Funnel

This e-book guides you through the essentials of building a successful sales funnel. Learn effective strategies to convert leads into high-ticket customers. Perfect for marketers and entrepreneurs aiming for growth.

Cross-Border Taxation

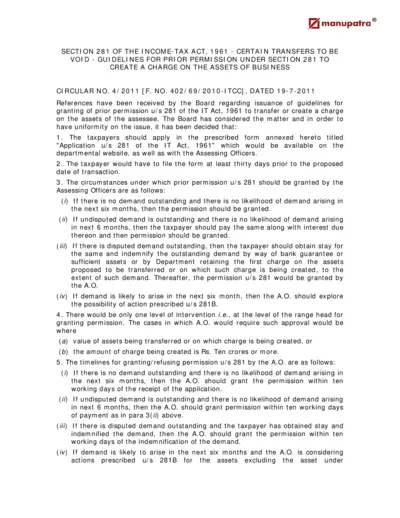

Section 281 IT Act 1961 - Guidelines for Transfers

This file contains guidelines on obtaining prior permission under Section 281 of the Income-Tax Act, 1961 for creating charges on assets. It details the application process, necessary conditions, and time frames for approval. Aimed at ensuring compliance with legal requirements surrounding asset transfers.

Sales Tax

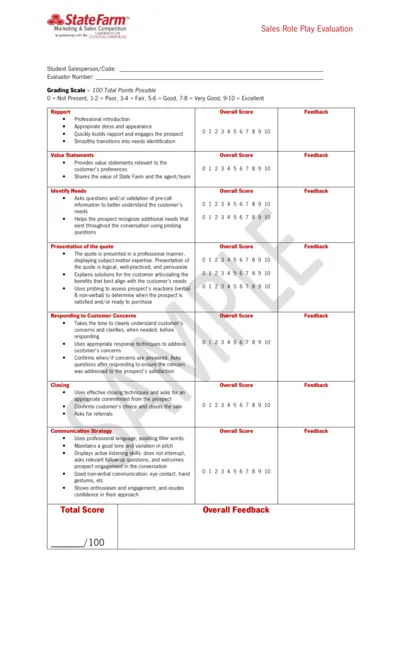

Sales Role Play Evaluation for Marketing & Sales Competitions

This document provides a comprehensive evaluation form for sales role plays, specifically designed for the State Farm Marketing & Sales Competition. It includes a grading scale and detailed criteria for assessing various sales skills. Ideal for evaluators and participants looking to enhance their performance.

Cross-Border Taxation

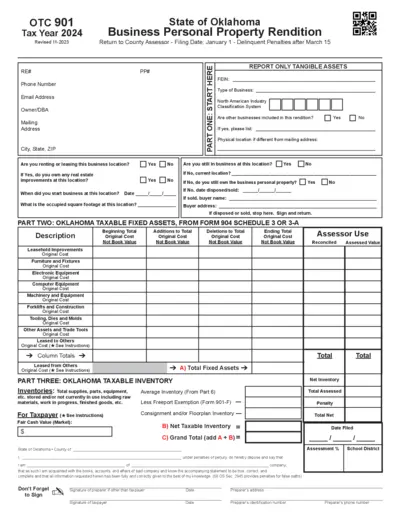

Oklahoma Business Personal Property Rendition 2024

This file serves as the Business Personal Property Rendition for the State of Oklahoma for the tax year 2024. It is crucial for businesses to accurately report their taxable personal property to avoid penalties. Use this form to provide necessary details about your business assets and filing information.

Cross-Border Taxation

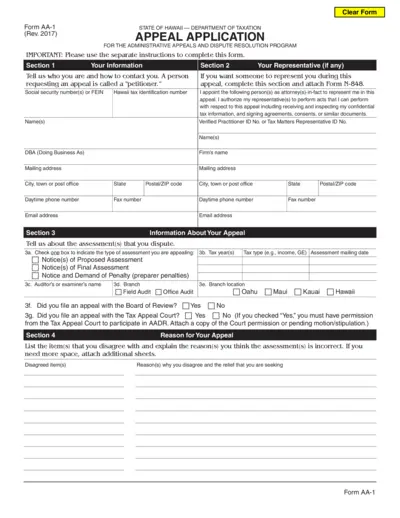

Hawaii Department of Taxation Appeal Application

This file contains the Appeal Application for the Administrative Appeals and Dispute Resolution Program in Hawaii. It serves as a formal request to appeal tax assessments made by the Hawaii Department of Taxation. Please follow the provided instructions to fill out and submit the form correctly.