International Tax Documents

Cross-Border Taxation

Alabama Form 2210AL Instructions for Underpayment Penalty

This document provides comprehensive instructions for Form 2210AL, which calculates the underpayment of estimated tax penalties in Alabama for 2022. It's essential for individuals with specific tax situations, such as farmers, fishermen, and high-income taxpayers. Ensure you understand the qualifications and processes to avoid penalties effectively.

Tax Residency

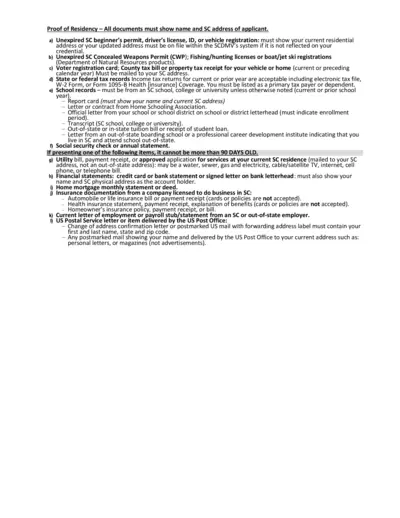

Proof of Residency Documentation Guidelines

This PDF outlines the accepted proof of residency documents needed in South Carolina. It provides necessary details for applicants and various types of documents required. Ensure you have the correct documentation to apply smoothly.

Cross-Border Taxation

Quarterly Tax Report Instructions - WA State

This document provides comprehensive instructions for filing the Quarterly Tax Report in Washington State. It includes crucial deadlines, filing formats, and contact information for support. Employers are encouraged to file electronically to ensure timely and accurate submissions.

Cross-Border Taxation

BIR Form No. 1701Q Guidelines for Tax Return

This document outlines the guidelines for filing BIR Form No. 1701Q, the Quarterly Income Tax Return for individuals, estates, and trusts in the Philippines. It provides essential information about who is required to file and detailed instructions for completing the form. Understanding these guidelines is crucial for compliance with tax regulations.

Cross-Border Taxation

New York State Highway Use Tax Return MT-903

The New York State Highway Use Tax Return MT-903 is required for businesses operating commercial vehicles in New York. It details the taxable miles traveled and applicable taxes due. Ensure accurate filing to maintain compliance with tax regulations.

Cross-Border Taxation

Instructions for Form 1120-S Tax Return 2023

This file contains essential instructions for completing Form 1120-S. It includes the necessary guidelines for S Corporations to file their income tax return accurately. Understanding these instructions is crucial for compliance with IRS regulations.

Cross-Border Taxation

Schedules M-1 and M-2 Form 1120-F Instructions

This document provides detailed instructions for completing Schedules M-1 and M-2, part of Form 1120-F. It is essential for foreign corporations to reconcile income and analyze retained earnings. Read this guide to ensure compliance with IRS requirements.

Cross-Border Taxation

Completing Form 42 - HMRC Guide and FAQs

This document provides essential guidance on completing Form 42 for reportable events about Securities and Options. Designed for employees and employers, it clarifies important rules and procedures. Follow the outlined steps to ensure accurate submissions.

Cross-Border Taxation

Hawaii Withholding Tax Return Form HW-14

The HW-14 form is the official Hawaii withholding tax return. It is required to report wages and tax withheld. Ensure timely submission to avoid penalties.

Cross-Border Taxation

Philadelphia Late Filing Abatement Instructions

This file provides guidance on filing a nunc pro tunc petition for late real estate tax abatement in Philadelphia. It outlines key steps, necessary forms, and important deadlines for applicants. Understanding these instructions is essential for taxpayers who wish to navigate the filing process effectively.

Cross-Border Taxation

Instructions for Form 2553 Election by Small Business Corp

This file contains the official instructions for completing and filing Form 2553. It provides important details for corporations wishing to elect S corporation status. Ensure compliance with IRS requirements by referring to this comprehensive guide.

Cross-Border Taxation

PA-41 Payment Voucher Instructions for 2022 Tax

The PA-41 Payment Voucher is a crucial document for fiduciaries to remit tax payments. This form is intended for estates or trusts needing to make fiduciary income tax payments. Ensure you follow the instructions carefully to complete the form accurately.