Tax Documents

Cross-Border Taxation

Instructions for Form 720 Quarterly Federal Excise Tax

This file contains the instructions for completing Form 720. It covers liability reporting and payment of federal excise taxes. Ideal for businesses and individuals responsible for excise tax compliance.

Agricultural Property Tax

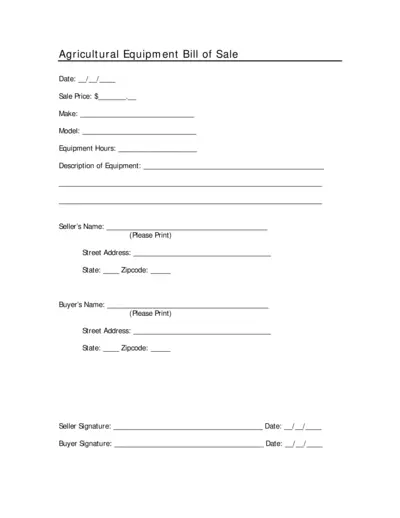

Agricultural Equipment Bill of Sale Document

This Agricultural Equipment Bill of Sale is a legal document that facilitates the transfer of ownership of agricultural equipment. It includes essential information such as sale price, make, model, and signatures from both the seller and buyer. Use this document to ensure a clear and formal agreement when buying or selling agricultural equipment.

Cross-Border Taxation

2016 South Carolina Individual Income Tax Form

This file contains the 2016 South Carolina Individual Income Tax Form and instructions for filing. It provides essential details about electronic filing options and important taxpayer services. Individuals and businesses can access crucial information to ensure successful tax submissions.

Cross-Border Taxation

Instructions for Form 8939 Allocation of Basis Increase

This file provides crucial instructions for filing Form 8939, an information return for property acquired from a decedent. It outlines the Section 1022 Election process, IRS reporting requirements, and necessary disclosures for executors. This guide is essential for estate executors managing decedent properties in 2010.

Cross-Border Taxation

Instructions for Form 8992 GILTI Calculation IRS

This file contains instructions for Form 8992, which is necessary for U.S. shareholders to calculate Global Intangible Low-Taxed Income (GILTI). It includes guidance on completion, submission, and penalties related to the form. Essential for compliance with the Internal Revenue Service (IRS).

Cross-Border Taxation

IRS Tax Form 1040 Instructions and Tables 2023

This document contains important instructions and tax tables for Form 1040 and 1040-SR for the year 2023. Users should refer to it for guidelines on how to accurately fill out their tax forms. Make sure to check the official IRS website for updates and final versions.

Cross-Border Taxation

Form 3800 General Business Credit Instructions 2023

Form 3800 provides detailed instructions on claiming general business credits and is essential for applicable corporations. This document includes specific guidelines for the current tax year. Ensure all pages are included with your submission for compliance.

Cross-Border Taxation

HSBC Individual Tax Residency Self-Certification

This file is an Individual Tax Residency Self-Certification form by HSBC. It helps determine your tax residency status for compliance with CRS and FATCA. It is essential for individuals opening or maintaining an account with HSBC.

Cross-Border Taxation

BIR Form 2551Q Quarterly Percentage Tax Return

The BIR Form 2551Q is a quarterly tax return used for reporting percentage tax liabilities in the Philippines. This form must be filled out with accurate taxpayer information and payment details. It is essential for both individuals and non-individual taxpayers who meet the criteria.

Cross-Border Taxation

Instructions for New York State CT-13 Form 2023

This file provides essential instructions for completing the New York State Form CT-13 for unrelated business income tax. It outlines who must file, how to submit the form, and important deadlines. Use this comprehensive guide for accurate filing and compliance.

Cross-Border Taxation

Alphalist Data Entry Module Version 7.0 Overview

This file provides comprehensive instructions and details for using the Alphalist Data Entry Module Version 7.0. It includes information on user login, form completion, and functionalities available within the module. Ideal for taxpayers and withholding agents managing their data entry needs.

Tax Returns

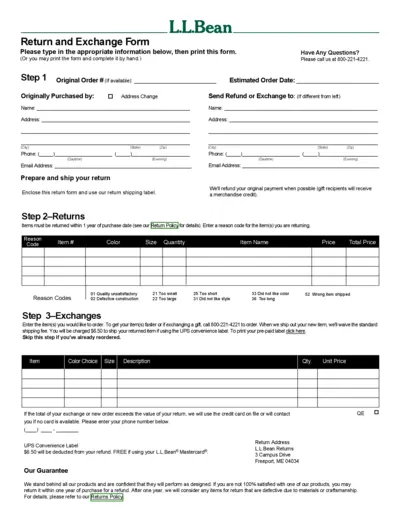

L.L.Bean Return and Exchange Form Instructions

This document provides users with essential information on how to fill out the L.L.Bean Return and Exchange Form. It includes detailed steps for returns and exchanges, alongside crucial contact information. Perfect for customers wanting to ensure their return process is smooth and straightforward.