Cross-Border Taxation Documents

Cross-Border Taxation

Connecticut Corporation Business Tax Instruction Booklet

This instructional booklet provides detailed information on the Connecticut Corporation Business Tax forms. It includes instructions for forms such as CT-1120, CT-1120 ATT, among others. This resource is essential for corporations to ensure compliance with tax regulations.

Cross-Border Taxation

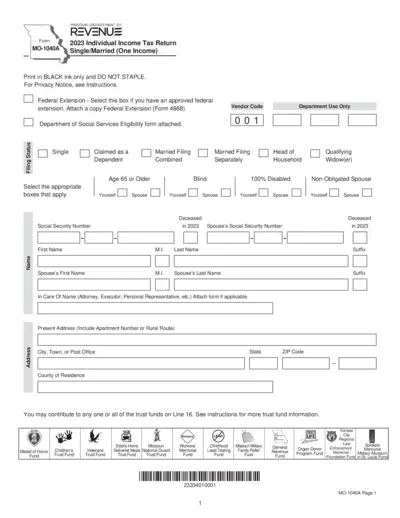

Missouri Individual Income Tax Return MO-1040A 2023

The MO-1040A is a form used for filing individual income tax returns in Missouri. It caters to single and married taxpayers. Complete this form to report your income and claim deductions.

Cross-Border Taxation

Minnesota Individual Income Tax Forms and Instructions

This file contains essential forms and instructions for filing individual income tax in Minnesota. It offers guidance on how to complete the forms and important contact information. Whether you are filing electronically or by mail, this document provides all necessary details.

Cross-Border Taxation

PAYE EMP201 Employer Monthly Declaration Guide

The PAYE EMP201 is an essential guide for employers looking to understand the new monthly declaration process. This file outlines the updated procedures for submitting tax information to SARS effectively. Follow the instructions to ensure compliance and accuracy in your employer tax submissions.

Cross-Border Taxation

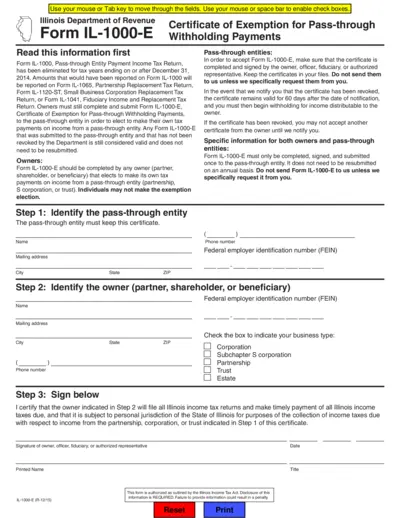

Illinois Form IL-1000-E Certificate of Exemption

The Illinois Form IL-1000-E is a Certificate of Exemption for Pass-through Withholding Payments. It is essential for owners of pass-through entities to submit this form to elect their own tax payments. This form must be completed by owners who want to manage their income tax returns independently.

Cross-Border Taxation

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is used for estimating income tax obligations for estates and trusts. This form assists fiduciaries in calculating and paying estimated taxes owed. It is essential for proper tax management and compliance.

Cross-Border Taxation

Understanding Gambling Winnings Tax in Wisconsin

This document provides essential information regarding the taxation of gambling winnings in Wisconsin. It outlines what residents and non-residents need to know about reporting winnings and claiming credits. Key regulations and filing instructions are also included to ensure compliance with state tax laws.

Cross-Border Taxation

2023 Schedule E Instructions for Income and Loss

This document provides detailed instructions for filling out Schedule E (Form 1040) for 2023. It is essential for reporting income or loss from various sources including rental real estate and partnerships. Make sure to follow the specified guidelines to avoid potential issues with your tax filings.

Cross-Border Taxation

Instructions for Form IT-204-LL - Filing Fee Payment

This file provides essential instructions for completing Form IT-204-LL, required for certain LLCs and partnerships in New York State. It outlines filing requirements, deadlines, and provides computation guidelines for fees associated with filing. Understanding these details ensures compliance with New York State tax regulations.

Cross-Border Taxation

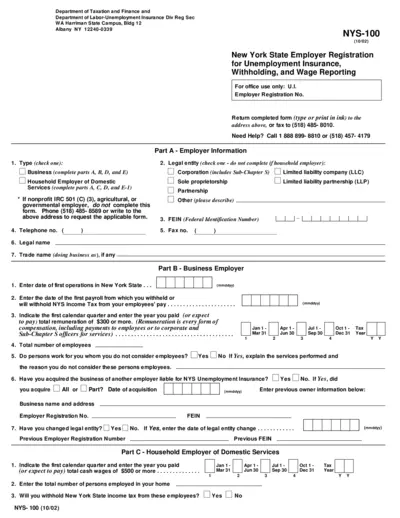

New York State Employer Registration for Unemployment Insurance

This file provides the registration form for New York State employers seeking to register for Unemployment Insurance, Withholding, and Wage Reporting. Users can find detailed instructions for filling out the form and submit it to the relevant department. Ensure compliance with state laws by completing this important document.

Cross-Border Taxation

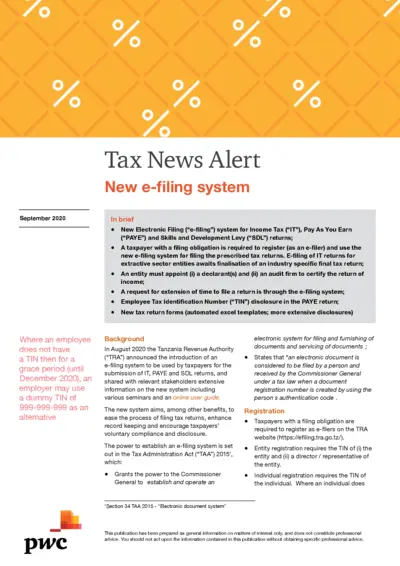

New E-filing System for Tax Returns in Tanzania

This file provides comprehensive details about the new electronic filing system for Income Tax, PAYE, and SDL returns in Tanzania. It outlines registration requirements, filing instructions, and the importance of compliance. Users will find valuable information on optimizing their tax return process with the new system.

Cross-Border Taxation

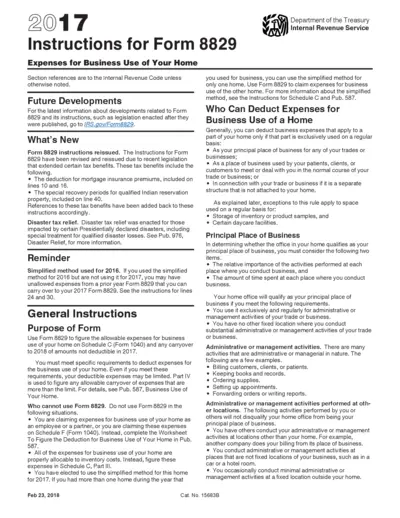

Instructions for Form 8829 Business Use of Home

This file provides detailed instructions for completing Form 8829, Expenses for Business Use of Your Home. It outlines eligibility criteria and deductions applicable to business owners. Follow these guidelines to ensure accurate reporting and maximize your home-based deductions.