Cross-Border Taxation Documents

Cross-Border Taxation

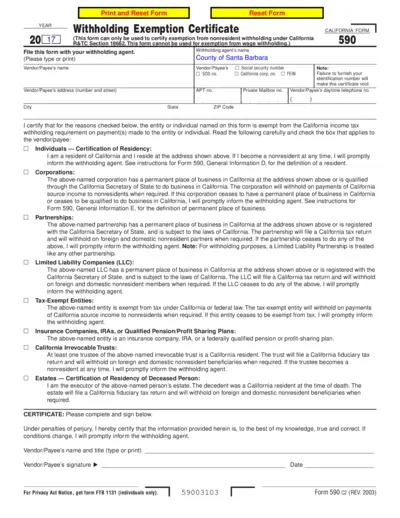

California Form 590 Withholding Exemption Certificate

California Form 590 is used to certify exemption from nonresidential withholding. Ensure that the appropriate sections are filled out accurately. This is essential for residents and entities wishing to avoid unnecessary tax withholdings.

Cross-Border Taxation

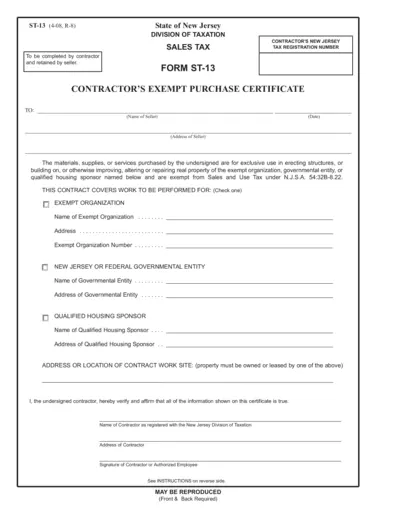

New Jersey Contractor's Exempt Purchase Certificate

The New Jersey Contractor's Exempt Purchase Certificate is a crucial document for contractors working with exempt organizations. This form allows contractors to purchase materials and services without paying sales tax for projects involving exempt entities. Understanding how to fill it out correctly is essential for compliance and tax exemption.

Cross-Border Taxation

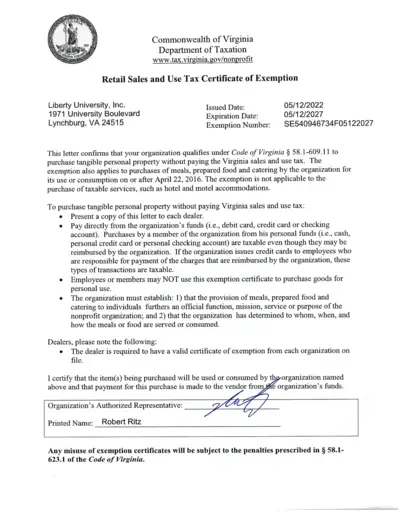

Virginia Retail Sales and Use Tax Exemption Certificate

This document serves as a retail sales and use tax exemption certificate for nonprofit organizations. It confirms the qualification for tax-exempt purchases. Ensure compliance with the specified instructions for valid use.