GSTR-10 Final Return Form Instructions and Information

The GSTR-10 form is a final return for taxpayers who cancel their GST registration. It includes details about stock, tax payable, and verification. This document is essential for ensuring compliance with GST regulations during registration cancellation.

Edit, Download, and Sign the GSTR-10 Final Return Form Instructions and Information

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the GSTR-10 form, start by gathering all necessary information including your GSTIN, cancellation details, and stock on hand. Carefully follow each section, ensuring accuracy in your input details. Consult guidelines for any specific instructions regarding tax calculations.

How to fill out the GSTR-10 Final Return Form Instructions and Information?

1

Gather your GSTIN and cancellation details.

2

List all stock of goods and inputs on hand.

3

Calculate tax payable based on inputs held.

4

Provide verification details as required.

5

Submit the completed form as per guidelines.

Who needs the GSTR-10 Final Return Form Instructions and Information?

1

Taxpayers who cancel their GST registration need this form to report their final tax liabilities.

2

Businesses that have ceased operations must use this form for compliance.

3

Registered persons who opt for cancellation under GST require it for official records.

4

Professionals who manage tax for their clients will utilize this form during registration cancellation.

5

Accountants must ensure this form is completed by clients who are winding up their business.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the GSTR-10 Final Return Form Instructions and Information along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your GSTR-10 Final Return Form Instructions and Information online.

Editing the GSTR-10 form on PrintFriendly is simple and intuitive. Use our advanced editing tools to make necessary changes to your PDF document. Finalize your edits and download the updated version hassle-free.

Add your legally-binding signature.

Signing the GSTR-10 form on PrintFriendly allows for a seamless process. You can electronically sign your PDF with our integrated signing feature. Ensure your document is complete and legally binding with just a few clicks.

Share your form instantly.

Sharing your completed GSTR-10 form is effortless on PrintFriendly. Utilize our sharing tools to send your PDF directly via email or through social media. Connect with stakeholders instantly to keep them informed.

How do I edit the GSTR-10 Final Return Form Instructions and Information online?

Editing the GSTR-10 form on PrintFriendly is simple and intuitive. Use our advanced editing tools to make necessary changes to your PDF document. Finalize your edits and download the updated version hassle-free.

1

Open the PDF file in PrintFriendly’s editor.

2

Select the fields you wish to edit and make changes.

3

Use the toolbar to modify text, images, and layout.

4

Review your edits carefully to ensure accuracy.

5

Save the document and download your edited version.

What are the instructions for submitting this form?

To submit the GSTR-10 form, you may do so online through the GST portal. Ensure all fields are completed accurately before submitting. For any queries, reach out to the GST helpline or your tax consultant for assistance.

What are the important dates for this form in 2024 and 2025?

Important dates for the GSTR-10 form submission in 2024 include the last day of the financial year and deadlines for GST cancellations. Ensure to file your GSTR-10 by these dates to avoid penalties. The filing deadlines may vary depending on changes in GST regulations.

What is the purpose of this form?

The purpose of the GSTR-10 form is to facilitate the final return for taxpayers who cancel their GST registration. It provides a comprehensive reporting mechanism for stocks, taxes, and other relevant information. Accurate submission is crucial to comply with government regulations and avoid penalties.

Tell me about this form and its components and fields line-by-line.

- 1. GSTIN: The unique identification number assigned to the taxpayer.

- 2. Effective date of cancellation: The date when the registration cancellation becomes effective.

- 3. Stock details: Details of inputs and capital goods held in stock.

- 4. Tax liabilities: Calculation of tax payable on closing stocks.

- 5. Signature: Authorized signatory's signature for verification purposes.

What happens if I fail to submit this form?

Failure to submit the GSTR-10 form can lead to complications in the cancellation of GST registration. Tax authorities may impose penalties or additional scrutiny on the taxpayer's account. It's imperative to ensure timely and accurate submission to avoid such issues.

- Penalties: Late submissions may incur monetary fines as per GST regulations.

- Legal Implications: Failure to submit can lead to legal action from tax authorities.

- Compliance Issues: Non-submission may result in non-compliance status affecting future registrations.

How do I know when to use this form?

- 1. Business Closure: When a business ceases operations and cancels GST registration.

- 2. Change of Ownership: In cases where ownership change requires registration cancellation.

- 3. Tax Compliance: To meet compliance requirements when terminating GST registrations.

- 4. Voluntary Cancellation: For registered individuals opting for voluntary cancellation.

- 5. Inactivity: When a taxpayer has not conducted business for an extended period.

Frequently Asked Questions

What is the GSTR-10 form?

The GSTR-10 form is a final return required by taxpayers who cancel their GST registration, detailing stock and tax liabilities.

How can I edit my GSTR-10 form?

Editing your GSTR-10 form on PrintFriendly is easy using our PDF editor, where you can alter any necessary fields.

Can I save my changes?

Currently, users can edit and download their files without saving them on the site.

What information do I need to fill out this form?

You will need your GSTIN, cancellation details, and accurate information about stock and tax.

Is there a deadline for submitting the form?

Yes, ensure to submit the GSTR-10 form within the stipulated timeline after your GST registration is canceled.

How do I access the GSTR-10 form?

You can download the GSTR-10 form from various government websites or edit it directly from your PDF.

Is there a fee for submitting the GSTR-10 form?

There are no fees associated with submitting the GSTR-10 form; however, taxes due must be paid.

Who can assist me with filling out this form?

Tax consultants or accountants can provide assistance in ensuring accurate completion of the GSTR-10 form.

What happens after I submit the GSTR-10 form?

Once submitted, your information is processed for compliance checks and recorded by the tax authorities.

Can I track the status of my GSTR-10 submission?

Status tracking can typically be done through your GST portal account after submission.

Related Documents - GSTR-10 Final Return

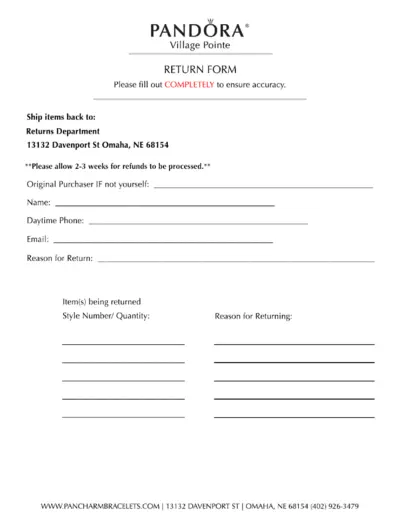

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

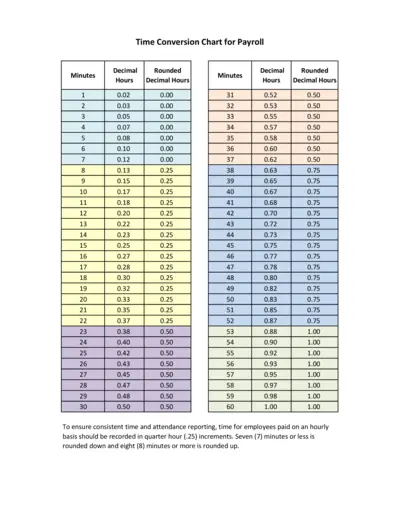

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

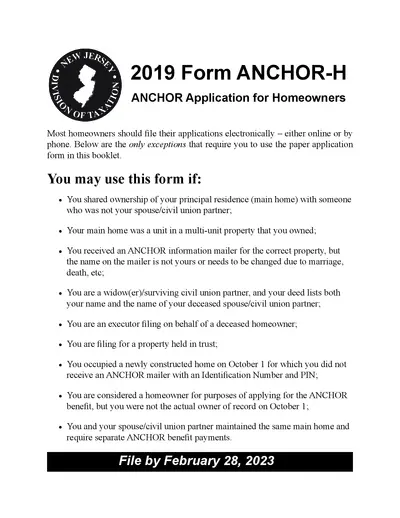

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

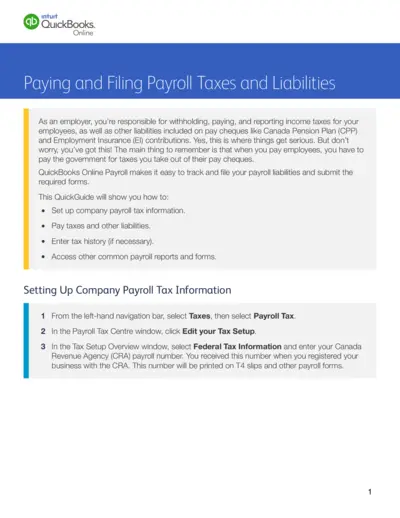

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

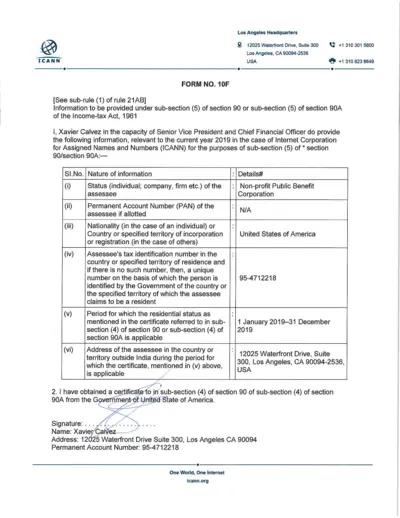

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

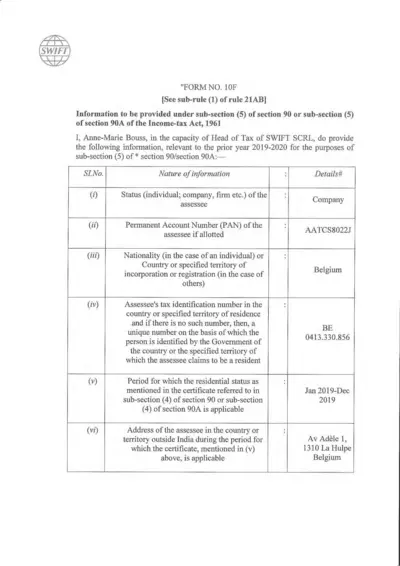

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

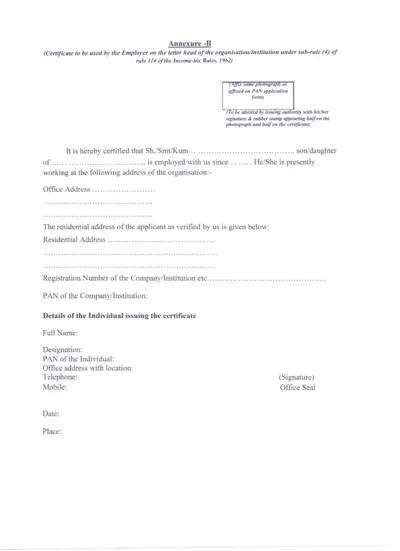

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

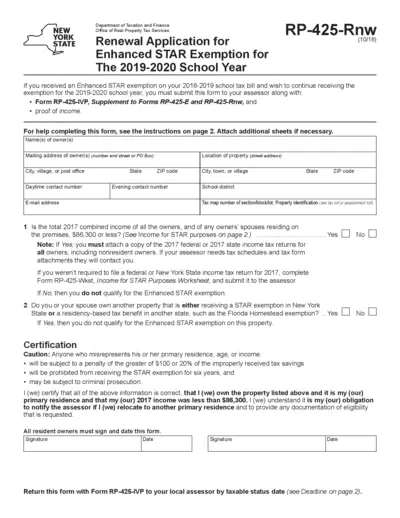

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

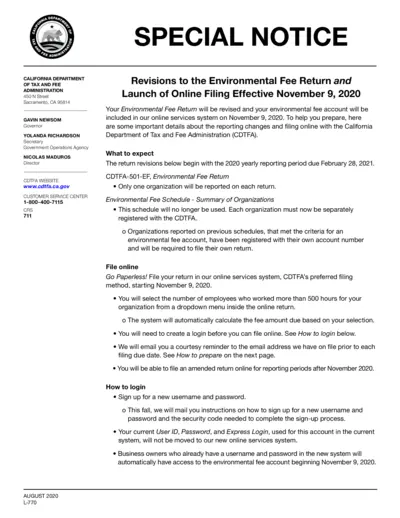

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

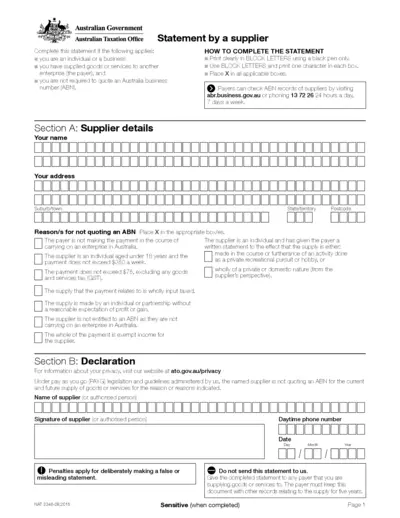

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

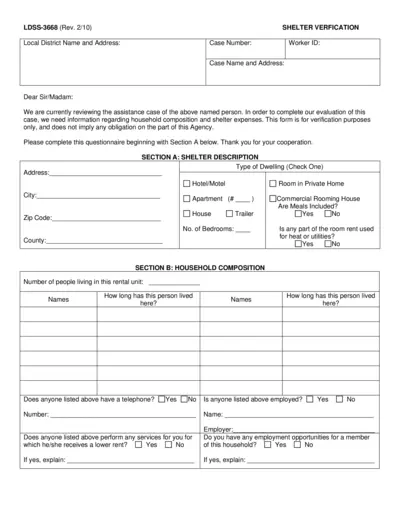

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

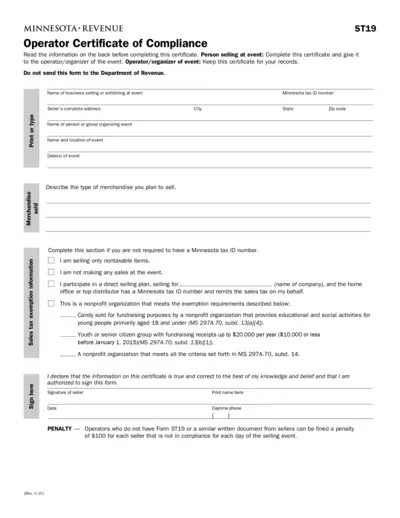

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.