Tax Documents

Tax Returns

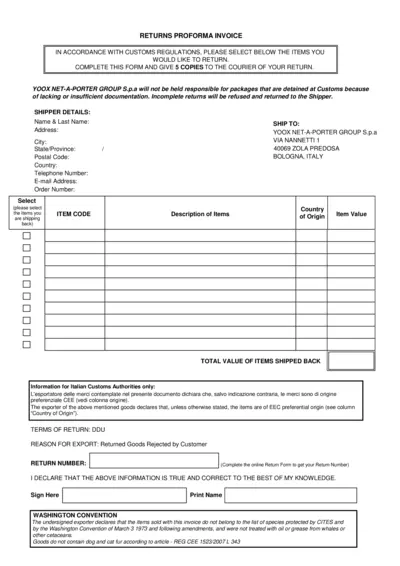

Returns Proforma Invoice for Customs Compliance

This Returns Proforma Invoice is designed for customers returning items through customs. It outlines the necessary information required for return shipping. Ensure to fill it out completely to avoid processing issues.

Payroll Tax

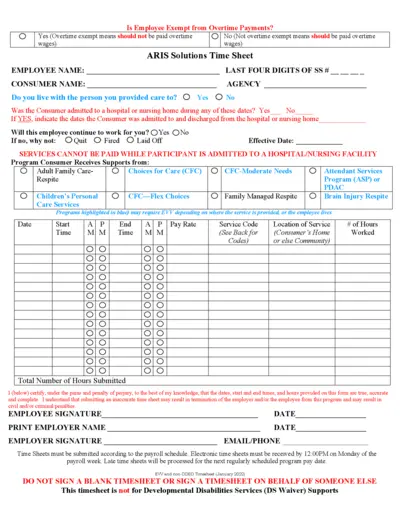

Employee Overtime Payment Exemption Form Guide

This file contains essential information about employee exemptions from overtime payments, including important instructions for filling out the associated time sheets. It's crucial for both employers and employees to understand their rights and responsibilities regarding overtime compensation. This guide also provides a step-by-step approach to ensure accurate submission of time sheets.

Tax Refunds

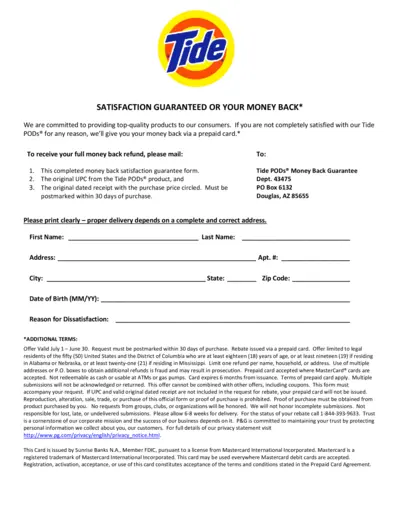

Tide PODs Money Back Satisfaction Guarantee Form

This file contains the Tide PODs Money Back Satisfaction Guarantee Form. It offers instructions for requesting a refund if you are not satisfied with the product. Follow the guidelines enclosed within for a seamless refund process.

Cross-Border Taxation

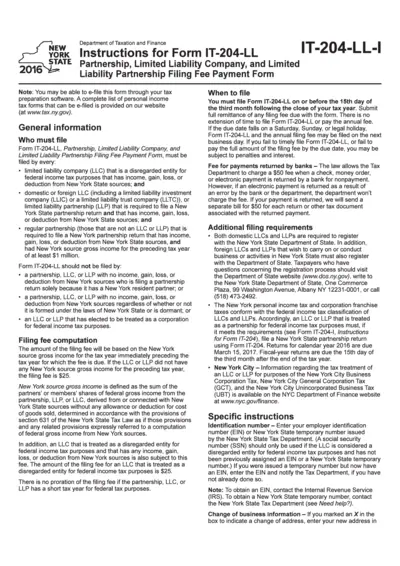

Instructions for Form IT-204-LL - Filing Fee Payment

This file provides essential instructions for completing Form IT-204-LL, required for certain LLCs and partnerships in New York State. It outlines filing requirements, deadlines, and provides computation guidelines for fees associated with filing. Understanding these details ensures compliance with New York State tax regulations.

Cross-Border Taxation

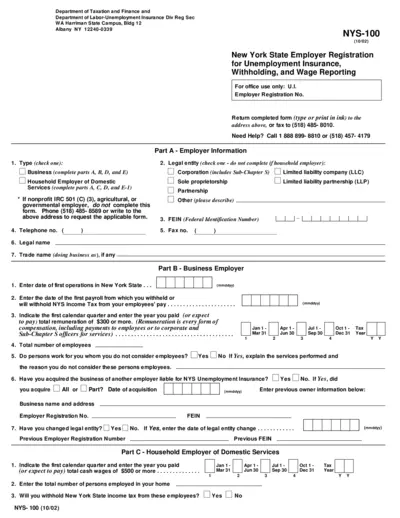

New York State Employer Registration for Unemployment Insurance

This file provides the registration form for New York State employers seeking to register for Unemployment Insurance, Withholding, and Wage Reporting. Users can find detailed instructions for filling out the form and submit it to the relevant department. Ensure compliance with state laws by completing this important document.

Tax Returns

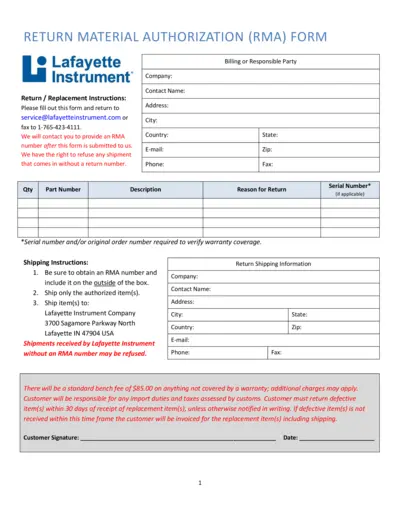

Return Material Authorization Form Instructions

This file provides the essential Return Material Authorization (RMA) form for returning items to Lafayette Instrument. It includes instructions for both domestic and international returns. Follow the guidelines to ensure a smooth return process.

Cross-Border Taxation

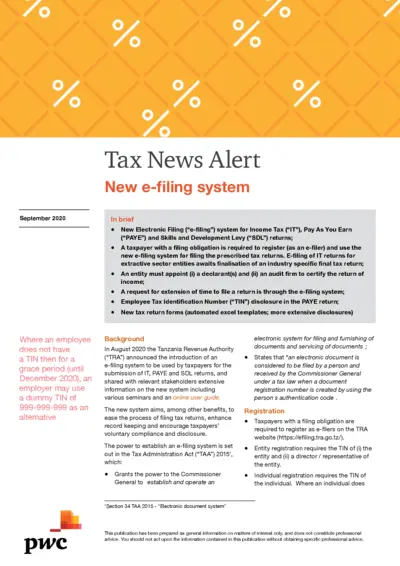

New E-filing System for Tax Returns in Tanzania

This file provides comprehensive details about the new electronic filing system for Income Tax, PAYE, and SDL returns in Tanzania. It outlines registration requirements, filing instructions, and the importance of compliance. Users will find valuable information on optimizing their tax return process with the new system.

Cross-Border Taxation

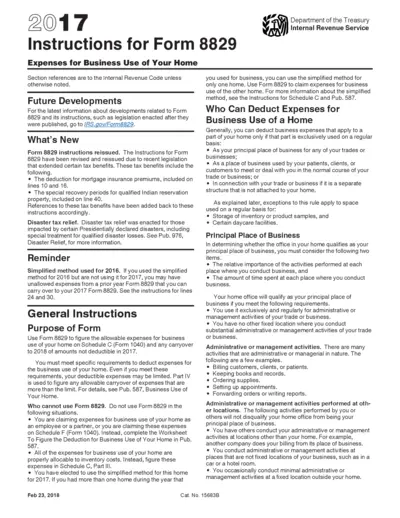

Instructions for Form 8829 Business Use of Home

This file provides detailed instructions for completing Form 8829, Expenses for Business Use of Your Home. It outlines eligibility criteria and deductions applicable to business owners. Follow these guidelines to ensure accurate reporting and maximize your home-based deductions.

Cross-Border Taxation

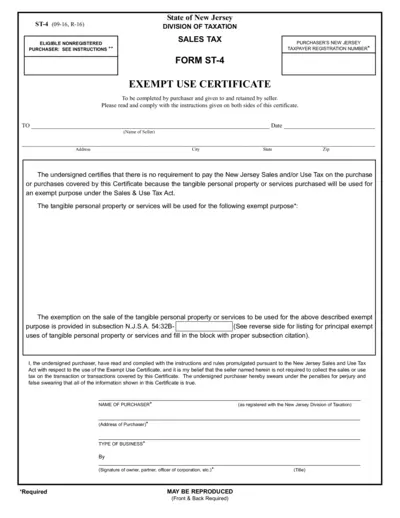

New Jersey Sales Tax Exempt Use Certificate ST-4

This file contains the New Jersey Sales Tax Exempt Use Certificate ST-4. It is designed for purchasers to certify the exemption from sales tax. Follow the instructions to properly fill out and submit the form for exempt purchases.

Payroll Tax

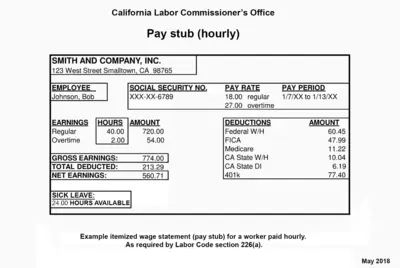

California Labor Commission Pay Stub Example

This file provides a sample pay stub for hourly employees. It outlines important earnings and deductions. Use it to understand your wage statements better.

Cross-Border Taxation

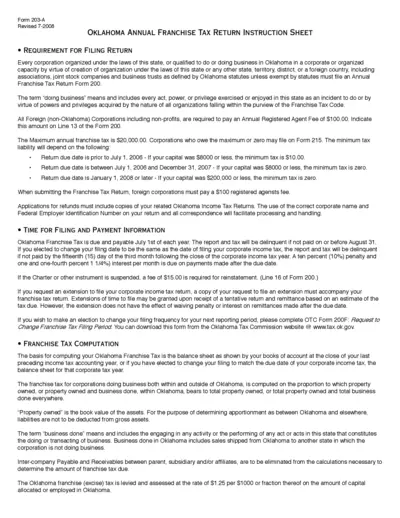

Oklahoma Annual Franchise Tax Return Instruction Sheet

This document provides essential instructions for filing Oklahoma's Annual Franchise Tax Return Form 200. It outlines requirements, due dates, and tax computation methods essential for compliance. Corporations, regardless of their origin, must adhere to these guidelines to avoid penalties.

Agricultural Property Tax

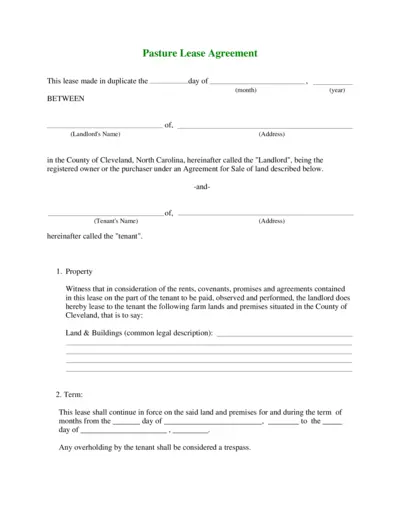

Pasture Lease Agreement Template for Livestock Rental

This Pasture Lease Agreement outlines the terms and conditions for leasing land for livestock pasturing. Perfect for landlords and tenants in Cleveland County, North Carolina. Ensure a smooth agreement with clear instructions and responsibilities.