Cross-Border Taxation Documents

Cross-Border Taxation

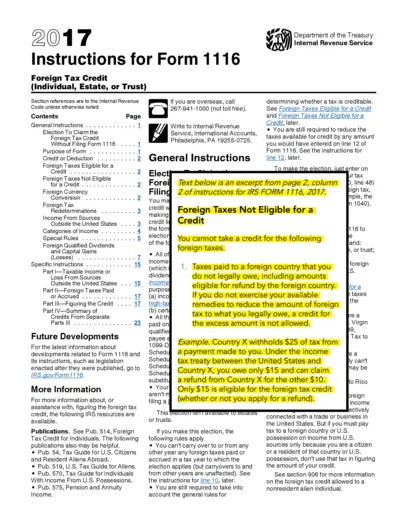

Instructions for Form 1116 Foreign Tax Credit

This file provides detailed instructions for filling out Form 1116, which is used to claim a foreign tax credit. It explains eligibility, deductions, and how to correctly report foreign taxes paid. Users will find guidance on specific line items and necessary qualifications to ensure compliance.

Cross-Border Taxation

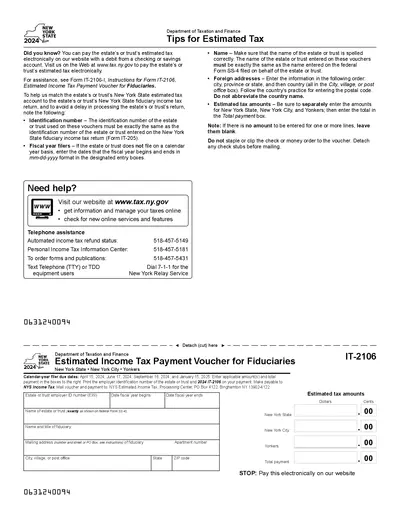

New York State 2024 Estimated Tax Payment Guide

This file provides essential tips for estimated tax payment for estates or trusts in New York State for the year 2024. It includes instructions on filling out the necessary forms and details on submission. For assistance, users can refer to the provided links and contact numbers.

Cross-Border Taxation

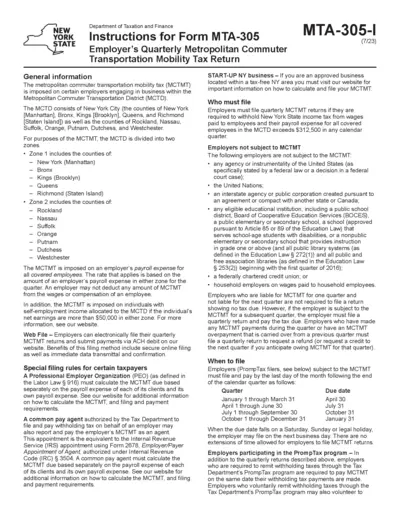

Instructions for Form MTA-305: Tax Return

This document provides detailed instructions for filing Form MTA-305, the Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return. It outlines the tax obligations for employers in the Metropolitan Commuter Transportation District and describes how to accurately report payroll expenses. Perfect for New York employers who need guidance on metropolitan commuter tax compliance.

Cross-Border Taxation

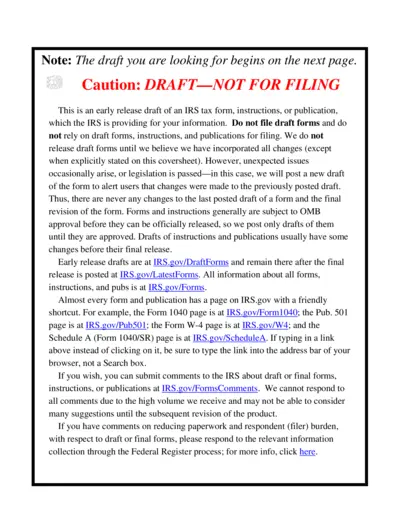

Schedule B-1 Form 1120-S Information and Instructions

The Schedule B-1 (Form 1120-S) is an IRS form used by S corporations to report information on certain shareholders. This early release draft provides essential instructions and details to assist filers in completing the form accurately. It is crucial to use the finalized version after the draft is approved.

Cross-Border Taxation

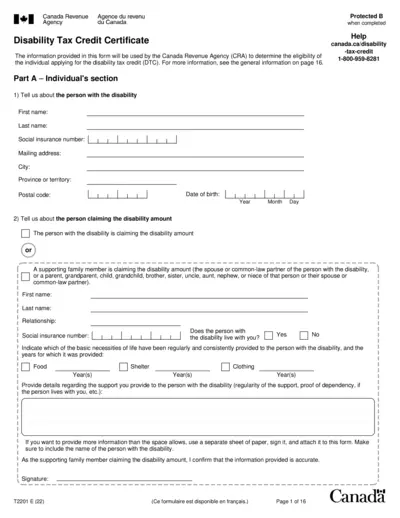

Disability Tax Credit Certificate Application Form

This file provides information about the Disability Tax Credit Certificate application process. It outlines the qualifications and necessary documentation needed for applicants. Ideal for individuals with disabilities and their supporting family members.

Cross-Border Taxation

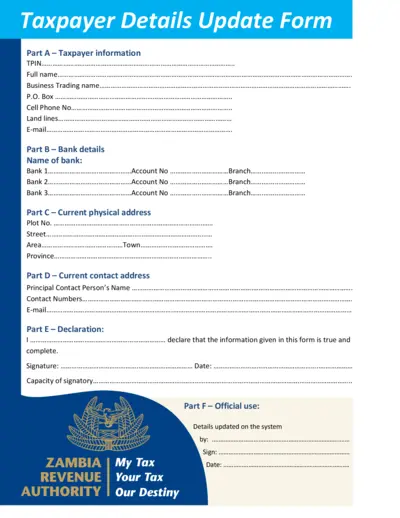

Taxpayer Details Update Form Essential Guide

This document provides essential information for updating taxpayer details. It includes sections for personal information, bank details, and contact addresses. Completing this form ensures your records are accurate and up to date.

Cross-Border Taxation

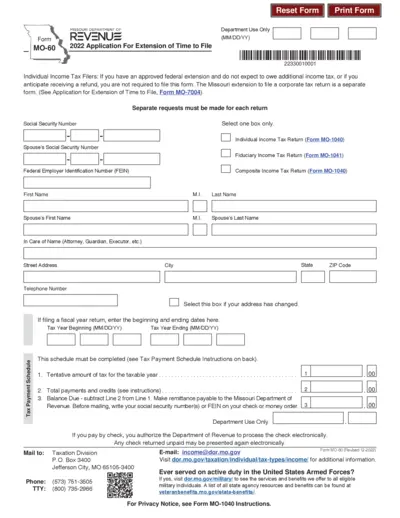

Missouri Department of Revenue Application for Extension

The Missouri Department of Revenue Form MO-60 allows for an extension of time to file individual and composite income tax returns. This form is essential for anyone who owes tax liabilities and needs more time to submit their returns. Be sure to check the specific conditions under which this form must be filed.

Cross-Border Taxation

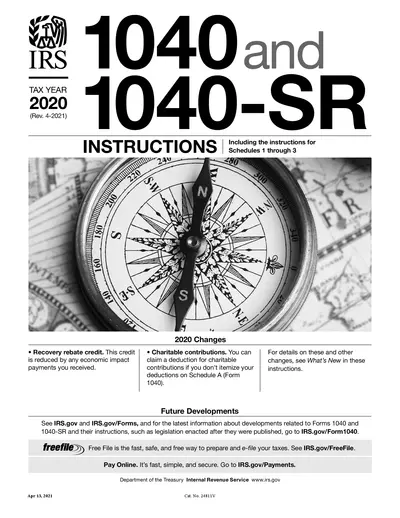

IRS 2020 Form 1040 and 1040-SR Instructions

This document provides comprehensive instructions for completing IRS Form 1040 and 1040-SR for the 2020 tax year. It includes details on filing requirements, line instructions, and relevant changes. Navigate through the contents to better understand your filing process.

Cross-Border Taxation

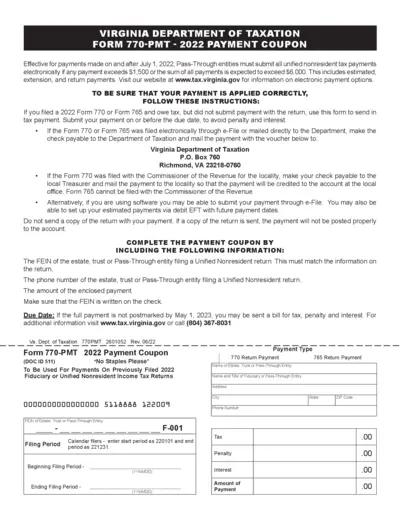

Virginia Department of Taxation Form 770-PMT Payment

The Virginia Department of Taxation Form 770-PMT is a payment coupon for unified nonresident tax payments. This form is essential for estates, trusts, and pass-through entities to submit their tax payments correctly. Complete the form accurately to avoid penalties and ensure timely processing.

Cross-Border Taxation

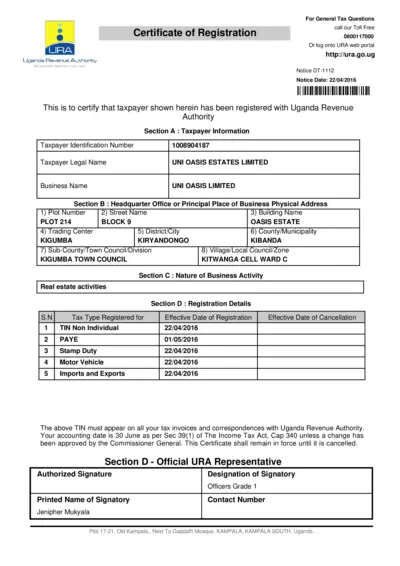

Certificate of Registration for Ugandan Taxpayers

This file serves as a Certificate of Registration issued by the Uganda Revenue Authority. It includes essential taxpayer information and registration details. Taxpayers are advised to maintain this document for reference in all tax-related correspondences.

Cross-Border Taxation

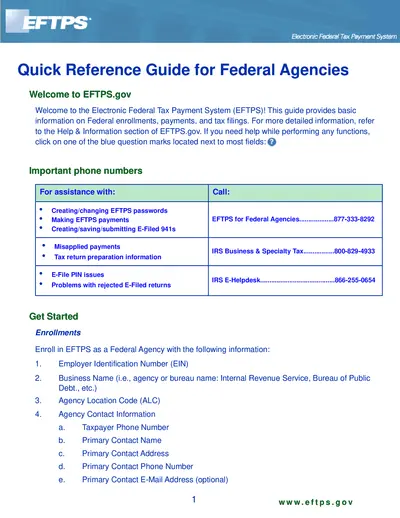

EFTPS Electronic Federal Tax Payment System Guide

This guide provides essential information about the EFTPS, including enrollment, payment methods, and tax filing instructions. Designed for federal agencies, it simplifies the tax payment process. For more thorough guidance, refer to the detailed sections within this document.

Cross-Border Taxation

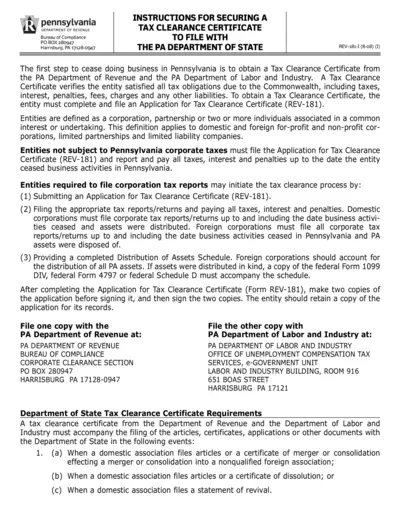

Instructions for Tax Clearance Certificate Pennsylvania

This document provides essential instructions for obtaining a Tax Clearance Certificate in Pennsylvania. It explains the process and requirements for entities ceasing business operations. Ideal for corporations and partnerships needing compliance with state regulations.