Property Law Documents

Property Taxes

Montana MW-3 Wage Withholding Tax Instructions

The Montana MW-3 form is designed for employers to report annual wage withholding tax. This easy-to-use form allows for electronic filing, payment, and submission of W-2s and 1099s. Ensure compliance with Montana's tax laws by following the detailed instructions provided.

Property Taxes

Texas Nexus Questionnaire - AP-114 Form Details

The Texas Nexus Questionnaire helps entities provide necessary information for tax purposes in Texas. It includes instructions on business activities, legal names, and federal identification. This form is essential for compliance with Texas tax regulations.

Property Taxes

Power of Attorney and Declaration of Representative

This file is essential for appointing a representative to handle tax matters. It grants limited authority to discuss confidential issues. Users must complete this form accurately to ensure proper representation.

Property Taxes

Philadelphia Business Income & Receipts Tax 2022

This file is the 2022 Business Income & Receipts Tax form for the City of Philadelphia. It provides essential details for filing tax returns and understanding tax liability. Follow the given instructions to accurately complete the form.

Property Taxes

Connecticut Nonresident and Part-Year Resident Income Tax Return

The Connecticut Form CT-1040NR/PY is essential for nonresidents and part-year residents to file their income taxes. This form provides taxpayers with the necessary instructions to accurately report their income in Connecticut. Ensure you meet all requirements for a successful filing with this comprehensive guide.

Real Estate

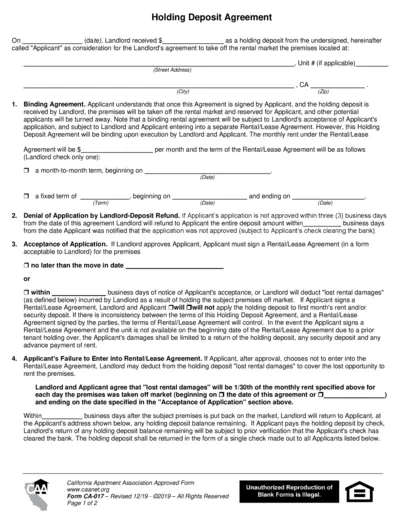

Holding Deposit Agreement for Rental Property CA

This Holding Deposit Agreement outlines the terms and conditions for reserving a rental property. It includes details regarding the holding deposit, application acceptance, and refund policies. Aimed at potential renters and landlords, this document provides a clear understanding of the binding nature of the agreement.

Property Taxes

Florida Partnership Information Return - Form F-1065

The Florida Partnership Information Return, Form F-1065, is essential for partnerships filing taxes in Florida. This form captures income, adjustments, and partnership details. Ensure compliance with state tax regulations by accurately completing this return.

Real Estate

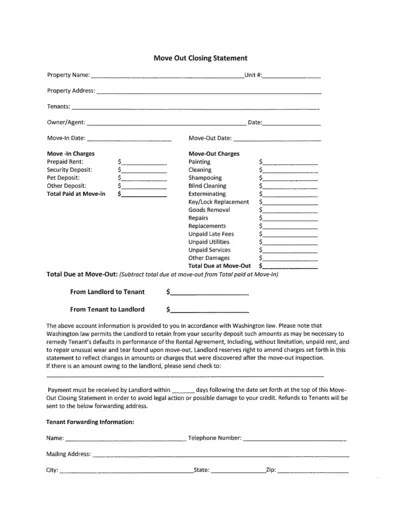

Move Out Closing Statement for Tenants & Landlords

This Move Out Closing Statement is essential for tenants and landlords. It outlines charges related to the move-out process and security deposit return. Use this document to ensure clarity and legality in your move-out transactions.

Real Estate

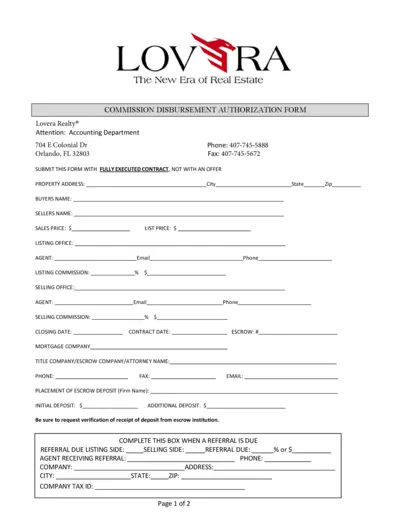

COMMISSION DISBURSEMENT AUTHORIZATION FORM

The Commission Disbursement Authorization Form is essential for real estate transactions. It outlines the commission distribution among agents and agencies. Proper completion ensures timely payments post-closure.

Property Taxes

2023 Form M1PR Homestead Credit Refund Instructions

This file provides essential instructions for completing the 2023 Form M1PR, a key tax form for claiming Homestead Credit Refunds. It assists homeowners and renters in understanding the requirements for tax refunds. Ensure you follow the guidelines carefully to maximize your potential refund.

Property Taxes

Colorado Charitable Contributions Tax Guide

This guide provides information on how to claim charitable contributions on your Colorado tax return. It outlines eligibility requirements and qualifying contributions. Use this document to ensure proper filing and maximize your deductions.

Property Taxes

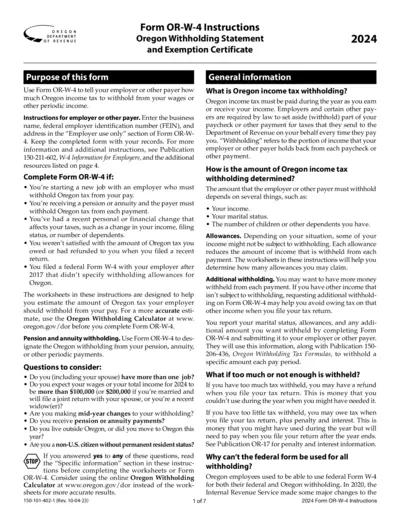

Oregon Withholding Statement Exemption Certificate

This document provides instructions for completing the Oregon Form OR-W-4 for withholding tax purposes. It outlines the necessary steps for employees and payers to ensure correct tax withholding. Use this form to communicate your tax withholding preferences to your employer.