Tax Documents

Payroll Tax

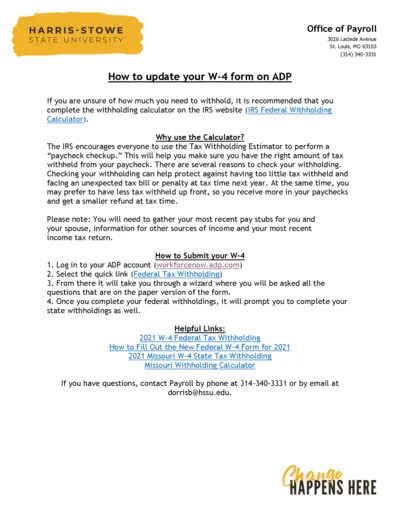

How to Update Your W-4 Form on ADP

This file provides detailed instructions on updating your W-4 form using ADP. It includes information about tax withholding and the importance of using the IRS calculator. Users will find step-by-step guidance for submission and links to helpful resources.

Cross-Border Taxation

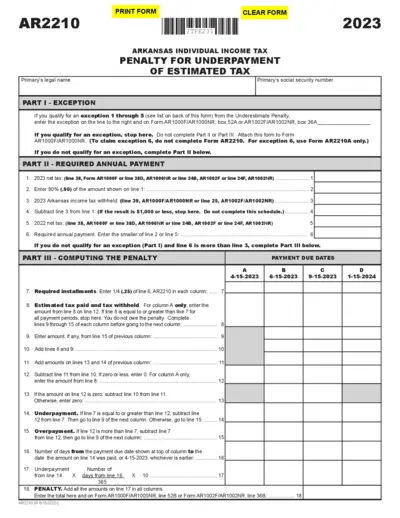

Arkansas Individual Income Tax Form AR2210 Instructions

The form AR2210 provides essential instructions for Arkansas taxpayers regarding underpayment penalties and exceptions. It includes detailed guidelines on annual payments and penalty computation. Users can easily understand their obligations and how to avoid penalties through this form.

Cross-Border Taxation

1771 Formulir SPT Tahunan Pajak Penghasilan Badan

This file is the official 1771 Formulir for annual tax reporting of corporate income. It provides guidance on filling out tax obligations accurately. The form includes necessary fields and instructions for submission to the tax authority.

Cross-Border Taxation

Virginia Pass-Through Entity Income Tax Instructions

This file contains detailed instructions for filling out the 2022 Form 502, specifically for Virginia Pass-Through Entities. It includes important updates on tax regulations and guidance for nonresident withholding. Use this document to ensure compliance with Virginia tax requirements.

Cross-Border Taxation

New Jersey Sales Tax Exempt Certificate ST-8 Guide

This PDF file serves as the New Jersey Sales Tax Exempt Certificate ST-8. It is used by property owners and contractors for exempt capital improvements. Complete this certificate to avoid sales tax on qualified labor and services.

Tax Returns

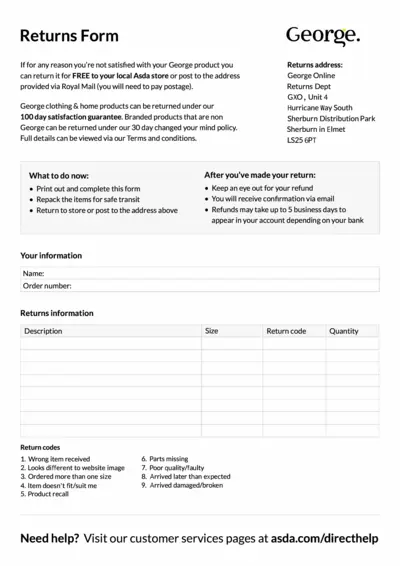

Returns Form for George Clothing and Home Products

This Returns Form is designed for customers returning George products. It outlines the process for returning items, including necessary information and where to send returns. Use this form to ensure a smooth return experience.

Cross-Border Taxation

IRS Form 4180 Tax Interview Instructions

IRS Form 4180 is a crucial document for individuals involved in tax matters. This form gathers necessary information during an interview related to trust fund recovery penalties. Completing this form accurately is vital for compliance and understanding tax liabilities.

Cross-Border Taxation

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and other dispositions of capital assets. It helps taxpayers detail their transactions for proper tax reporting. This form is required along with Schedule D when filing your tax return.

Cross-Border Taxation

PA Corporate Tax Report Instructions 2020

This file contains essential instructions for filling out the PA Corporate Tax Report. Ensure accuracy by following the guidelines outlined in the document. Perfect for businesses seeking compliance with Pennsylvania tax regulations.

Cross-Border Taxation

New York State ST-101 Annual Sales Use Tax Instructions

This document provides essential instructions for completing Form ST-101, New York State Annual Sales and Use Tax Return. It includes important updates, filing requirements, and information on exemptions and credits. Ideal for businesses needing to comply with New York sales tax regulations.

Cross-Border Taxation

IRS Form 706 Estate and Generation-Skipping Tax Return

This file includes the IRS Form 706, which is used for reporting estate and generation-skipping taxes. It contains detailed instructions on itemizing funeral expenses and administrative costs. This form is essential for executors handling estates subject to claims.

Cross-Border Taxation

New York State IT-201 Instructions and Guidelines

This file contains detailed instructions for filing the IT-201 Full-Year Resident Income Tax Return for New York State. It includes information about filing requirements, refund options, and essential tax obligations. Users can refer to this document for comprehensive guidance on their tax filing process.