Tax Documents

Cross-Border Taxation

Instructions for Form 6252 Installment Sale Income

This document provides comprehensive instructions for completing Form 6252, which is used to report income from installment sales. It includes details on recordkeeping, completion sections based on sale year, and general and special rules. Whether you're selling real estate or personal property, this guide is essential for compliance with IRS regulations.

Payroll Tax

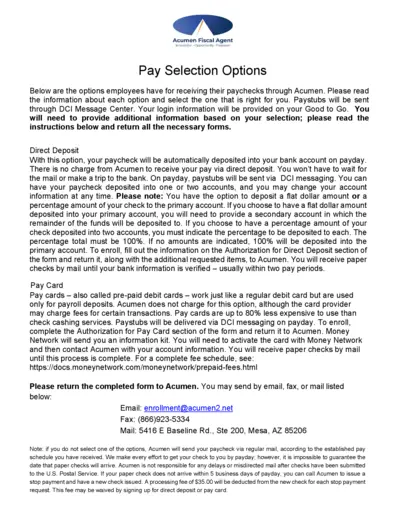

Acumen Fiscal Agent Pay Selection Options

This file outlines the pay selection options available for employees at Acumen. Users can choose between direct deposit, pay card, or paper check for receiving their paychecks. Detailed instructions for completing the form and submitting your choice are also included for your convenience.

Tax Returns

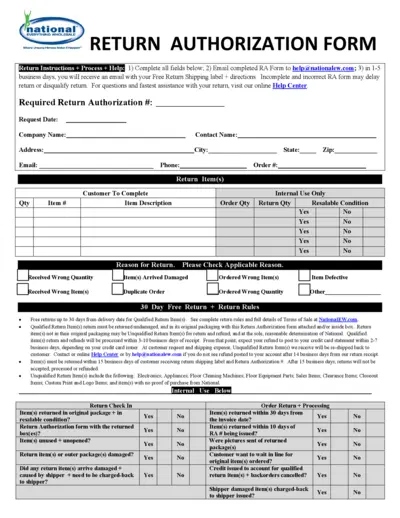

Return Authorization Form Instructions and Details

This file provides essential instructions for completing the Return Authorization Form. It outlines the return process and guidelines for qualified returns. Follow the instructions carefully to ensure a smooth return experience.

Cross-Border Taxation

IRS Publication 537 Installment Sales 2023 Guide

IRS Publication 537 offers guidance on installment sales for tax reporting. This resource explains the tax implications and responsibilities associated with such sales. Ideal for individuals and businesses involved in real estate or property transactions.

Cross-Border Taxation

Instructions for New York State IT-204-LL Form

This file provides essential instructions for filling out the IT-204-LL Form for New York State. It outlines the filing requirements and penalties for non-compliance. Understanding this guide is crucial for partnerships and LLCs engaging in New York State commerce.

Cross-Border Taxation

2023 Oklahoma Corporation Income and Franchise Tax

This document contains the 2023 instructions and forms for Oklahoma Corporation Income and Franchise Tax. It serves as a guide for businesses required to file their corporate taxes in Oklahoma. Ensure compliance and understand the requirements for filing to avoid penalties.

Cross-Border Taxation

Hawaii Employee's Withholding Allowance Form HW-4

The HW-4 form allows employees in Hawaii to declare withholding allowances for tax purposes. Understanding how to fill it out helps ensure the correct tax amount is withheld. This guide provides important instructions and information related to the form.

Cross-Border Taxation

New York State Tax Return IT-201 2020

The New York State Resident Income Tax Return IT-201 for 2020 is designed for individuals who need to file their state income tax. This form includes vital information on income, filing status, and deductions. It is essential for accurate tax reporting and compliance in New York State.

Cross-Border Taxation

Ohio Tax Instructions for Individuals 2023

This file contains essential instructions for filing Individual Income Tax (IT 1040) and School District Income Tax (SD 100) in Ohio for the tax year 2023. Users can find guidance on filing original and amended returns, along with relevant forms and resources. The document includes important details on credits, deductions, estimated payments, and other key topics for Ohio taxpayers.

Cross-Border Taxation

Alabama Form 2210AL Instructions for Underpayment Penalty

This document provides comprehensive instructions for Form 2210AL, which calculates the underpayment of estimated tax penalties in Alabama for 2022. It's essential for individuals with specific tax situations, such as farmers, fishermen, and high-income taxpayers. Ensure you understand the qualifications and processes to avoid penalties effectively.

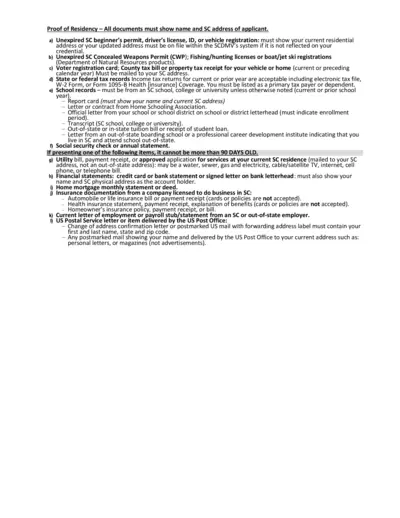

Tax Residency

Proof of Residency Documentation Guidelines

This PDF outlines the accepted proof of residency documents needed in South Carolina. It provides necessary details for applicants and various types of documents required. Ensure you have the correct documentation to apply smoothly.

Cross-Border Taxation

Quarterly Tax Report Instructions - WA State

This document provides comprehensive instructions for filing the Quarterly Tax Report in Washington State. It includes crucial deadlines, filing formats, and contact information for support. Employers are encouraged to file electronically to ensure timely and accurate submissions.