Tax Documents

Cross-Border Taxation

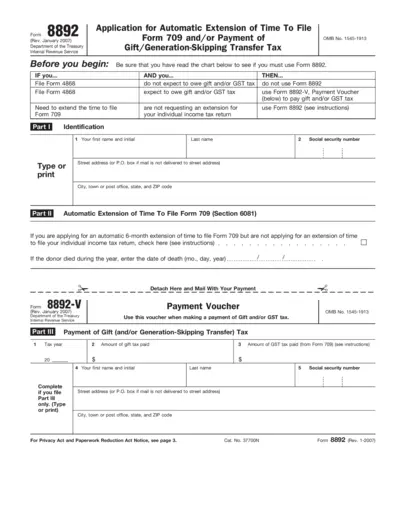

Form 8892 Automatic Extension for Gift Tax Filing

Form 8892 allows taxpayers to request an automatic 6-month extension for filing Form 709. It is essential for individuals who anticipate owing gift or generation-skipping transfer taxes. Completing this form timely can help mitigate penalties and interest.

Tax Residency

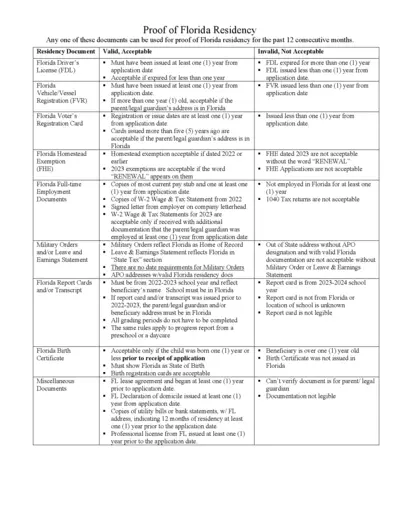

Proof of Florida Residency Documentation Requirements

This document outlines the acceptable proofs of Florida residency for the past 12 months. It is crucial for individuals seeking to establish residency in Florida. Ensure you have the right documents ready for submission.

Cross-Border Taxation

Step by Step Guide for PAYE Returns in Kenya

This file provides a comprehensive guide on filling out the PAYE tax return forms for employers in Kenya. It includes essential instructions and resources to assist users in compliance with tax regulations. Perfect for both new and returning users seeking to understand the PAYE return process.

Cross-Border Taxation

Instructions for Form 8993 Deduction for FDII and GILTI

This file contains detailed instructions for completing Form 8993 regarding the Section 250 Deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI). It is essential for domestic corporations to accurately report deductions related to foreign-derived income. Understanding this form is crucial for compliant tax filing.

Cross-Border Taxation

New York State E-ZRep Authorization Form

The NY State E-ZRep Authorization Form allows taxpayers to give permission to their tax professionals to access and manage their tax information. It includes necessary details about taxpayer and professional, tax matters covered, and expiration of authorization. This form facilitates smooth communication between taxpayers and the Tax Department.

Sales Tax

Sales Orders and Cash Sales Guide for NetSuite

This document provides comprehensive instructions and guidelines for managing sales orders and cash sales in NetSuite. Users will find step-by-step directions on entry, approval, and billing procedures. Ideal for finance and operations personnel seeking to streamline sales transactions.

Cross-Border Taxation

California Sales and Use Tax Return Instructions

This file provides detailed instructions for completing the CDTFA-401-A form. It helps users understand how to file their State, Local, and District Sales and Use Tax Return accurately. Follow the guidelines to ensure your tax return is filed correctly and on time.

Cross-Border Taxation

Schedule 8812 - Child Tax Credit Instructions

Schedule 8812 is used to claim credits for qualifying children and other dependents. It is essential for individuals filing Form 1040, 1040-SR, or 1040-NR. This form helps assess eligibility for the Child Tax Credit and Additional Child Tax Credit.

Cross-Border Taxation

Reporting Like-Kind Exchange IRS Form 8824

This document provides essential instructions for reporting Like-Kind Exchanges using IRS Form 8824. It includes detailed guidelines and examples to ensure accurate submissions. Perfect for taxpayers and professionals handling real estate exchanges.

Cross-Border Taxation

Completing Form Modelo 210 Non-Resident Tax Return

This document provides comprehensive instructions for completing the Modelo 210 form for non-resident property owners in Spain. It includes crucial information about tax rates and prerequisites for successful submission. An example of the completed form and its corresponding instructions are also included.

Sales Tax

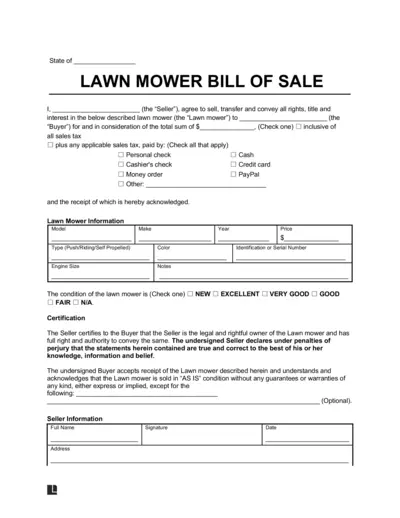

Lawn Mower Bill of Sale Document

The Lawn Mower Bill of Sale is a legal document used for the sale and transfer of ownership of a lawn mower. This form ensures that all pertinent information, including the condition and specifications of the mower, is clearly documented for both buyer and seller. It is crucial for maintaining a record of the transaction and protecting both parties' rights.

Payroll Tax

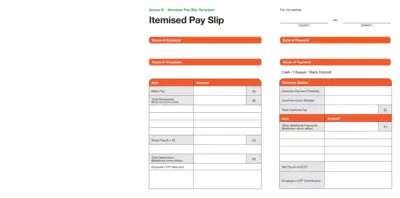

Itemised Pay Slip Template for Employers and Staff

This document provides a detailed itemised pay slip template for employers and employees. It helps to outline salaries, deductions, and overtime pay clearly. Perfect for businesses looking to maintain transparency in payroll processes.