International Tax Documents

Cross-Border Taxation

Form 9423 Collection Appeal Request IRS Document

Form 9423 is the IRS Collection Appeal Request form used by taxpayers to appeal collection actions. It provides guidance on how to fill it out and details the appeal process. This form is crucial for anyone disputing IRS collection actions such as levies or liens.

Cross-Border Taxation

Application for Registration BIR Form 1902

This document is the Application for Registration for individuals earning purely compensation income in the Philippines. It is essential for local and alien employees to obtain their Tax Identification Number (TIN) from the Bureau of Internal Revenue. Filling out this form correctly ensures compliance with taxation laws.

Cross-Border Taxation

IA 1040X Amended Iowa Individual Income Tax Return

The IA 1040X is a form used to amend your Iowa Individual Income Tax Return. It allows taxpayers to correct mistakes or report changes in their income. Completing this form ensures that your tax records are accurate and up-to-date.

Cross-Border Taxation

Maximize Deductions: Understanding NOL Examples

This file provides a comprehensive guide to understanding Net Operating Loss (NOL) examples. It includes specific scenarios and calculations to help taxpayers optimize their deductions. Designed for both consumers and tax professionals, this resource is invaluable for effective tax planning.

Cross-Border Taxation

Digital C-Form User Manual for Madhya Pradesh

This user manual provides detailed instructions on applying for the Digital C-Form via the MPCTD web portal. It guides users through the necessary steps to validate their digital signature and manage related forms. Essential for registered dealers in Madhya Pradesh.

Cross-Border Taxation

Application for Tax Directive Gratuities IRP3(a)

The Application for a Tax Directive (IRP3(a)) is essential for taxpayers who are seeking tax directives for gratuities. It provides instructions for filling out the form correctly and details the necessary information required for processing. This document is vital for ensuring compliance with South African tax regulations.

Cross-Border Taxation

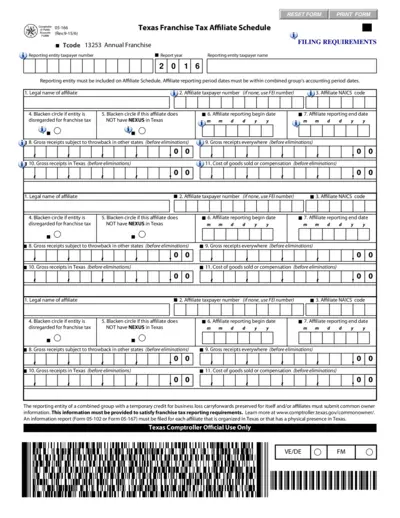

Texas Franchise Tax Affiliate Schedule Form 05-166

The Texas Franchise Tax Affiliate Schedule Form 05-166 is a crucial document for businesses involved in franchise taxation in Texas. It provides detailed instructions and requirements for affiliate reporting, helping companies stay compliant with state regulations. Utilize this form to accurately report affiliate information and ensure proper franchise tax handling.

Cross-Border Taxation

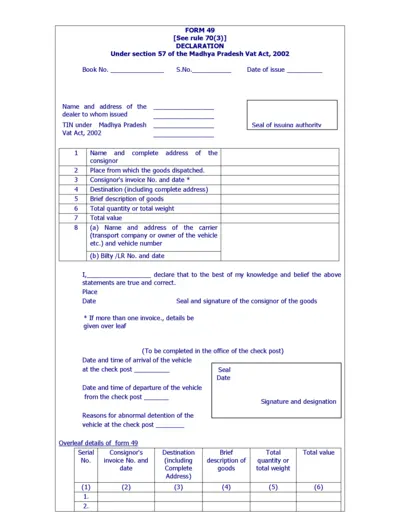

Madhya Pradesh VAT Form 49 Declaration Details

Form 49 is a declaration required under the Madhya Pradesh VAT Act, 2002 for consignors. It captures essential information regarding the goods dispatched including details about the dealer, consignor, and carrier. This form is crucial for compliance with tax regulations.

Cross-Border Taxation

Form 8938 Instructions Statement of Foreign Assets

This document contains essential instructions for filling out Form 8938, which reports specified foreign financial assets. It is crucial for U.S. citizens and certain domestic entities for compliance with tax regulations. Ensure you understand the filing requirements and reporting thresholds outlined in this guidance.

Cross-Border Taxation

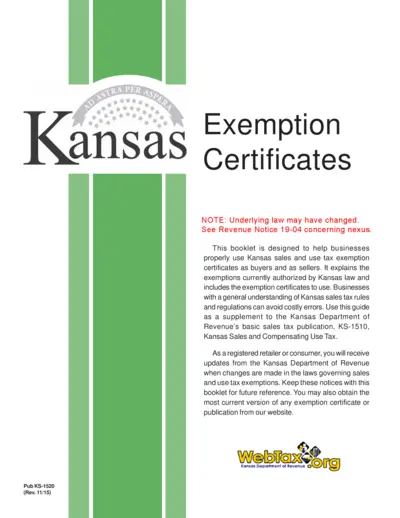

Kansas Sales and Use Tax Exemption Certificates Guide

This file is a comprehensive guide for businesses on using Kansas sales and use tax exemption certificates. It includes authorized exemptions and details on completing the certificates. Businesses can avoid costly errors by following the guidelines provided in this guide.

Cross-Border Taxation

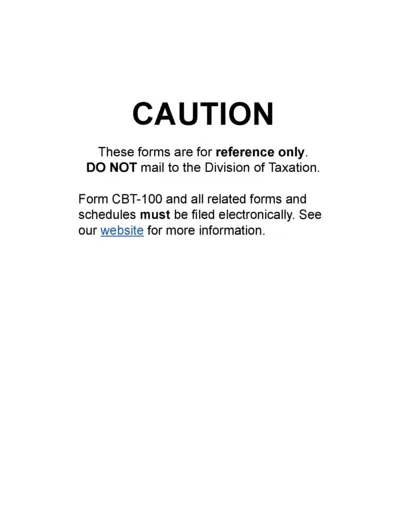

2023 New Jersey CBT-100 Corporation Tax Return

The 2023 CBT-100 form is the New Jersey Corporation Business Tax Return for corporations. It is essential for businesses operating in New Jersey for the tax year ending June 30, 2024. Accurate completion ensures compliance with state tax laws.

Cross-Border Taxation

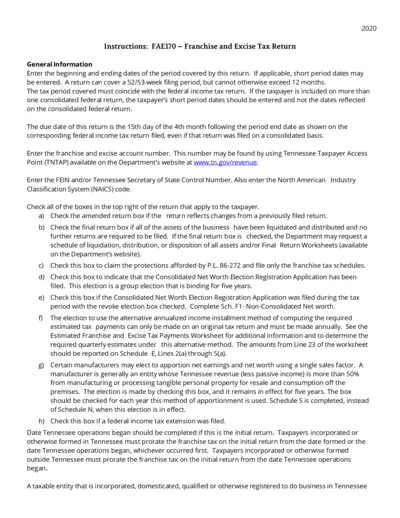

FAE170 - Franchise and Excise Tax Return Instructions

The FAE170 form provides essential instructions for filing Franchise and Excise Tax Returns in Tennessee. It includes detailed guidelines on filling out the form and important tax information. Utilize this file to ensure compliance with state tax regulations.