International Tax Documents

Cross-Border Taxation

2023 New Jersey Partnership Return Instructions

This document provides comprehensive instructions for New Jersey's NJ-1065 Partnership Return, ensuring accurate tax reporting. It outlines essential filing requirements for partnerships, income allocation, and pertinent deadlines. Ideal for both resident and non-resident partners in New Jersey.

Cross-Border Taxation

Instructions for Form 8975 Country-By-Country Report

This file contains detailed instructions for completing Form 8975 and its Schedule A. It provides essential guidance on filing requirements for U.S. multinational enterprises. Users can find necessary definitions, procedures, and forms to ensure proper reporting.

Cross-Border Taxation

Instructions for Form CT-6 NY S Corporation Election

This document provides detailed instructions for filing Form CT-6. It is essential for federal S corporations electing to be treated as New York S corporations. Ensure compliance with New York State Tax Law while following this guide.

Cross-Border Taxation

Oregon Pass-Through Entity Withholding Form OR-19

The Form OR-19 is used by pass-through entities in Oregon to withhold taxes for nonresident owners. This ensures compliance with state tax obligations on Oregon-source distributive income. Proper usage helps avoid tax penalties and supports accurate reporting.

Cross-Border Taxation

Instructions for Form 8996 Qualified Opportunity Funds

Form 8996 is essential for corporations and partnerships investing in Qualified Opportunity Zones (QOZs). It certifies the organization as a Qualified Opportunity Fund (QOF) and ensures compliance with investment standards. Accurate completion assists in gaining tax benefits associated with investments in QOZs.

Cross-Border Taxation

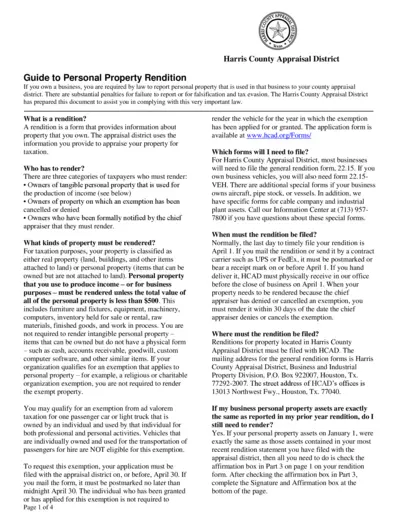

Harris County Appraisal District Personal Property Guide

This document serves as a comprehensive guide for businesses on reporting personal property for taxation in Harris County, Texas. It outlines the process, required forms, and deadlines for submission. Understanding this guide is crucial for compliance and avoiding penalties.

Cross-Border Taxation

Travel Logbook 2021/22 for SARS Tax Deductions

This Travel Logbook is essential for taxpayers receiving a travel allowance from SARS. It guides users in accurately recording business travel for tax deductions. Follow the provided instructions to ensure a valid claim.

Cross-Border Taxation

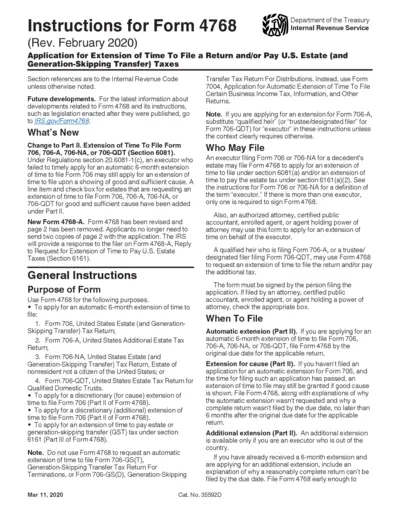

Form 4768 Application for Estate Tax Extension

This file contains the instructions for Form 4768, the application for extension of time to file U.S. estate taxes. It provides essential guidelines for executors seeking an extension, details about eligibility, and instructions on submission. Users can learn how to complete the form accurately and within prescribed timelines to avoid penalties.

Cross-Border Taxation

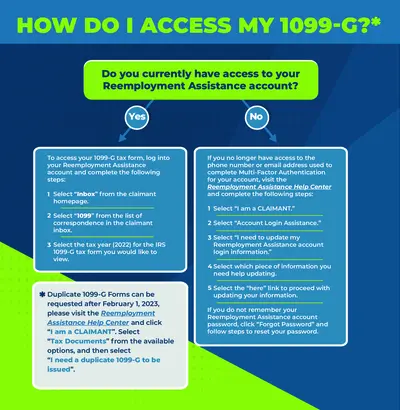

How to Access and Request a 1099-G Tax Form

This document outlines the steps to access your 1099-G tax form through your Reemployment Assistance account. It also provides guidance on how to request duplicate forms if needed. Essential for individuals seeking tax information for the year 2022.

Cross-Border Taxation

Arizona Employee Withholding Election Instructions

This file provides essential instructions for Arizona employees regarding their withholding election. It outlines procedures for new and current employees to complete the Arizona Form A-4. The document also includes information for nonresidents and important deadlines.

Cross-Border Taxation

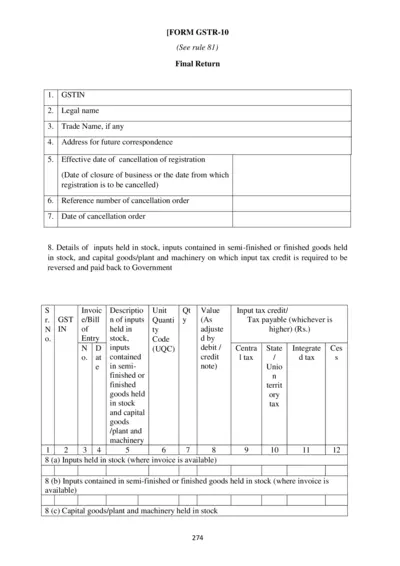

GSTR-10 Final Return Form Instructions and Information

The GSTR-10 form is a final return for taxpayers who cancel their GST registration. It includes details about stock, tax payable, and verification. This document is essential for ensuring compliance with GST regulations during registration cancellation.

Cross-Border Taxation

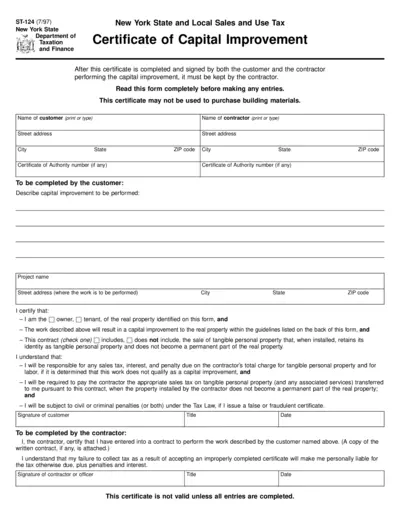

New York State Sales Use Tax Capital Improvement

This file contains the New York State Certificate of Capital Improvement. It details the requirements for customers and contractors regarding sales and use tax exemptions. Following the guidelines in this document is essential for compliance.