Tax Documents

Cross-Border Taxation

Minnesota Individual Income Tax Forms and Instructions

This file contains essential forms and instructions for filing individual income tax in Minnesota. It offers guidance on how to complete the forms and important contact information. Whether you are filing electronically or by mail, this document provides all necessary details.

Tax Residency

Instructions for Applying Italian Permit of Stay

This document provides step-by-step instructions for non-EU citizens applying for the Italian Permit of Stay for study purposes. It outlines necessary documentation, procedures at the post office, and renewal processes. Understanding this form is crucial for a hassle-free application experience.

Cross-Border Taxation

PAYE EMP201 Employer Monthly Declaration Guide

The PAYE EMP201 is an essential guide for employers looking to understand the new monthly declaration process. This file outlines the updated procedures for submitting tax information to SARS effectively. Follow the instructions to ensure compliance and accuracy in your employer tax submissions.

Cross-Border Taxation

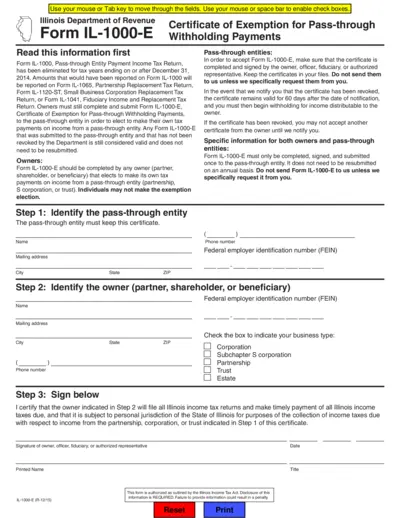

Illinois Form IL-1000-E Certificate of Exemption

The Illinois Form IL-1000-E is a Certificate of Exemption for Pass-through Withholding Payments. It is essential for owners of pass-through entities to submit this form to elect their own tax payments. This form must be completed by owners who want to manage their income tax returns independently.

Cross-Border Taxation

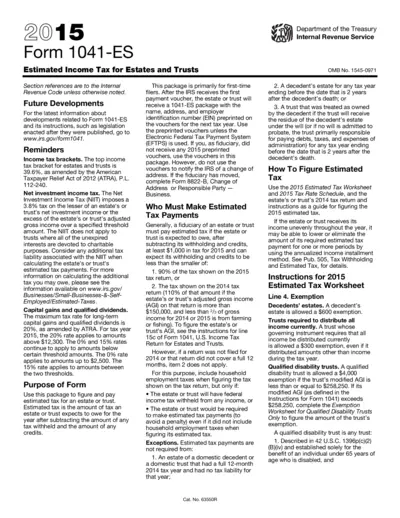

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is used for estimating income tax obligations for estates and trusts. This form assists fiduciaries in calculating and paying estimated taxes owed. It is essential for proper tax management and compliance.

Sales Tax

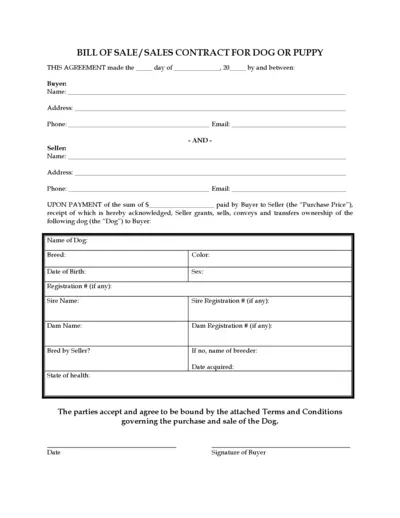

Bill of Sale for Dog or Puppy Sale Agreement

This document is a legally binding agreement regarding the purchase of a dog or puppy. It outlines the responsibilities of the buyer and seller, including payment terms and health guarantees. This contract protects both parties in the transaction.

Cross-Border Taxation

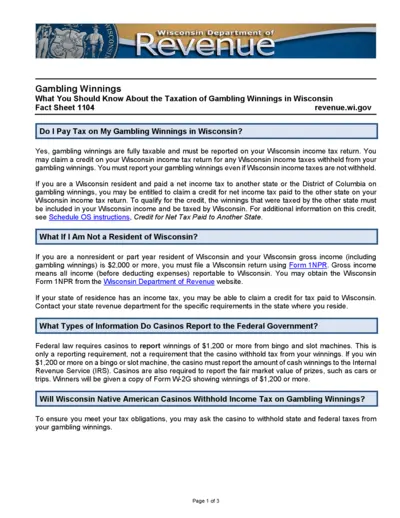

Understanding Gambling Winnings Tax in Wisconsin

This document provides essential information regarding the taxation of gambling winnings in Wisconsin. It outlines what residents and non-residents need to know about reporting winnings and claiming credits. Key regulations and filing instructions are also included to ensure compliance with state tax laws.

Tax Returns

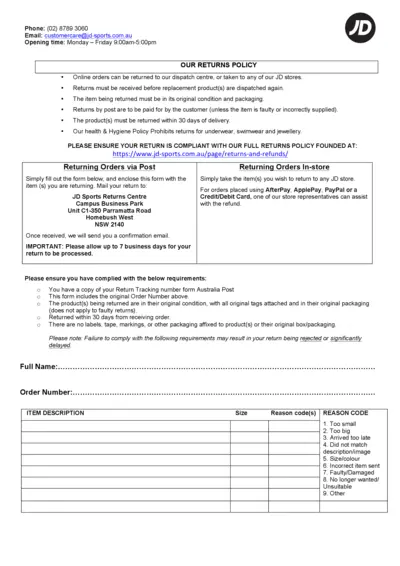

JD Sports Return Instructions and Policy Overview

This document outlines the return policy and instructions for returning items to JD Sports. It provides essential details regarding the return process, including how to return items via post or in-store. Adhering to this guide ensures a smooth and hassle-free return experience.

Payroll Tax

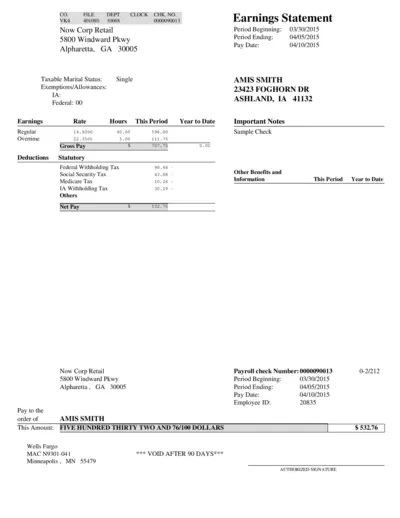

Earnings Statement and Pay Information for Employees

This document is an Earnings Statement that details the pay information for employees. It provides a summary of earnings, deductions, and net pay. Use it to understand your compensation and tax withholdings for the reporting period.

Payroll Tax

Time Sheet Import and RUN Powered by ADP Instructions

This file provides comprehensive guidance on importing time sheets using ADP's payroll application. Users will find detailed instructions on setting up their time sheet import file. It's essential for businesses looking to streamline their payroll processes with ADP.

Cross-Border Taxation

2023 Schedule E Instructions for Income and Loss

This document provides detailed instructions for filling out Schedule E (Form 1040) for 2023. It is essential for reporting income or loss from various sources including rental real estate and partnerships. Make sure to follow the specified guidelines to avoid potential issues with your tax filings.

Tax Returns

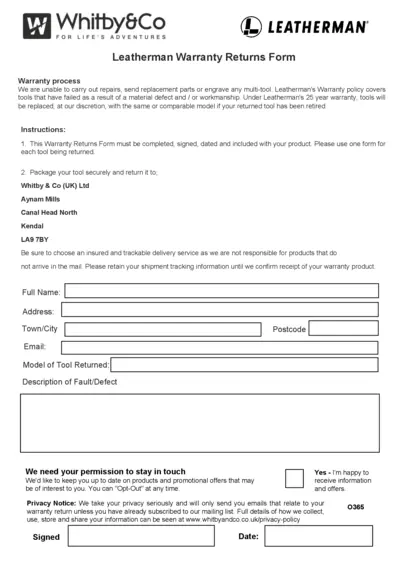

Leatherman Warranty Returns Form Instructions

This document provides detailed instructions for returning your Leatherman multi-tool under warranty. Ensure that you follow the specified steps for a smooth warranty claim process. Fill out the warranty return form accurately to facilitate efficient handling of your claim.