International Tax Documents

Cross-Border Taxation

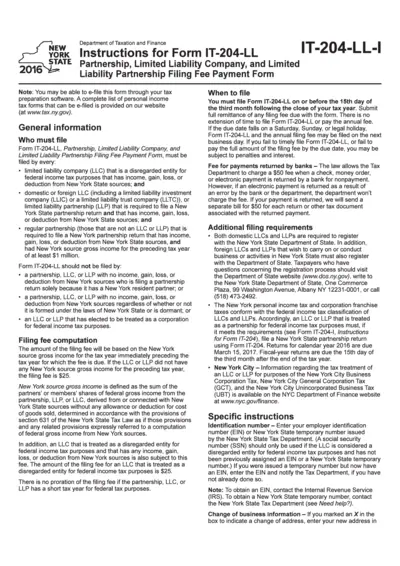

Instructions for Form IT-204-LL - Filing Fee Payment

This file provides essential instructions for completing Form IT-204-LL, required for certain LLCs and partnerships in New York State. It outlines filing requirements, deadlines, and provides computation guidelines for fees associated with filing. Understanding these details ensures compliance with New York State tax regulations.

Cross-Border Taxation

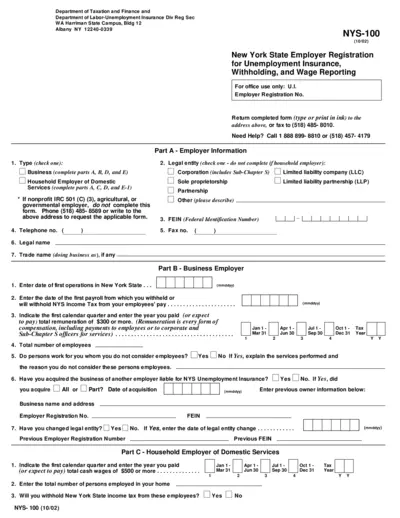

New York State Employer Registration for Unemployment Insurance

This file provides the registration form for New York State employers seeking to register for Unemployment Insurance, Withholding, and Wage Reporting. Users can find detailed instructions for filling out the form and submit it to the relevant department. Ensure compliance with state laws by completing this important document.

Cross-Border Taxation

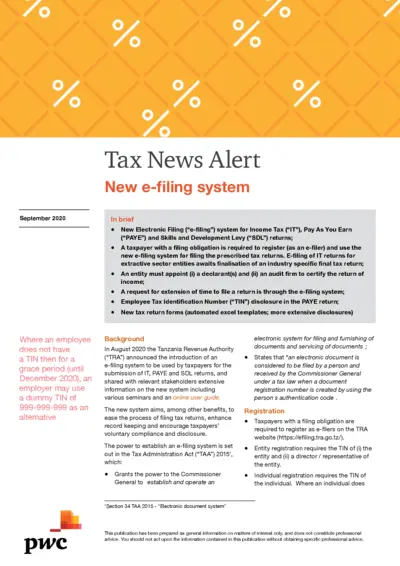

New E-filing System for Tax Returns in Tanzania

This file provides comprehensive details about the new electronic filing system for Income Tax, PAYE, and SDL returns in Tanzania. It outlines registration requirements, filing instructions, and the importance of compliance. Users will find valuable information on optimizing their tax return process with the new system.

Cross-Border Taxation

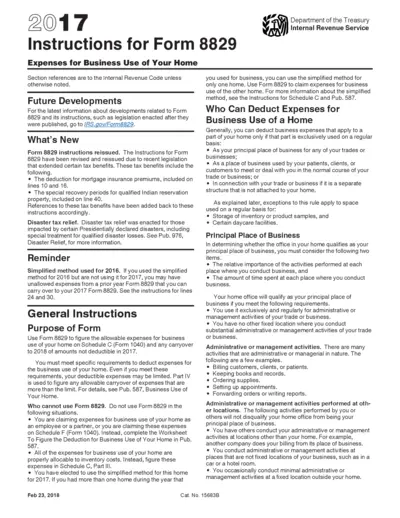

Instructions for Form 8829 Business Use of Home

This file provides detailed instructions for completing Form 8829, Expenses for Business Use of Your Home. It outlines eligibility criteria and deductions applicable to business owners. Follow these guidelines to ensure accurate reporting and maximize your home-based deductions.

Cross-Border Taxation

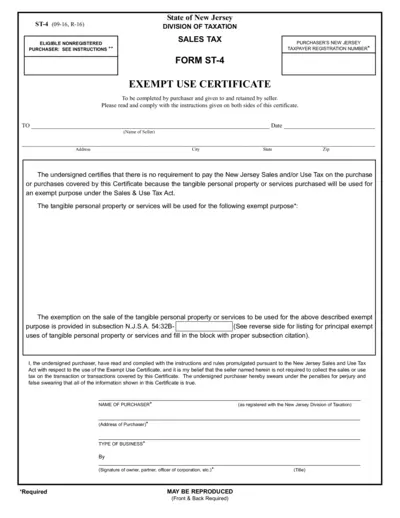

New Jersey Sales Tax Exempt Use Certificate ST-4

This file contains the New Jersey Sales Tax Exempt Use Certificate ST-4. It is designed for purchasers to certify the exemption from sales tax. Follow the instructions to properly fill out and submit the form for exempt purchases.

Cross-Border Taxation

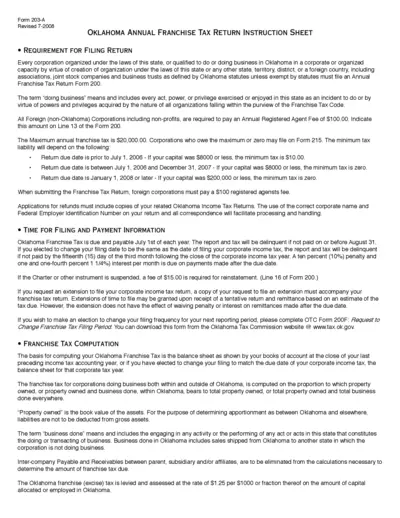

Oklahoma Annual Franchise Tax Return Instruction Sheet

This document provides essential instructions for filing Oklahoma's Annual Franchise Tax Return Form 200. It outlines requirements, due dates, and tax computation methods essential for compliance. Corporations, regardless of their origin, must adhere to these guidelines to avoid penalties.

Cross-Border Taxation

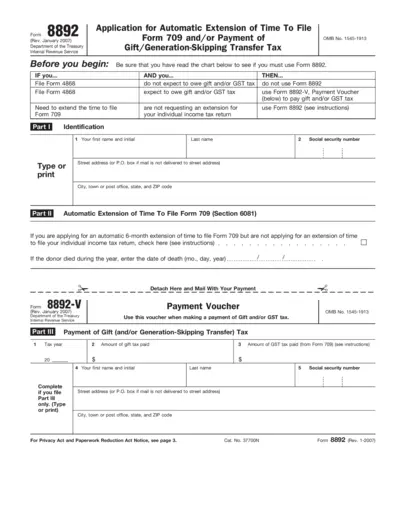

Form 8892 Automatic Extension for Gift Tax Filing

Form 8892 allows taxpayers to request an automatic 6-month extension for filing Form 709. It is essential for individuals who anticipate owing gift or generation-skipping transfer taxes. Completing this form timely can help mitigate penalties and interest.

Tax Residency

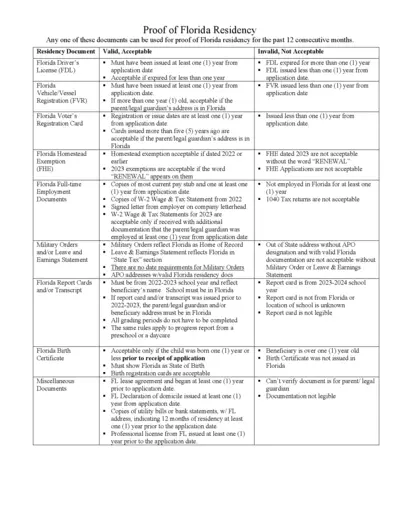

Proof of Florida Residency Documentation Requirements

This document outlines the acceptable proofs of Florida residency for the past 12 months. It is crucial for individuals seeking to establish residency in Florida. Ensure you have the right documents ready for submission.

Cross-Border Taxation

Step by Step Guide for PAYE Returns in Kenya

This file provides a comprehensive guide on filling out the PAYE tax return forms for employers in Kenya. It includes essential instructions and resources to assist users in compliance with tax regulations. Perfect for both new and returning users seeking to understand the PAYE return process.

Cross-Border Taxation

Instructions for Form 8993 Deduction for FDII and GILTI

This file contains detailed instructions for completing Form 8993 regarding the Section 250 Deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI). It is essential for domestic corporations to accurately report deductions related to foreign-derived income. Understanding this form is crucial for compliant tax filing.

Cross-Border Taxation

New York State E-ZRep Authorization Form

The NY State E-ZRep Authorization Form allows taxpayers to give permission to their tax professionals to access and manage their tax information. It includes necessary details about taxpayer and professional, tax matters covered, and expiration of authorization. This form facilitates smooth communication between taxpayers and the Tax Department.

Cross-Border Taxation

California Sales and Use Tax Return Instructions

This file provides detailed instructions for completing the CDTFA-401-A form. It helps users understand how to file their State, Local, and District Sales and Use Tax Return accurately. Follow the guidelines to ensure your tax return is filed correctly and on time.