International Tax Documents

Cross-Border Taxation

Schedule 8812 - Child Tax Credit Instructions

Schedule 8812 is used to claim credits for qualifying children and other dependents. It is essential for individuals filing Form 1040, 1040-SR, or 1040-NR. This form helps assess eligibility for the Child Tax Credit and Additional Child Tax Credit.

Cross-Border Taxation

Reporting Like-Kind Exchange IRS Form 8824

This document provides essential instructions for reporting Like-Kind Exchanges using IRS Form 8824. It includes detailed guidelines and examples to ensure accurate submissions. Perfect for taxpayers and professionals handling real estate exchanges.

Cross-Border Taxation

Completing Form Modelo 210 Non-Resident Tax Return

This document provides comprehensive instructions for completing the Modelo 210 form for non-resident property owners in Spain. It includes crucial information about tax rates and prerequisites for successful submission. An example of the completed form and its corresponding instructions are also included.

Cross-Border Taxation

New Jersey Division of Taxation Closing Agreement

This document outlines the process for submitting a Closing Agreement in New Jersey. It includes necessary forms and instructions. Ideal for taxpayers needing resolution with their state tax liabilities.

Cross-Border Taxation

Instructions for Form 6251 Alternative Minimum Tax

This document provides detailed instructions on how to complete Form 6251, which is used by individuals to calculate their Alternative Minimum Tax (AMT). It includes the latest updates, exemptions, and requirements for filing this form. Essential for any taxpayer subject to AMT to ensure accurate reporting and compliance with tax laws.

Cross-Border Taxation

BIR Form 2551 Quarterly Percentage Tax Return Instructions

This document provides crucial information regarding the BIR Form 2551, which is essential for submitting quarterly percentage tax in the Philippines. It contains guidelines, necessary fields, filing procedures, and payment details. This form is specifically tailored for individuals and businesses with taxable transactions who need to comply with tax regulations.

Cross-Border Taxation

IRS Publication 526 Charitable Contributions 2023

IRS Publication 526 provides detailed guidance on how to claim deductions for charitable contributions on your tax return. It outlines which organizations are qualified and what types of contributions are deductible. This publication is essential for anyone looking to maximize their charitable deduction on their taxes.

Cross-Border Taxation

New Jersey ST-5 Exempt Organization Certificate

This file contains the application form for the ST-5 Exempt Organization Certificate needed for sales tax exemption in New Jersey. Nonprofit organizations must efficiently complete this form to ensure timely processing. Follow all instructions carefully to avoid delays or denials.

Cross-Border Taxation

Pennsylvania 1099-MISC Withholding Exemption Certificate

The REV-1832 form allows individuals and entities to certify their exemption from Pennsylvania income tax withholding. It's crucial for payees to correctly fill this out to ensure compliance. This form is essential for both payors and payees in managing tax deductions effectively.

Cross-Border Taxation

NY State Tax Offer in Compromise Form DTF-4.1

The NY State Offer in Compromise Form DTF-4.1 allows taxpayers to propose a settlement on fixed liabilities. Use this form if you have no protest or appeal rights. Ensure you meet the eligibility criteria and provide the required information for your offer.

Tax Residency

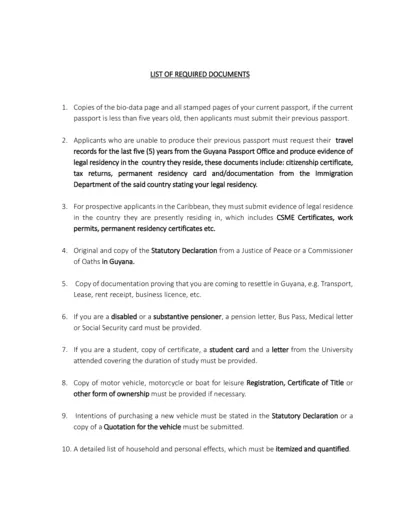

Required Documents for Resettlement in Guyana

This document provides a comprehensive list of required paperwork for individuals looking to resettle in Guyana. It outlines the necessary forms and proofs needed for a successful application. Understanding these requirements is crucial for a smooth re-migration process.

Cross-Border Taxation

Virginia Elective Pass-Through Entity Tax Instructions

This document provides detailed instructions for the 2023 Virginia Form 502PTET and its associated schedules. It outlines the process for pass-through entities to file their elective income tax electronically. This is essential for eligible owners seeking to claim corresponding tax credits.